Introduction

The client is a US B2B insurance company that connects insurance agents and potential customers. Their idea was to make it possible for insurance agents to create tailored websites for their companies in a couple of minutes using the client’s platform. At the same time, the insurance websites for the customers would all be helpful and user-friendly so that people seeking insurance could choose which one fits them best.

Challenge

The challenge was to develop a platform for creating and hosting customized websites for insurance agents. The idea was that any agent could log in to a platform and within a couple of minutes make a website that would feature their unique branding elements such as logo, color theme, and relevant information about their agency or company. The company already had an API but it hadn’t been used before the Elinext team joined the development process. The Elinext team was hired to develop the front end of the platform and the missing part of the back end.

The platform had to consist of two parts:

- The admin panel would have all the information about the insurance agents who signed a contract with our client and where the agent can customize the website.

- A website that would contain the insurance options that the client offers (accidental death, hospitalization, term life, etc.), product descriptions, About Us page, and payment integration.

Solution

Module 1: Admin portal (for admins and insurance agents)

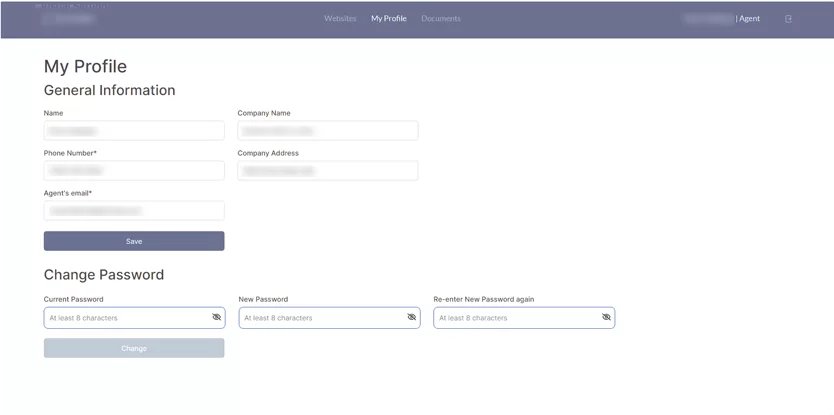

- Authentication and authorization

Both the admin from the side of our client and insurance agents can log into the system. The agents can access their data, while the admin can manage agents’ settings.

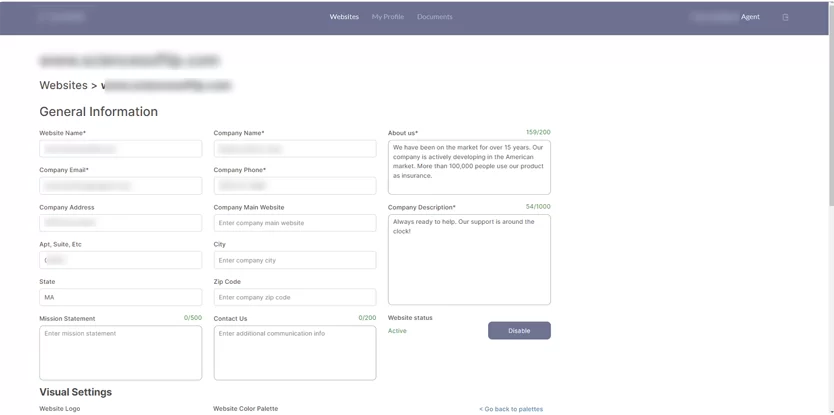

- Website management

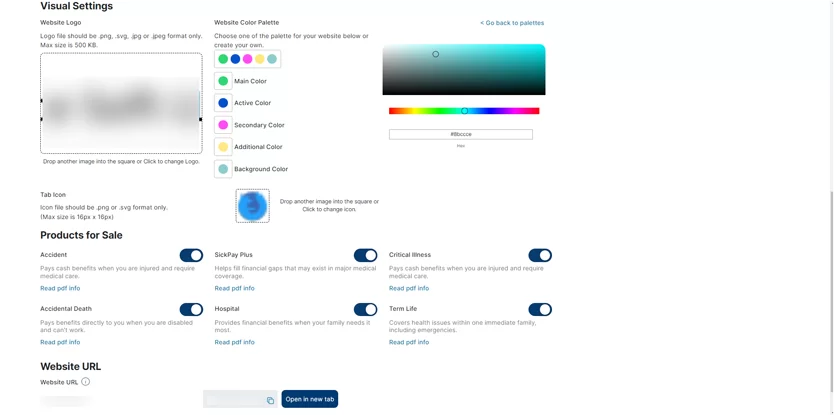

All agents can customize their websites. They are offered a list of standard products and they choose the products they are going to sell. Agents also provide information about their company (URL, address, phone number, etc.), upload their own logo, and select a color palette for the website or create their own color palette.

- Agent management

The admin can manage all insurance agents, which includes adding, editing, and deleting agent profiles.

- Document management

Document management allows uploading, editing, and deleting of documents ― extensive PDF brochures for each insurance product. This is an easy way for insurance agents to provide detailed information about their products. After the paper is linked to the product, the link “Read pdf info“ for the product is updated on the website details page.

Module 2: Website (for end customers)

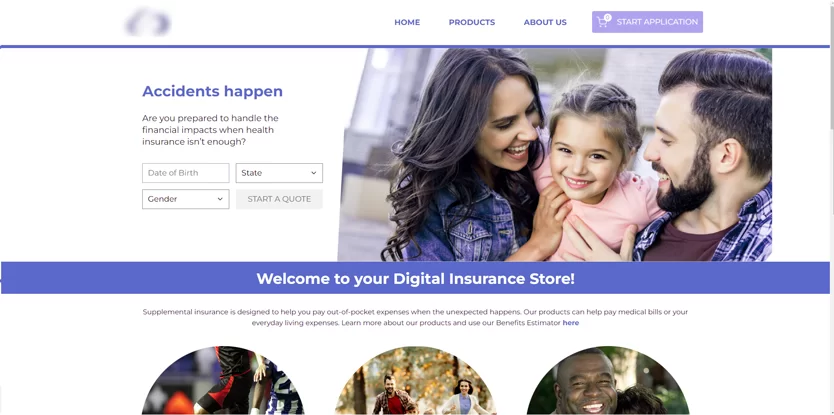

- Home page

The Elinext team built a customizable home page to be used by end customers, i.e. people who are seeking to buy insurance from insurance agents. Customers can acquire the insurance online via the website.

- About Us page

This fully customizable page contains information about the insurance company that includes the company image, mission statement, logo, company description, and company contacts.

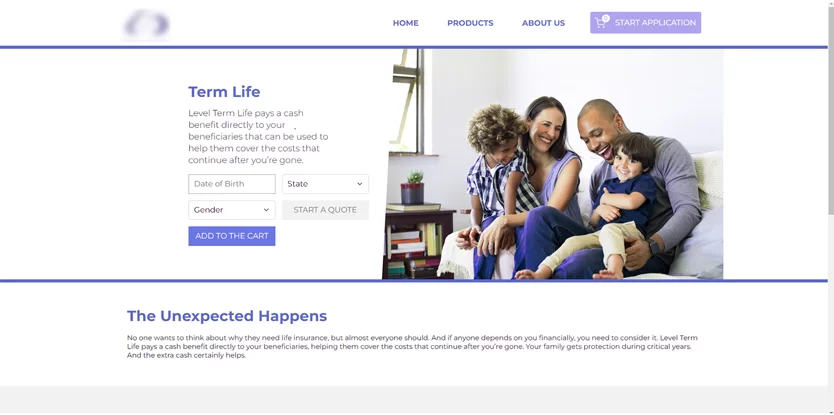

- Product details page

All products have their own landing pages, where users can see the information and benefits of every insurance product. Potential customers also can get a preliminary quote for the insurance.

- Cost Calculator

Potential customers can enter their relevant personal information (age, gender, ZIP code, etc.) and receive an approximate cost of their insurance and which benefits they would get in case of an insurance case.

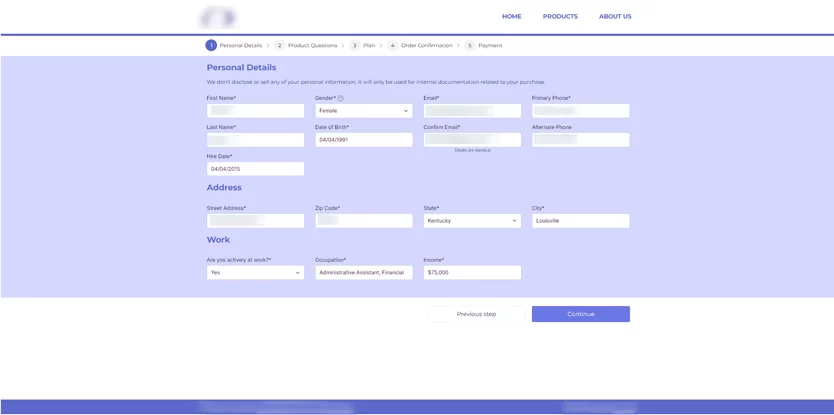

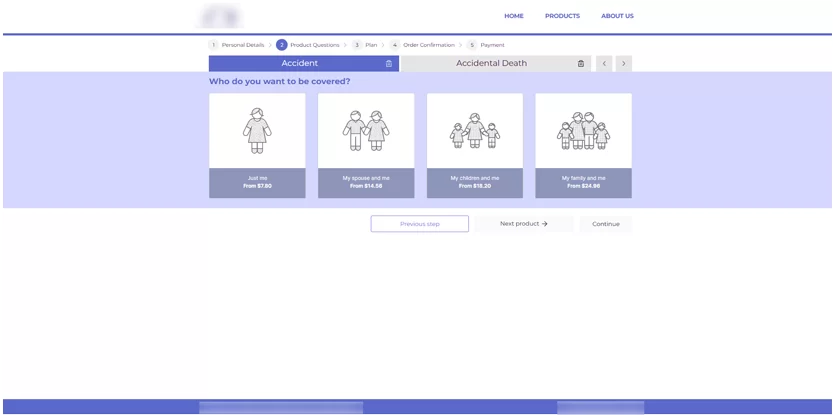

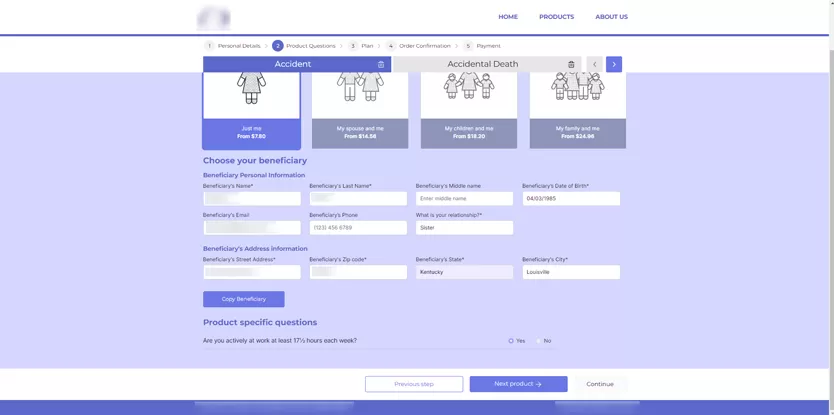

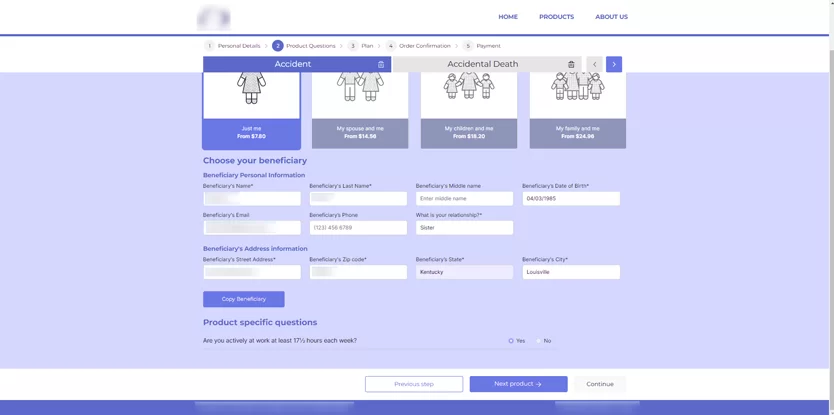

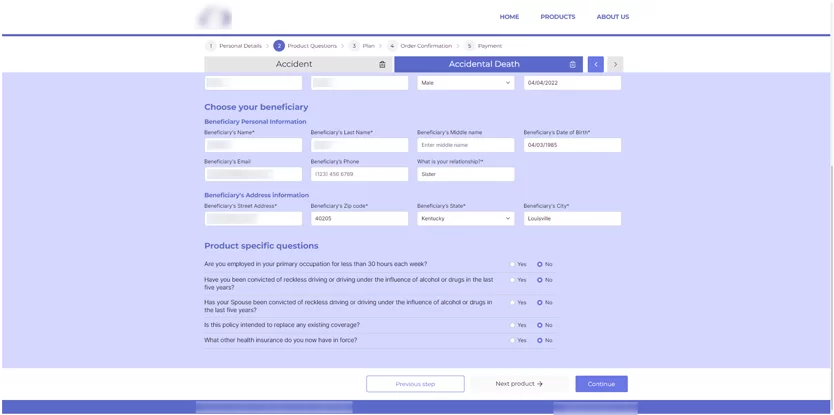

- Application process

Through the application process, the end customer can acquire insurance online via the insurance agent’s website. The flow starts after the customer has selected the products that they want to buy. The flow ends when the customer has paid for the insurance product.

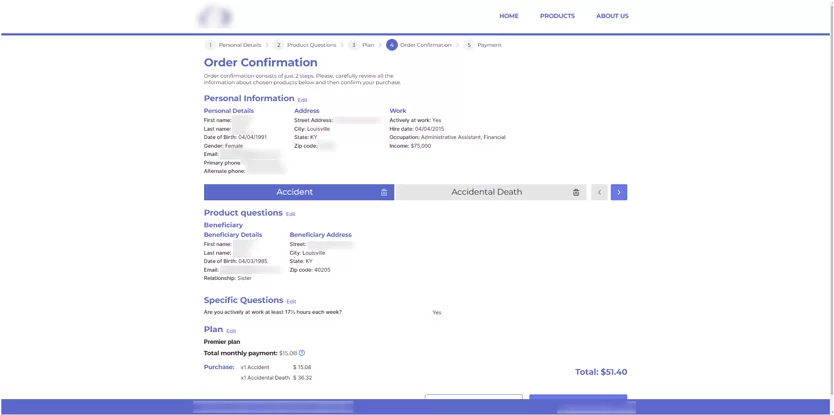

The whole application process of acquiring an insurance product asks the customer to perform the following steps:

1) Provide personal information;

2) Answer product-specific questions;

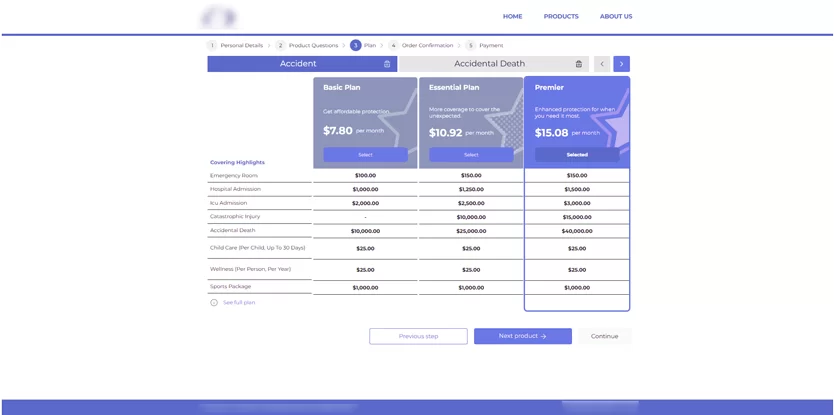

3) Select the plan and the type of coverage;

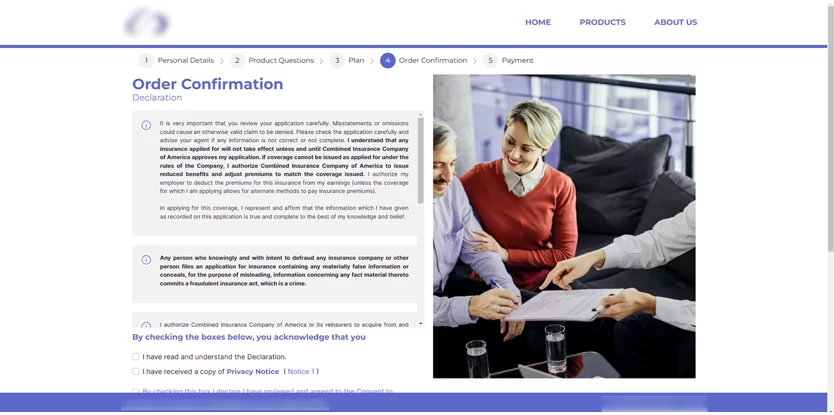

4) Accept legal terms and conditions;

5) Pay for the insurance via the payment portal.

Result

The project is launched, and the Elinext team is still gathering feedback, which is very positive so far. We are still working to add some more details and additional features to make the interface richer and more user-friendly.

The Elinext team has skilled experts who love working on tough and interesting projects. Feel free to reach out to Elinext to learn more about our development services.