It may be difficult to pinpoint the exact moment when the story of fintech started but it is definitely still being written. Today, the global consumer adoption of fintech solutions is at 64%, and after healthcare fintech remains the most invested industry.

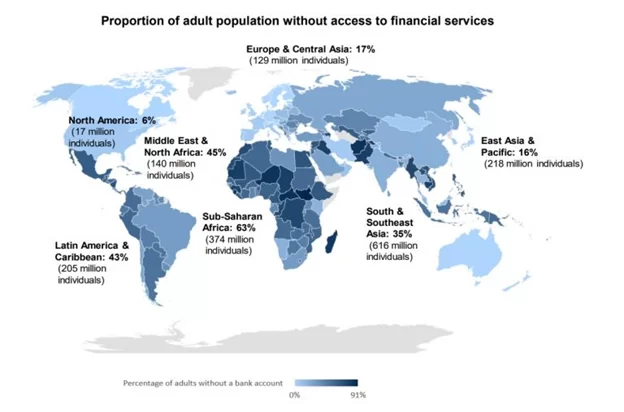

In no small part the growing interest and investments in the fintech sector is driven by fintech’s promise of better financial inclusion and stability since there are still around 1.4 billion people who remain unbanked in the 21st century.

Source: Payments cards and mobile

But before we dive into the discussion on how fintech 2.0 promotes financial inclusion, let’s have a closer look at where we are today.

From Fintech 1.0 to Fintech 2.0

During the financial crisis of 2008, banks and financial institutions pulled out from several markets, which opened numerous opportunities for newcomers who wanted to reinvent finance. This first wave of fintech companies unbundled banking products while focusing on new and more effective ways of providing existing financial services. Startups zeroed in on being good at one thing — so, Venmo has become synonymous with peer-to-peer payments, Robinhood with stock trading, Acorns with micro-investing.

Even more importantly, Fintech 1.0 led to a fractured customer experience with too many apps focusing on just one area and competing for a user’s attention. Thus, the financial landscape was ripe for the second wave of evolution.

Fintech 2.0 approach is about facilitating greater collaboration and partnership between players and focus on rebundling of services — integrating everything a customer needs under a single roof. Ultimately, combining services that used to be spread across multiple apps will lead to saved time and better customer experiences.

How does Fintech 2.0 support financial inclusion?

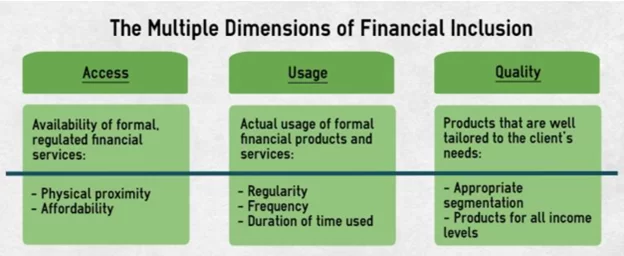

According to the World Bank Group, financial inclusion is defined across three dimensions — access, usage and quality of financial services.

Source: Semantic Scholar

Now, let’s see how fintech 2.0 comes through in every dimension.

Access

Essentially, access means how easy it is for a consumer to obtain a financial service or product, and that’s where fintech shines. From peer-to-peer lending apps to mobile wallets to alternative credit scoring platforms, industry players invest in custom fintech solutions to cater to the needs of the unbanked and underbanked population.

- Banking services. Challenger banks and neobanks continue to disrupt the traditional banking sector by offering convenience, lower fees, and higher interest rates. For instance, Chime, a US-based digital bank, boasts no monthly fee and no minimum balance while offering mobile-first checking accounts, saving accounts, and a fee-free overdraft service.

- Alternative lending. Fintech lending startups leverage technology to remove barriers to loans for small and medium size businesses. These platforms can use alternative sources of data to help consumers build credit score while enabling lenders assess lending risks and make informed decisions.

- Investments and savings. Qapital, DigiKolo, Qoins are all prime examples of fintech savings apps that make the money-saving process less of a hassle. Some fintech saving solutions like Plum rely on machine learning to analyze your spending habits and automatically set aside an affordable amount.

- Fintech payment companies are focused on simplifying the logistics of online payment processing to make them easily accessible and affordable for businesses and individuals alike. One example is M10 — a modern payments platform that supports instant domestic and cross-border payments without the regulatory risk.

Usage

Usage refers to the uptake of financial products and services as well as how they are being used after initial acquisition.

- Better financial literacy

Financial inclusion starts with financial literacy. Multiple studies including those carried out by OECD indicate that poor level of financial literacy leaves people ill-equipped to use financial products properly or make sound financial decisions. As a result, financial literacy is officially acknowledged as an essential skill that requires lifelong learning that starts early in childhood.

As part of the rebundling initiative, many challenger banks like Revolut are extending their services with low-cost products for young adults. But even more fintech players focus exclusively on this segment and provide financial literacy apps for kids and teens, which are designed to encourage transparent and engaging financial education and promote responsible spending and saving habits. One such example is Leap, a Dubai-based fintech startup that targets the unbanked population under 18 with an app that teaches youngsters to make smarter money choices.

Comprehensive digital infrastructure

The evolving financial landscape requires robust digital infrastructure and well-functioning systems to reach the underserved population. To that end, fintech startups have been working on strategic partnerships with incumbent banks and telcos, blending their capabilities and laying the foundation for advanced financial ecosystems.

At the same time, fintech 2.0 tries to close gaps in financial infrastructure through such revolutionary technology as DLT, or Distributed Ledger Technology. Blockchain-based cryptocurrencies and central bank digital currencies (CBDC) are transforming the financial and economic ecosystems, creating an infrastructure that is global and easily accessible for everyone with an Internet connection. For instance, almost a half of Nigerians own some form of cryptocurrency using it to buy and sell goods and services or send money across borders to family and friends.

Share of adopters who either own or use cryptocurrency

Source: Statista

Quality

And last but not least, quality of financial services refers to the overall customer experience and how well a service or product is tailored to a consumer’s needs.

Personalized approach to customer service

To nurture positive customer experiences and promote inclusion, fintech companies turn to big data analytics and machine learning to crunch vast amounts of consumer data collected from a multitude of sources, including financial information, demographics, social media activity, online behavior and personal interests. Rich customer profiles based on the insights allow fintech businesses to cluster consumers into micro-segments and personalize their financial offering to meet the unique needs of a customer.

Another way that fintech improves customer service is through AI-powered chatbots. Look at MyEva, an intelligent chatbot that can evaluate a user’s financial situation and then guide them to their personal goals by offering investment assistance.

Security and fraud prevention

In 2022, banking saw almost a 100% increase in fraud cases as fraudsters use stolen bank cards mainly targeting financial services, eCommerce, and gambling industries.

To combat fraud and enhance user experiences, fintech companies develop advanced fraud detection systems that use artificial intelligence and big data to monitor transactions and identify anomalies like suspicious transactions, login attempts, or bot activity in real time. A prime example of a fintech startup leveraging technology to prevent fraud is Cleafy. This Italian company offers a continuous fraud detection and risk assessment platform that monitors operational traffic, scores cumulative risk and provides threat intelligence.

Wrapping up

The importance of financial inclusion can’t be overestimated. In fact, it is included in 8 out of the UN’s 17 Sustainable Development Goals. And according to the World Bank, financial inclusion is rapidly increasing, and fintech plays an important role in it. From providing easily available financial services to supporting comprehensive digital infrastructure to improving the quality of customer experiences, fintech startups work hard on expanding access to all.