“Over the next ten years, ESG will emerge as the largest behavioral driver for system-wide changes across all industries”.

This is one of the key findings presented in a recent KPMG study. ESG initiatives have indeed experienced a massive ascent to prominence lately, fueled by the push towards carbon neutrality, increased consumer focus, and growing regulatory pressure. In fact, by 2026 asset managers are expected to increase their ESG-related assets under management to US $33.9 tn, a significant jump from US $18.4 tn in 2021.

ESG forerunners pay particular attention to the financial sector as they recognize the importance of technological innovations that fintechs bring to achieve ESG goals. But is it a harmonious symbiosis where fintech empowered the ESG agenda? Or can ESG with its regulations limit the potential of fintech development?

To better understand this intricate dance between innovation and responsibility, let’s dive a bit deeper into what ESG exactly is.

Discovering the essence of ESG

ESG is not a definition or a single standard. Short for Environmental, Social, and Governance, ESG is a set of pillars or criteria used to evaluate a company’s performance on sustainability issues and identify business risks and opportunities related to them. Essentially, these criteria include:

- E, Environmental, refers to the impact that a company makes on the planet. It includes how a company addresses climate concerns, including its greenhouse gas emissions and its total carbon footprint. Beyond the climate impact, the environmental component also encompasses factors like water usage, air quality, and land practices affecting deforestation and biodiversity.

- S, Social, focuses on a company’s impact on people — its workforce, consumers, and the communities it operates within. This component addresses employee and labor practices, health and safety protocols, mental well-being, and community engagement.

- G, Governance, involves a company’s leadership structure, executive compensation, auditing processes, internal checks, and shareholder privileges. Elements influencing a company’s governance rating include the composition of its board of directors, risk management strategies, accounting transparency, and more.

3 pillars of ESG

Source: TechTarget

The core principles behind ESG are centuries old — throughout history, different religious groups abstained from investing into companies linked to gambling, alcohol, or weapons. But the first mainstream mention of ESG is considered to be in a 2004 report titled Who Cares Wins published by The Global Compact. The report called attention to the need to integrate ESG considerations into capital investment decisions in order to create more sustainable markets and ensure better outcomes for both societies and businesses.

Further drawing on the “Who Cares Wins” report, in 2006 the United Nations launched its Principles for Responsible Investment (PRI). This initiative provided a clear framework for investors to incorporate ESG criteria into their decision-making processes.

In today’s business landscape, there’s an increasing demand for transparency around ESG performance. Companies are now expected to disclose their ESG strategies and future plans in as much detail as financial metrics.

The Debate: Is ESG a boost or a barrier for fintech innovation?

The symbiosis of fintech and ESG brings forward an intriguing conundrum: while the integration of ESG principles into fintech development can undeniably amplify the reach and impact of sustainable financial solutions, are there scenarios where ESG might inadvertently stifle the rapid innovation that characterizes the fintech industry?

Argument 1: ESG hinders fintech development

Supporters of this perspective believe that the ESG framework can add layers of complexity, slow down processes, increase costs, and impede the agility that fintech firms are primarily known for.

Stricter ESG regulations can stifle innovation

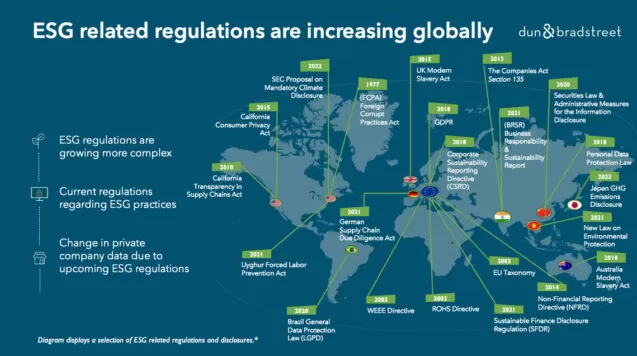

In recent years, there has been a surge in ESG regulations as investors and consumers are increasingly demanding transparency and accountability from businesses regarding their ESG performance.

Different countries and regions have their own sets of ESG regulations. For example, in the European Union, the Sustainable Finance Disclosure Regulation (SFDR), one of the latest mandates, requires financial entities to disclose how they take sustainability risks into account when developing and distributing their financial products. Meanwhile, global initiatives like the Task Force on Climate-related Financial Disclosures (TCFD), provide frameworks for companies to report on climate-related risks and opportunities.

ESG regulations across the world

Source: PlanA

While these regulations aim to foster sustainability, they can sometimes curtail rapid innovation. Characterized by their agile approach, fintech businesses may find themselves navigating a complex labyrinth of ESG regulations that are not designed with the nimbleness of startups in mind.

High compliance costs for fintech startups

For startups, resources are often limited, and every dollar counts. The financial burden of adhering to ESG compliance, be it through mandatory sustainability reporting, audits, or the integration of specific ESG-driven features, can be significant. And while these costs are manageable for larger financial institutions, they can pose significant challenges for emerging fintech startups, potentially impacting their growth or even viability.

Potential mismatches in short-term fintech objectives vs long-term ESG goals

The pressure to deliver quick returns on investments is very high for fintech startups, especially those backed by venture capital. Meanwhile, ESG initiatives aim at long-term objectives with benefits being realized over more extended periods of time. This mismatch can potentially lead to a dilemma where fintech companies have to choose between rapid scalability and more thorough ESG integration.

Argument 2: ESG as a catalyst for fintech innovation

While there are arguments suggesting ESG might limit fintech’s rapid development, there is a robust and compelling counter-narrative. This perspective views ESG not as a stumbling block, but rather as a driving force behind fintech innovation, capitalizing on the evolving demands and priorities of the global market.

Catering to the growing consumer demand

Today’s consumers, especially Millennials and Gen Z, are becoming increasingly sensitive about where they deposit their money. There’s a pronounced demand on their part for products and services centered around sustainability, ethics, and societal impact. fintech, with its digital-first and agile nature, is perfectly poised to meet these needs previously underserved by traditional players.

ESG as a differentiator in a crowded market

With a slew of startups vying for customers’ attention, the fintech landscape is a challenging environment for new entrants. However, by embedding ESG principles into their core offerings, new players can stand out from the competition and leverage first-mover advantage to gain a stronger foothold on the market.

Consider the case of TreeCard, an ESG fintech startup, that empowers users to reduce their carbon footprint and make eco-friendly financial decisions. In addition to providing debit cards from sustainably sourced wood, TreeCard allocates 80% of profits to reforestation. Or have a look at Aspiration — the US-based online bank that defines itself as a fintech for environmentalists that offers a “Pay What is Fair” fee model, emphasizing its commitment to no hidden fees. Furthermore, they invest funds in sustainable projects and ensure that customer deposits do not support fossil fuel projects.

Attracting impact investments

The global investment community is undergoing a paradigm shift. Beyond the traditional metrics of returns, investors are increasingly preferring companies that also deliver positive environmental and societal outcomes. ESG-aligned fintech startups are well-positioned to attract this kind of capital. Impact investors are more likely to support and infuse capital into platforms that can quantifiably showcase their contributions to ESG goals, giving such startups not just capital but also an engaged investor base.

The balancing act between fintech innovation and ESG principles

As industries evolve and societies advance, there’s a growing recognition that true progress is not merely about technical breakthroughs. Today, aligning these developments with sustainable and ethical practices is crucial to foster a new world that is equitable and environmentally responsible.

Finding a balance between fintech development and ESG objectives can be challenging and strict regulations can hinder innovation. But even though the two are occasionally at odds, they have the potential to become mutually beneficial partners. By incorporating ESG principles, fintech can become a catalyst for a more sustainable and inclusive financial era. And ESG considerations, when intertwined with fintech solutions, can drive the financial industry towards transparency, accountability, and more ethical decision-making.