Did you know that content with the hashtag investing on TikTok has more than 10.5 billion views? Or that videos tagged #PersonalFinance has collected more than 7.7 billion views? This growing financial TikTok space even has its own name — FinTok. And given the popularity of the social network among younger generations, it’s clear that teens and kids are interested in money-related topics. In no small part increased interest was triggered by the pandemic’s impact on family finances and fear around job security and income fluctuations.

And fintech companies are taking notice. Today we see a new breed of fintech startups rushing to fill a void in solutions geared towards helping Generation Z and Generation Alpha better manage their money.

Brief market overview

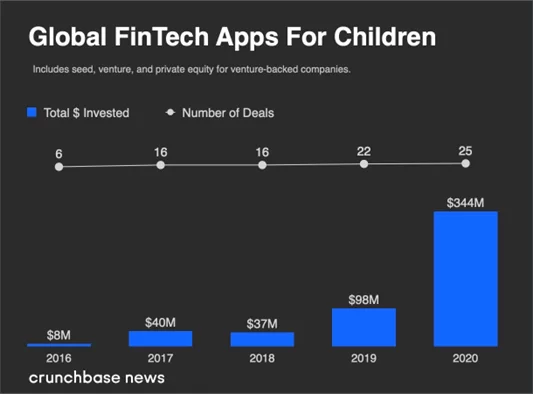

Children below 19 years old constitute 16 percent of the world’s population, amounting to 1.3 billion. The opportunity to tap into this market is not lost on forward-thinking fintech startups. According to a Crunchbase report, over the past five years investors infused over $500 million into 89 fintech products catering to the needs of kids, teens and their parents.

Source: Crunchbase

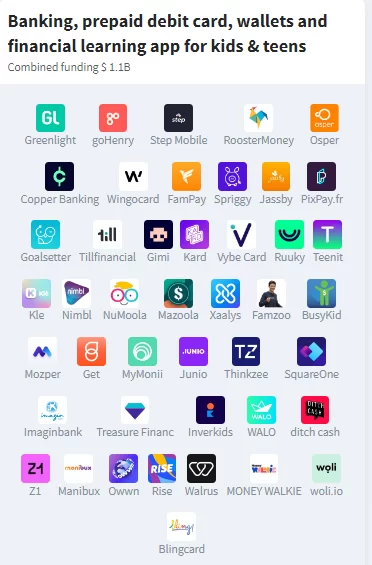

Although this is still a niche market, there are already market leaders that have gained millions of active users like Greenlight (4 mln), GoHenry (2 mln), Step Mobile (4 mln).

Source: Dealroom

Far-reaching benefits of fintech apps for children

Besides the opportunity to capitalize on the new niche, there are numerous advantages to empowering the youth with tailored fintech tools.

- Promoting financial literacy. Since financial education in schools is rare, many children struggle even with simple decisions like understanding a bank statement or making a transfer. Further down the road, the lack of sound financial knowledge among young people and adults is a barrier to economic advancement. That’s why putting financial literacy at kids’ fingertips is the first step towards raising financially secure adults and ensuring their long-term financial success.

- Creating lifelong customers. Fintech companies that manage to build loyalty by catering to the financial needs of kids and teens can further establish themselves as the child’s primary financial institution when they grow up.

- Attracting parents. In addition to children, fintech startups may appeal to kids’ parents. For example, neobanks that start offering kids’ accounts, can strengthen the brand to the whole family and make parents ultimately switch over.

Building a fintech app for kids: Things to consider

Just like any niche products, apps for kids have their own set of challenges. From child-friendly design to engaging functionality to parental control, make sure you account for the specifics described below when developing a custom fintech solution for children.

1. Diversified design

Designing for kids is a drastically different ballgame than designing for adults. Children love bright colors and they expect visual and auditory feedback whenever they interact with a digital surface. They are also more imaginative, so the app’s design needs to give children freedom to explore and stay creative within the app.

2. Engaging and exciting experiences

Children are very curious but at the same time they have shorter attention spans. This means that your fintech app needs to be packed with exciting and innovative experiences to keep young users engaged and motivated. Friendly digital helpers in the form of a mascot character or a chatbot can help kids and teens navigate the product, while making the entire experience smooth and fun.

3. Children-friendly features

In the Play Store and App Store, kids’ apps can be filtered by age ranges. That’s because kids develop pretty fast and where one age group requires clear instructions, another may dive right in and go intuitively. So, the rule of thumb is to focus on a two-year age range and make your app easy-to-use for that group.

As for functionality, fintech apps for kids may boast different feature sets depending on your focus. Financial education lessons, chore management and allowance payments, earning and saving, and more. For example, GoHenry, a popular allowance management app, allows kids to use saving goals, track spending, check balance, manage chore tasks and pay back money to a parent’s account if they borrow funds.

Source: GoHenry

4. Parental control

When children are still learning to make sound financial decisions, parents need to stay on top of things and retain control over certain activities like spending. Depending on the particular type, fintech apps for kids need to come equipped with flexible parental controls like spending and transaction limits, automatic blocking of harmful spending categories, spending alerts and notifications, remote card locking/unlocking.

5. Gamification elements

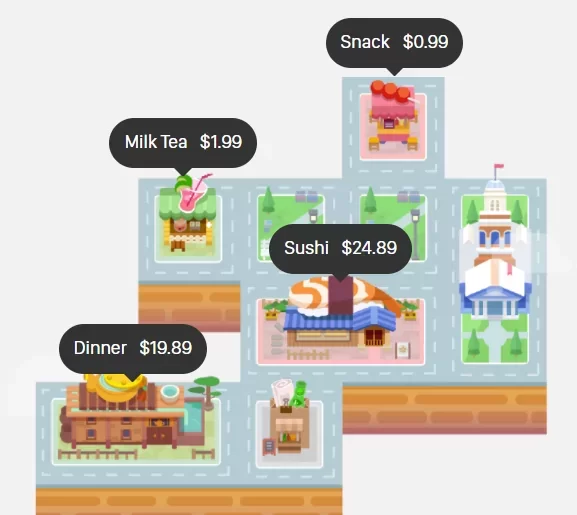

Speaking of apps for kids, gamification is a must since it boosts children’s motivation while keeping them engaged. Puzzles and quizzes, challenges and rewards, quests and special missions — these features can make even a boring process like saving or tracking expenses more exciting for kids. For instance, Fortune City allows users to build and manage a virtual town by recording expenses.

Source: Fortune City

6. Data security

When it comes to financial apps, no matter for kids or adults, security can never be an afterthought since these solutions deal with sensitive personal data. Make sure your fintech app has adequate data privacy and security measures like end-to-end data encryption, secure protocols, multi-factor authentication, and more.

Equally important for data security is compliance with applicable regulatory standards that aim to ensure confidentiality and integrity of personally identifiable information. For example, PCI DSS lays out the security principles for credit, debit, and cash transactions, GDPR provides regulations on data protection and privacy, SWIFT CSP regulates defenses against cyberattacks for financial institutions that use the Swift payment system.

Fintech is going back to school

The kids fintech market is having its moment right now as more and more parents are looking for resources to help prepare their children for their financial future. Indeed, the path to financial wellbeing starts in childhood, and the earlier, the better. Children as young as 3 years old can already grasp the basic concept of money, and by the age of 7 many of our money habits are already set.

To fill the financial literacy gap, fintech companies are stepping up with a slew of kids-first applications that cover everything from allowance money management and chores tracking to investment accounts and debit cards.

At Elinext, we rely on the best practices in fintech software development to deliver feature-rich, easy-to-use, and secure financial applications. With the perfect combination of developers’ expertise and business-savvy management, Elinext has become a go-to fintech development partner for startups and S&P 500 companies that want to disrupt the financial industry with top-notch fintech products. Contact us to discuss the details of your next fintech project.