BFSI is an umbrella term and abbreviation that stands for “banking, financial services and insurance”.

Artificial Intelligence (AI) turns out to be very helpful for dozens of things in this sector. AI evaluates creditworthiness, automates repetitive tasks like data entry, identifies and mitigates cybersecurity threats, streamlines the loan approval process, automates claims assessment and processing, and fulfills quite a number of other tasks.

Obviously, if you’re not living in a bunker, you’ve heard of such an AI tool as ChatGPT. This is essentially a language model created by the company OpenAI. A simple chat that is able to generate human-like responses to user queries. ChatGPT can help companies in the financial sector.

In what way though? Let’s explore the capabilities of ChatGPT at BFSI step-by-step to define whether it is more of a seasonal trend or a helpful tool that will change things. We’ll dive deeper into Chat GPT’s benefits and limitations, as well as we’ll look into potential and current use cases.

Chat GPT in Banking

Allied Market Research assessed the global AI in banking market size to be valued at $3.88 billion back in 2020. Projections were made for it to reach $64.03 billion by 2030, growing at a tremendous CAGR of 32.6%.

ChatGPT is one of the products that got tremendous recognition in banking. Chatbots, virtual assistants that could be created with the help of learning technologies like ChatGPT, and play quite a significant role in AI in banking market growth.

ChatGPT was developed by OpenAI. It is a tool that utilizes enhanced ML algorithms to generate responses that imitate a conversation that could be happening between humans: with the human making a query, and the machine giving out inputs.

The language model training is based on textual data, and as the software has become quite popular online, there is no lack of training in it recently. Therefore ChatGPT provides its users with accurate and relevant responses to the queries. The tools have found many applications, some of which will be later discussed in the blog post.

The increasing reliance of the financial services sector on AI presents a substantial opportunity for ChatGPT to revolutionize this industry. Given its capacity to handle extensive data, ChatGPT has the potential to serve as a supplementary tool for delivering personalized financial guidance and assistance.

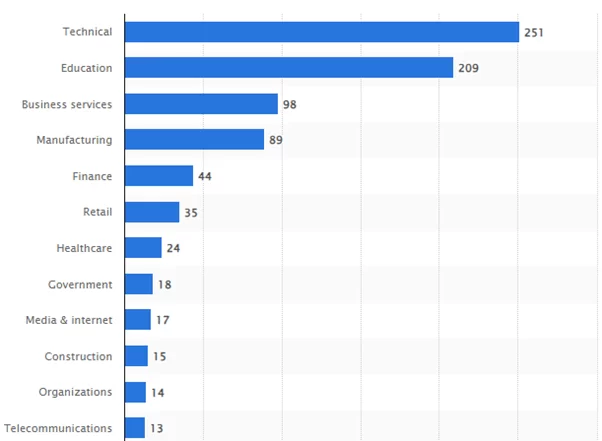

In March of 2023, Statista conducted research on the amount of companies using ChatGPT in their business function in 2023. Here is how it looked:

Amount of companies using ChatGPT in their business function in 2023, by industry

Source: statista.com

As you can see, the financial industry is not the top of the list but they do not overlook the use of ChatGPT. Every banking application seems to have a chat with support that is based on AI. Investors use ChatGPT as a useful supplementary tool. More on HOW other companies in the BFSI sector use it, and which benefits it has to bring to the company to justify the use of it in the next chapter.

Benefits of ChatGPT or BFSI Sector

We’ve asked ChatGPT about what benefits it can bring to the table and commented on what the AI has to offer. It turned out, that it lines up perfectly with observations we’ve made ourselves, and confirmed by use cases that we’re going to mention in the future.

Enhanced Customer Service and Support

ChatGPT is a perfect customer support specialist. It processes through huge datasets and addresses all the responses that come its way. If the chatbots are run with the help of ChatGPT, it can help a bigger number of clients in a smaller amount of time

Hence, the customer attrition is reduced, the customer satisfaction rate is over the roof, and that should help in strengthening the connection between the bank and its customers.

Capital One uses its assistant called Eno. Then there’s Erica from the Bank of America. The bank claims that more than 37 million clients have engaged with Erica. leading US banks have been utilizing. Smaller banks could develop their own AI-helper

Facilitating Decision-Making

ChatGPT won’t be your financial advisor, but it can help your financial advisor in the ways a rare tool can. Once you figure out your financial goal and choose your investment, ChatGPT might be able to show you the way to reach it.

The chat uses ML to scrutinize data and offer insights, so financial advisors and investment managers are set to make more well-informed choices regarding their client’s portfolios. We’ve recently explored robo-advisors in fintech in our blog, ChatGPT is in line with those

Automation for Efficiency

Automation is the key to creating efficiency. By automating routine tasks, such as handling customer service inquiries, ChatGPT frees up human resources for more intricate and strategic responsibilities.

This not only leads to cost reduction but also enhances overall productivity and efficiency within the organization.

Compliance and Security

It might surprise you, but ChatGPT is also a great security specialist. It increases security and compliance for banks and other financial institutions as the tool has the potential to monitor every transaction and report on customer interactions that are suspicious.

It can help identify potential fraud or compliance violations, thus safeguarding the institution and its customers.

Use Cases of ChatGPT for BFSI

ChatGPT can be used by banks to enhance the intellect of their virtual assistant. That way, it will answer the routine questions customers might have. It could be an inquiry about their account balance, or about a certain transaction that was made. It can even be a marketing tool as customers will be asking about interest rates to invest their money, probably.

Banks will also benefit from the automation ChatGPT can bring their way. Imagine having a tool for dealing with all the routine tasks. That frees up your employees and, hence, increases productivity, as human bank workers can now give more of their work time to more complex issues.

Customer Service and Support

Probably, the most straightforward way to use ChatGPT in BFSI is customer support and service. Most of the banks already incorporated chatbots or so-called virtual assistants to respond to an endless array of customer inquiries.

Using AI instead of human beings in responding to routine default questions of clients improves the speed and quality of operations connected with customer services. ChatGPT’s active involvement in the process also reduces the workload of human customer support specialists. Most of the modern banks use AI in their customer support.

Utilizing AI for Investment Guidance and Portfolio Management

One promising application of fintech AI systems is in investment advice and portfolio management. ChatGPT proves instrumental in assisting financial advisors and investment managers in rendering well-informed decisions regarding their clients’ investment portfolios.

For instance, a financial advisor can harness ChatGPT’s capabilities to assess a client’s financial objectives, risk tolerance, and investment preferences. Personalized investment guidance can be provided, aligning closely with these individual factors.

Additionally, AI can continuously monitor market trends, recognizing prospective investment opportunities.

Also, ChatGPT can be employed to automate routine tasks related to portfolio management, such as rebalancing or tax loss harvesting. This automation not only streamlines operations within financial institutions but also yields cost reductions and heightened operational efficiency.

eToro surveyed investors and provided us with some numbers on the matter.

Based on the research findings, 31% of investors in the 18-to-34 age group report that they currently employ services akin to ChatGPT to influence their investment decisions. Additionally, 38% of respondents aged 35 to 44 have indicated a similar practice. Among those investors who are open to or are already utilizing AI, a substantial 60% express their willingness to grant AI the authority to modify and execute trades on their behalf.

Fraud Detection

Yuelin Li, a Chief Product Officer at Onfido in her article “Is ChatGPT capable of fraud?” tries to find an answer to this. She concludes that Chat itself is not capable of committing fraud, but is an exceptional supplementary tool for that. For instance, one could use it to create fake documents or other papers to create a fake ID.

ChatGPT by itself would never commit fraud but could be used to create fraudulent activity. In the same manner, ChatGPT could be used to DETECT fraud.

Artificial intelligence can monitor and supervise the accounts of bank customers on the subject of potentially fraudulent activities. Also, at the very least, ChatGPT can be used to analyze financial claims to identify which ones contain suspicious language. Maybe those claims would have unusual phrasing or will be too technical. Also, ChatGPT can automate compliance and regulatory tasks (anti-money laundering).

Threats of ChatGPT in BFSI

ChatGPT and similar AI chatbots bring a lot of value, but as it’s implemented in every day banking operations, they can carry certain threats and challenges. The companies in the BFSI sector need to consider them before turning to ChatGPT.

Potential data breaches

ChatGPT may handle sensitive customer information, and any security vulnerabilities could lead to data breaches. Also, the vulnerability of chatbots is in their capacity for data transmission. Different malicious attacks can create an overload and increase pressure on the AI-run software.

Misinformation and Inaccurate Advice

Gordon Crovitz, co-chief executive of NewsGuard, characterizes ChatGPT as the most powerful tool for spreading misinformation in the history of the Internet. the truth is, the tool relies on data it’s been trained on, and it very much could be outdated, or inaccurate. It can submit incorrect financial advice, which obviously can have serious consequences for investors.

Customer dissatisfaction

Poorly implemented or malfunctioning chatbots can frustrate customers, leading to a negative perception of the financial organization. If you’re having an issue and trying to attract the bank’s attention to it, and the chatbot gives you an answer that is barely related to your issues, it will provide you with a sour taste. More often than not, a user’s interaction with a chatbot doesn’t result in a resolution.

Ethical Concerns

AI chatbots can and will be used for social engineering fraud. More to that, ChatGPT can be biased and unfair and is not responsible, nor accountable for the issues it brings.

Summary: Is ChatGPT Disrupting The Fintech And Banking Industry?

Customer support is impacted by ChatGPT, and investors seem to like it as well. Fraud detection and regulatory compliance are also some areas in the Chat could be helpful. These applications signify a transformative shift towards greater efficiency, cost reduction, and improved customer experiences within the sector.

It is still too early to say how much of a role ChatGPT (or AI in general) will play in future software development and how widely it is going to be used in them, but all the predictions say that thesis software has tremendous potential, and AI market in BFSI continues to grow.

Discover the future of financial software with Elinext’s expertise in ChatGPT integration. Let’s collaborate to create intelligent, customer-centric solutions that set you apart in the BFSI industry. Reach out to us now to discuss your project and unlock unparalleled possibilities.