The Nordic region holds a particularly strong reputation amongst the European banking community. High profitability, efficiency, and capital strength have always placed Nordic banks as some of the best-performing in the world.

Moreover, today, the region stands out as a hotspot of neobanks (aka digital-only banks) and fintech companies.

There is a good reason behind it — technologically advanced Nordic nations are world champions in using contactless payment technologies.

While there are several explanations for the popularity of digital payment innovations, the main one is that the governments of the Nordic region actively support the fintech sector and the infrastructure for digital payments is being massively rolled out in the region.

Anyway, the Nordic citizens are willing and able to pick up new technology, so digital challengers are thriving, revolutionizing the Nordic’s financial landscape and making the nations closest to becoming cashless societies.

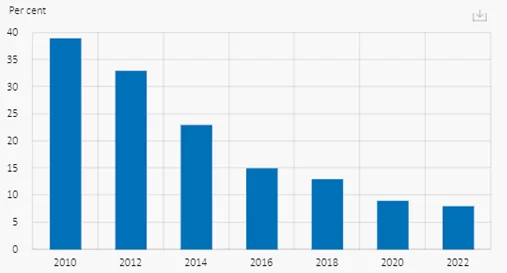

One clear example of such commitment to a cashless lifestyle is Sweden. As per a survey by the Swedish Central Bank, only 8% of Swedes used cash for recent purchases in 2022, a significant decrease from the 40% recorded in 2010.

Percentage of Swedes paying for their most recent purchase in cash

Source: The Swedish Central Bank, the Riksbank.

After all, to understand that Nordic challenger banks are gaining public trust at a large scale it would be enough to look at the figures provided by Statista.

The source predicts the Neobanking market in the Nordics is expected to increase by 13.12% from 2024 to 2028, reaching a market size of US$192.90bn by 2028.

But who exactly are these standout players, disrupting the Nordic banking sector and what’s the secret sauce behind their success? Let’s find out.

5 Emerging Neobanks Redefining the Nordic Financial Services Industry

- Revolut (the United Kingdom-Lithuania)

Founded in 2015 by Nikolay Storonsky and Vlad Yatsenko, two former bankers, this fintech heavy-hitter started as a digital banking platform focused on providing users with a better way to manage their money across borders. The company stood out from fellow fintechs due to its intuitive interface, competitive fees, and the convenience of exchanging currencies at the interbank rate, without any hidden charges.

This revolutionary approach gained instant popularity, and Revolut quickly amassed a large user base across Europe.

Revolt’s success in Europe paved the way for its global expansion. The British-Lithuanian neobank now operates in 38 countries and has over 35 million customers globally.

Apart from its core services of foreign exchange and money transfers, the unicorn has diversified its offerings to include features such as basic crypto services, stock trading, budgeting tools, insurance, savings and investments, and more.

The neobank allows users to hold 150+ currencies on a debit card, and effortlessly send or spend money in local currencies worldwide.

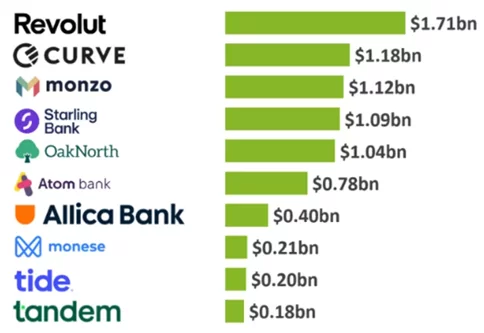

As of March 2023, Revolut was one of the most well-funded neobanks in the UK with $1.71bn in total funding.

Top 10 most well-founded neobanks in the UK, as of 19th March 2023

Source: Fintech Global Research

The company reported that 2023 marked another exceptional year of growth, with revenue increasing by 75% to approximately $2 billion.

- Lunar (Denmark)

The Aarhus C-based company was founded in 2015 by Ken Villum Klausen on a mission to simplify and enrich people’s financial lives.

Lunar is a fully digital mobile banking application catering to both individual and business customers. It offers a variety of financial services including insurance, savings, budgets, loans, and investments.

Lunar Business, a part of Lunar, serves small businesses by offering a comprehensive business package that includes integrated accounting solutions, loans, and more.

Danish challenger bank also launched junior accounts for 15-17-year-olds. The app for younger users provides a simplified set of functions such as a basic account and card, spending overview, budgeting tools, savings goals, instant notifications, and free transfers and payments.

So far, the challenger brand has more than 750,000 private and business customers across the Nordics, offices in Aarhus, Stockholm, Copenhagen, and Oslo and has built its team to a comfortable +500 employees.

In the first half of 2023, Lunar’s net interest and fee incomes saw a twofold increase “compared to the same period last year”. In August 2019 the fintech obtained its banking license and is now “one of few banks with a Nordic banking platform.

- Rocker (Sweden)

Rocker, formerly known as Bynk, has gained a notable share of market space thanks to the ability to package its offering into flexible, easy-to-use, and affordable payment products.

Having taken its first steps in the Nordic fintech scene in 2016, this newcomer has won the hearts of thousands by offering a highly personalized banking experience, with features like a dedicated personal banker and access to investment products and exclusive offers.

In February 2022, Rocker achieved a remarkable milestone by being the first challenger bank in the Nordics to launch a full-scale biometric card, Rocker Touch.

As Rocker continues to grow, the company’s ambitions include expanding its product offerings, elevating user experiences, and accelerating customer growth.

- Wise (The United Kingdom)

First launched in 2011, the London-based Wise has been making waves in the European challenger ecosystem with its innovative platform for transfers that uses the real exchange rate, with significantly lower fees than traditional banks.

The company offers a range of services designed to streamline international money transfers and currency management processes.

The core services include multi-currency accounts, money transfers, debit cards, expense management for business, and direct debit services.

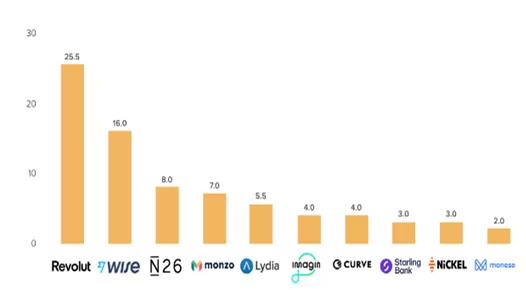

In 2023, the British fintech star managed to increase its active customer base by over 30% and now it reaches 16 million customers worldwide.

Top 10 neobanks in Europe based on number of customers in millions

Source: Digital Banking in Europe, BPC and Fincog, 2023

Recently, the company has reported impressive results, with pre-tax profits reaching £194.3 million for H1 2023, marking a remarkable 280% increase compared to the previous year. Given the robust start to the year, Wise anticipates a 33-38% income growth for FY24.

- Holvi (Finland)

Created by entrepreneurs and for entrepreneurs in 2011, Holvi is among the pioneering digital business banking services in the European market.

As an authorized payment institution supervised by the Financial Supervisory Authority of Finland in the European Economic Area, it caters to around 35,000 business clients in its primary markets of Germany and Finland.

Available on desktop and mobile devices, an online-only financial management service provides freelancers and small business owners with checking accounts and built-in tools to simplify the most important business functions like invoicing, account management, reporting, and receipts.

In addition to its traditional business banking services, the Holvi solution has features that set it apart from competitors. Some of the advanced functionalities include:

- Invoicing creation, sending, and tracking capabilities

- Receipt scanning and recording

- Options to export accounting data via Dropbox

Besides, as an extra, Holvi encourages people to venture into e-commerce — the challenger bank allows its Finnish and German customers to create an online store for their business via the website or an app.

Planning to join the Nordic fintech community with an innovative solution? Elinext is poised and ready to help you pave the way.

As a trusted fintech software development services company, Elinext can help you launch, grow or upgrade your product, whether you’re a young startup or a mature brand looking to explore new opportunities.

Having been in the industry for nearly 30 years, we have the required fintech competence to make your ambition a reality.

Our ability to create tailored experiences, adapt to evolving client wants and needs, and stay agile has been instrumental in the successful delivery of multiple challenging fintech projects, including Financial risk management software, 3-tier ERP and payment processing solution, Software for processing and management of securities for a global fintech company, and more.

One of our recent ambitious projects, the Update of UK-based Crypto Digital Bank, stands out with its particularly successful outcomes.

Despite an extremely tight deadline, the development team managed to complete the project on time. The well-coordinated joint efforts of our vetted experts have resulted in improved app performance and balanced usability. Moreover, the new value-added features have increased the active user base significantly and helped to achieve deeper market penetration.

Find out more about Elinext’s proven expertise across financial technology and talk to our subject matter experts to know how we can help provide value.