In today’s fast-paced world, the need for wealth management solutions has never been more evident. With economic uncertainties and complex financial markets, people are looking for more effective ways to manage, grow, and protect their wealth. COVID-19 played no small part in it — around 62% of people around the world admit that the pandemic forced them to take more control over tracking their spending. The desire to preserve financial stability coupled with the growing smartphone usage and familiarity with digital banking contribute to the increasing popularity of wealth management apps

Market overview

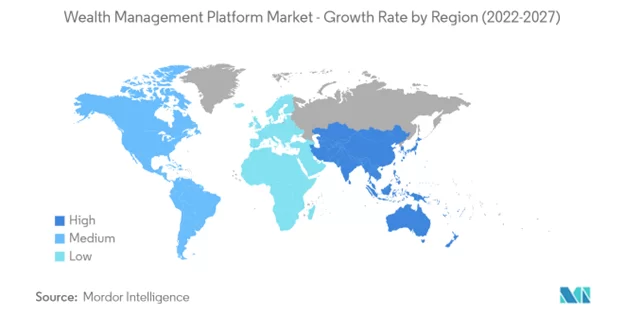

In 2022, the global wealth management software market size was valued at USD 4.27 billion, and by 2030 it is expected to reach USD 12.07 billion, growing at a CAGR of 13.9%. China is expected to demonstrate a significant rise in the fintech industry. In 2021, there were over 194 million online wealth management users in China.

Source: Mordor Intelligence

Despite the existence of established players in the wealth management app market, there are plenty of opportunities for new entrants, particularly those with fresh and innovative ideas, and a comprehensive understanding of the evolving needs of modern customers.

But when it comes to custom financial software development, there is no one-size-fits-all approach as there are many factors at play here like your financial goals and specific requirements. However, there are some key steps that you should follow to get your idea off the ground.

Building a wealth management app step by step

Step 1. Know your audience

When developing a custom wealth management app, identifying the target audience and understanding their needs is a crucial step in ensuring the app’s success. Your target audience may consist of various user demographics with different needs and goals. And while some users may be beginners looking to gain control over their finances, others may be more experienced and seeking advanced tools to optimize their portfolios. This will further inform what type of a wealth management app you want to build.

Step 2. Identify key features of your wealth management app

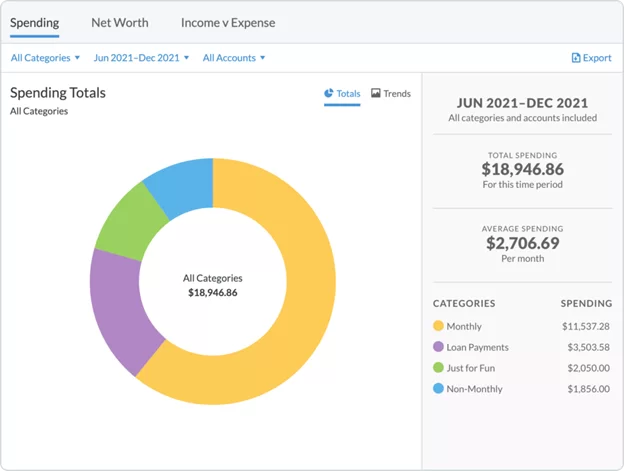

Budgeting and expense tracking

For many people, wealth management starts with planning a budget and then sticking to it. You can start winning users by offering them an easy-to-use platform to monitor their spending habits, visualize expenses and compare them against pre-set budgets. With real-time data at their disposal, users can quickly identify areas of overspending and adjust their financial behavior accordingly.

Case in point

Have a look at You Need a Budget (YNAB) — a comprehensive budgeting app that focuses on helping users create a zero-based budget, meaning that every dollar has a specific job. YNAB helps users track spending broken down into categories, drill down into subcategories and see month-to-month spending trends.

Source: YNAB

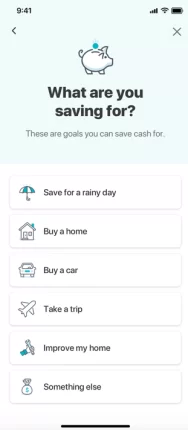

Financial goal planning

Another vital component of a wealth management app is financial goal planning. Your solution should allow users to set specific goals like saving for a vacation or buying a car, and track their progress over time. By breaking down financial goals into smaller, achievable milestones, users can stay motivated and on track toward reaching their long-term objectives.

Case in point

One of the most popular wealth management apps with 25 million users, Mint is designed for budgeters of all levels. Its Goals feature aims to make setting and achieving financial goals simple and easy. In addition to a number of predefined goals like paying off credit card debt or saving for an emergency, a user can set custom goals to cover their specific objectives and assign them to an account. Then, the app will do the math for you and calculate how much you need to achieve your goal based on your expenses and other factors.

Source:Mint

Investment management

For a while, investing was considered exclusive to extremely wealthy groups of people. But in today’s digital era, investing is no longer restricted to niche populations as there are multiple investment options, from stocks and bonds to cryptocurrencies and collectibles. The investment management feature takes the complexity out of the process by allowing users to track portfolios, monitor performance, diversify, and adjust investments based on market trends, personal financial goals, and risk tolerance.

Case in point

M1 Finance is one of the best apps for investment management. The app allows users to invest in stocks and cryptocurrency with no commission, borrow money at low rates, and transfer money. With its Auto Invest feature, the solution intelligently allocates money from every deposit to ensure that the portfolio stays on track. In addition, the app offers tips, videos, and tutorials on how to invest money to make it easier for beginners to start their investment journey.

Source: Google Play

Account aggregation and tracking

According to PaymentsJournal, an average consumer owns around 5 different accounts across all types of financial institutions. Account aggregation refers to the consolidation of financial data from checking, savings, investment, business, and other accounts in one place, enabling much-needed clarity and simplicity. Having an entire financial profile within one app allows users to monitor their financial health more effectively, identify areas for improvement, and make informed decisions based on their personal financial goals.

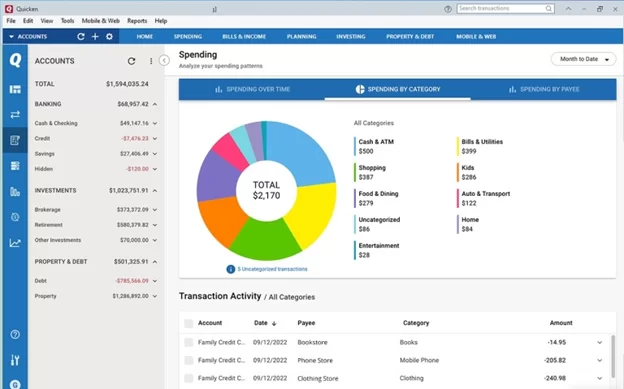

Case in point

Quicken is another versatile wealth management solution that supports account aggregation, among other things. By using the Direct Connect, Web Connect, or Express Web Connect method or a combination of those, Quicken automatically accesses and retrieves data from a user’s financial institutions during nightly aggregation sessions.

Source: PCMag

Personalized financial recommendations

If there is one feature that helps a wealth management app stand out from the crowd, it is personalization. With data analytics and advanced machine learning capabilities, a wealth management app can analyze a user’s financial habits and preferences, combine those insights with market trends and forecasts, and come up with tailored, data-driven financial advice, whether it is a personalized portfolio management strategy or budgeting and saving tips.

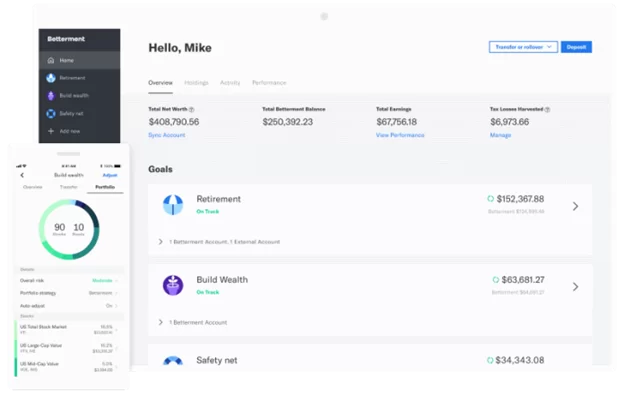

Case in point

Betterment is an investment platform that offers personalized investment advice and portfolio management services. The app’s algorithms use data analytics to provide users with personalized recommendations based on their financial goals and risk tolerance. In addition, Betterment offers tax-efficient investment strategies to maximize users’ investment returns.

Source: Algorithm-X Lab

Security and privacy features

The finance industry is one of the most commonly targeted by cybercriminals and hackers. In 2022, finance and insurance organizations around the world experienced 566 data breaches, amounting to more than 254 million leaked records. At the same time, the average cost of a cybercrime in the finance industry is 40% higher than in all other sectors.

If you are building a wealth management app, robust security and privacy are of paramount importance. Consider implementing multi-factor authentication, encrypting sensitive financial data using standards like AES, performing penetration testing and vulnerability scanning, and leveraging real-time threat intelligence capabilities. And don’t forget about compliance with GDPR, PCI DSS, and other data protection standards to ensure your users’ data is safe.

Step 3. Develop and test

When you are set on what you are going to build and for whom, you need to decide on the approach — whether you are building a native or cross-platform app — and choose the right tech stack. To give you a perspective, the most popular programming languages for finance and fintech solutions include Python, Java, C++, C#, C, and Ruby, according to HackerRank.

Most popular programming languages for finance and fintech

Source: Hackerrank

You also need to onboard a development team for the task at hand that has experience in building and testing financial apps and understands the industry specifics. If hiring and maintaining a skilled in-house team requires significant resources, outsourcing can be a suitable option. Outsourcing allows you to tap into a diverse pool of talented specialists who have a proven track record in building fintech solutions and can bring valuable insights into the process.

Step 4. Launch and maintain

Once your wealth management app has been thoroughly tested, it’s time to bring it to the market. At this stage, you need to prioritize marketing and promotional efforts to generate interest around your app. Make use of different marketing channels, such as social media, content marketing, and targeted ads, to reach your target audience effectively.

However, the work doesn’t end with the app launch. To ensure the app’s long-term success, it is crucial to provide follow-up support and continuous improvement. Regularly monitor user feedback, reviews, and app performance metrics to identify potential issues or areas that can be optimized.

Wrapping up

In today’s dynamic fintech environment, building a wealth management app can be rewarding as more and more people are looking for convenient and user-friendly ways to stay on top of their finances. But the industry’s unique challenges and competitive landscape can also pose difficulties.

Understanding your target audience, identifying the right features, developing and testing the app, and ensuring a successful launch and ongoing maintenance are all critical steps to creating a robust wealth management app that meets the needs of customers. By following these guidelines and adapting them to your unique goals, you can develop an app that stands out in the competitive market and helps users manage, grow, and protect their wealth more effectively.