Financial Software

Development

Elinext: Expert-level in FinTech Software Development

Elinext is recognized as a leading expert in FinTech software development.

Our team combines deep industry insight with technical excellence to create secure, high-performing, and innovative software that meets today’s complex financial demands. Rely on our proven expertise to overcome challenges and drive your business forward.

Elinext is recognized as a leading expert in FinTech software development.

Our team combines deep industry insight with technical excellence to create secure, high-performing, and innovative software that meets today’s complex financial demands. Rely on our proven expertise to overcome challenges and drive your business forward.

Custom Financial Software

Development Services by Elinext

-

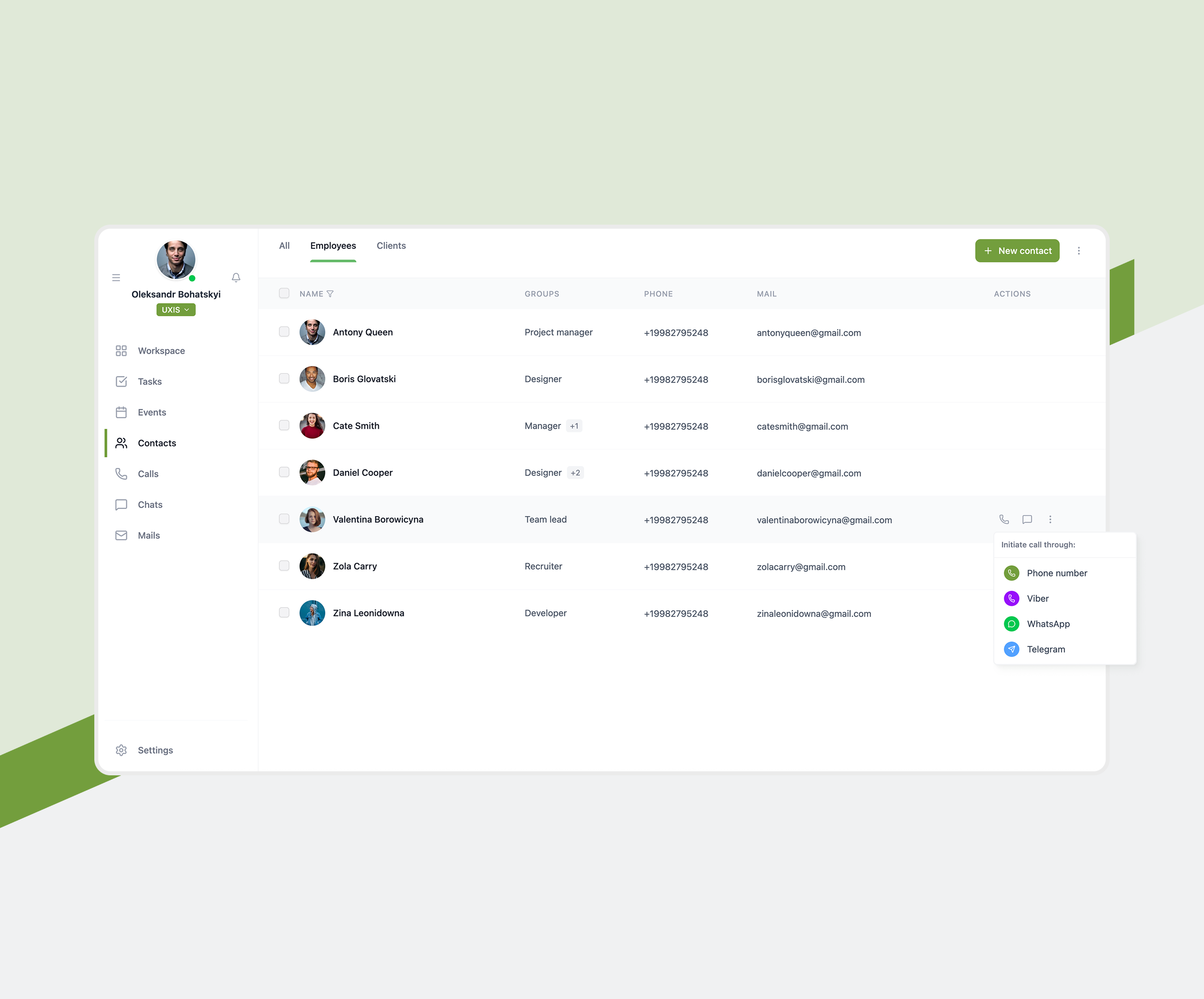

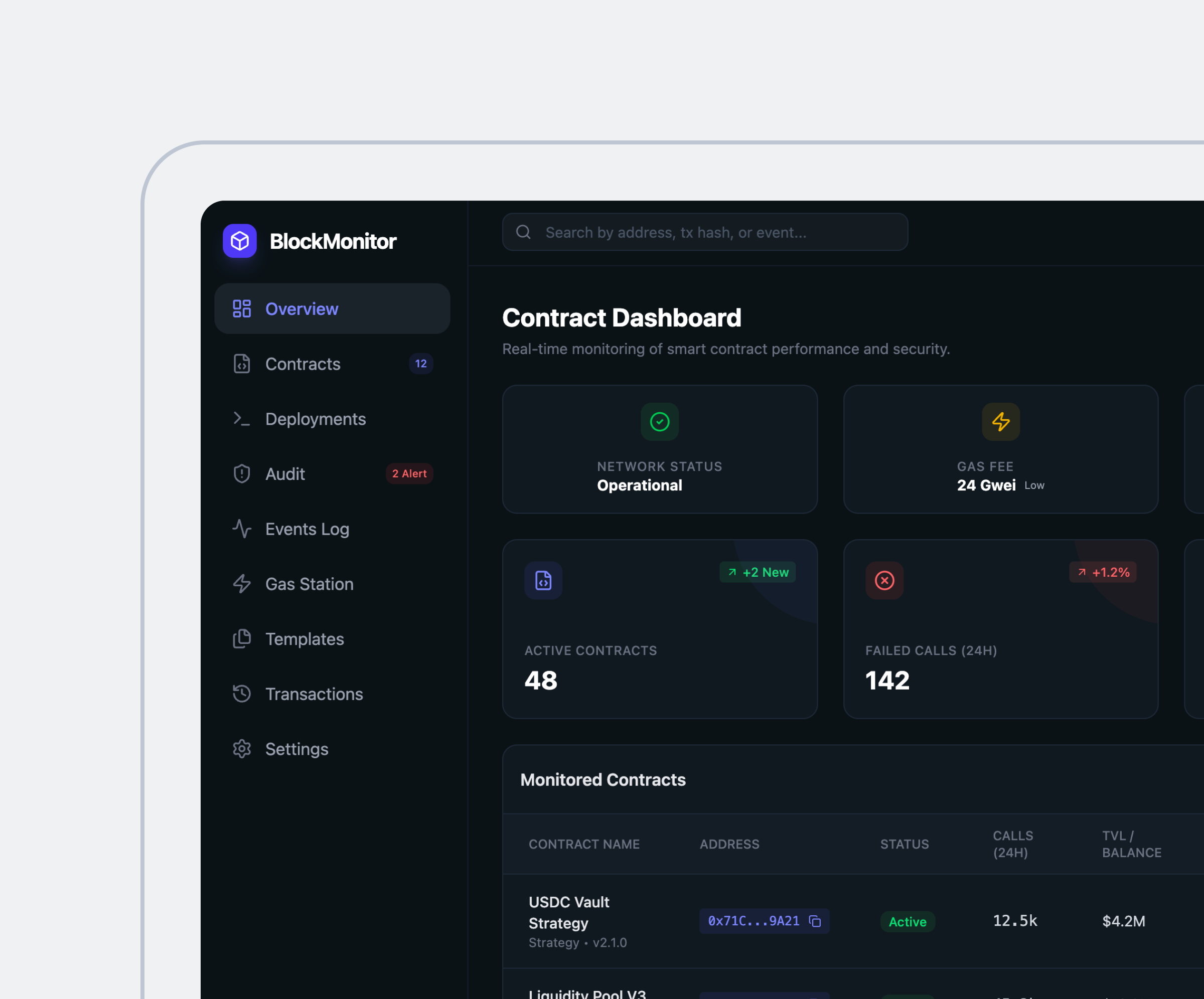

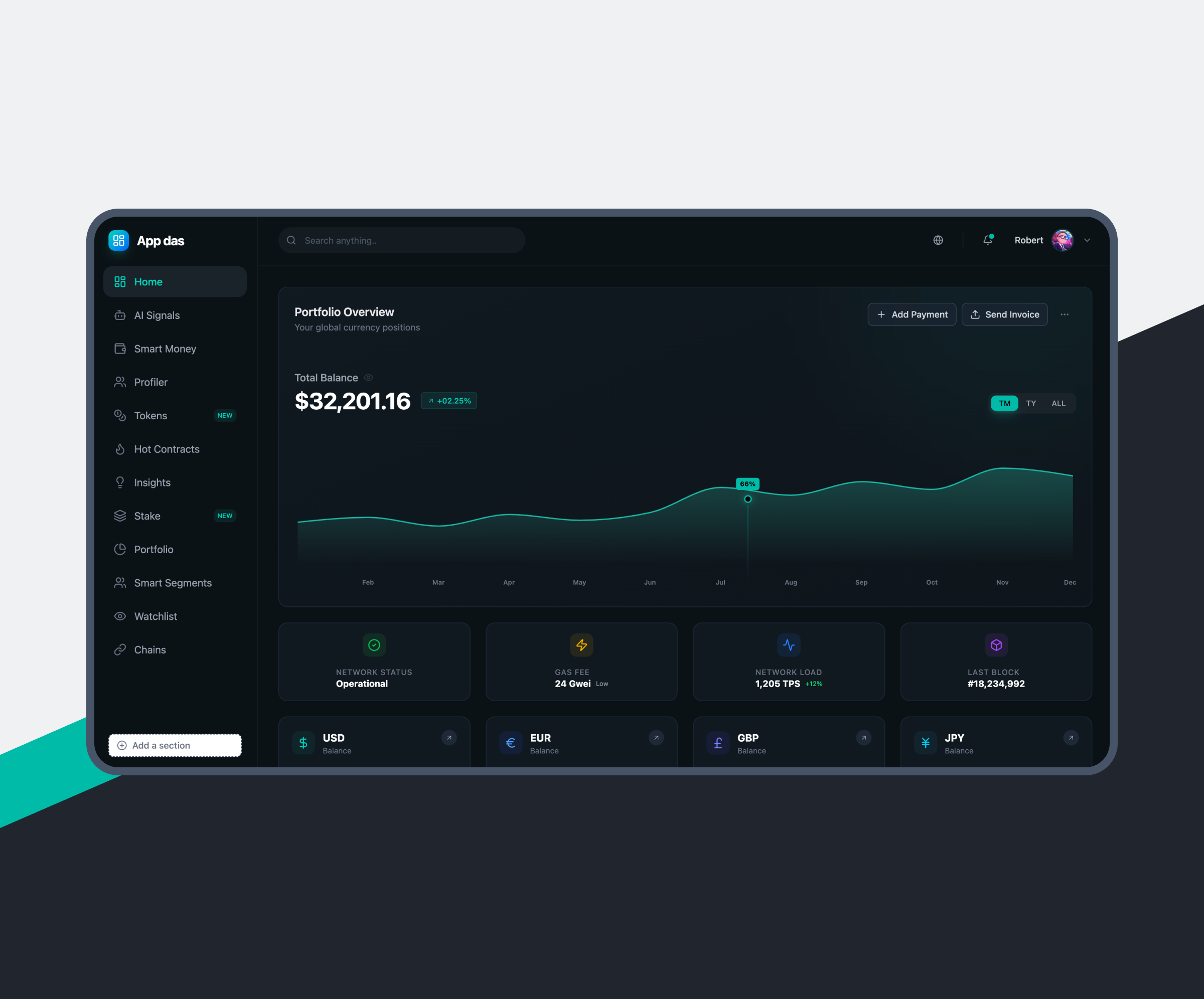

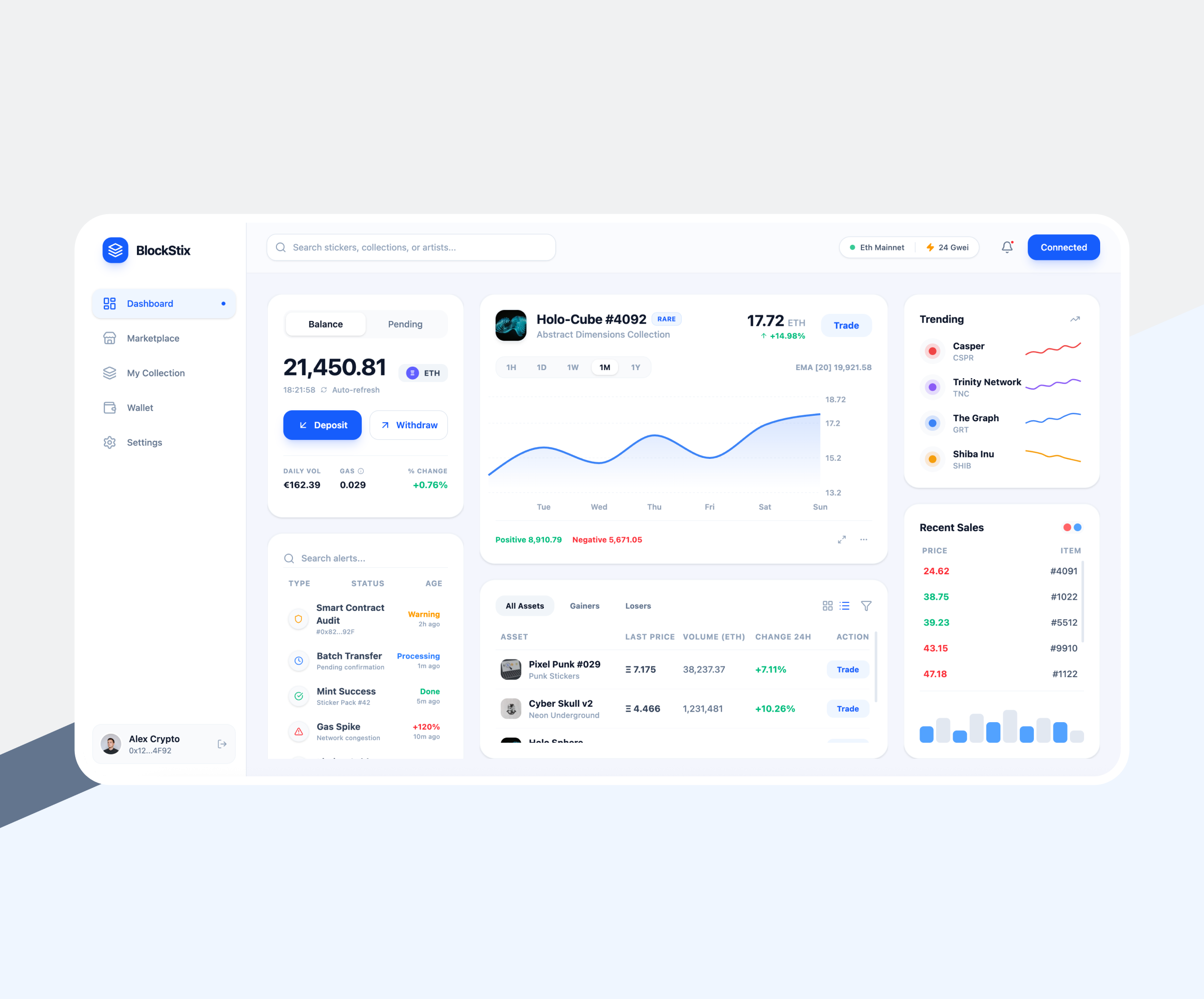

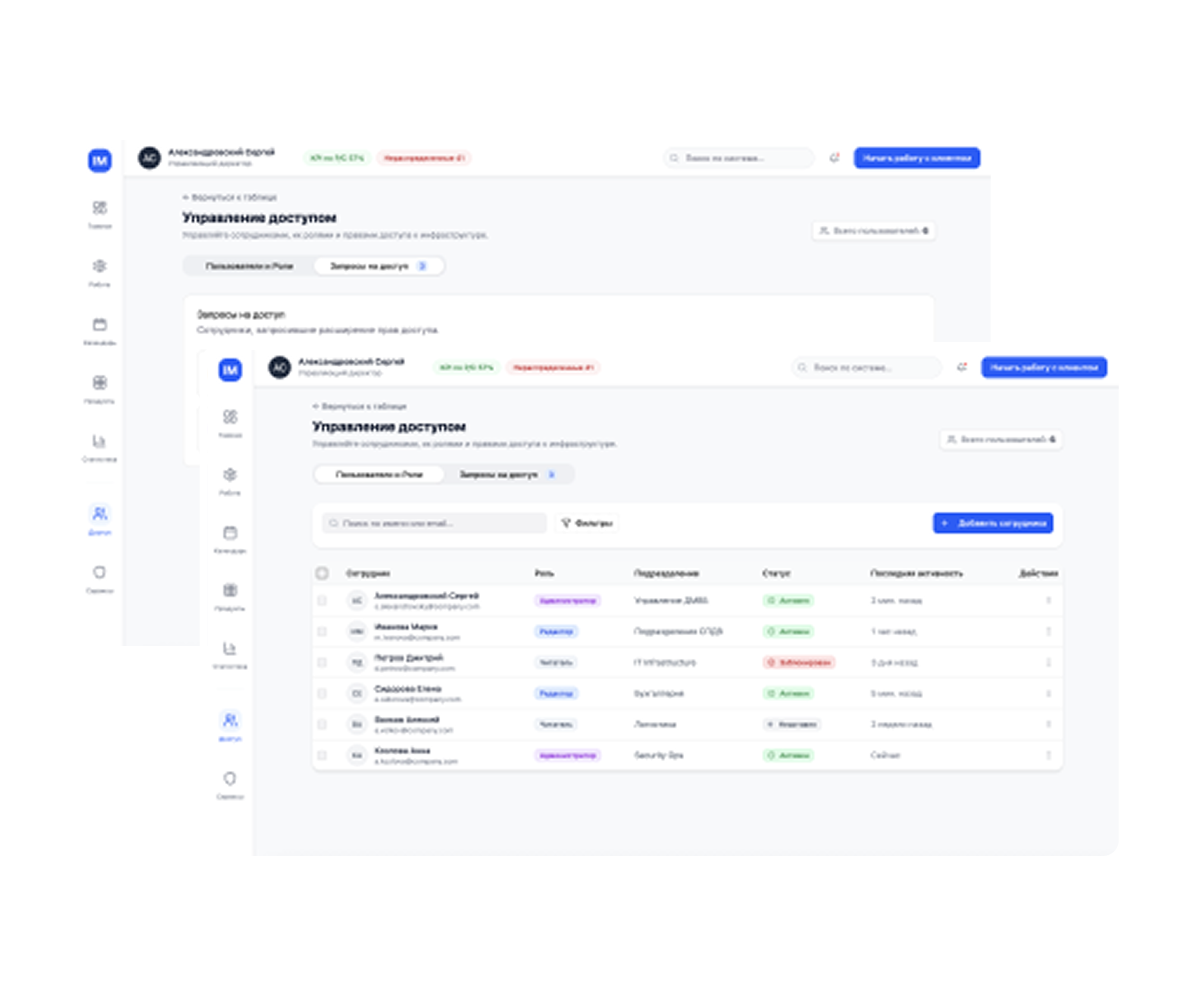

Custom FinTech Software Development

Elinext’s financial software developers craft bespoke fintech solutions that meet your company’s specific business demands. Our tailored approach guarantees scalable, secure, and high-performance applications that integrate seamlessly.

-

FinTech Consulting Services

For over a decade, our expert consulting has provided strategic insights and practical guidance to navigate the complex financial landscape. We collaborate closely to optimize processes and drive digital innovation for our customers.

-

FinTech Integration Services

Elinext engineers deliver robust integration services that connect diverse systems and platforms for financial organizations. Our seamless approach ensures streamlined operations and consistent, accurate data flow.

-

Elinext allows you to protect your operations with our advanced cybersecurity services. We deploy proactive measures and continuous monitoring to secure your data and maintain regulatory compliance.

-

FinTech Software Support

After we’re done with the development, or if you want these services for your own product, we can offer comprehensive maintenance and troubleshooting for your FinTech applications. We ensure reliable performance, prompt updates, and minimal downtime.

-

Digital Financial Transformation

Elinext ensures you can accelerate your digital financial transformation with innovative solutions that modernize processes, enhance customer experiences, and empower data-driven decision-making.

-

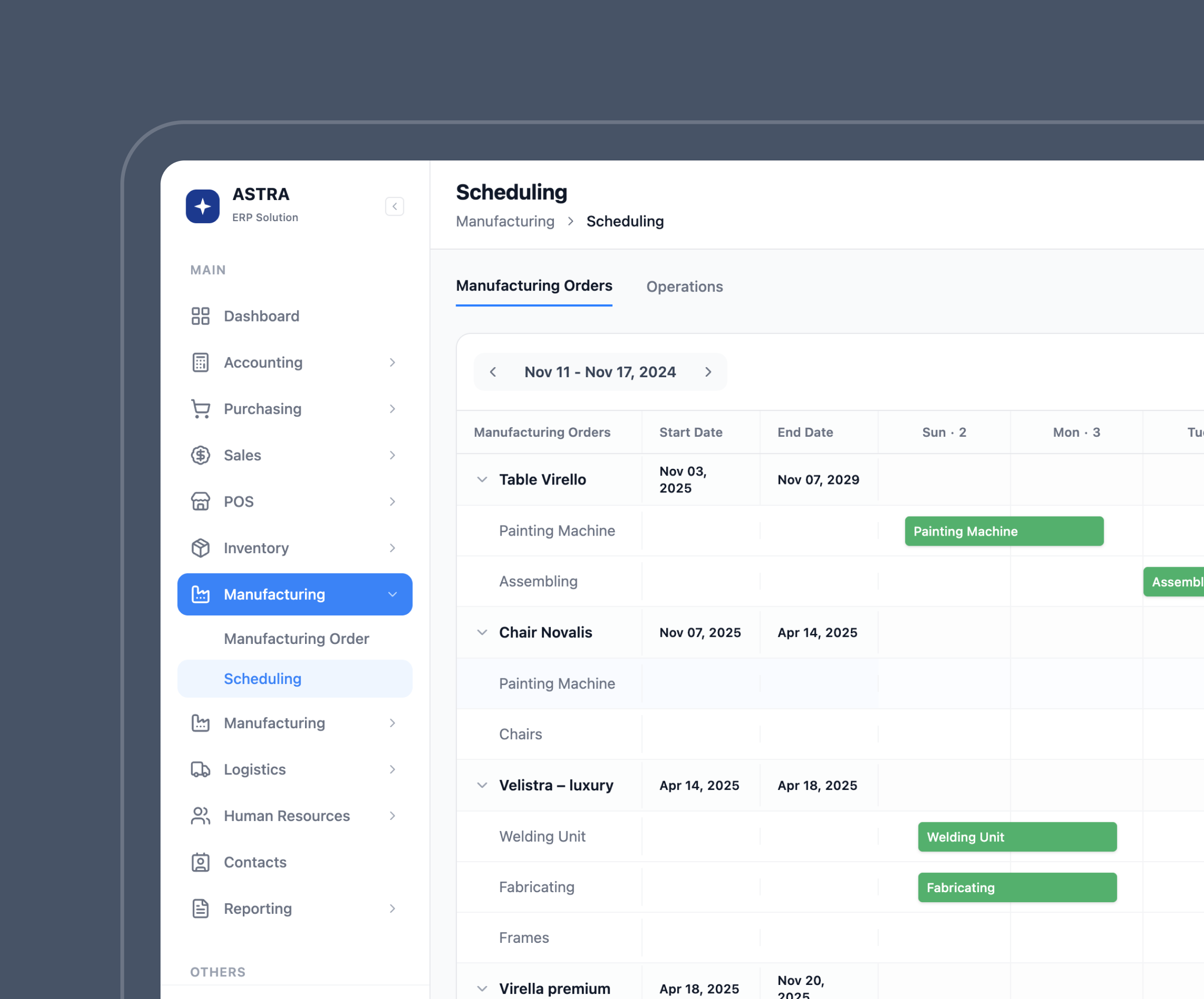

Legacy App and System Modernization

Our engineers are capable of revitalizing outdated systems through our modernization services. We update legacy applications and infrastructure, integrating modern technologies to boost efficiency and security.

-

We enable businesses to streamline their data lifecycle with our management services. Our data specialists facilitate efficient aggregation, secure storage, and insightful analysis to drive informed, compliant decision-making.

-

Our finance software developers bring to life user-friendly mobile applications designed for secure financial services. This solutions ensure real-time access to critical data and a seamless user experience.

Sustainability and ESG Services for the Financial Industry

Sustainability and ESG services are a structured method of integrating ESG criteria into financial digital products and platforms. The service is intended for financial and fintech organizations managing ESG risks and reporting. The result is investor trust, transparency, and regulatory alignment. Elinext enables ESG analytics and reporting within financial software systems.

Our Awards and Recognitions

Advanced Techs

We Implement in FinTech Software

Custom FinTech

Solutions We Offer

What Our Experts SayWhat Our Experts Say

Core Technologies We Work With

-

Frontend 12+0Practice28 yearsProjects70+Workforce40+JavaScript library by Meta enabling component-based web apps with scalability, reusability, and flexibility globally.Practice28 yearsProjects50+Workforce25+Front-end framework by Google enabling enterprises to build scalable, maintainable, and secure web apps globally.Practice7 yearsProjects20+Workforce15+Progressive front-end framework enabling developers to build scalable, lightweight, and maintainable apps globally.Practice28 yearsProjects400+Workforce80+Most popular web programming language enabling interactive apps, dynamic websites, and enterprise-scale platforms globally.

-

-

Backend 12+0Practice27 yearsProjects250+Workforce60+Enterprise programming language enabling enterprises to build scalable, reliable, and secure applications globally.Practice20 yearsProjects150+Workforce50+Microsoft’s cross-platform framework enabling enterprises to build scalable apps for desktop, mobile, and web globally.Practice20 yearsProjects130+Workforce50+Popular programming language enabling enterprises to build AI, analytics, web, and backend apps with simplicity and scalability globally.Practice20 yearsProjects110+Workforce30+Popular web programming language enabling enterprises to build dynamic websites, CMS, and apps globally.Practice13 yearsProjects100+Workforce50+JavaScript runtime enabling enterprises to build scalable, fast, and real-time applications globally.Practice9 yearsProjects40+Workforce10+Programming language by Google enabling enterprises to build scalable, high-performance apps globally.Practice28 yearsProjects70+Workforce15+Programming language enabling enterprises to build high-performance, reliable, and secure systems, games, and enterprise apps globally.Practice28 yearsProjects10+Workforce3+Legacy programming language enabling enterprises to run mission-critical systems in banking, insurance, and government globally.

-

-

Mobile 12+0Practice15 yearsProjects60+Workforce25+Apple’s mobile operating system enabling enterprises and developers to build apps for iPhone, iPad, and wearable devices globally.Practice14 yearsProjects70+Workforce30+Google’s mobile OS enabling enterprises and developers to build apps for billions of smartphones and devices globally.Practice6 yearsProjects20+Workforce15+Cross-platform framework enabling enterprises to build apps for iOS, Android, and web with a single codebase globally.Practice7 yearsProjects30+Workforce15+Cross-platform framework enabling enterprises to build mobile apps using JavaScript and React with scalability globally.

-

-

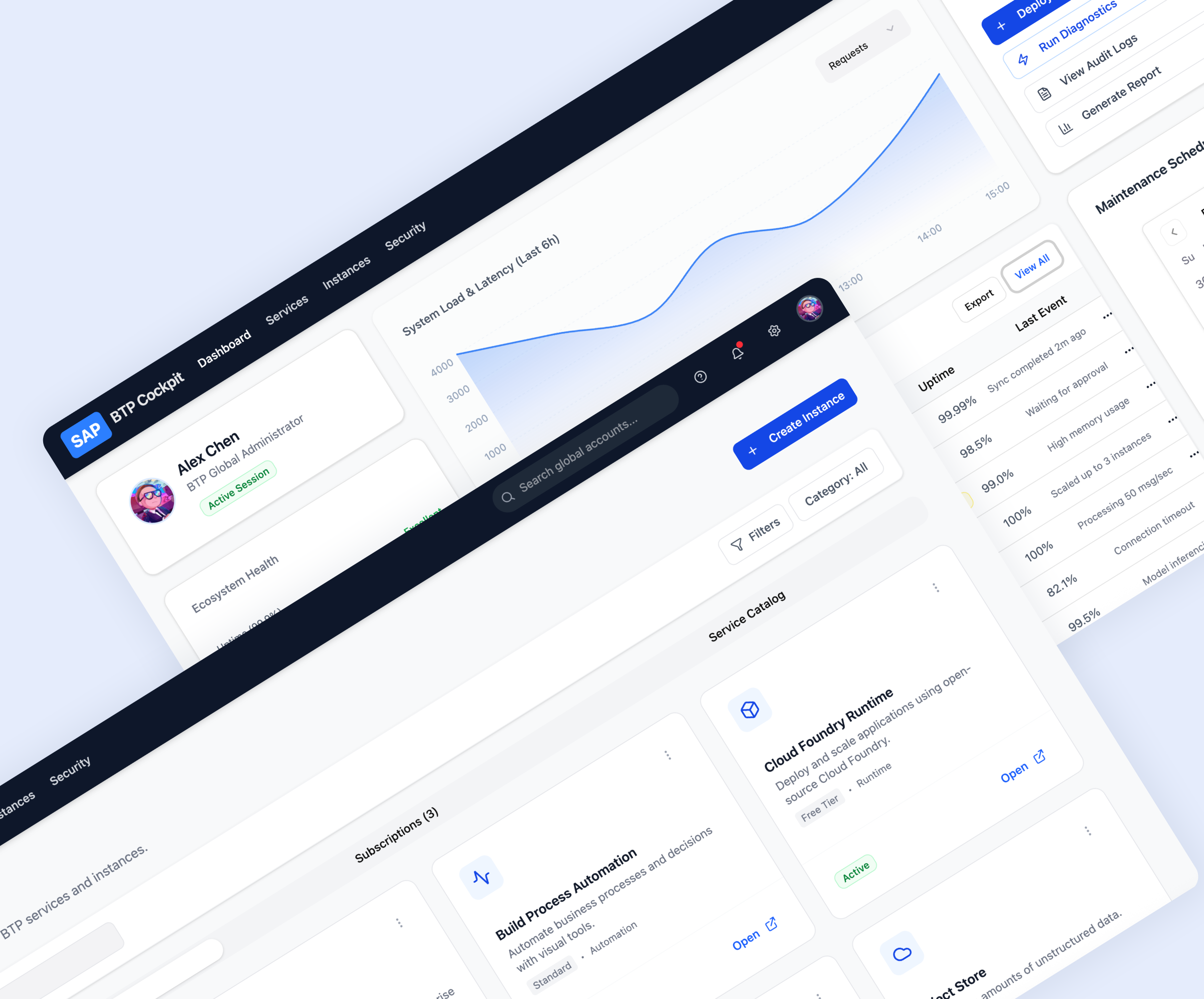

Cloud & Platforms 12+0Practice13 yearsProjects30+Workforce10+Largest cloud provider offering compute, storage, AI, and analytics with unmatched scale, global infrastructure, and millions of customers.Practice12 yearsProjects10+Workforce10+Cloud platform uniting AI, data, and IoT with hybrid support, strong security, and 60+ global regions for enterprise scalability.Practice12 yearsProjects20+Workforce15+Cloud platform with strong AI, data analytics, and open-source tools enabling business innovation at scale across 200+ countries.

-

-

Big data 12+0

-

-

DevOps 12+0

-

Why Our Clients Choose

Elinext as a FinTech Software Development Company

Choose your

Service Option

Hire FinTech Software Developers

from Elinext

Why Elinext?

Listen to Our Clients

FAQ

-

Security ensures the protection of sensitive data, prevents fraud, and guarantees regulatory compliance. In fintech, even minor breaches can lead to major financial and reputational losses, so robust security is non-negotiable.

-

Finance software development services are quite a wide range. Timelines vary based on complexity and features. A basic MVP can take 3–4 months, while full-scale systems may require 6–12+ months. We offer flexible engagement models to accelerate time to market without compromising quality.

-

Costs depend on project size, scope, tech stack, and team composition. We provide transparent estimates after requirements analysis and offer scalable pricing options for startups and enterprises alike.

-

Yes, our team specializes in seamless integration with legacy systems, CRMs, ERPs, and third-party APIs. We ensure smooth data flow, minimal disruption, and improved functionality across your tech ecosystem.

Looking for Related Services?

Financial Software Development

ArticlesFinancial Software Development

Articles

Articles

Articles