Trading Software

Development Services

Elinext: Leading Experts In Trading Software Development

With the ongoing technological shifts and changing regulations, having robust trading software in place is one of the key elements to staying ahead of industry transformations. Elinext is a trading software development company that offers cutting-edge trading software solutions, enabling trading firms to perform deep data analysis, minimize risks and react to changing market conditions in a timely manner.

With the ongoing technological shifts and changing regulations, having robust trading software in place is one of the key elements to staying ahead of industry transformations. Elinext is a trading software development company that offers cutting-edge trading software solutions, enabling trading firms to perform deep data analysis, minimize risks and react to changing market conditions in a timely manner.

Custom Trading Software

Development Services We Offer

-

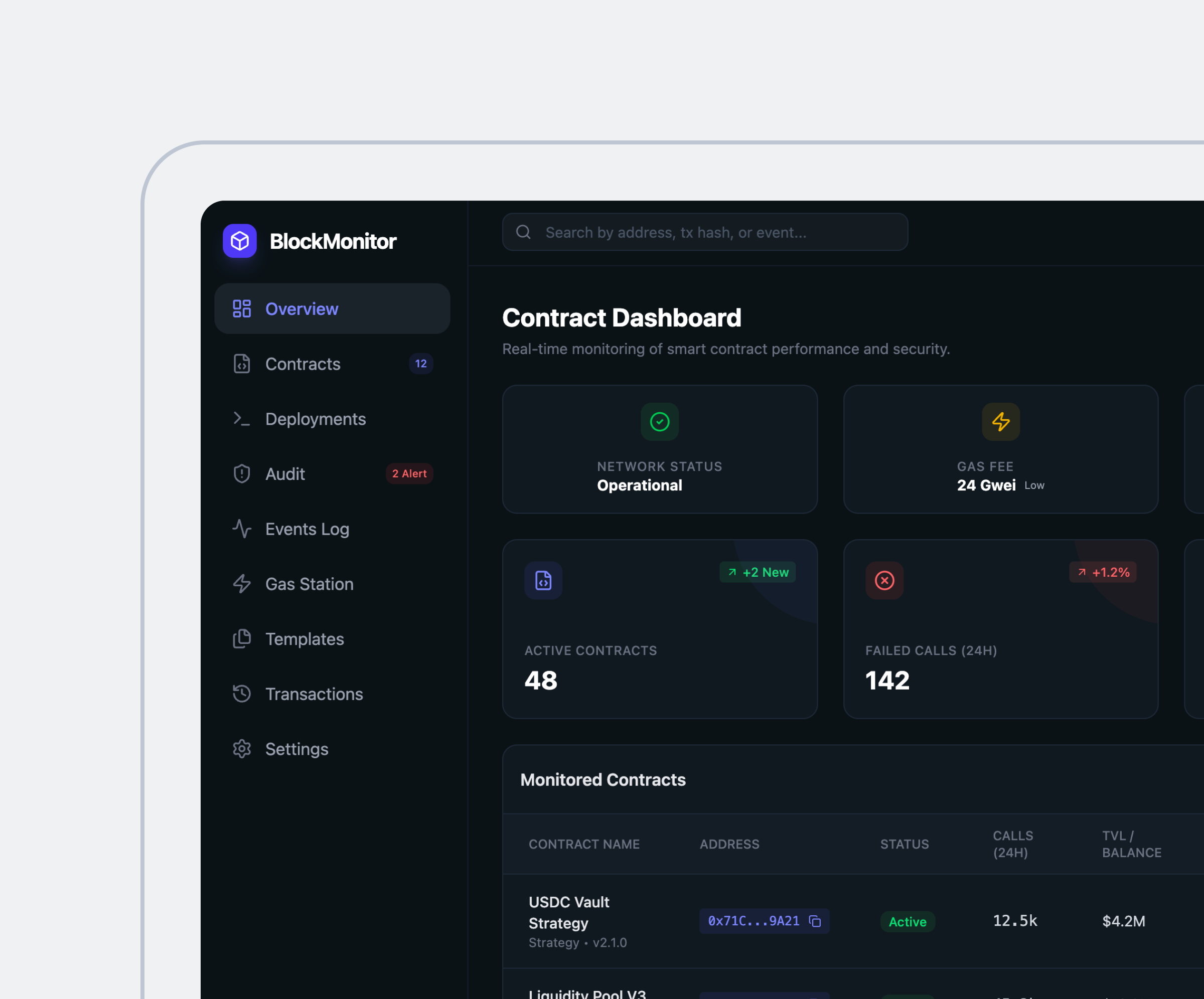

Custom Trading Platform Development

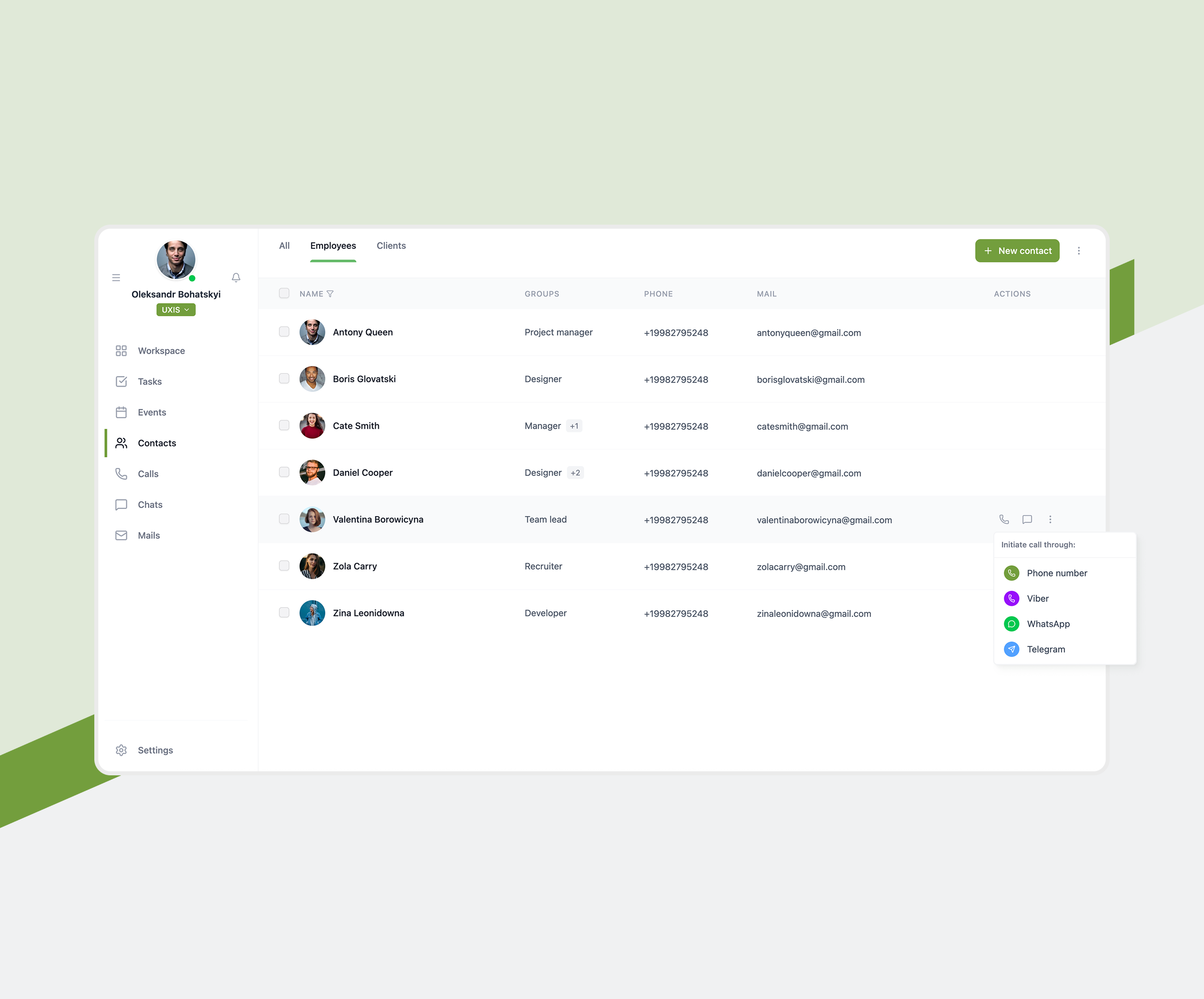

Custom Trading Platform DevelopmentElinext specializes in custom trading software development services, offering robust trading platforms with extensive customizations, multi-asset trading support, enhanced security and much more.

-

We develop well-designed mobile trading apps for iOS and Android that allow users to trade their assets, access important market information and process their payments while being on the go.

-

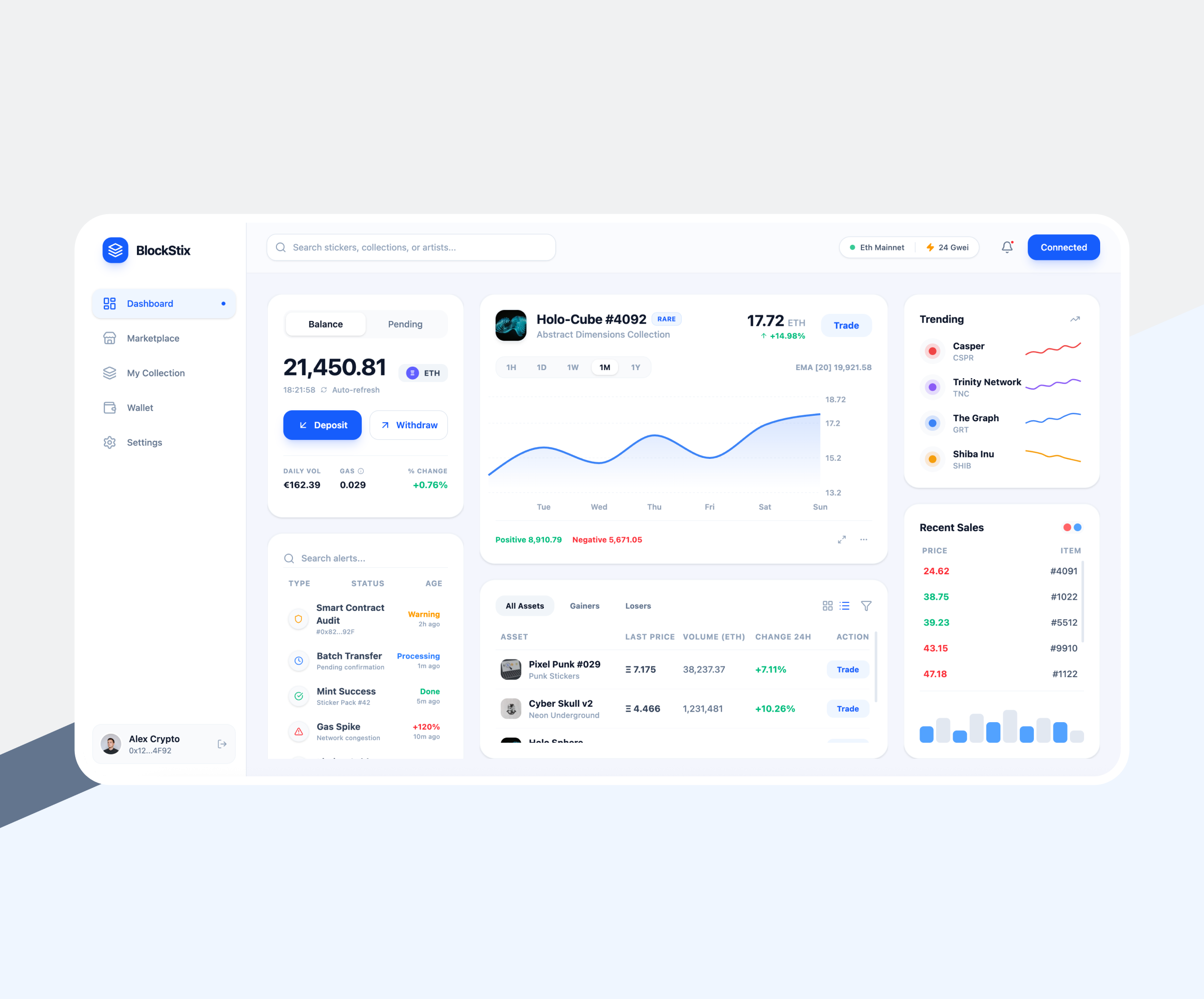

Custom Stock Trading Software

Custom Stock Trading SoftwareOur dedicated team develops stock trading software customized to your trading needs with real-time updates, stock market analysis and smooth trade execution.

-

Trading Software Consulting Services

We help you fulfill your project vision by determining your priorities and business strategy, offering our expert advice and helping you devise a working development plan.

-

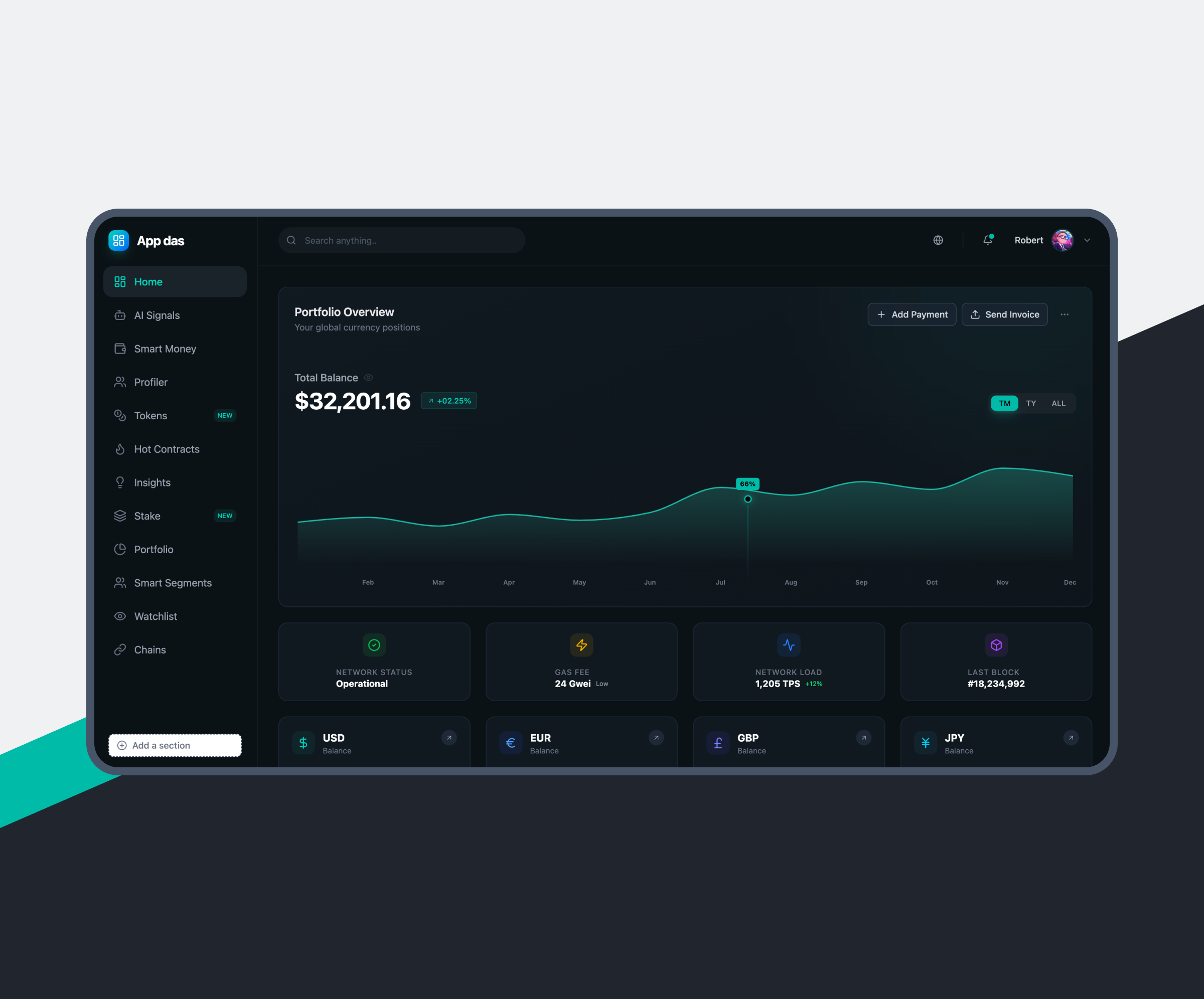

We design scalable software that facilitates cryptocurrency trade with helpful management and automation mechanisms, fast transaction support and wallet integration.

-

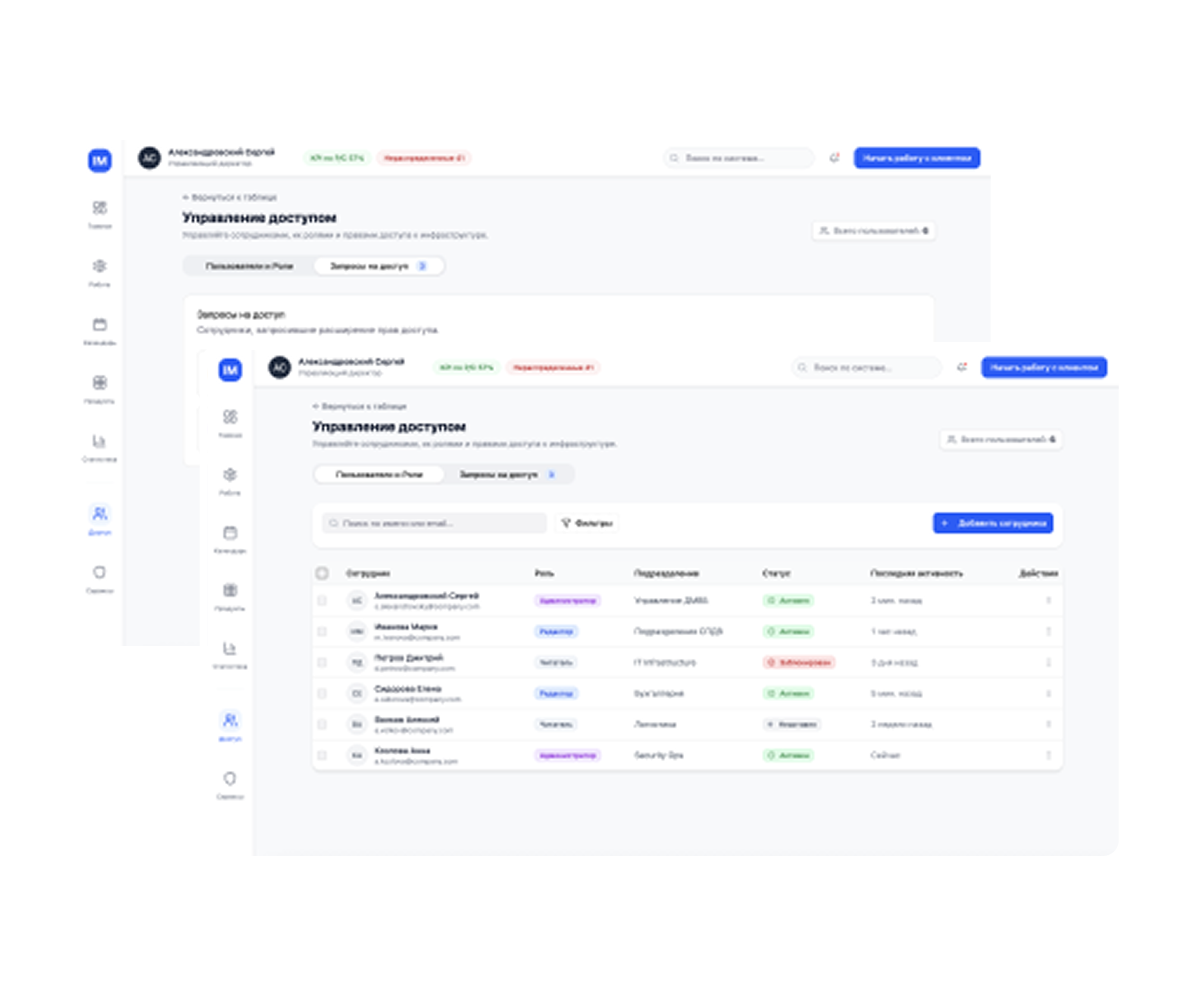

Elinext offers cybersecurity audit testing services by performing rigorous security checks and finding potential vulnerabilities and implementing the best security practices to assure the security of your trading systems.

Our Awards and Recognitions

Advanced Techs We Implement

In Trading Software Solutions

-

We integrate AI and ML models into our trading software solutions, harnessing their strong analytical and predictive power for better market overview and decision-making.

-

Our custom trading platform development services incorporate blockchain for transparent, secure transactions, tokenized asset trading, cross-border payments and much more.

-

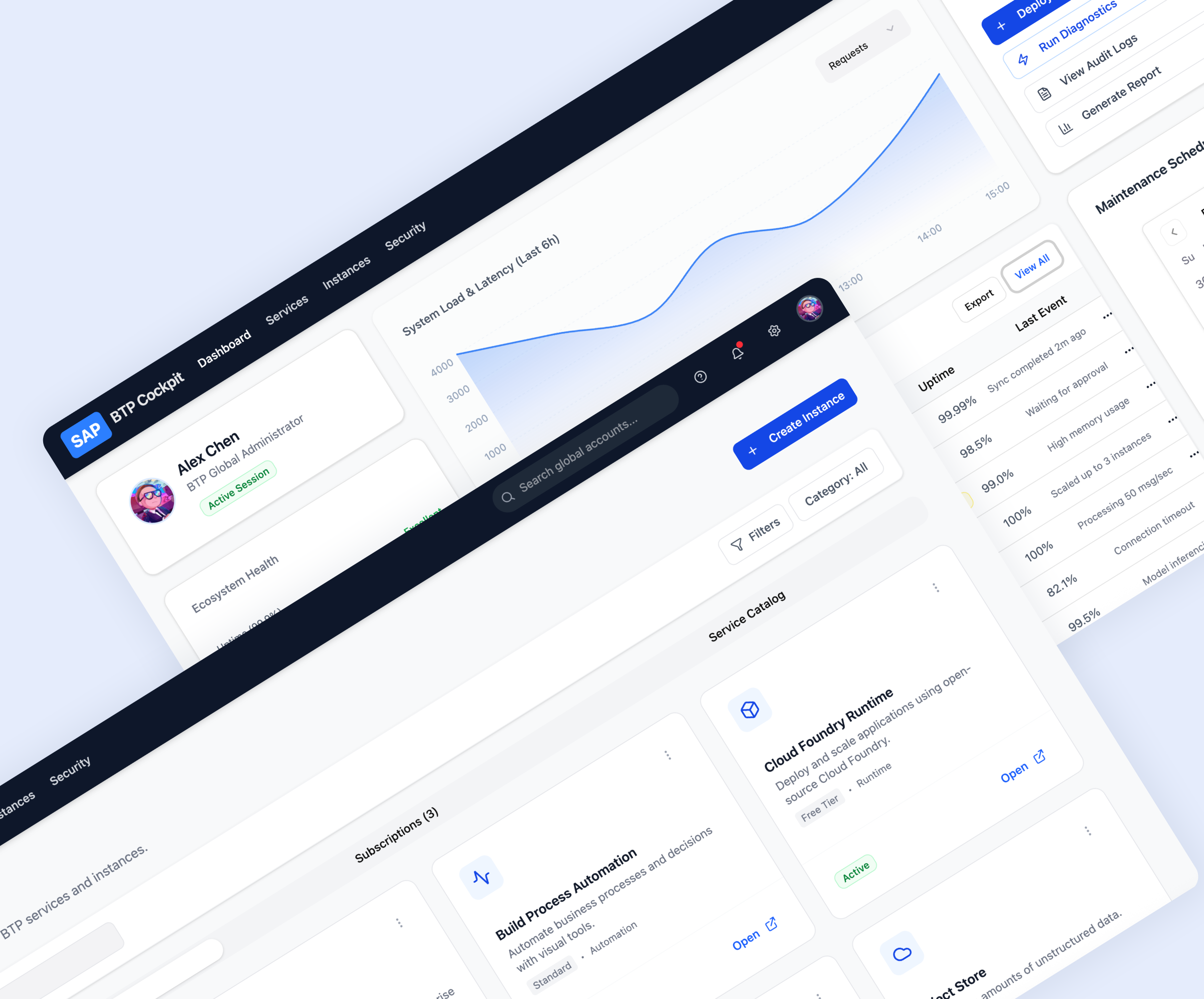

Cloud Computing Solutions

We offer cloud computing integration for trading software to provide maximum scalability, easier management, high availability and secure data storage.

-

Our team of experts integrates IoT solutions with trading environments to provide real-time data collection, market monitoring and overall management, boosting speed and accuracy.

-

Quantitative Analysis Tools

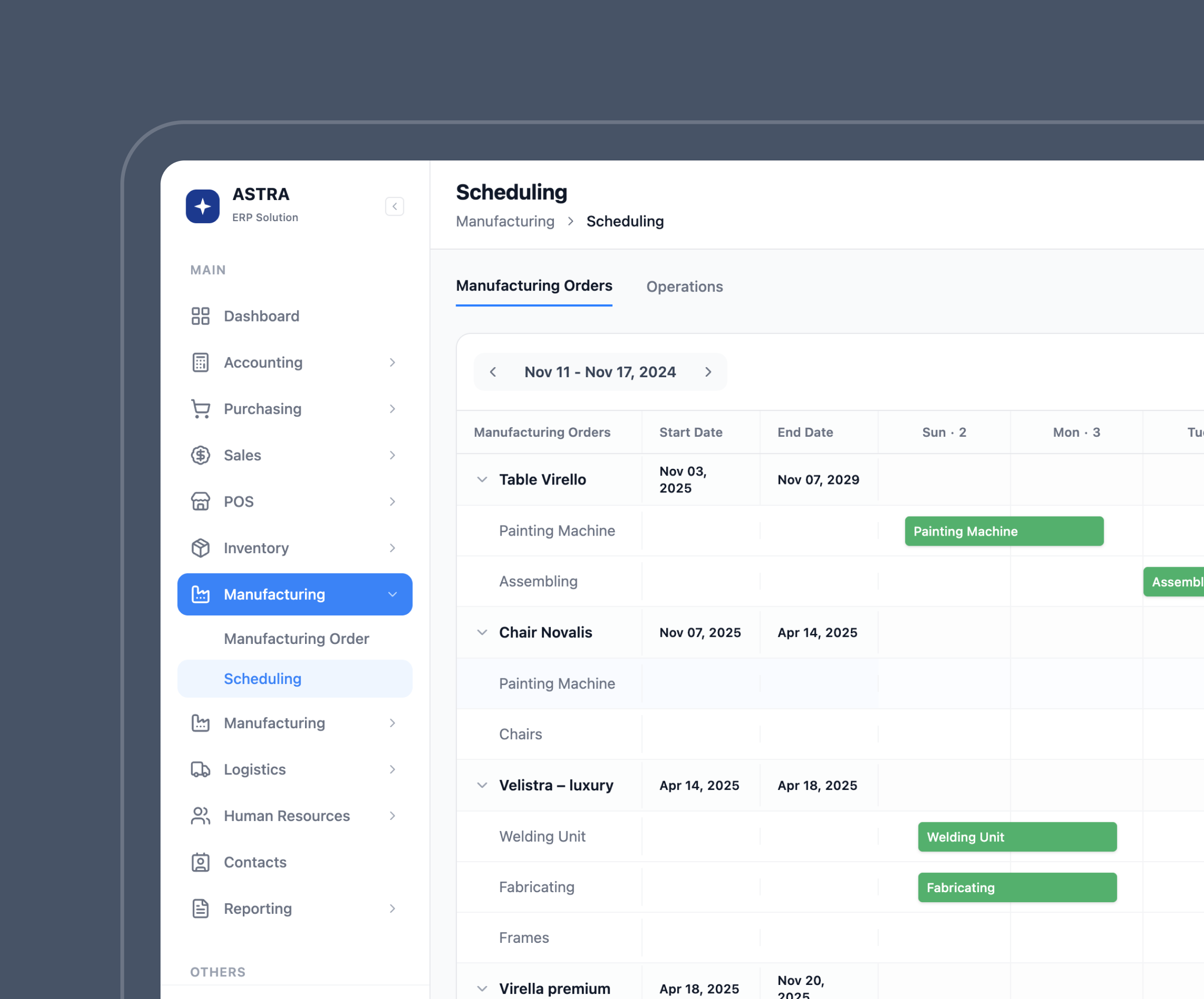

We implement quantitative analysis tools for advanced analysis and reports through real-time data collection, market trend predictions and algorithmic trading support.

-

We build solutions capable of big data analytics, processing vast amounts of market data for unique, informative insights, useful predictions and convenient visualizations.

Core Technologies We Work with

-

Frontend 12+0Practice28 yearsProjects70+Workforce40+JavaScript library by Meta enabling component-based web apps with scalability, reusability, and flexibility globally.Practice28 yearsProjects50+Workforce25+Front-end framework by Google enabling enterprises to build scalable, maintainable, and secure web apps globally.Practice7 yearsProjects20+Workforce15+Progressive front-end framework enabling developers to build scalable, lightweight, and maintainable apps globally.

-

-

Backend 12+0Practice20 yearsProjects130+Workforce50+Popular programming language enabling enterprises to build AI, analytics, web, and backend apps with simplicity and scalability globally.Practice13 yearsProjects100+Workforce50+JavaScript runtime enabling enterprises to build scalable, fast, and real-time applications globally.Practice27 yearsProjects250+Workforce60+Enterprise programming language enabling enterprises to build scalable, reliable, and secure applications globally.

-

-

Databases 12+0

-

-

Cloud Services 12+0Practice13 yearsProjects30+Workforce10+Largest cloud provider offering compute, storage, AI, and analytics with unmatched scale, global infrastructure, and millions of customers.Practice12 yearsProjects10+Workforce10+Cloud platform uniting AI, data, and IoT with hybrid support, strong security, and 60+ global regions for enterprise scalability.

-

-

APIs 12+0

-

The Benefits Of Trading Software

Development Solutions By Elinext

Choose Your

Service Option

Ready To Choose Elinext As Your Trading Software Developer?

Hire Trading Software Developers

from Elinext

Why Elinext?

Listen to Our Clients

Looking for Related Services?

FAQ

-

Yes, we provide algorithmic solutions with AI/ML integration designed to automate the buying and selling of assets according to market conditions. We also offer custom algorithm development.

-

Yes, we build mobile trading apps for Android and iOS with cross-platform source code compatibility, personalized features and an engaging UI/UX design. We also provide trading software consulting services to determine the scope of the project.

-

Of course! As a trading platform development company, we specialize in creating custom trading software that takes into account the unique demands of your project in order to develop a high-performing end-result that not only meets but exceeds expectations.

-

The duration of trading software development is highly dependent on the complexity and requirements of the project and can take anywhere from a couple of weeks to a year.

-

The associated development costs are highly dependent on the nature of the project. For more accurate cost estimates, please get in touch with an Elinext representative.

Trading Software Development

ArticlesTrading Software Development

Articles

Articles

Articles