Client

A startup from the UK used Elinext to develop web and mobile factoring software for helping goods suppliers and buyers avoid delivery gaps.

Challenge

All too often, suppliers do not get paid in advance or even shortly after they have delivered goods to their buyers. In fact, the payment is usually delayed for up to three months due to all the paperwork. And that disrupts the supplier’s cash flow.

Many banks offer services to solve the problem. What they do is purchase the buyer’s debt by paying the supplier for their goods. But whenever banks are involved, there is a lot of bureaucracy and delays, so one British startup conceived of an alternative solution.

The founders’ idea was to create a factoring system that would mimic the services provided by banks in a simplified, digitized manner. To bring the idea to life, the startup partnered with a web developer in 2020, and worked with them for almost a year. But that developer failed to meet the client's request, and the company sought to replace them.

In the end, the startup came across Elinext. And we responded swiftly, providing our programmers’ CVs in the most proactive manner, which made them choose us.

Process

The startup’s CTO disfavored any formal development structures, be it Scrum meetings or other Agile practices we were used to. But that wasn’t a problem for our team — we adapted to their approach and pace, and the client confidently let us do our job without constant supervision.

We tracked the progress in Microsoft Azure using tickets and stories, calling with the client daily and chatting on Slack.

Initially, we had one developer and BA; afterward, our devs replaced the remaining members of their original team and DevOps joined soon after.

The work mostly went off without a hitch, and the only challenge we encountered was related to the illiteracy of some suppliers. In some countries, known as the global production center, people struggled to fill invoice templates. What we did was simplify the UI/UX as much as possible, and everyone could then use the system.

Product

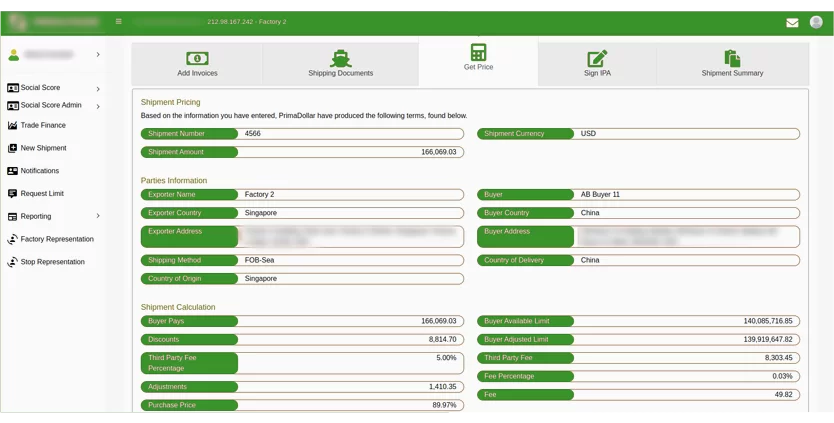

We built the application using microservice-based architecture. And the app succeeds as a simpler procedure of cutting delays in payment through a third party than that offered by banks. Here’s how it works.

A supplier uploads an invoice in the system and gets paid by our client, who will then invoice the supplier’s buyer. As a result, the supplier gets cash shortly after delivering the goods, while the buyer can still take time to pay for them — but instead of paying the supplier, they will pay our client.

Let’s consider the key modules of the application.

Shipment Wizard

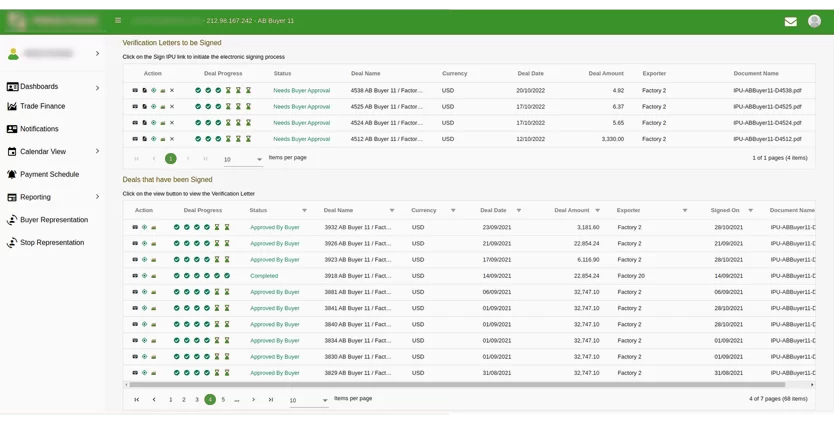

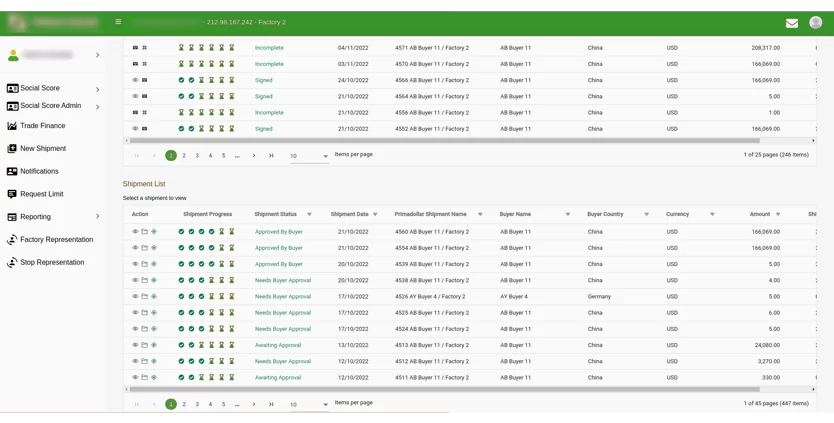

The main module within which the two parties work is the Shipment Wizard. And here’s how it works.

It starts when the supplier has agreed with the buyer that the payment should be channeled through our client’s system. After that, the supplier creates a respective deal in the system, enclosing the invoice, which will further be processed by our client.

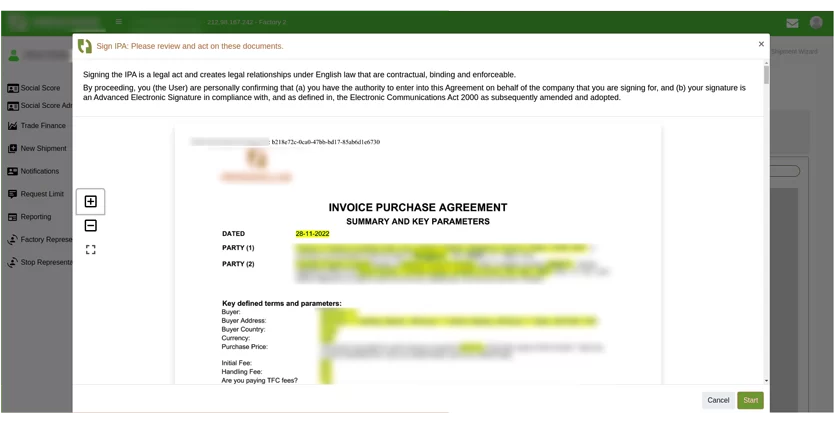

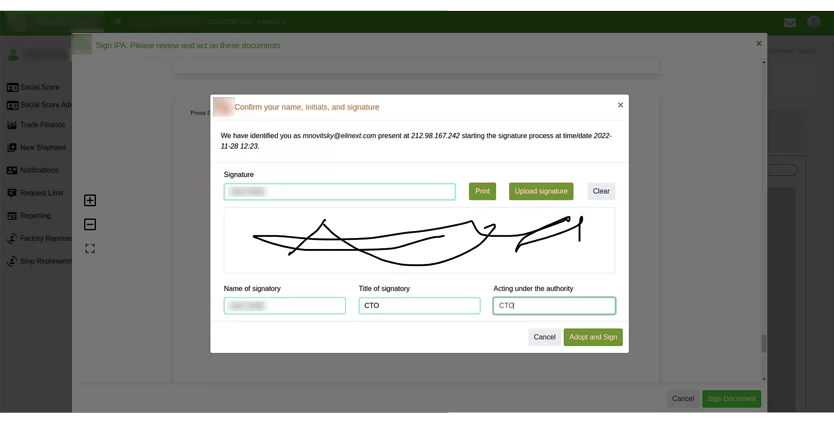

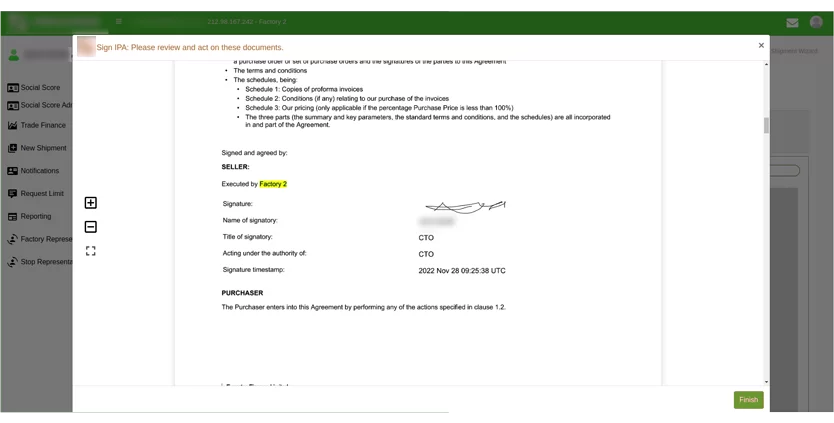

Once our client has reviewed the details and approved the deal, the buyer will see it listed for approval on their dashboard. And it’s their turn to double-check the deal. If everything is fine, they can push the “Approve” button and, if necessary, upload an approval document with an e-signature. Adding a signed document of the type IPU/IPA during the deal creation is mandatory, while optional documents don’t have to be signed.

Overall, the deal will go through several status changes over its life cycle until it’s “Paid Out” and, finally, “Complete.” These two statuses will be assigned manually by our client after the other two parties have approved the completion.

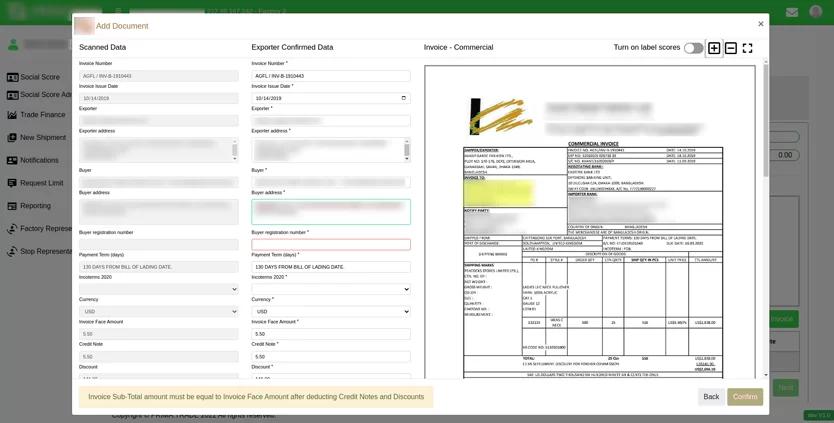

Automated Document Text Recognition

We simplified entering invoice data into the system by using the text recognition AI tool Conpend. Once you’ve uploaded an invoice in pdf, the tool will pull the text from the file and place it in respective fields. And if the algorithm fails to recognize any text and match it to appropriate fields, you’ll still be able to enter the missing pieces manually.

Back Office

The Back Office is our client’s exclusive remit within the system. After a deal has been submitted, the operator based in the supplier’s country will see it listed in Deals Awaiting Approval. From there, they can check the deal details by reviewing the original invoice in pdf and the fields containing the information from that file.

The operator will then fix any mistakes, check back with the two parties and, after getting their written approval, approve the deal digitally in the system.

Results

It took us a bit less than a year to build this microservice-based application. And this product is now used by some of the world’s largest online fashion retailers and other businesses reselling globally. As of today, about ten people are working on the project. And we are working on another part of this client’s ecosystem: an environmental, social and governance (ESG) platform.