The Covid-19 pandemic has exacerbated cybercrime. As the pandemic dramatically changed our lifestyles, transforming us into potential always-connected victims, cybercriminals saw themselves forced to tailor their scams to the new reality and enrich their crime panoply. Society has witnessed an unprecedented rise in crimes such as E-commerce frauds, impersonations, credit or debit card frauds, or phishing e-mails. As a result, the finance and banking industry had no other choice than to counterattack by investing in solutions meant to enhance data security and prevent fraud. FinTechs – such as Elinext – design solutions meant to enhance cybersecurity at multiple levels.

The pandemic landscape and how it fuelled banking fraud

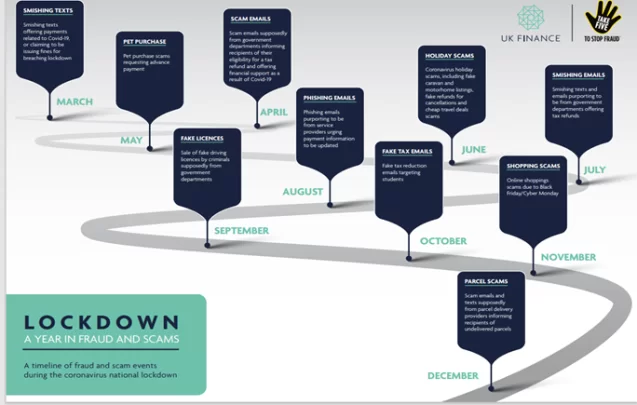

According to a report published by UK Finance, the pandemic forced people to work remotely, shop online, check e-mails regularly, opt for online services such as mobile banking, etc. The always-connected phenomenon forced cybercriminals to diversify their tactics. The report presents a timeline of the most common frauds and scams during the pandemic:

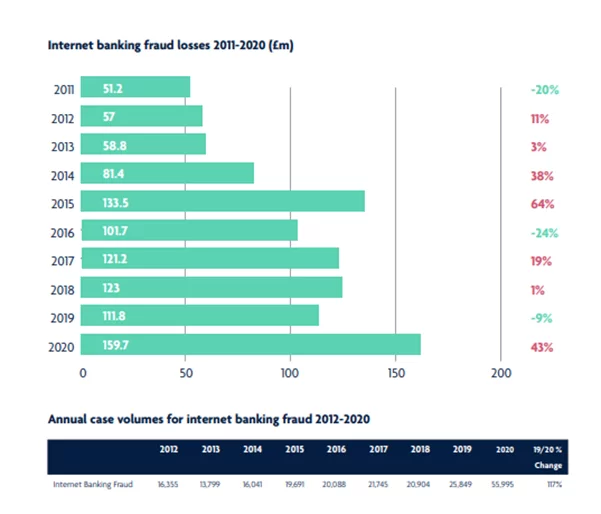

For instance, in 2020 alone, more than 25.000 bank-branded phishing websites were shut down in the UK. In 2020, the security systems employed by banks saved £326.2 million by stopping internet banking frauds. This chart is self-explanatory:

Among the most common scams/frauds mentioned in the report, it is worth highlighting the following ones:

- Counterfeit cards – the criminal uses the information from the magnetic stripe to create a fake card

- Card ID theft – the criminal uses stolen personal information and card details to take over an account

- Unauthorised remote banking – the criminal obtains access to a bank account via remote banking channels (mobile, Internet, or telephone banking) and makes unauthorised money transfers.

- Malicious redirection – when the victim tries to make a payment to a legitimate payee, the criminal convinces him/her to redirect payment to a controlled account

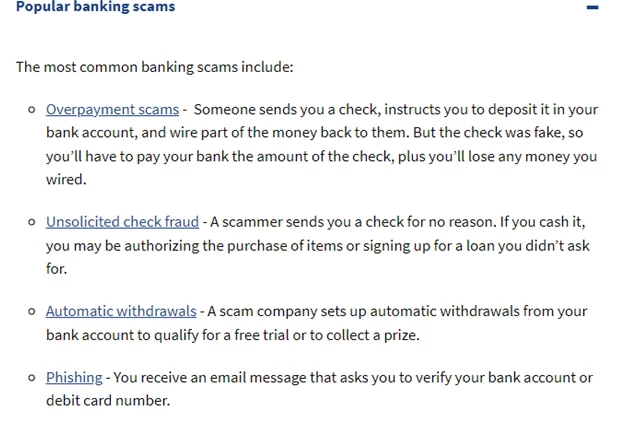

The U.S. government identifies the most popular banking scams:

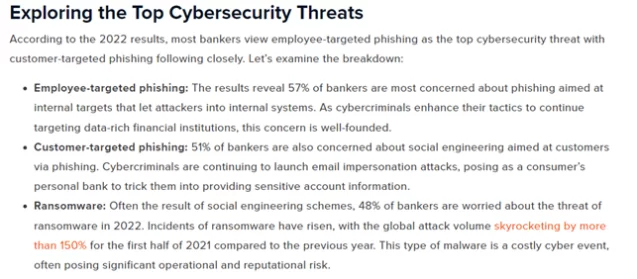

These statistics are already disruptive without even mentioning the spike in cyberattacks – such as DDoS attacks, ransomware, infostealer malware, or botnets– that financial and banking institutions need to deal with. According to CSI, these are the main cybersecurity threats as of 2022:

According to UpGuard, in the first quarter of 2021, the financial sector was the most targeted one for phishing attacks.

As far as DDoS attacks are concerned, the same source highlights that the financial sector was the third most targeted industry between 2020 and 2021.

These are only some examples of the level of inventiveness cybercriminals are currently showing off. It almost goes without saying that the banking and financial industry got urged to take action. Apart from law enforcement, close collaboration with governments and regulators, awareness-raising campaigns, or intelligence sharing as new threats arise, the finance and banking industry is also heavily relying on technology to ensure their customers’ safety.

Software solutions to identify and prevent banking frauds and scams

Due to the richness of customer information they hold and – of course – the big bucks they manage, the financial and banking industries and their customers make a very attractive target for cybercriminals. Let’s take a look at some software solutions meant to make it difficult for cybercriminals to attain their goals.

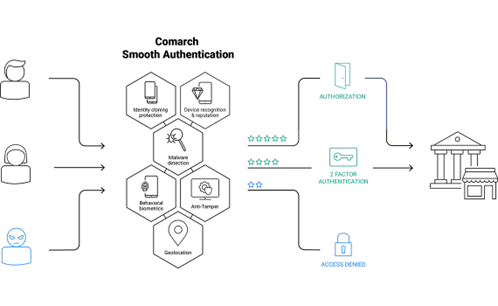

This software was designed for those companies – such as banking or financial institutions -that provide customers with web and/or mobile access to their services. The software is an added security layer meant to protect customers against multiple types of online frauds:

This risk-based authentication software is able to detect real-time frauds thanks to its behavioural biometrics abilities and advanced features such as device recognition or malware detection. This is how the software works:

Feedzai offers a series of innovative, ML-powered solutions designed to prevent financial crime. Their software solutions range from anti-money laundering to account takeover or transaction fraud. Their Transaction Fraud software allows financial institutions to detect fraud in real-time by analysing transaction, device, and behavioural data. According to Feedzai, their software solutions allow risk managers to create “hyper-granular profiles” for IPs, cards, terminals, and devices.

Intercept X Endpoint by SOPHOS

This AI-powered antivirus has been designed to automatically detect, prioritize, and investigate known and unknown threats alike. Among its most notable features, we can highlight:

- 24/7 managed threat response

- AI-driven analysis to detect and investigate suspicious activity

- Advanced ransomware protection technologies able to disrupt the entire attack chain

- Prevents exploit-based attacks

- Detects and prevents techniques such as credential theft, APC, or code cave utilization

- Offers central, cloud-based management

When it comes to AI and ML-powered analytic prowess, we would not be wrong to claim that SAS is a heavyweight champ. SAS® Identity 360 is an innovative software solution designed to detect and prevent identity theft and digital fraud. Let’s take a look at its main features:

- Thanks to its AI and ML-powered analytic methods, customers can not only evaluate the risks of new apps but can also rapidly detect manipulated, stolen, or synthetic identities

- Uses ML and data analytics to monitor suspicious behaviour and patterns, thus minimizing the risks of account takeovers

- Prevents synthetic identity fraud by generating real-time alerts

- Reduces the risk of e-commerce payments fraud by detecting fraudulent shopping behaviours

- Uses predictive analytics and anomaly detection to identify new types of fraud

KYC compliant, the Q5id app allows users to authenticate in a matter of seconds by scanning their face and palm. These scans are then compared with the previously stored biometrics. The main advantage of this solution is the fact that no customer, employee, or partner can be tricked to give up his/her password. All biometric data is converted into hashed tokens and stored in an encrypted database, thus ensuring that it cannot be sold, stolen, or traded.

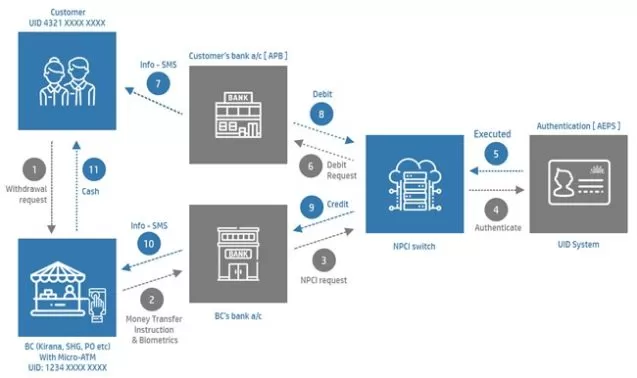

Mantra’s Aadhaar Enabled Biometric Device for AePS

This India-based company has developed a software solution that allows bank account holders to safely access financial and banking services by providing their Aadhaar number and validating their identity through iris scanning or biometric fingerprint. This is how the system works:

Aculab’s VoiSentry & FaiSentry

This ML and AI-powered identity identification and verification system allows for real-time biometric voice authentication, thus minimizing fraud risks. The use of voice biometrics streamlines the interaction with customers by eliminating the time-consuming manual identification processes.

If you need more advice on data protection strategies, this article by Elinext – alongside various compelling Case Studies – provides valuable insights into different cybersecurity facets.

Wrap up

Where there is money, there is a risk. It has always been so. And gone are the days when physical thefts were our only concern. In the era of online transactions, criminals have tailored their tactics to fit the new digital reality. Statistics do nothing but highlight the obvious: the financial and banking institutions need to invest heavily in cyber security to defend themselves and their customers’ assets against cyberattacks and fraud schemes that are increasingly sophisticated and recurring. Fortunately, FinTechs are developing more and more innovative solutions to help mitigate these threats.