Even if the COVID-19 pandemic turned the entire world upside-down, the truth is that the digitalization process was already underway, taking by storm all the facets of our lives: work, social interaction, healthcare, purchases and payments, banking, etc. Thanks to the already existing digital infrastructure and development spree, the world managed to swerve the unprecedented restrictions and keep afloat crucial systems such as healthcare, employment, trading, or education. Undoubtedly, the social and economic impact was tremendous, forcing ordinary people and – above all – businesses to rely on digital solutions to minimize disruption. With the pandemic shaking the very foundation of the global economy, there is no wonder that the demand for digital solutions in the entrepreneurial ecosystem has increased drastically over the past two years. In today’s article, we will take a look at some relevant FinTech solutions that helped businesses navigate the pandemic.

The accelerated digital transformation in the entrepreneurial area

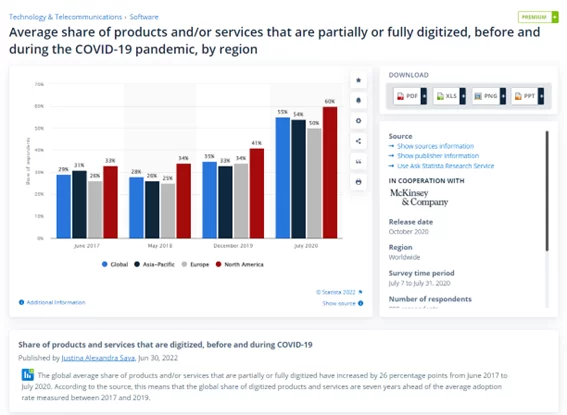

Digital solutions have played a crucial role in the global response to the pandemic. And, as reflected in the United Nations Conference on Trade and Development’s report, it includes both health-related and non-health-related areas. According to Statista, the average adoption rate of digital solutions during the pandemic is no less than 7 years ahead of the rate registered between 2017 and 2019.

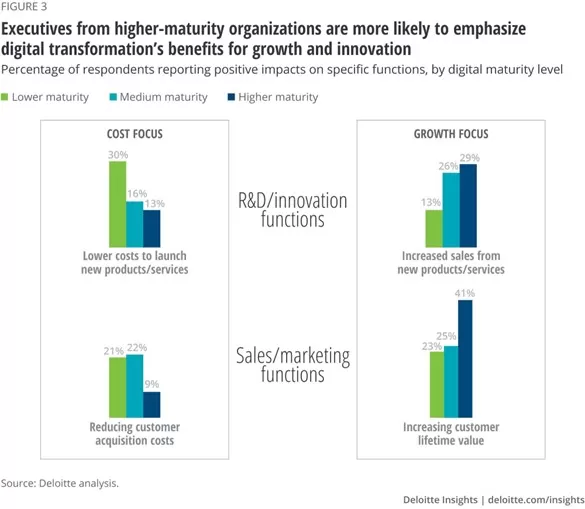

According to an article published by Deloitte, a business’ digital maturity highly conditions its financial performance. The greater a company’s digital maturity, the more benefits it reaps in terms of efficiency, customer satisfaction, revenue growth, and product/service quality.

From digital solutions that support the impressive growth of e-commerce (e.g. online banking, customer financing solutions, or cash advance) to specific governmental digital programs such as the UNCTAD digital government platform, the Fintech industry played a fundamental role in the recovery of the entrepreneurial ecosystem.

FinTech solutions for businesses in the post-COVID-19 era

With social restrictions in place and customers’ purchasing power going lower and lower due to the pandemic, businesses found it harder and harder to survive in a harsh economic global reality. Fortunately, the FinTech industry – compounded with businesses’ willingness to adapt – came up with innovative solutions that fuelled recovery. Let’s take a look at some relevant examples.

Cash advance to ensure cash flow

Traditional loans usually involve complex and long approval processes, putting businesses against the ropes when they most need to cope with cash flow problems. Even though we are talking about short-term solutions based on predicted monthly revenues, services such as Kabbage or Payability offer businesses quick funding alternatives that eliminate origination fees and complicated paperwork.

Customer financing services

Allow us to state the obvious: businesses and their customers are indivisible partners. “A satisfied customer is the best business strategy of all,” says Michael LeBoeuf. But what happens when the hard-earned loyalty of your customers sees itself affected by low purchasing power? Payment options such as Klarna or AfterPay grant your customers the possibility to conveniently split their online purchases into various installments. This strategy not only allows customers to purchase the products they need when they really need them but also makes expensive products accessible. Double win for businesses!

International money transfer solutions

When a business operates globally, international money transfers are part of its daily routine. In a fast-paced entrepreneurial landscape, the ‘5 to 7 business days’ policy has turned not only obsolete but – most of the time – expensive too. And here is where Fintech players come onto the stage, offering business advantageous, reliable, and real-time solutions to a pressing problem. Software solutions such as WorldRemit, Revolut, or Transpay not only offer customers the possibility to easily manage online international payments but also come with advantageous features such as real-time currency exchange rates, free subscription plans, multiple payment options, or tools for operating with stocks, commodities, and even cryptocurrency.

Cloud accounting tools for automated payroll, bookkeeping, etc.

Keeping a business running involves paying attention to a wide variety of aspects, including payroll, taxes, payments, invoices, keeping track of expenses and revenue, and the list can continue. Once again, FinTech players come to the rescue with products specifically designed to take pressure off and eliminate errors. Cloud-based accounting solutions such as Freshbooks, Sage 50cloud Accounting, or Zoho Books allow businesses to keep their accounting data handy at all times and manage finance efficiently and safely.

Peer-to-peer lending sites

This innovative financial technology connects borrowers directly to investors via websites, allowing them to lend/borrow money without the necessity to get a bank involved. We are talking about a ‘social’ or ‘crowd’ financing method that – if compared to banks – offers lower rates for the borrower and higher interest rates for the lender. Funding Circle could be a good example.

Online banking

Even though online banking was already in the spotlight before the COVID-19 pandemic, nowadays business owners have turned this technology into their favourite method to manage their financial assets. And there are good reasons for it: lower fees, time-saving, availability on the go, real-time financial transactions, permanent access to account balance and transactions, enhanced user experience, etc. In two words: CONVENIENCE and SPEED. Thanks to online banking, queueing in front of a physical desk to pay a bill, transfer money, or deposit a cheque have become obsolete activities. There is no wonder that the popularity of online banks such as N26 or NOVO has skyrocketed.

Payment getaways

Thought out to simplify payments and minimize fees, payment getaways have become a necessity for those businesses that operate mainly online and strive to meet their customers’ expectations when processing payments: reliability, safety, and an overall customer-friendly experience. Even though there are multiple payment getaways worth mentioning, we will only mention PayPal, Stripe, and Authorize.net.

Talent sourcing

Employees are the most valuable asset a company has. Your business’ workforce is the key element – unfortunately often underestimated – that can make the difference between success and failure. Up until now, recruiting talent for your business implied posting an ad, waiting for candidates to apply, and starting a lengthy and stressful selection process. Indeed, it is as time-consuming and tiresome as it sounds. Once again, Fintech players have come up with the perfect solution to explore vast talent pools: AI-powered matching technology that identifies and invites relevant candidates to apply for a job. Just take a look at how ZipRecruiter, Manatal, or SeekOut function.

Wrap up

The COVID-19 pandemic put a spotlight on digitalization, urging businesses to place their bets on innovative FinTech solutions to thrive. While it is true that digitalization in the post-Covid era still comes with a series of risks and challenges – faulty digital infrastructure, cybersecurity threats, poor digital skills among employees, digital divides, etc., – it is also true that the FinTech industry threw a lifeline to all businesses, regardless of their size. Thanks to FinTechs, the era of slow, expensive, and constraining financial services is coming to an end.