Payment App Development Services

Elinext: Leading Experts in FinTech App Development

Payment App Development Solutions We Offer

-

Payments and Money Transfers

We build features that let users send and receive money instantly and securely. Transfers support cards, banks, and wallets, giving customers a smooth and predictable payment experience.

-

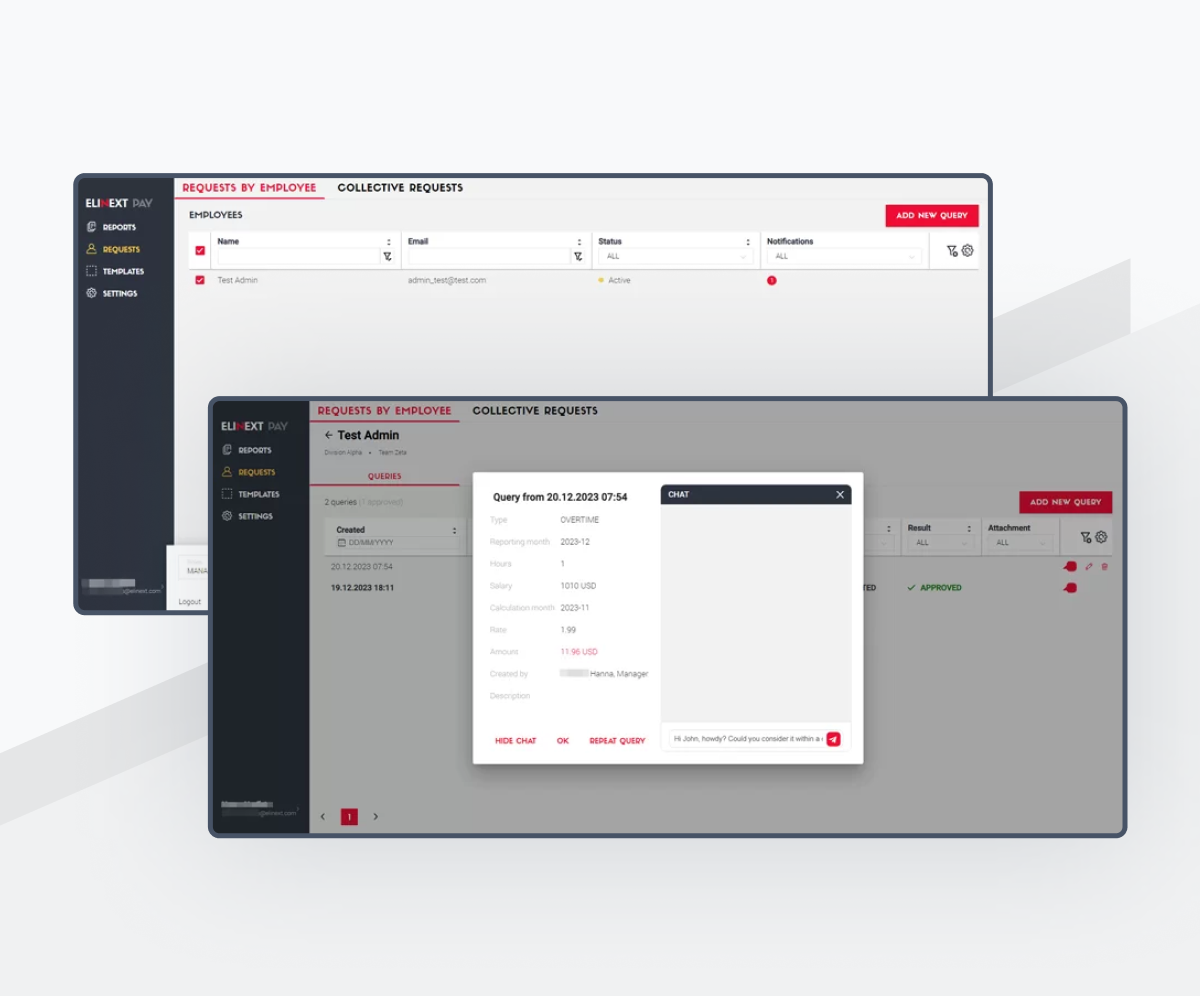

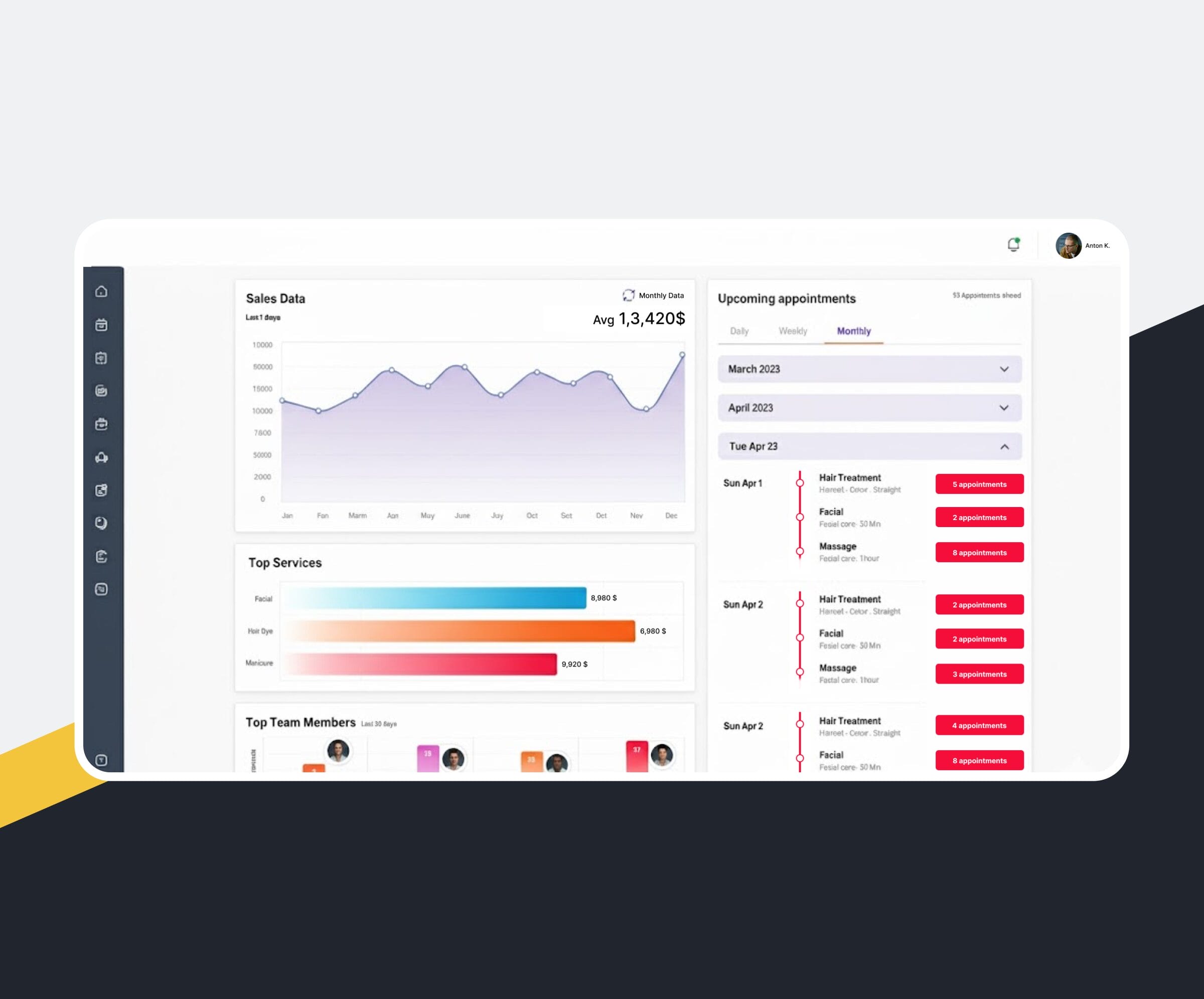

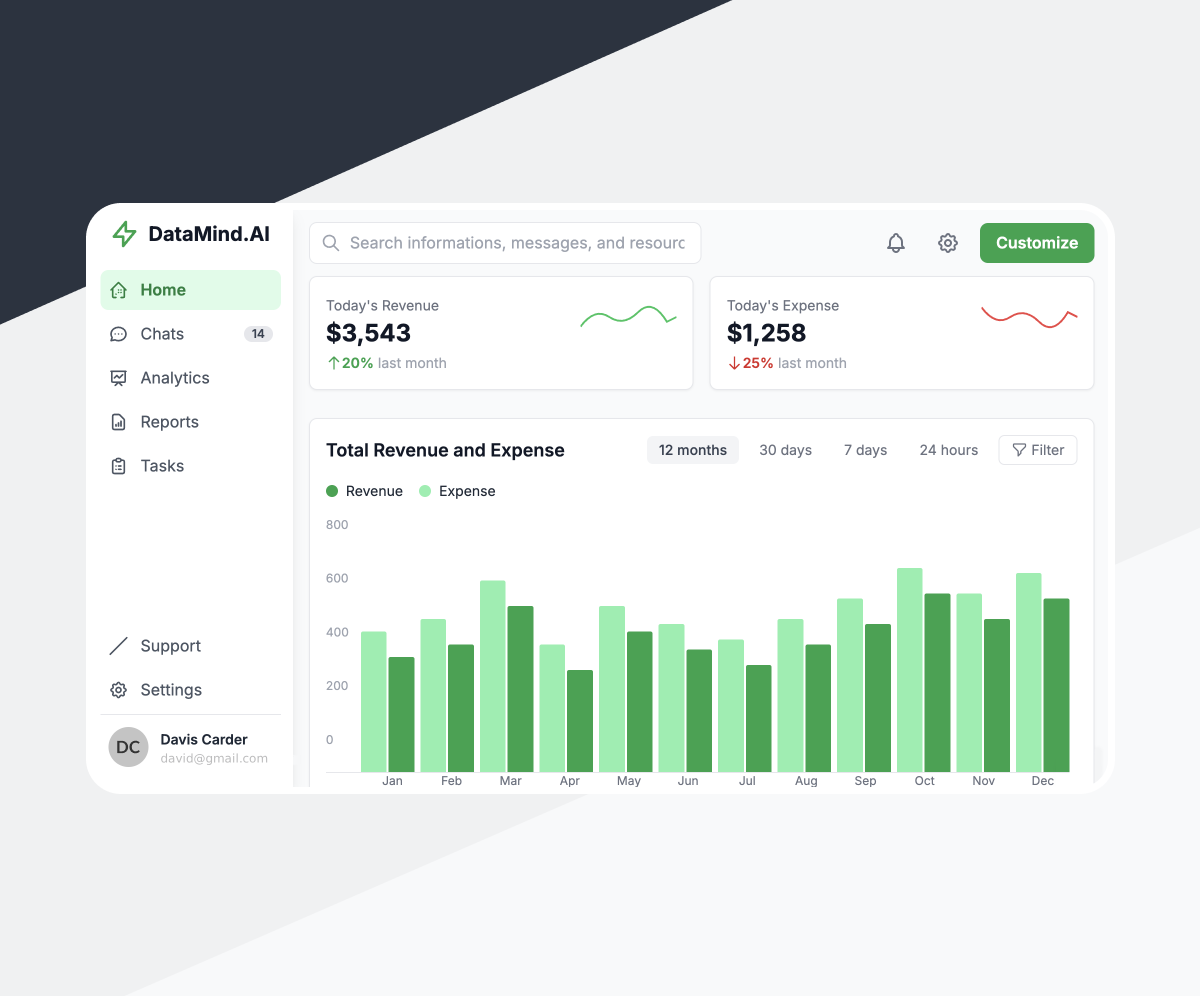

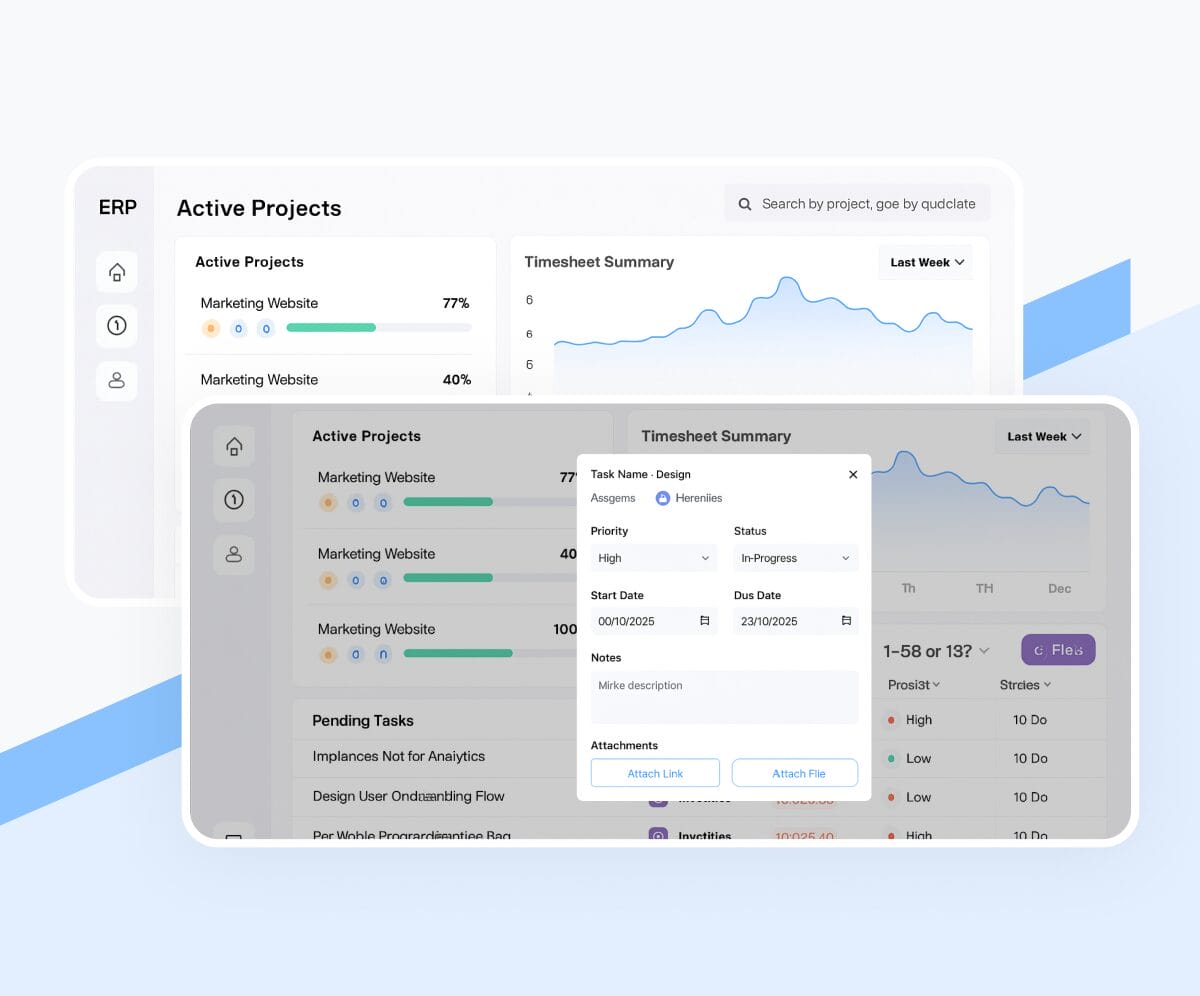

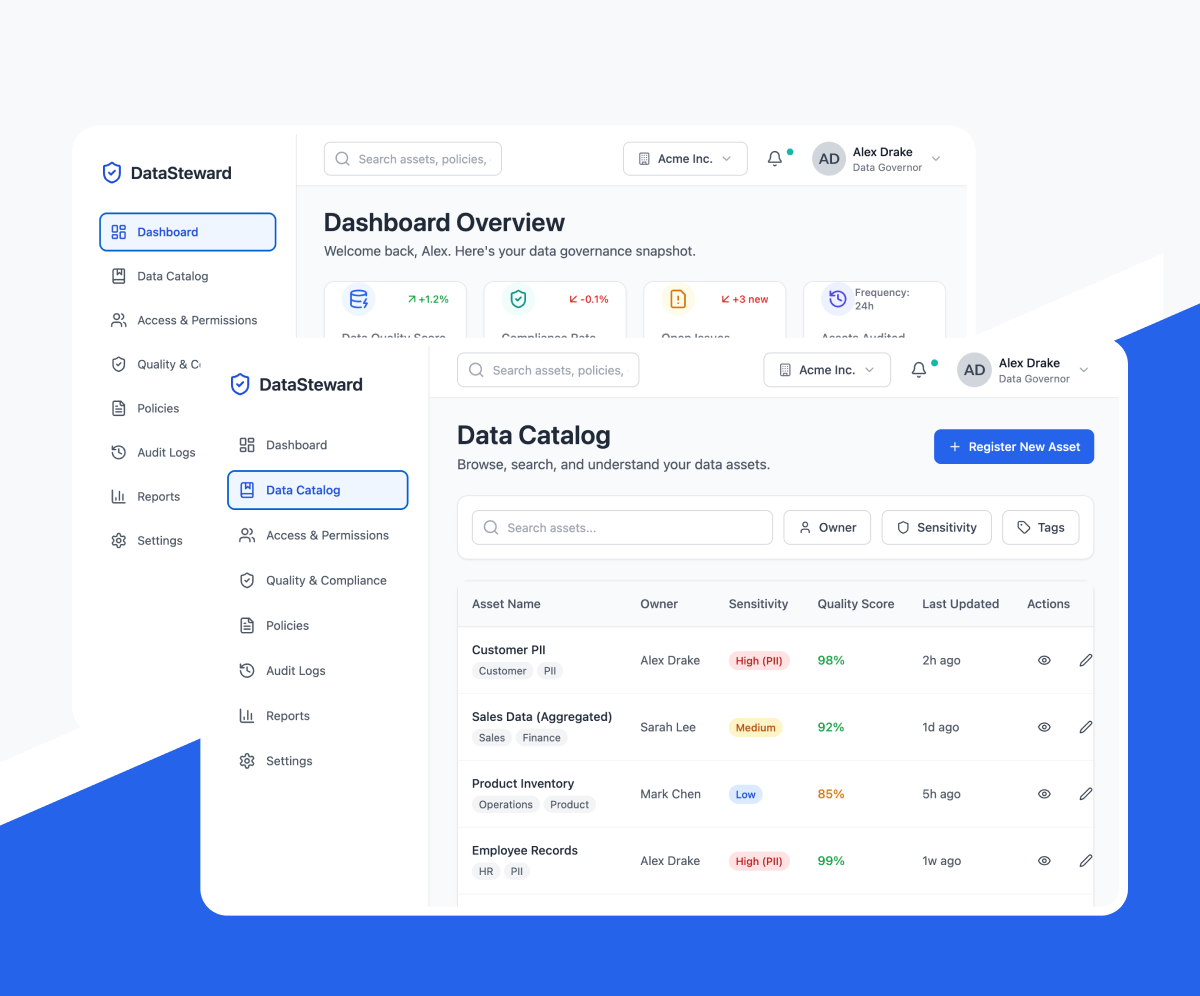

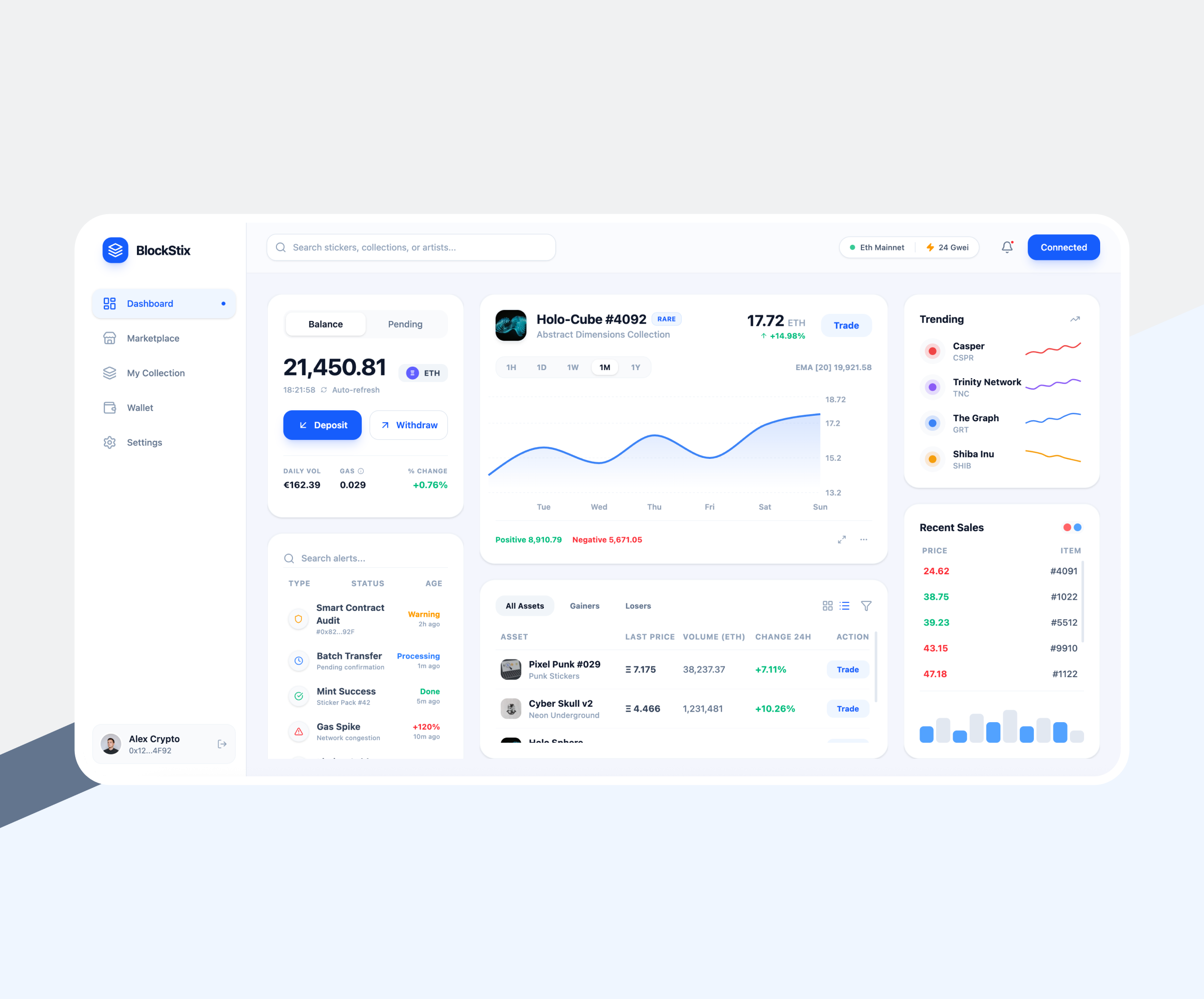

Payment Transactions Tracking

Users can track every operation in real time, including status updates, amounts, and merchant details. This improves transparency and helps reduce disputes and support requests.

-

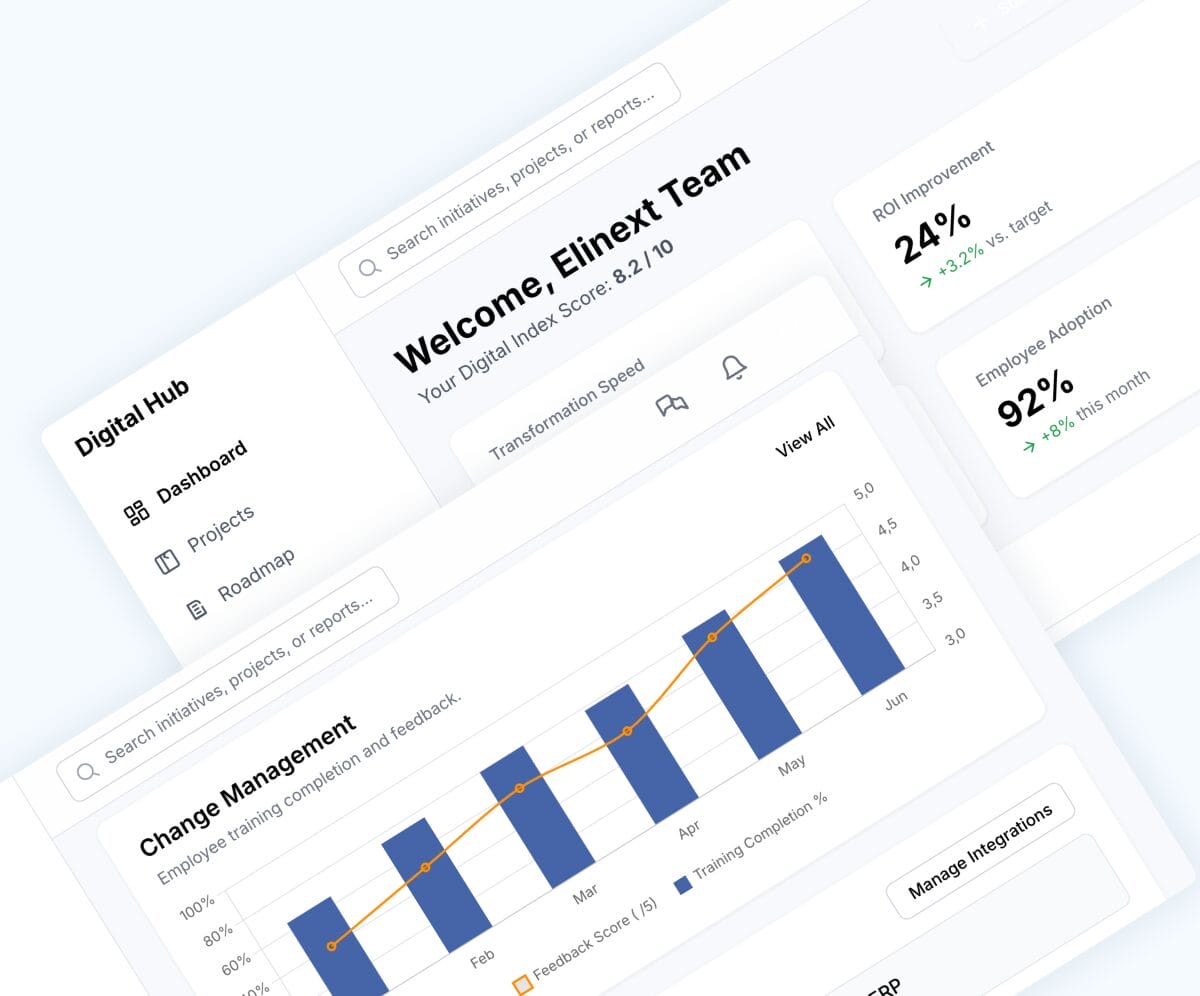

Spend Management

We add tools that categorize expenses, set limits, and provide insights into spending patterns. This helps users make smarter financial decisions and stay in control of their budgets.

-

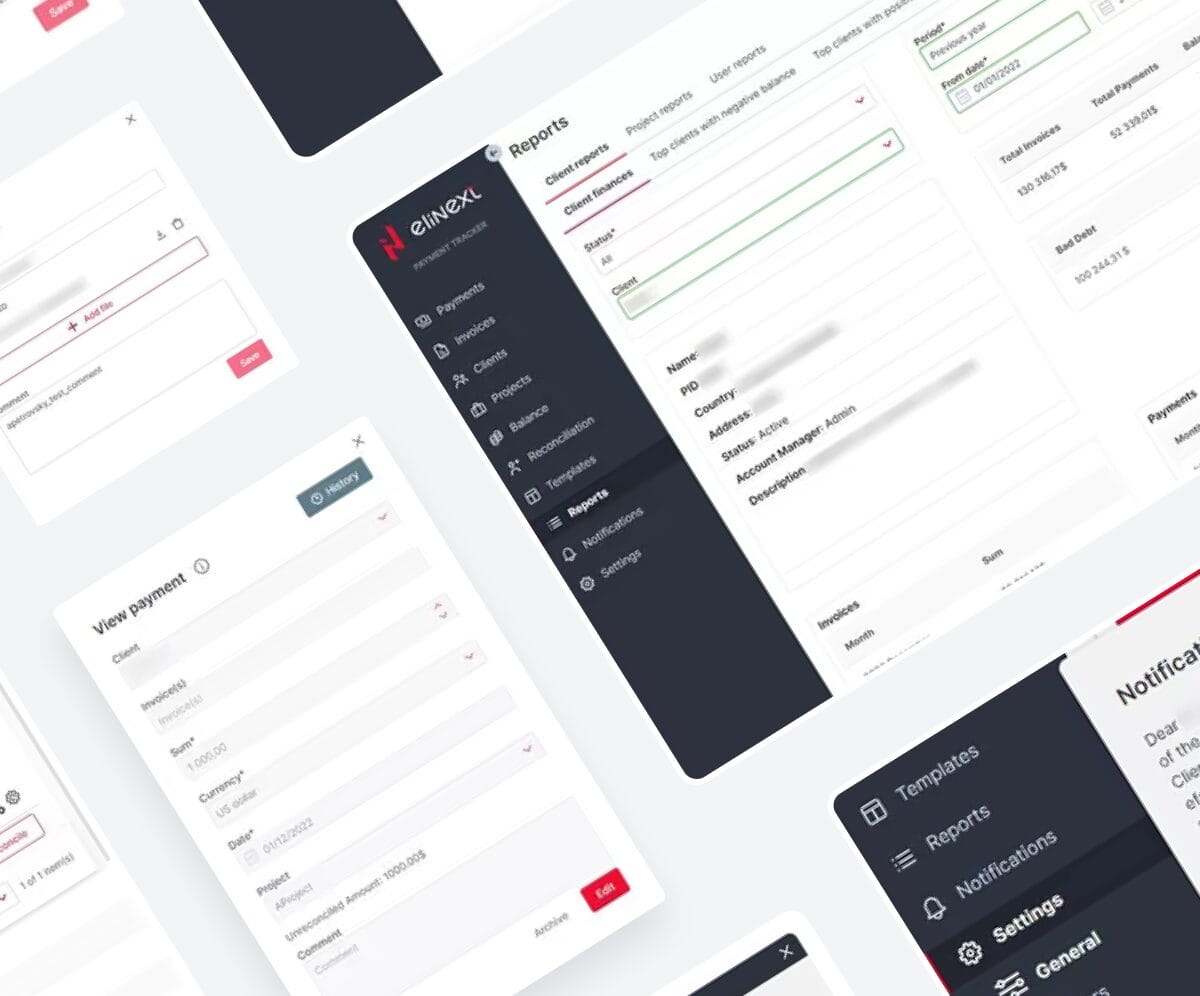

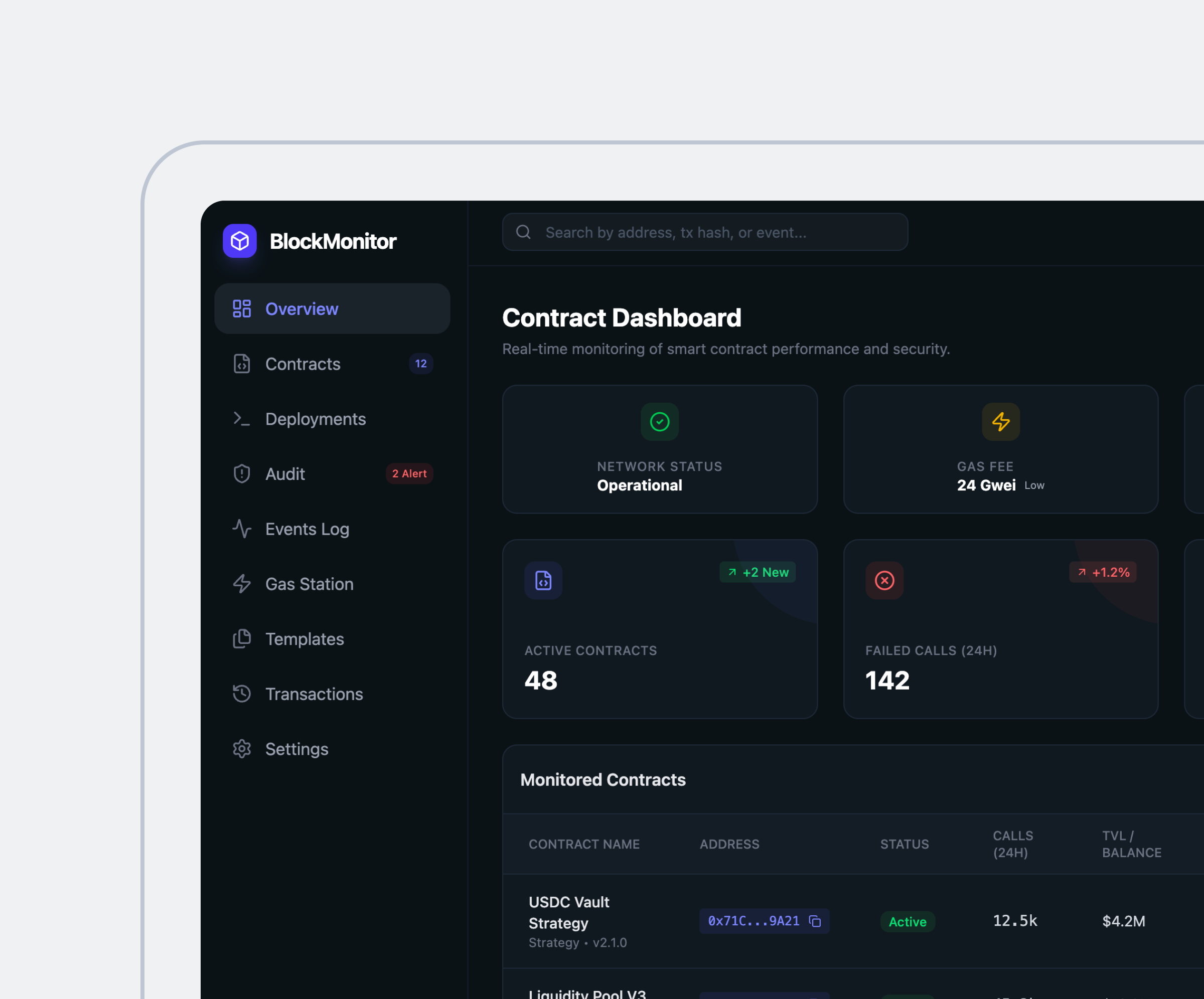

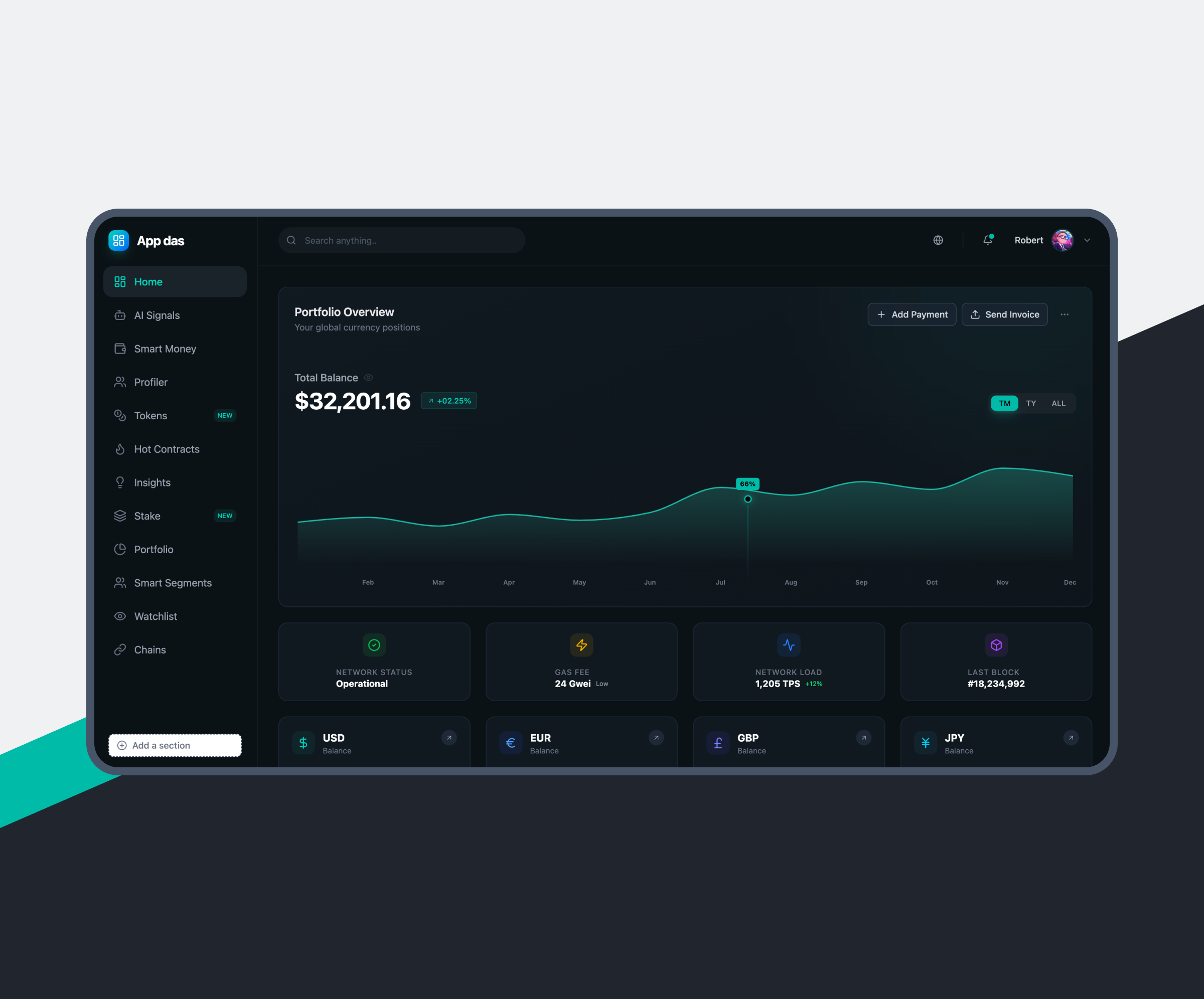

Funds Management

Elinext develops dashboards that show balances, recent activity, and available funds across accounts. Users can move money, set rules, and manage their financial flow easily.

-

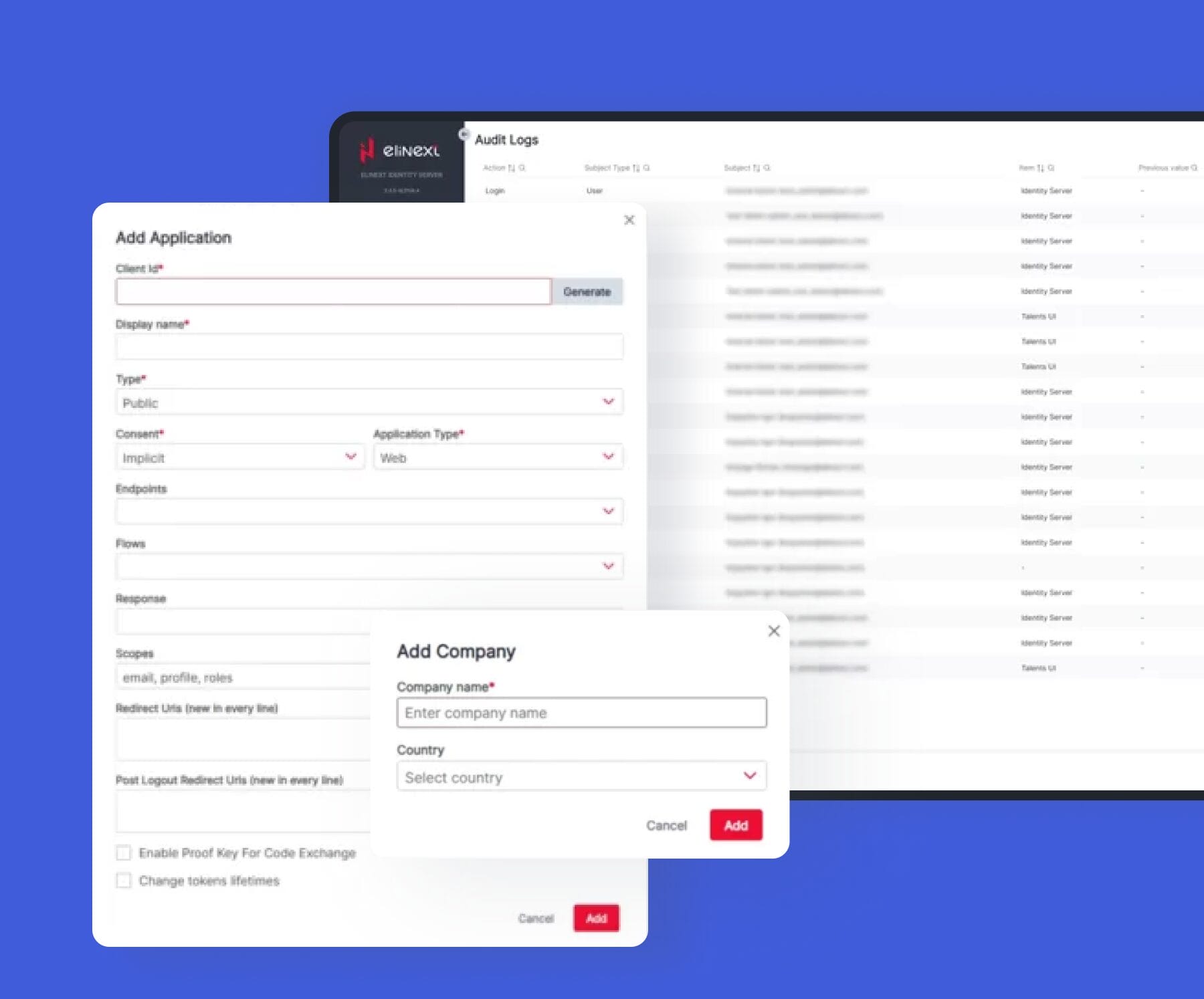

We enable secure profile handling, identity verification, password resets, and multi-factor authentication. This keeps accounts protected while making onboarding simple.

-

Billing and Invoicing

Our solutions support automated billing, invoice generation, reminders, and status tracking. Businesses can reduce manual work and ensure payments come in on time.

Our Awards and Recognitions

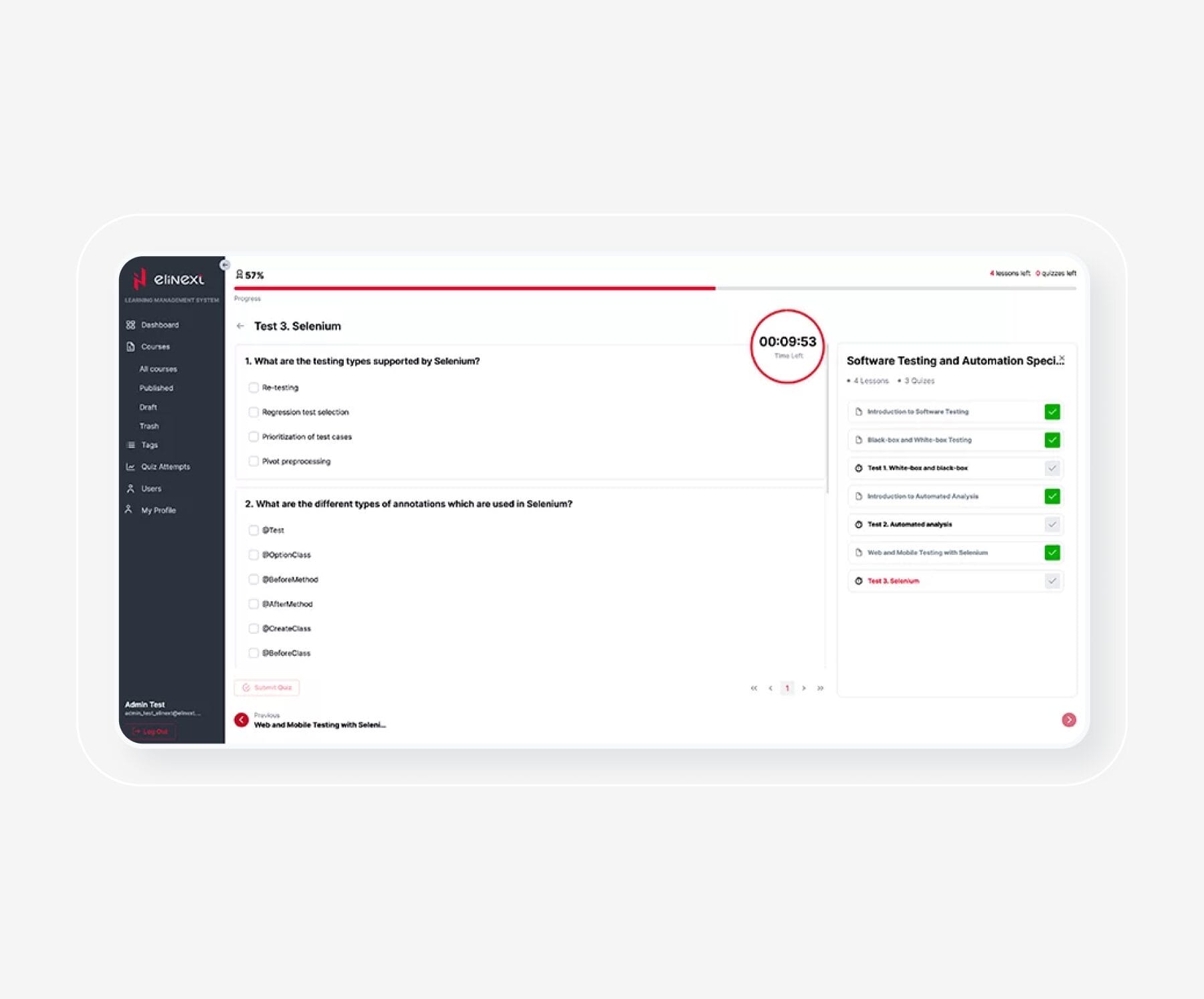

Advanced Techs We Implement in FinTech Software

Types of Payment App We Develop

-

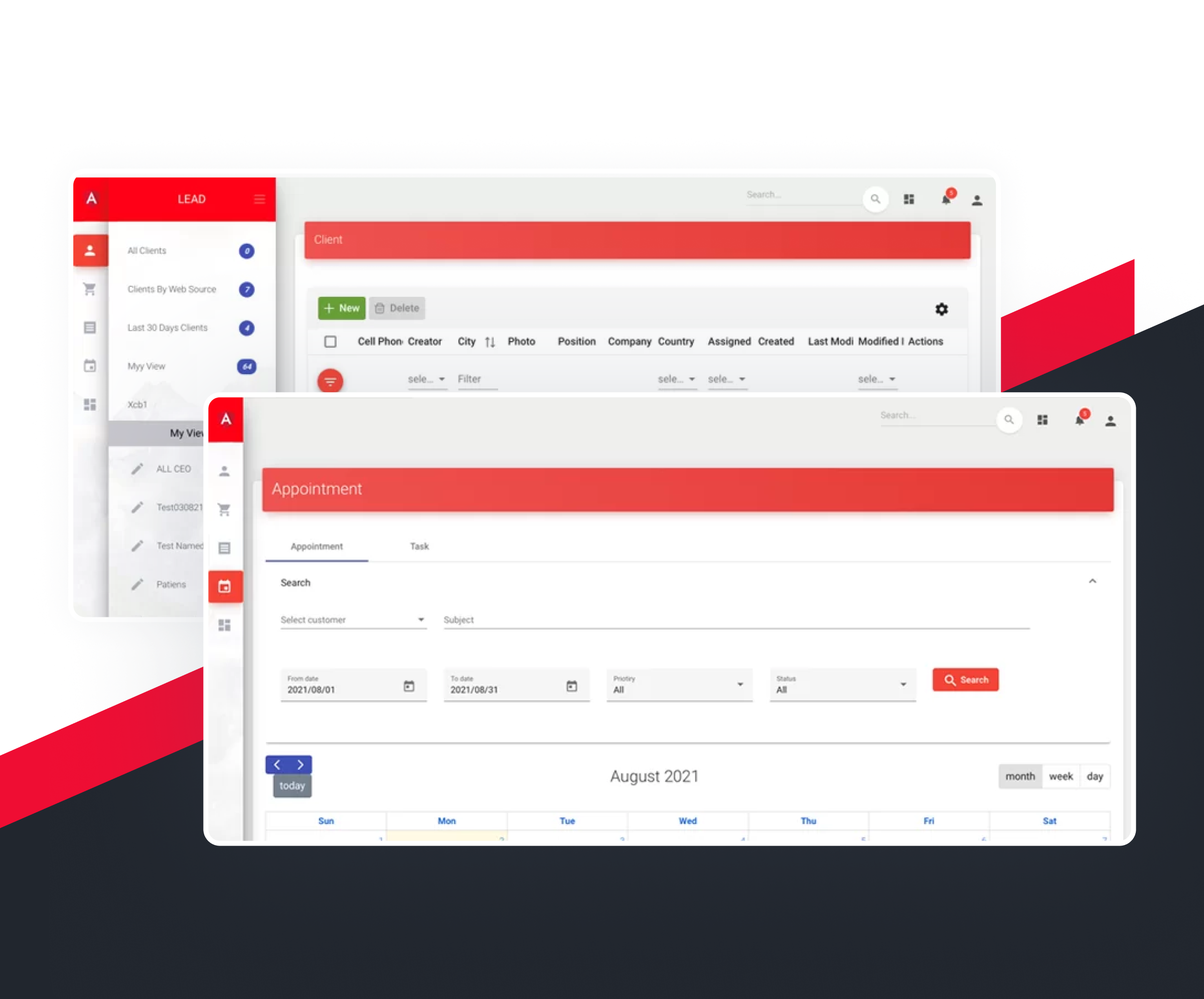

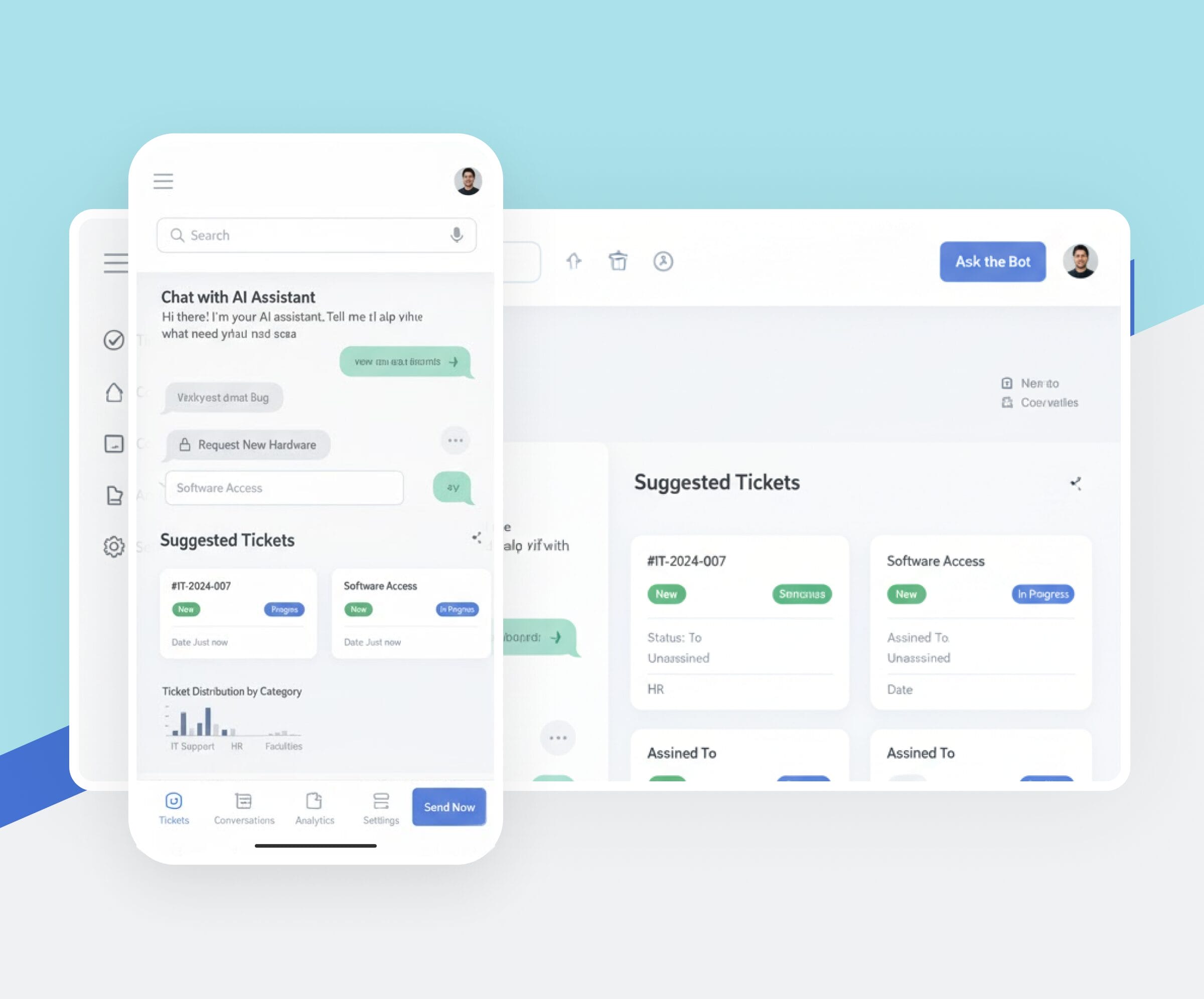

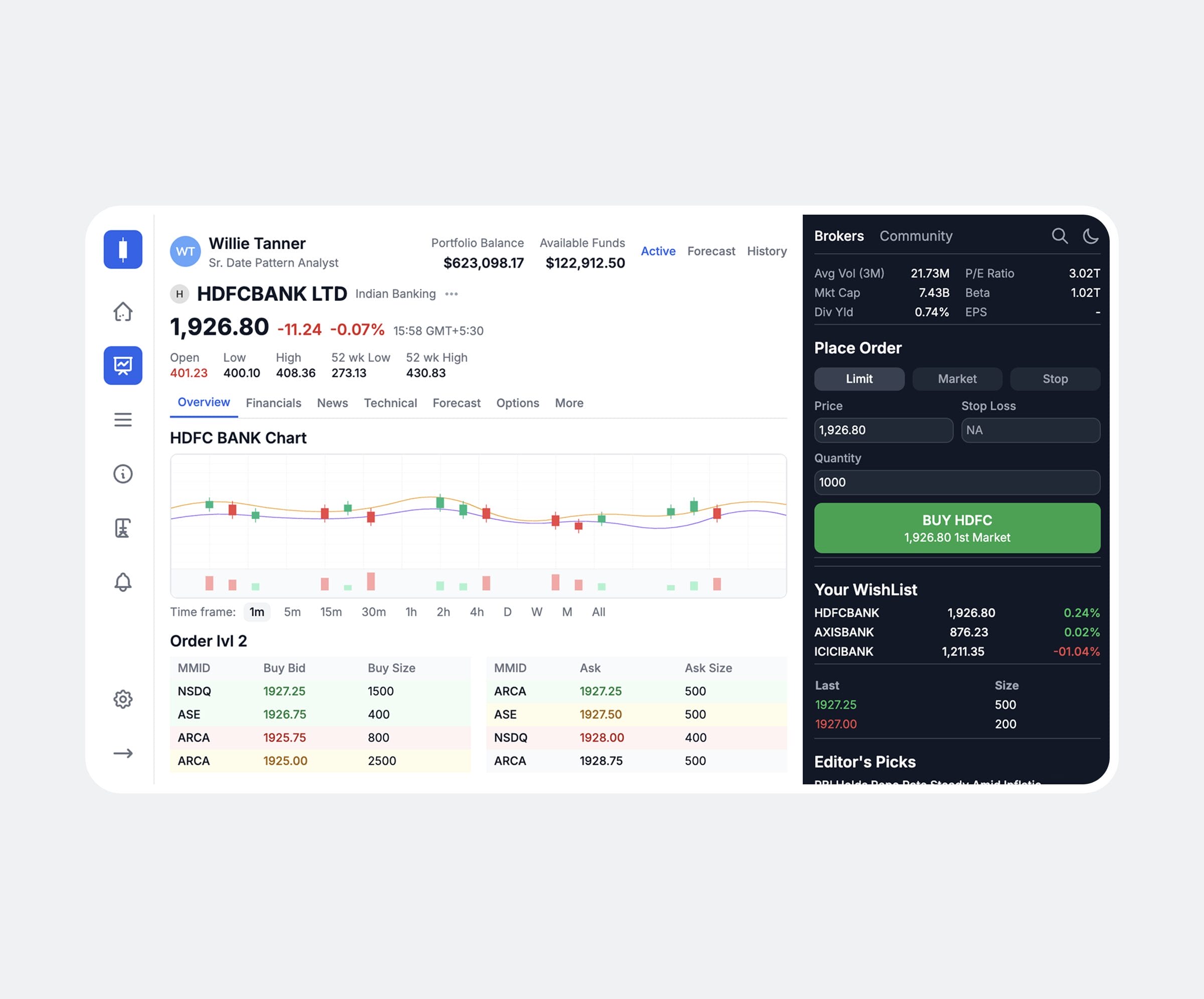

Payment App Development

We create multifunctional apps for fast and secure digital payments. These projects often require comprehensive payment app development services that cover backend logic, UI, and integrations.

-

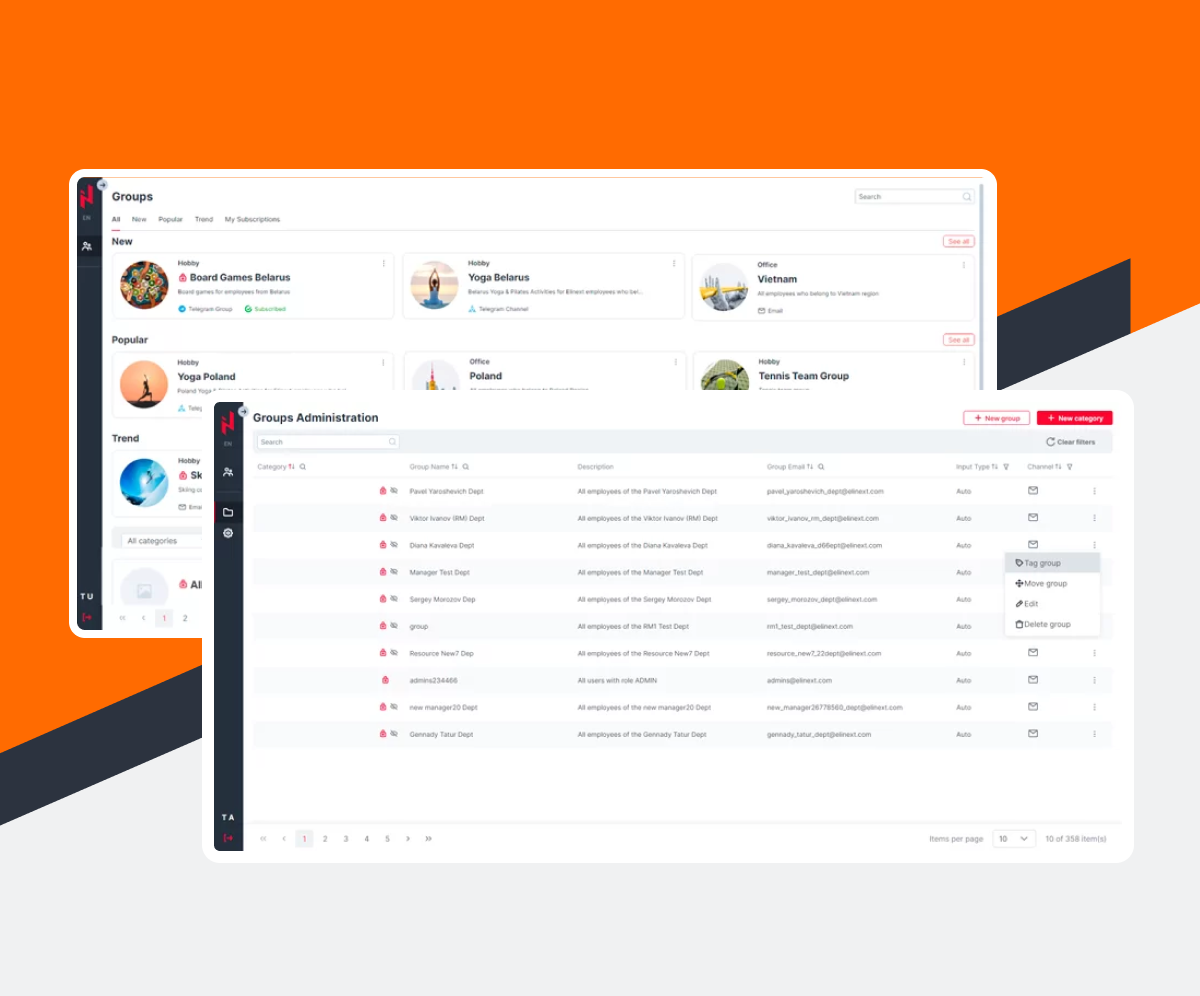

Mobile Wallet Development

Our mobile wallets let users store cards, manage balances, and pay anywhere. These solutions showcase our ability to deliver reliable payment apps for both iOS and Android.

-

Payment Gateway Development and Integration

We develop and connect payment gateways supporting global currencies, high-load processing, and secure authorization to ensure uninterrupted online transactions.

-

Payments Processing Software Development

Our systems automate routing, clearing, and settlement. This includes applying advanced payment app development services to support large-scale transaction flows.

-

Point-of-Sale (POS) Software Development

We build POS systems for retail and hospitality, enabling smooth checkouts, inventory syncing, and secure payment acceptance across devices.

-

Billing Software Development

We deliver billing platforms that automate invoicing, handle recurring charges, and improve financial accuracy for subscription-based and service-oriented businesses.

-

ACH Payment Processing Software Development

Our ACH solutions support secure bank-to-bank transfers and high-volume processing while ensuring compliance with U.S. automated clearing regulations.

-

Subscription Management Platform Development

We develop subscription systems that manage customer plans, automate renewals, and handle varied billing cycles to improve retention.

-

BNPL App Development

We create “buy now, pay later” apps with quick credit checks, flexible payment scheduling, and clear repayment management.

-

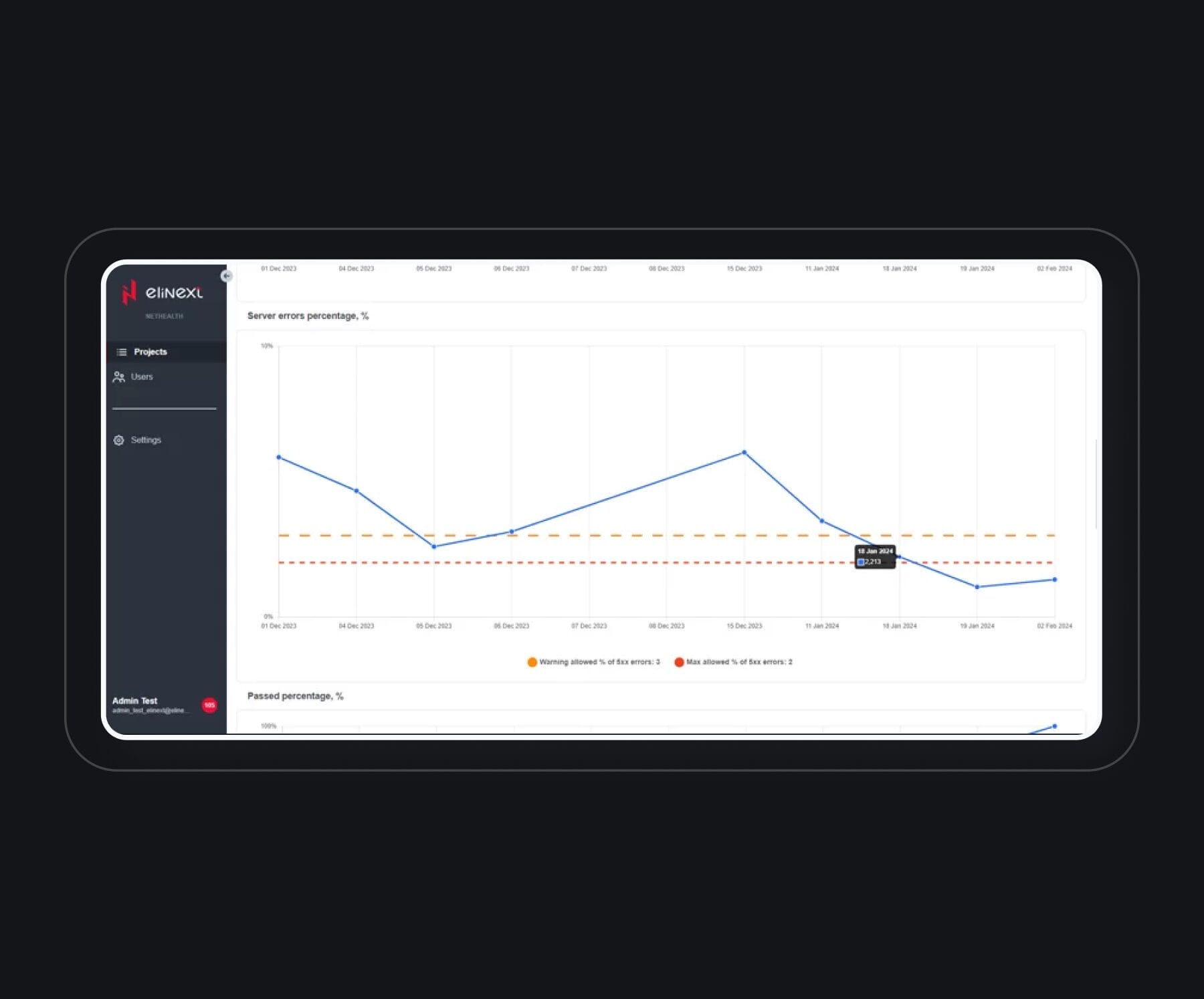

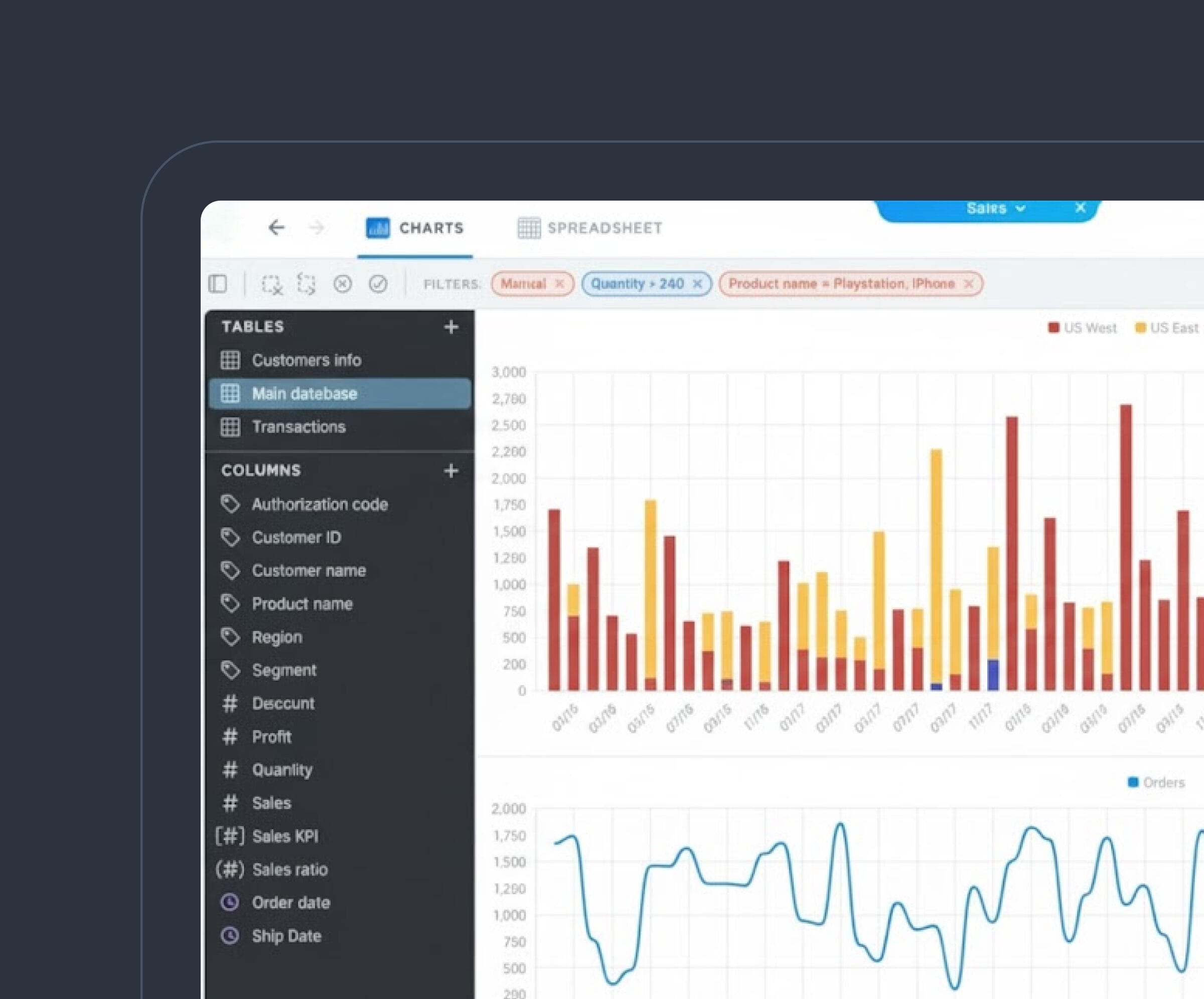

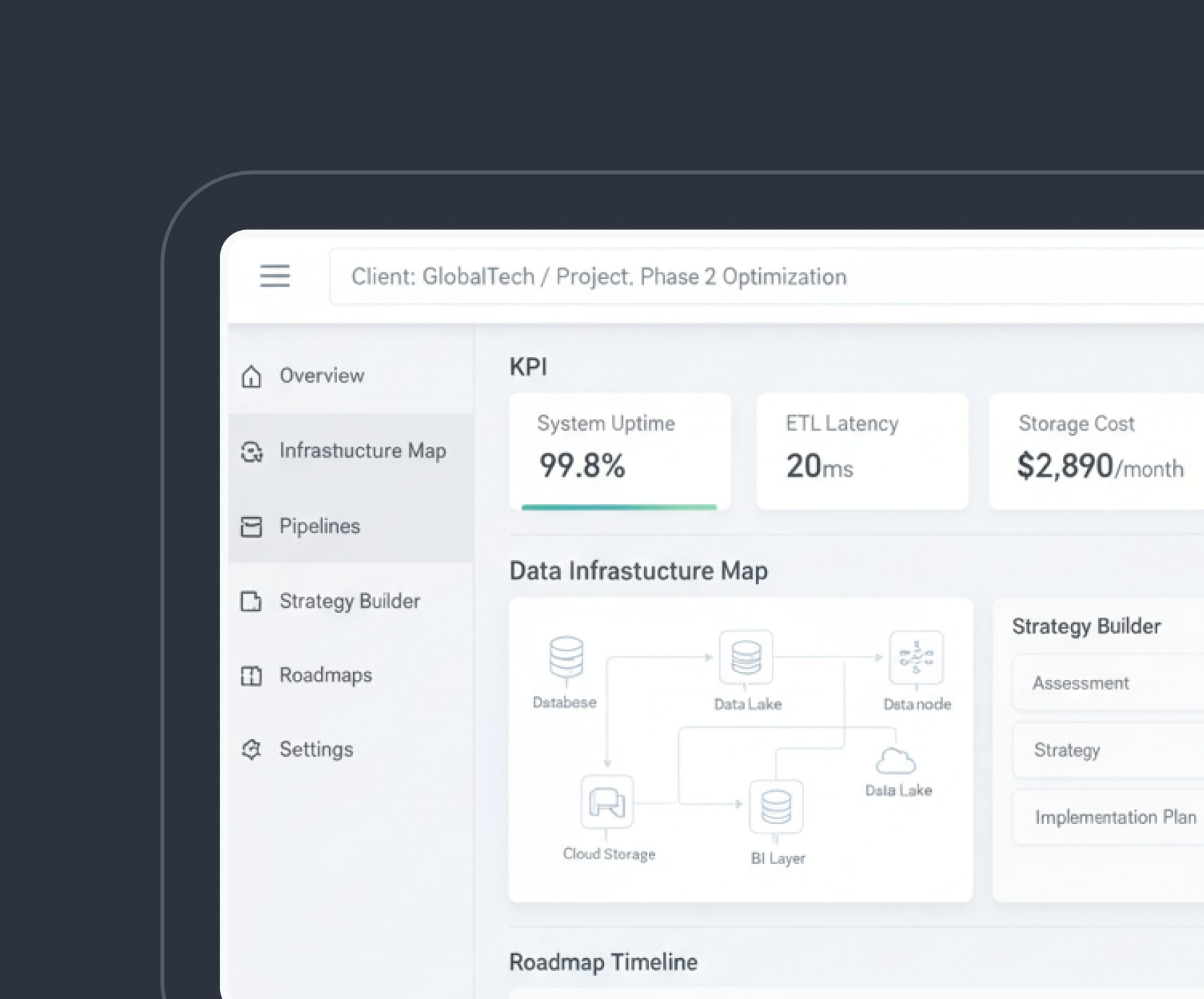

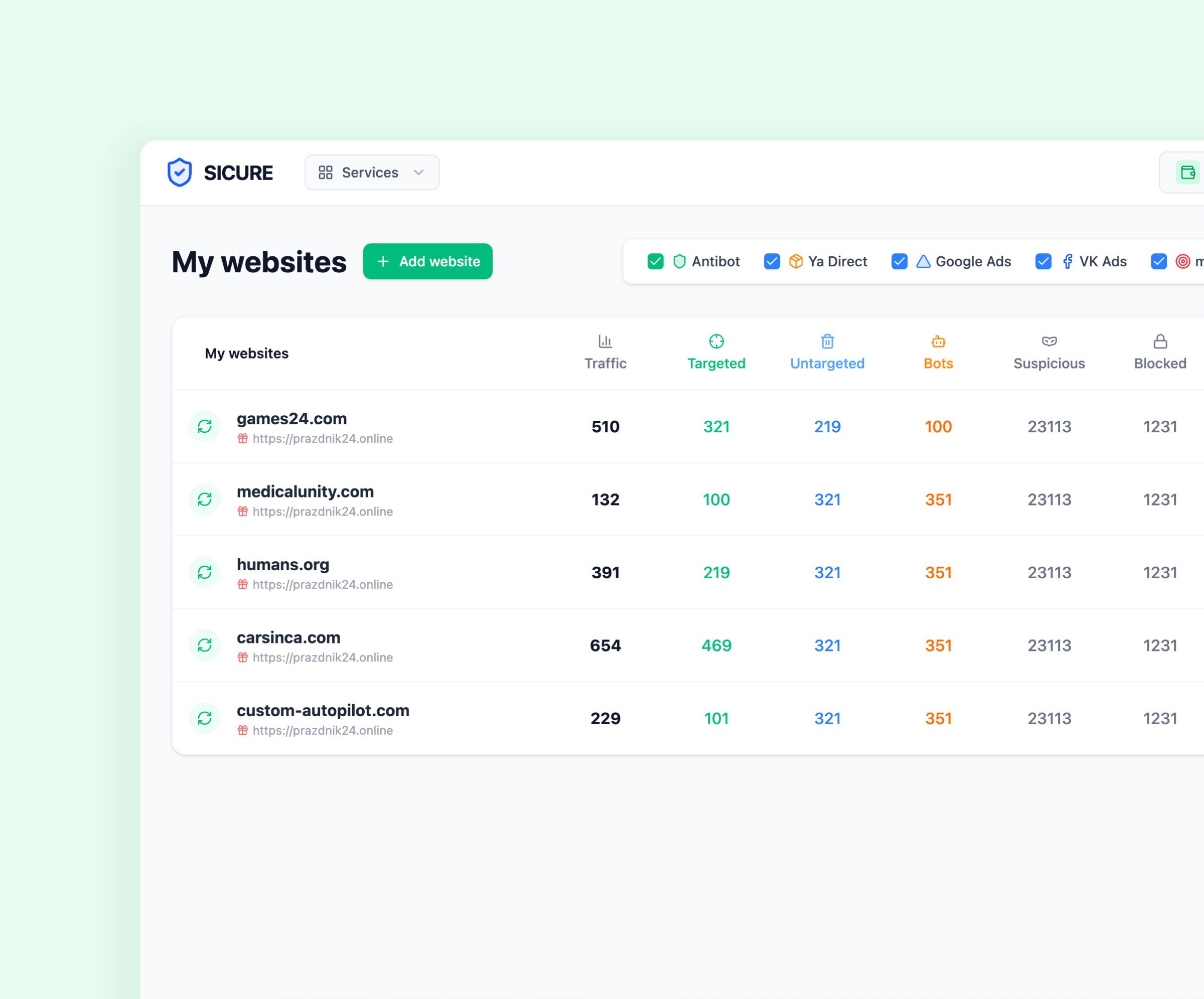

Payment Analytics Software Development

We build analytics tools that help companies track payment flows, detect patterns, and make data-driven decisions using advanced reporting capabilities.

-

Payment Fraud Detection System Development

Our fraud detection tools use machine learning to identify suspicious behaviors, minimize risks, and protect both users and merchants.

-

Bank-based Payment App

These apps integrate directly with core banking systems, allowing users to transfer funds, check balances, and manage accounts securely.

-

Standalone Payment App

We develop independent payment apps that function outside banking infrastructure and rely on modern fintech APIs for broad payment method support.

-

Social-media-centric Payment App

Our team creates payment solutions embedded into social platforms, enabling P2P transfers, creator monetization, and in-app purchases.

-

Mobile-OS-based Payment App

We build OS-optimized apps that leverage native features for speed, convenience, and secure transactions, representing tailored payment app development for each platform.

Payment App Development Services by Elinext

What Our Experts Say

Key Implementations for Payment App Security

-

KYC/AML

We implement KYC/AML checks to validate user identities and monitor transactions. This reduces fraud risks and helps businesses stay compliant with financial regulations.

-

Device Identification

Device recognition tools track known devices and flag anomalies. This helps block unauthorized access and strengthens overall app protection.

-

Data Encryption

We use strong encryption to protect sensitive data both at rest and in transit. This ensures financial information cannot be intercepted or misused.

-

Password & PIN

Password and PIN layers add basic but essential protection. They help users secure their accounts while supporting broader authentication strategies.

-

Multi-factor Authentication

MFA requires multiple confirmations, making account takeover attempts far more difficult. It adds a reliable layer of user verification.

-

Biometrics

Fingerprint, facial, or voice identification provides fast and secure authentication. Biometrics help minimize unauthorized access while improving user convenience.

-

RASP

Runtime protection detects suspicious actions inside the app and blocks threats instantly. It safeguards the system even during active use.

-

AI models analyze user behavior and identify anomalies. This allows early detection of fraud attempts before any real damage occurs.

-

Secure Communication

We apply secure protocols like TLS to protect data exchanged between devices and servers. This prevents interception or tampering during communication.

-

Secure Storage

Sensitive information is stored in encrypted containers with strict access rules. This protects user data even if a device is compromised.

-

E-signature

E-signature tools authenticate approvals and document actions. They provide legal protection and support transparent financial operations.

-

QR-code and CrontoSign Support

Secure QR and CrontoSign verification enhance transaction safety. These features make authentication both quick and highly reliable as part of our payment app development solutions.

Clients We Serve

The Benefits of Payment App Development Solutions by Elinext

Choose Your Service Option

Hire Payment App Developers

from Elinext

Why Elinext?

Listen to Our Clients

FAQ

-

A payment app is a tool that lets people move money digitally like paying bills, sending funds to friends, or checking balances. It replaces cash or cards with simple, quick, and convenient transactions on a phone or browser.

-

Custom apps let businesses build exactly what their customers need. It helps create smoother payments, adds features that fit the brand, and avoids limitations of ready-made tools. You get more control and better user experience.

-

Depending on the business, a payment app can include money transfers, bill payments, saved cards, QR payments, spending analytics, or security checks. The feature set is flexible and tailored to how your users pay.

-

Any company that handles payments from banks and fintech startups to online stores, retail chains, and service providers. If your customers pay you regularly, a custom payment app can make their lives easier.

-

Security is a top priority. We use modern protection tools, monitor risks, and follow strict industry rules. The goal is simple: offering payment app development services keep user data safe and make sure every payment goes through without worry.

-

Yes, they can. We can add options for multiple currencies, global cards, and cross-border payments so users can pay or receive money abroad just as easily as they do locally.

-

Timelines vary by complexity. A basic app might take a few months, while a feature-rich one can take longer. We always break the work into clear stages so clients can track progress.