Lift your business to greater heights with SaaS solutions developed by Elinext. Save on infrastructure, open up opportunities for on-demand scaling and agility, and enjoy a high level of security along with improved accessibility to the key processes held within your financial organization — all within a single solution. From consulting, design, and deployment to analytics, risk management, and regulatory compliance — Elinext has got you covered.

Enable fast and accurate analysis of customer data with BI solutions Elinext develops, and get immediate insights into your audience preferences. Whether it is a traditional, cloud, mobile, or social BI solution development, we make sure that its outcome will go in line with your business goals, enhancing your performance on the market.

Take a step towards personalization of services your company provides with advanced CRM solutions Elinext develops. Apart from offering a carefully organized helpdesk system aimed at facilitating various business processes held within the company, distributed banking CRM software we develop use the power of machine learning, allowing to shorten sales cycles, retain customers, unlock cross-selling opportunities, and make overall customer relationship intelligently personalized.

Upgrade systems working for your company success with Artificial Intelligence (AI) solutions offered by Elinext. We make machine learning an indistinguishable component of customer relationship management systems, account opening systems, commercial loan origination systems, etc. From the development of smart chatbots to the detailed data analysis — artificial intelligence solutions by Elinext make banking services competitive and up-to-date.

Attract more customers and improve the way of providing banking services with Elinext advanced and user-friendly mobile applications. Mobile banking application development at Elinext results in the delivery of solutions that ensure simple yet secure sign-in, offer bank account management options and allow tracking spending habits. Upon your request, we can enhance the app with an intelligent chatbot, perform integration with a QR code payment system, develop versions for wearables, and incorporate shared finance features.

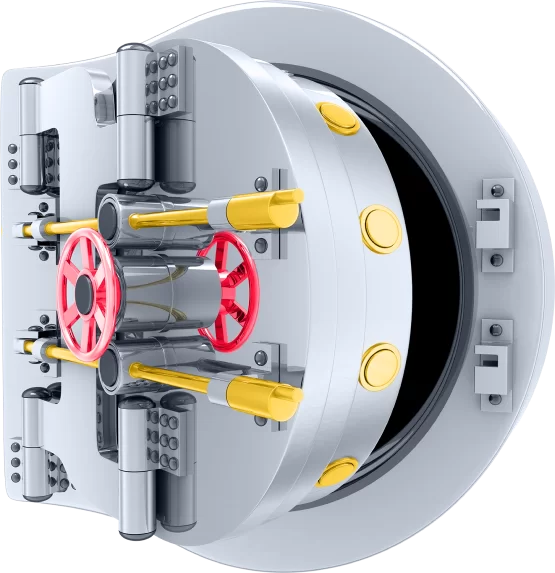

Eliminate breaches in your digital banking systems to ensure data privacy and security by taking advantage of Elinext expertise in the domain. Solutions we use to address the issue include two-factor authentication, analytic tools such as BI that detects suspicious activity, network segmentation, advanced threat protection (ATP) — whatever is required to keep your business safe.