The sinuous path from drug discovery to reaching its final consumer

Can the use of software for drug commercialization shake the pharmaceutical industry by its roots? There must be good and ‘profitable’ reasons for relevant players (such as biotech, pharma, or tech giants such as IBM) to place their bets on innovation at all stages of a business. Reportedly, being able to produce the right drug, at the right time, at an appropriate production rate, at the right price, and sell it using the right channels are game-changing factors, generating profits that go beyond one’s imagination.

Investments in digitalization – A game-changing approach

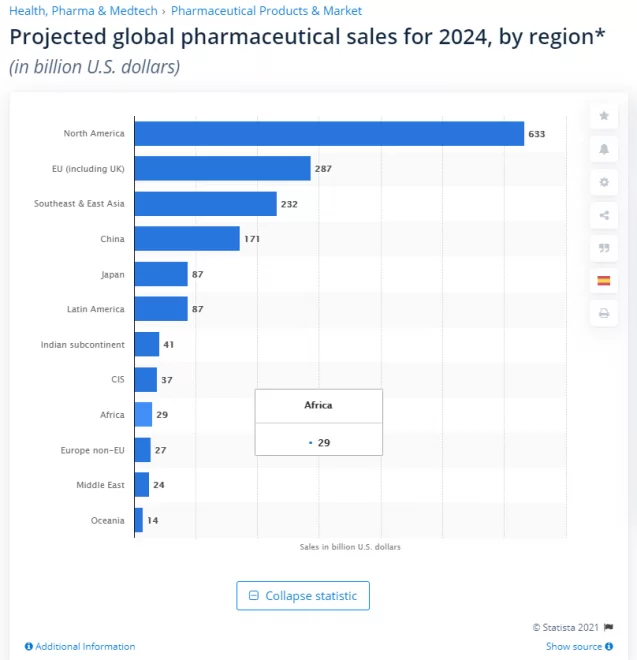

According to Statista, by 2024, the projected pharmaceutical sales in North America will reach 633 billion U.S. dollars.

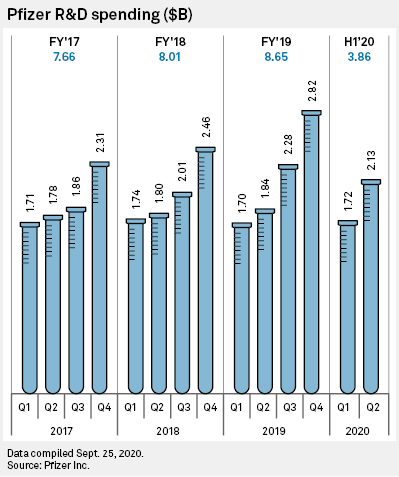

In 2021, Pfizer forecasts it will earn between $59 billion and $61 billion, out of which $4 billion will come from the vaccine alone. However, meeting the international market demands would have been impossible without a highly orchestrated supply network that allows information and supply to flow seamlessly alongside the physical product. Back in 2009, Pfizer started its digitalization process by implementing a standard ERP that covered all the business’ manufacturing, financial, and commercial processes. Pfizer has come a long way since then, currently using IoT solutions to improve the efficiency of their supply chain.

Mirko Senatore, director of Pfizer’s EMEA team, can’t see a future of the pharma industry without digitalization. In his view, the use of ‘pick by voice’ systems for performant logistics, real-time visibility tools, ‘control tower’ strategies operated via 4PLs, advanced analytics for data reporting and capturing, real-time temperature monitoring or active cooling technologies for temperature-sensitive drugs must be integral parts of any pharma business’ technological portfolio. You can read the entire interview here.

Can software solutions accelerate innovation?

Pfizer just showed the world that they can accelerate innovation. For the newcomers in the pharmaceutical reality, it is important to know that the process of any drug development has 5 crucial stages: discovery, clinical trials, marketing & distribution, commercialization, and – last but not least – pharmacovigilance. Each and every one of these stages can be accelerated and simplified with the help of new technologies. But today we will focus on drug commercialization. These are only some of the applicable technological solutions:

Salesforce CRM – they simplify and speed up communication between doctors and pharmaceutical representatives.

Deep learning – allows for adverse event reports from various sources and channels to be systemized efficiently.

Multi-channel marketing automation – these systems ensure that sales activities and marketing run smoothly and flawlessly.

It almost goes without saying that pharmaceutical organizations can highly benefit from automating routines and thus accelerate the entire process of drug discovery and distribution.

Pharma sales digitalization in the USA can’t happen in the blink of an eye

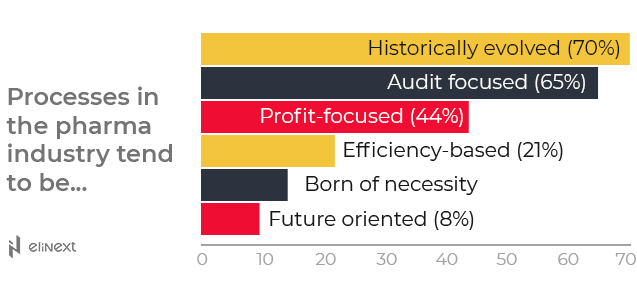

Increasing the competitive edge via digitalization takes time and, above all, money. But there is more to the story. The “Pharma Insights 2019” study, conducted by MAIN5, clearly shows that only 8% of the pharma processes are actually future-oriented:

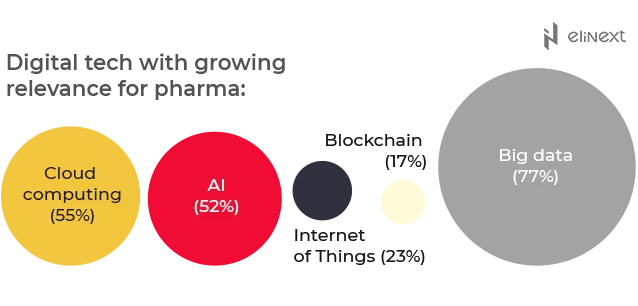

According to the same study, pharma is predominantly a data-driven business whose value could increase through an efficient and fast computational mass analysis of the existing large data repositories.

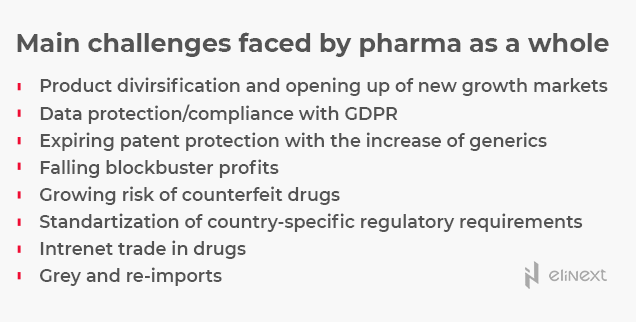

MAIN5’s report underlines the challenges that the pharma industry has to face during the digitalization process:

It is common sense that, in order to ensure the patient’s safety, the pharma industry needs to comply with strict regulations. For instance, to comply with FDA’s 21 CFR part 11, electronic records and signatures must be treated similarly to handwritten signatures and paper records. There is no wonder that, under the current scenario, many pharma organizations perceive the existing regulations as outdated and stifling.

Unfortunately, apart from compliance requirements and legal regulations, there are other factors that hinder the pharmaceutical digitalization process. For instance, the gap between the existing infrastructure and digital processes. This problem is often worsened by the employees’ reluctance to embrace the change (often caused by the lack of digital knowledge). In order for a pharma business to remain competitive in 2021, marketers and managers should not only focus on building a motivating and satisfying customer-based culture but also an employee-based one.

The outbreak of the COVID-19 pandemic gave birth to a pharma digital reset. It is not uncommon for sales representatives to use social media or diverse apps to inform and persuade patients and caregivers. Using Skype to contact your physician, a portal to obtain your medical record, or accessing patient communities to share information with other patients suffering from a similar condition is no longer a novelty.

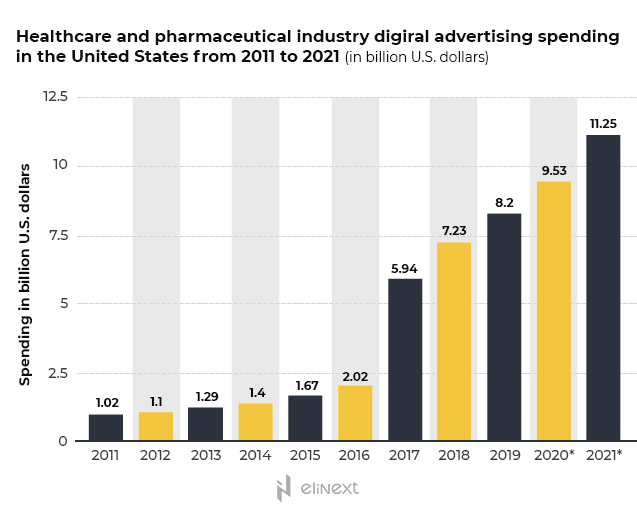

According to Statista, the U.S. pharma and healthcare industry invested in 2019 8.34 billion U.S dollars in digital advertising. By the end of 2021, the sector is expected to invest over 11 billion dollars in it.

For example, the use of advanced analytics for mining electronic medical records, thus identifying those patients who are likely to suffer from a specific disease in the future, will allow savvy companies to join the winning side.

Is Pharma 4.0 an attainable goal?

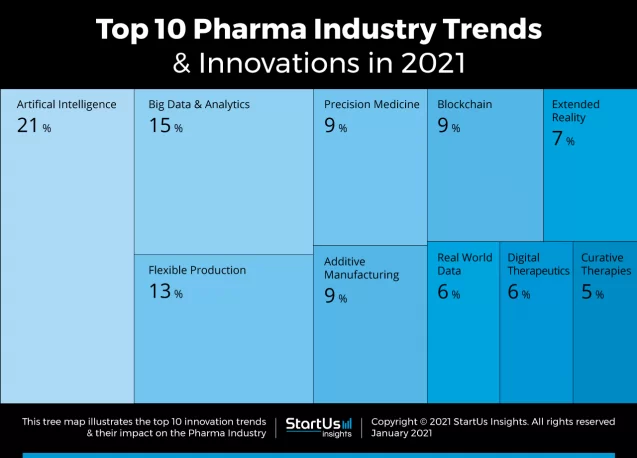

It wouldn’t be too wrong to say that, nowadays, the pharma industry is undergoing a storm that brings with it new challenges on a daily basis. But, on the bright side, it also brings new opportunities. Absorbing knowledge on the go and implementing new practices is steadily reconfiguring the global pharmaceutical landscape. Pharma 4.0 is definitely in the making. According to StartUs Insights, the most notable 2021 pharma industry trends revolve around AI, blockchain technology, extended reality, alongside other Industry 4.0 emerging technologies.

They analysed 1,745 pharma start-ups & scale-ups that are impacting the industry. Among the analysed companies, the U.S. hosts most of them, while India and Europe register increased activity.

According to the study, blockchain technology can revolutionize the way drugs are produced and distributed. Currently, blockchain technology is under testing to address the problem of dangerous counterfeit and low-grade medicines that somehow enter the supply chain, endangering patients’ lives. Digitalizing transactions using blockchain technology can enhance security in the ecosystem of pharma transactions.

For example, the British start-up Veratrak uses a blockchain-based platform that enables workflow management. Their collaborative platform targets the pharma supply chain by ensuring secure document sharing among partners.

Healthcare and pharma management creates a very complicated and fast-changing environment so some digitalization projects started in the 2010s can take decades here to adapt to the non-stop changes.

The pandemic put the spotlight on the pressing need for enhancing speed and accuracy when it comes to mass-producing new drugs and distributing them seamlessly, thus responding to the global pressing demands. The pharma industry seems to be ready to take on the challenge!