Nearly two decades ago, Amazon introduced us to its recommendation system, setting a new benchmark in customer experiences. Today, personalized recommendations are a part and parcel of our digital lives. From tailored financial services to customized eCommerce product offerings to a list of TV shows curated to our liking, customers expect a personalized approach throughout all interactions, and insurance is no exception.

To meet the growing customer demand for personalized experiences, insurance carriers leverage segmentation, i.e. grouping users based on demographics, age, and other characteristics in order to design the most appealing offer for them. But with the abundance of data available today and sophisticated insurance industry software, insurance carriers can drill down even further to the segment of one.

The benefits of hyper-personalization are far-reaching. With the ability to target the right customers with the right offering, insurers can drive more leads, improve revenue, and boost loyalty. Business benefits of leveraging advanced personalization are shown on the Eligraphics below:

Source: Earnix

Levels of personalization

When it comes to building an effective personalization strategy, there is no one-size-fits-all as the target audience of an auto insurance company will differ from that of a health insurance carrier. But essentially, there are 3 ways that insurers can deliver personalization.

1. Personalized bundles

As generic offers do not cut it anymore, bundling can help insurance companies create unique customized offerings to win back customer loyalty. For instance, if a customer is looking to buy homeowner insurance and auto insurance, an insurance company can bundle these policies into a single package to give a customer the desired coverage — all in one transaction. In addition to personalization and convenience, bundles offer the opportunity to cross-sell and secure new revenue streams for insurance providers.

Case in point

A one-stop shop for all insurance needs, Allstate offers a range of bundles, the most popular include home and auto, renters and auto, renters and motorcycle insurance. Customers can benefit from multiple types of protection while enjoying multi-policy discounts.

2. Personalized communication

The impact of personalized messaging on customers loyalty cannot be underestimated. According to research by Wiraya, as many as 86% of customers who left their insurance, bank, or mobile provider were unsatisfied with the way they were contacted. And 17% complained they never received relevant information.

Now with the abundance of data from wearables and smart devices, insurers can get much deeper insights into a user’s activity. By integrating insurance industry software with AI-powered chatbots, insurers can send personalized recommendations and real-time notifications to users at scale.

Case in point

Health insurer Aetna has partnered with Apple to launch the Attain app that uses health history coupled with smartwatch data to provide personalized health recommendations and set customized fitness goals. By achieving the goals, users earn reward points that can further be redeemed for gift cards or Apple Watch.

3. Personalized quotes

In addition to tailored recommendations, insurance carriers can leverage the power of data analytics to customize insurance plans and dynamically adjust quotes based on the user’s activity. Health insurers can utilize all available health data (medical records, data from wearables and fitness trackers) to come up with a personalized health plan. Car insurance companies can tap into telematics data to offer usage-based insurance models.

Case in point

Progressive, a top auto insurance company, offers the Snapshot program that personalizes the insurance rate based on the actual driving. The program utilizes a mobile app or a plug-in device to monitor a user’s driving behavior and offer a customized premium depending on the result (i.e. high-risk driving leads to higher premiums).

Doing personalization right

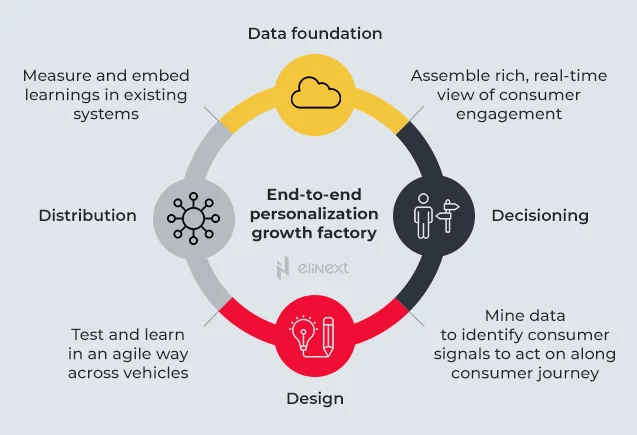

Personalized insurance quotes and bundles are a great way to drive more sales, but how do you approach personalization? As you can see from the graphics below, it all starts with data.

Source: McKinsey&Company

Data foundation

The lifeblood of any business, data is the key component of a successful personalization strategy. The better you know your customers — their interests, goals, pain points, and frustrations — the more you can tailor your offering to their unique needs.

The insurance industry is awash with data from traditional sources like willingly shared customer data and third-party marketing databases as well as new and alternative sources like social networks, sensors, wearable devices, mobile apps, and more. By breaking down data silos and bringing data under one roof, an insurer can assemble a more holistic view of customers to underpin personalization initiatives.

Decisioning

Sending offers and promotional emails every Tuesday at a preset time is not the best way to deliver value. Instead, insurers can leverage behavioral data to find the right trigger points for each policyholder and target them with the right messages at the right time. For example, if an insured had a poor claims experience, an insurance provider can send a well-timed notification before the policy expiration to remind about renewal and offer a personal discount.

Design

Like any other initiative, your personalization strategy requires careful design and continuous testing. As personalization relies on customers’ needs and behavior that evolve, you need to be able to analyze your offering and optimize it in order to make sure it continues to be highly relevant for your customers.

Distribution

The right technological capabilities are what enable effective, data-driven personalization. To that end, you may need to invest in cloud-based insurance industry software that will streamline business processes and help you deliver customized offers at scale. If you want to reap the benefits of personalized communication, add a layer of conversational AI in the form of intelligent chatbots that will assist your policyholders with their routine tasks and provide personalized offers.

The bottom line

Personalization has penetrated every nook and cranny of our digital lives, bringing a range of benefits — from better customer service to more relevant offerings. And businesses that embrace personalization see an increase in customer loyalty and satisfaction, and hence a boost in leads and sales.

Forward-thinking insurance carriers leverage personalization to disrupt traditional models and stay competitive on today’s landscape. There are different ways to leverage personalization — customized insurance quotes, highly relevant communication, dedicated apps, tailored insurance bundles. The key to an effective strategy is to base it on real-world data and deep customer insights.

Looking for a partner to develop personalized insurance software? Elinext can help you turn your project idea into reality. Have a look at our recent case study about developing a car insurance auction platform.