Buy Now Pay Later App Development Services

Elinext: Leading Experts in Financial App Development

Buy Now Pay Later App Development Solutions We Offer

We design simple onboarding flows that verify identity and estimate creditworthiness in seconds. Users get fast approval, and providers reduce manual checks and onboarding errors.

Elinext enables providers to set and update installment rules, fees, and repayment schedules with ease. Clear terms help users understand their commitments and improve repayment rates.

Our systems process loan requests instantly using automated scoring and fraud checks. This helps users make quick decisions and reduces operational load for the provider.

We build repayment tools that support autopay, reminders, and flexible payment methods. This keeps repayment smooth for users and predictable for businesses.

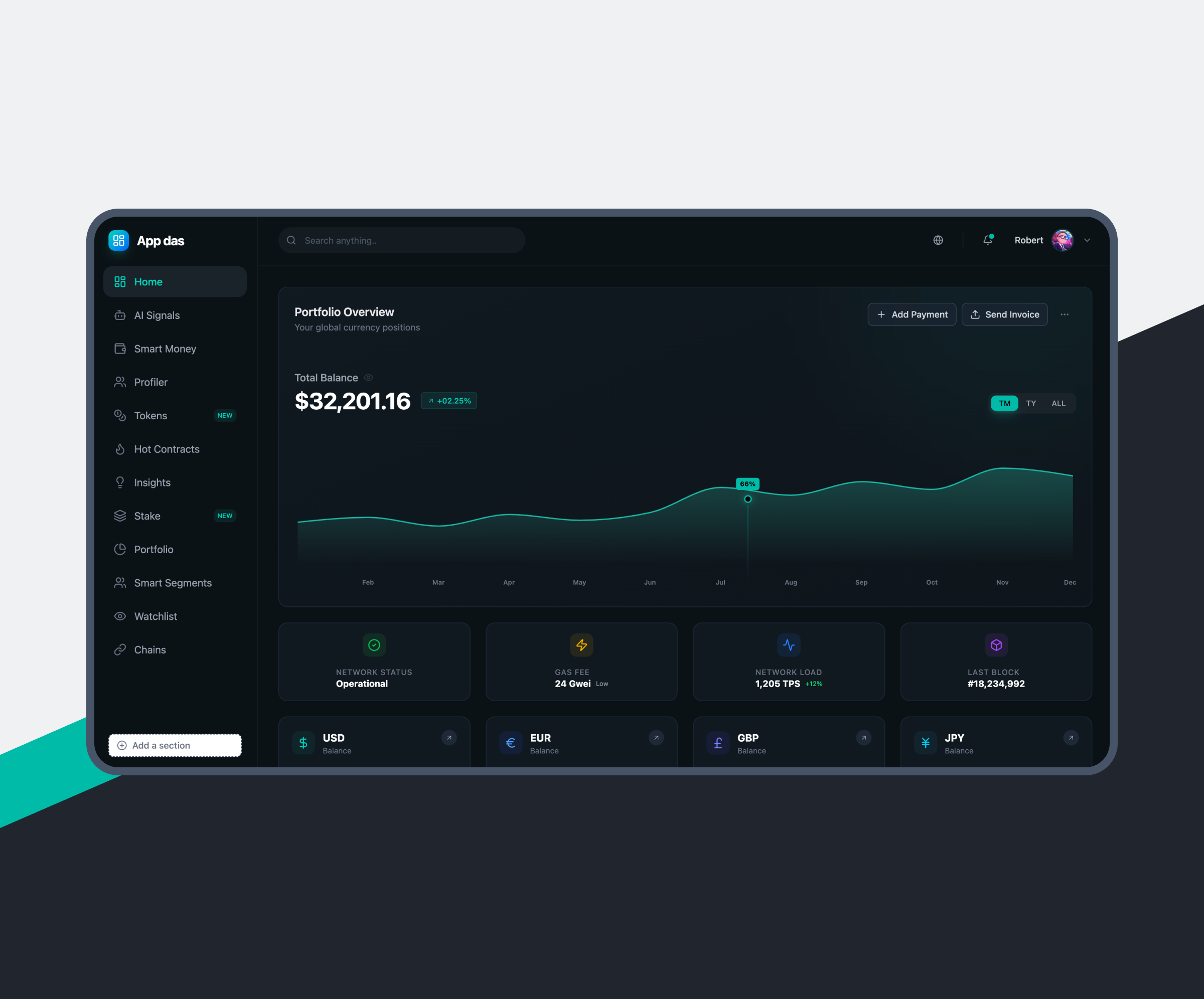

Users can track every purchase, installment, and payment date in real time. Clear visibility helps reduce confusion and improves overall trust in the service.

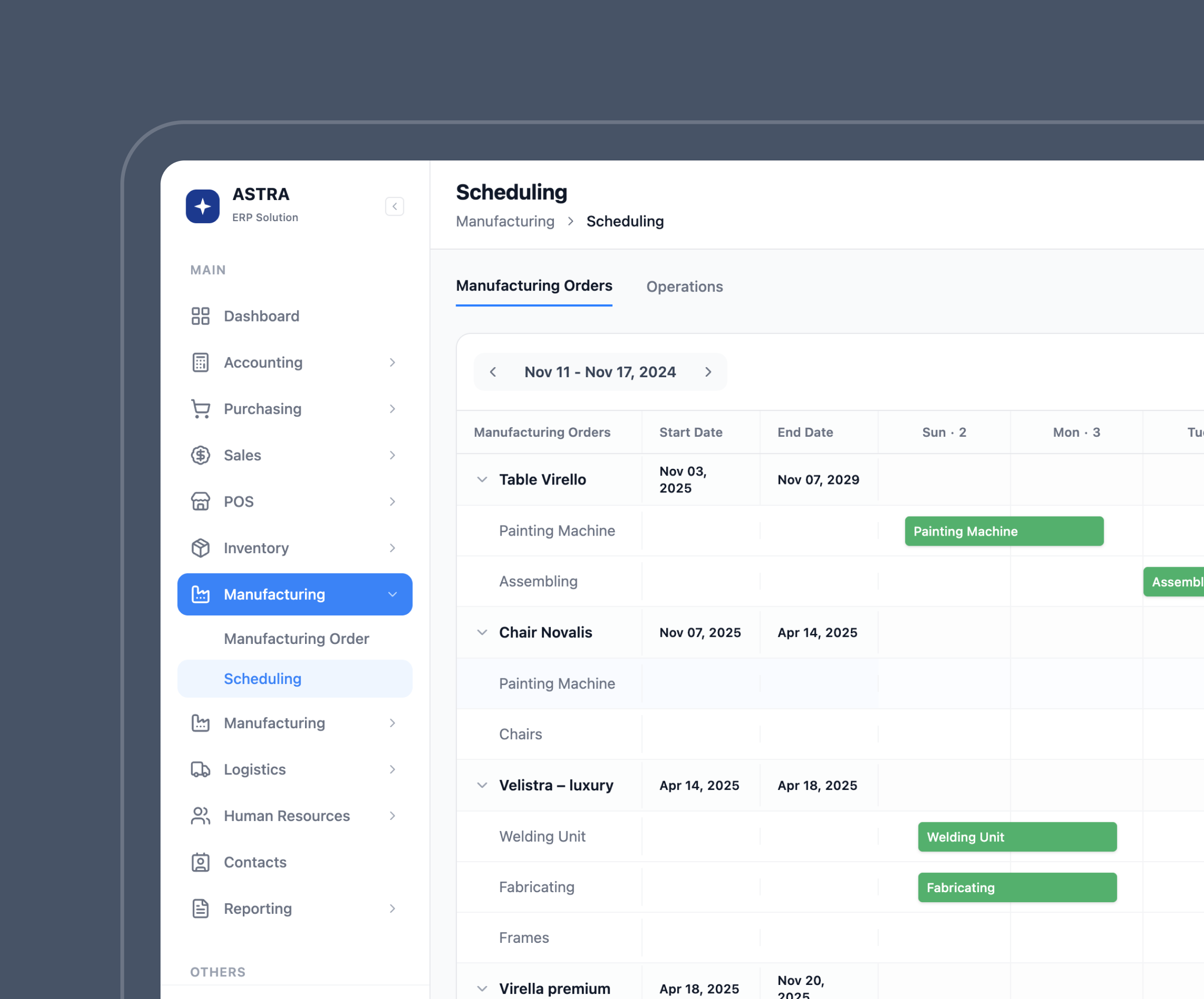

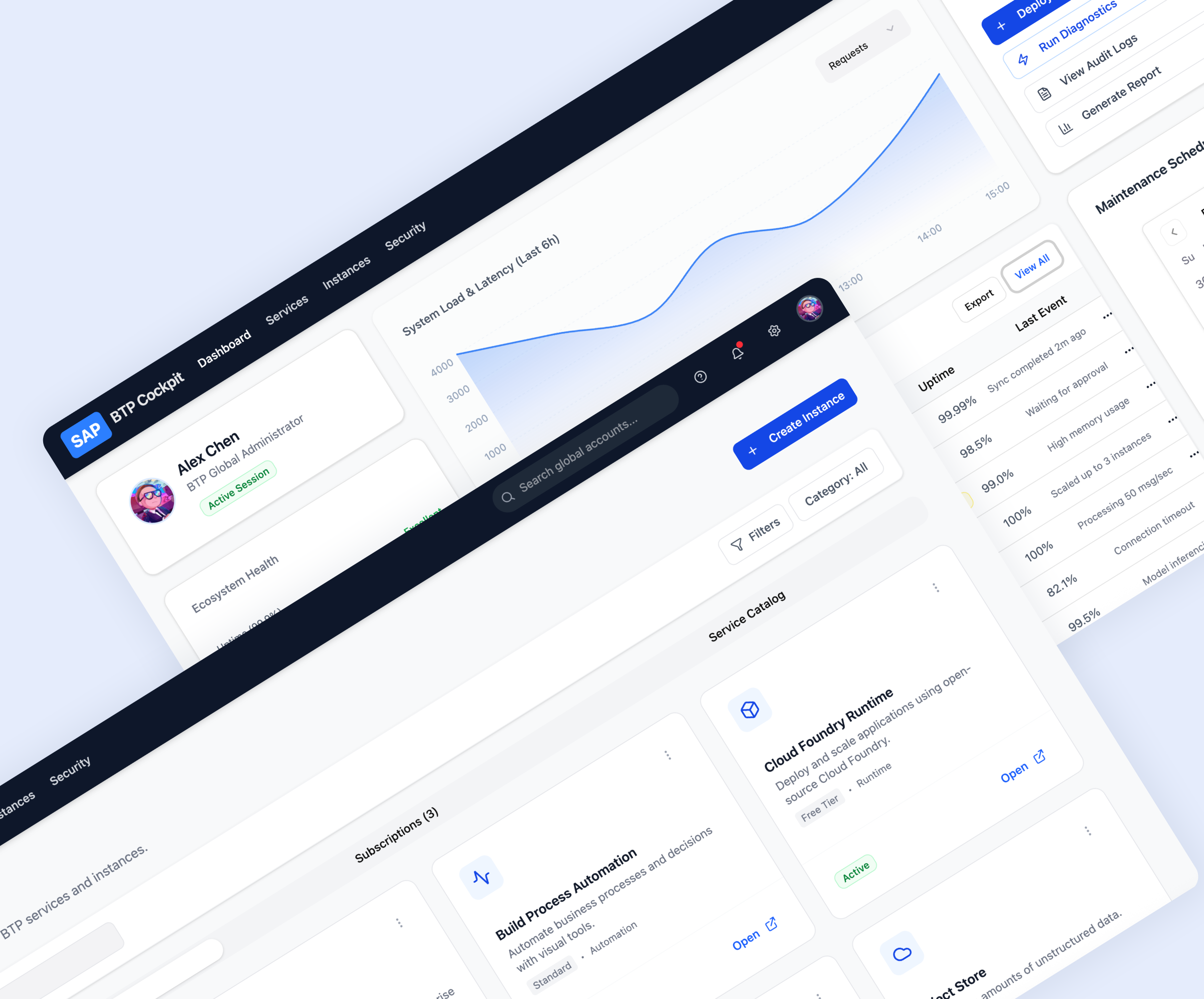

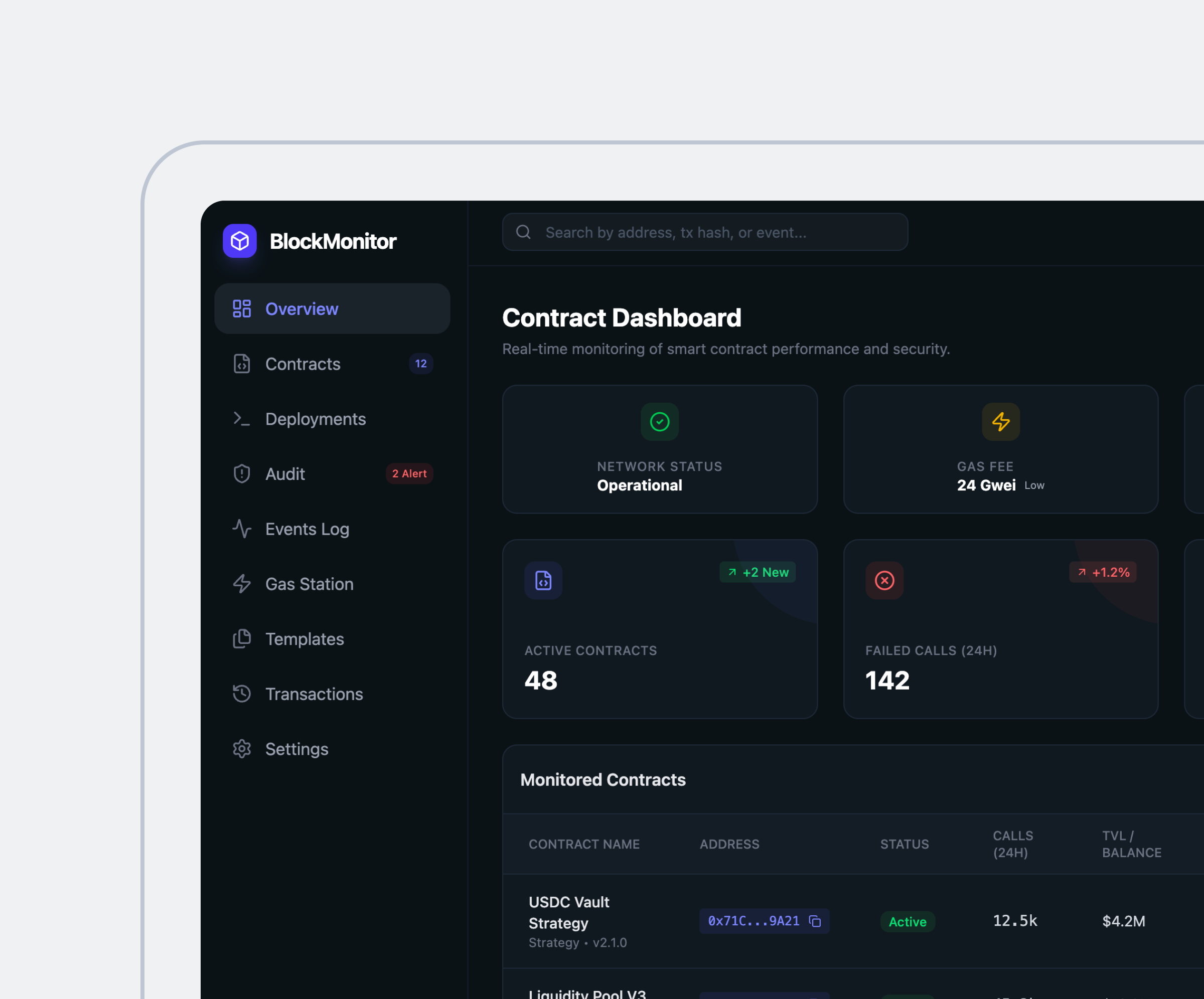

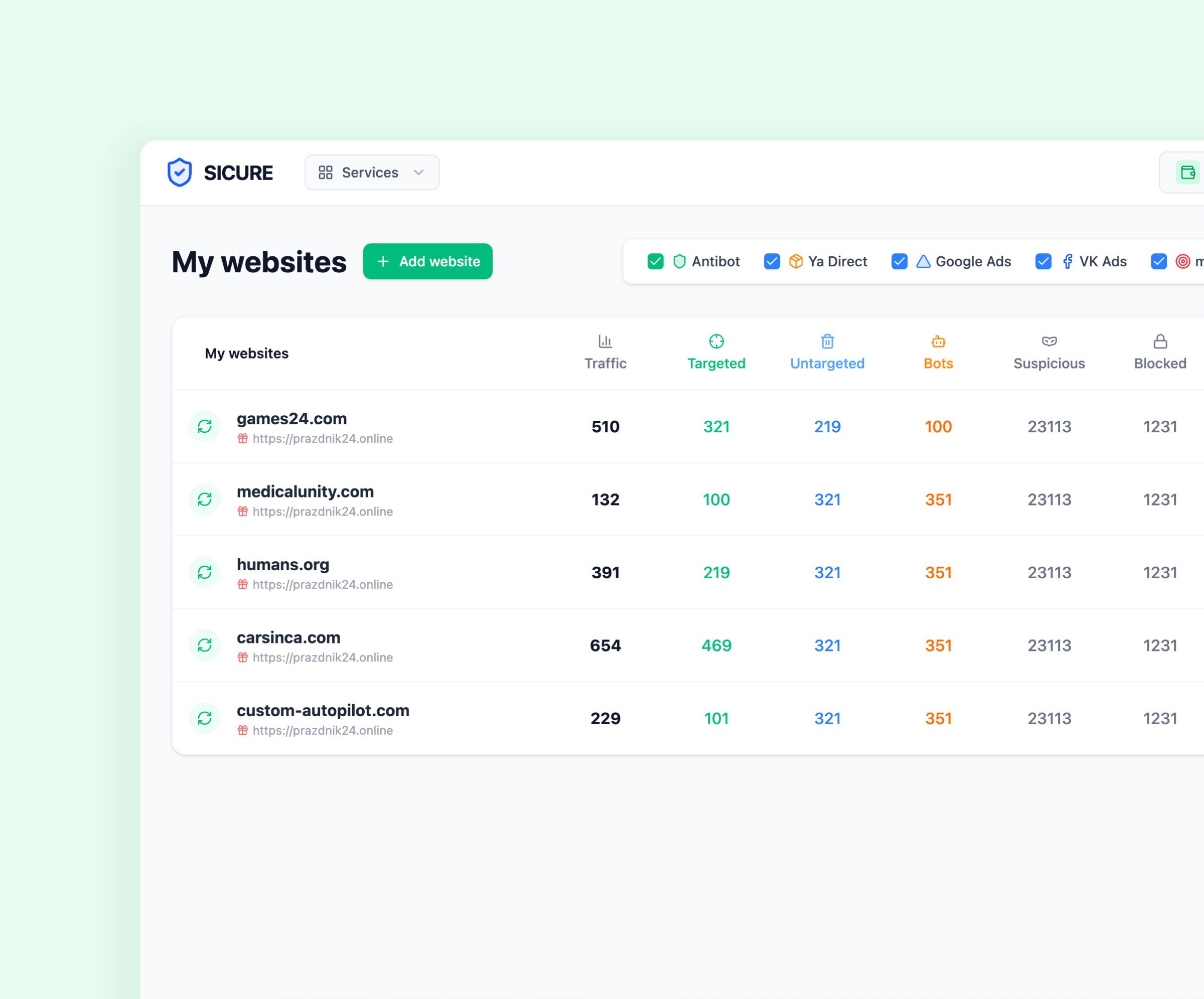

Elinext creates dashboards that highlight repayment trends, risks, and customer behavior. Providers get the insights they need to refine offers and meet compliance requirements.

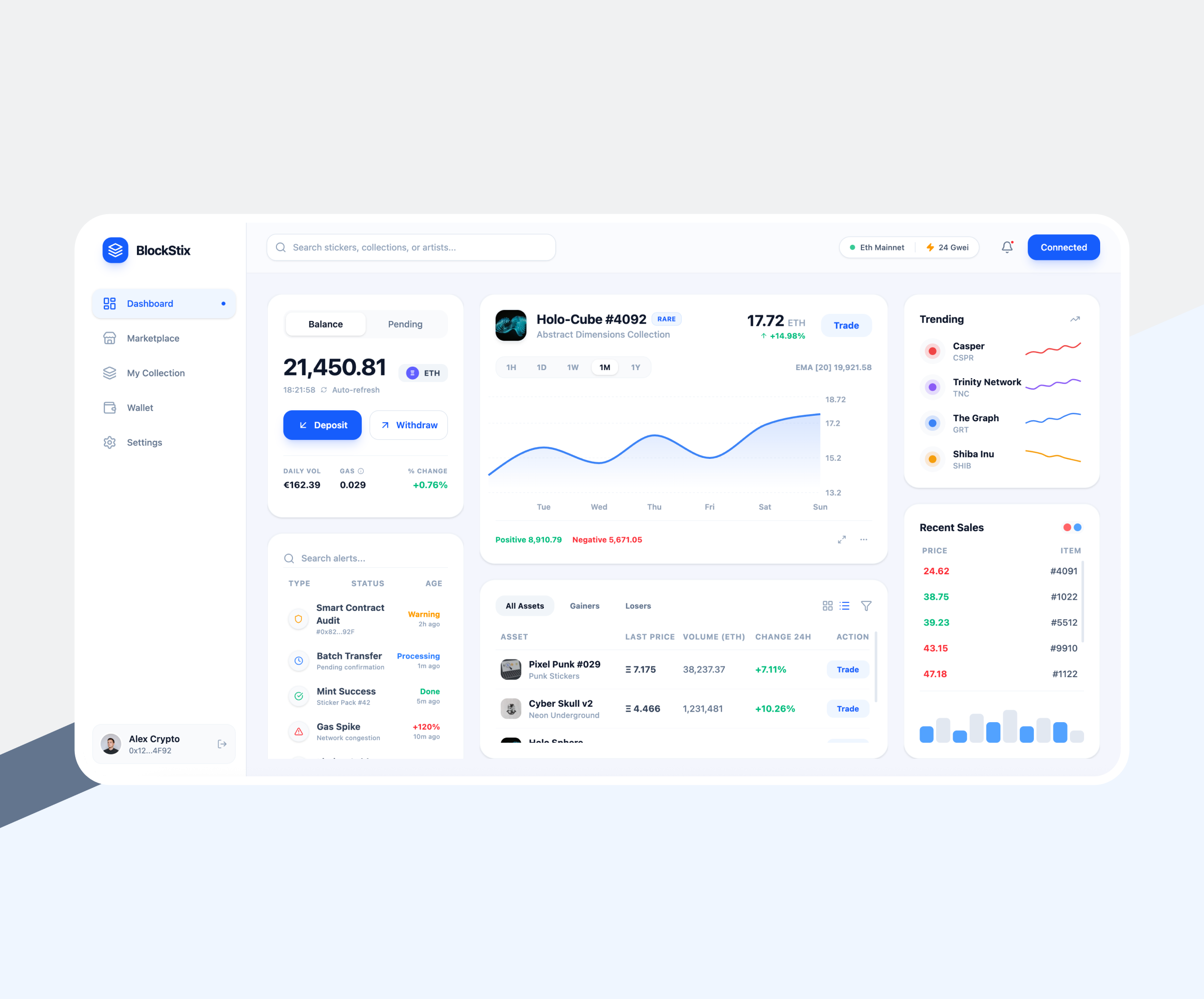

We develop built-in shopping tools that let users browse, select items, and activate BNPL directly in the app. This creates a smooth, uninterrupted buying experience.

Elinext supports QR codes and POS integrations so customers can use buy now pay later app services at physical stores as easily as online. Approvals happen instantly at checkout.

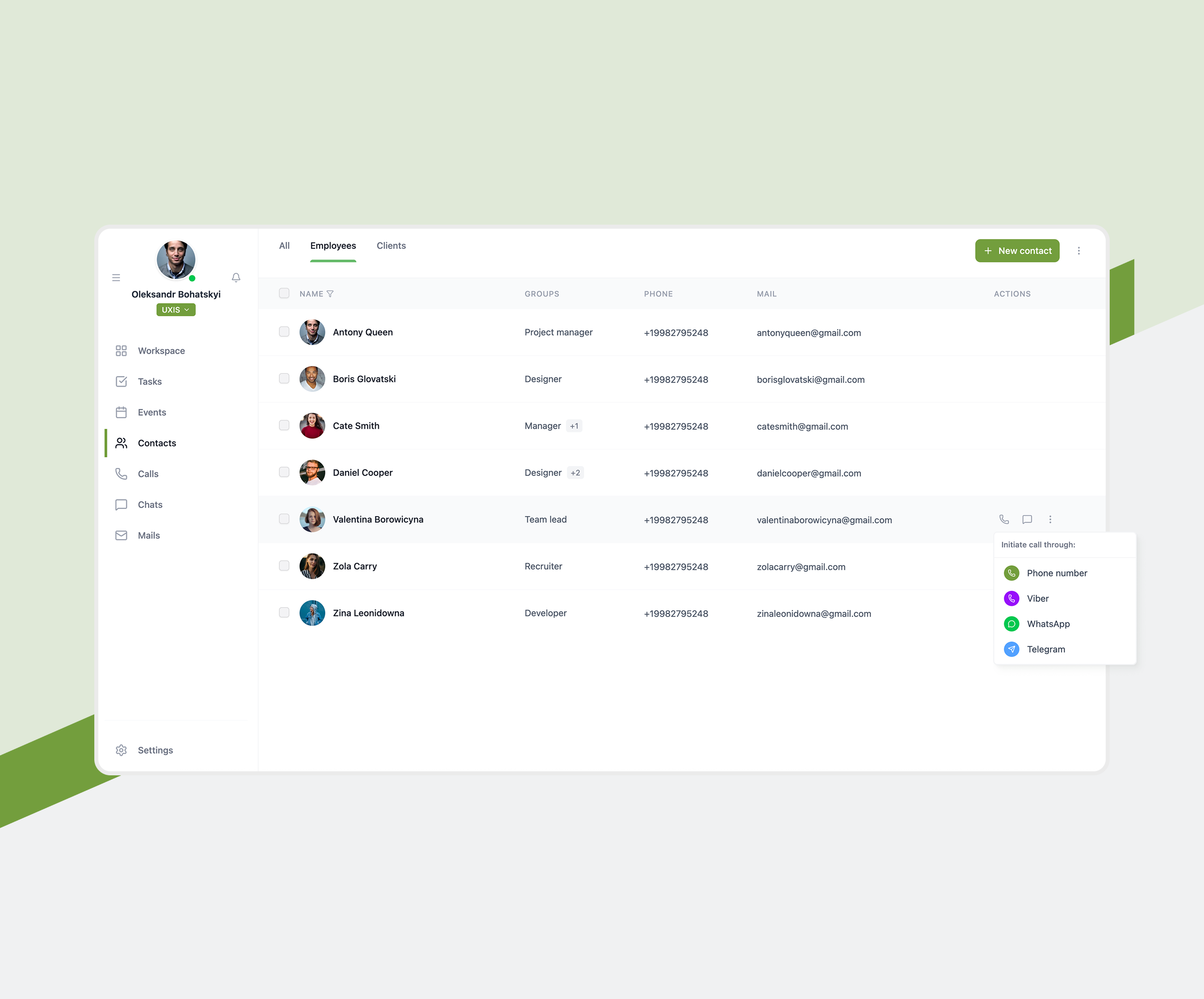

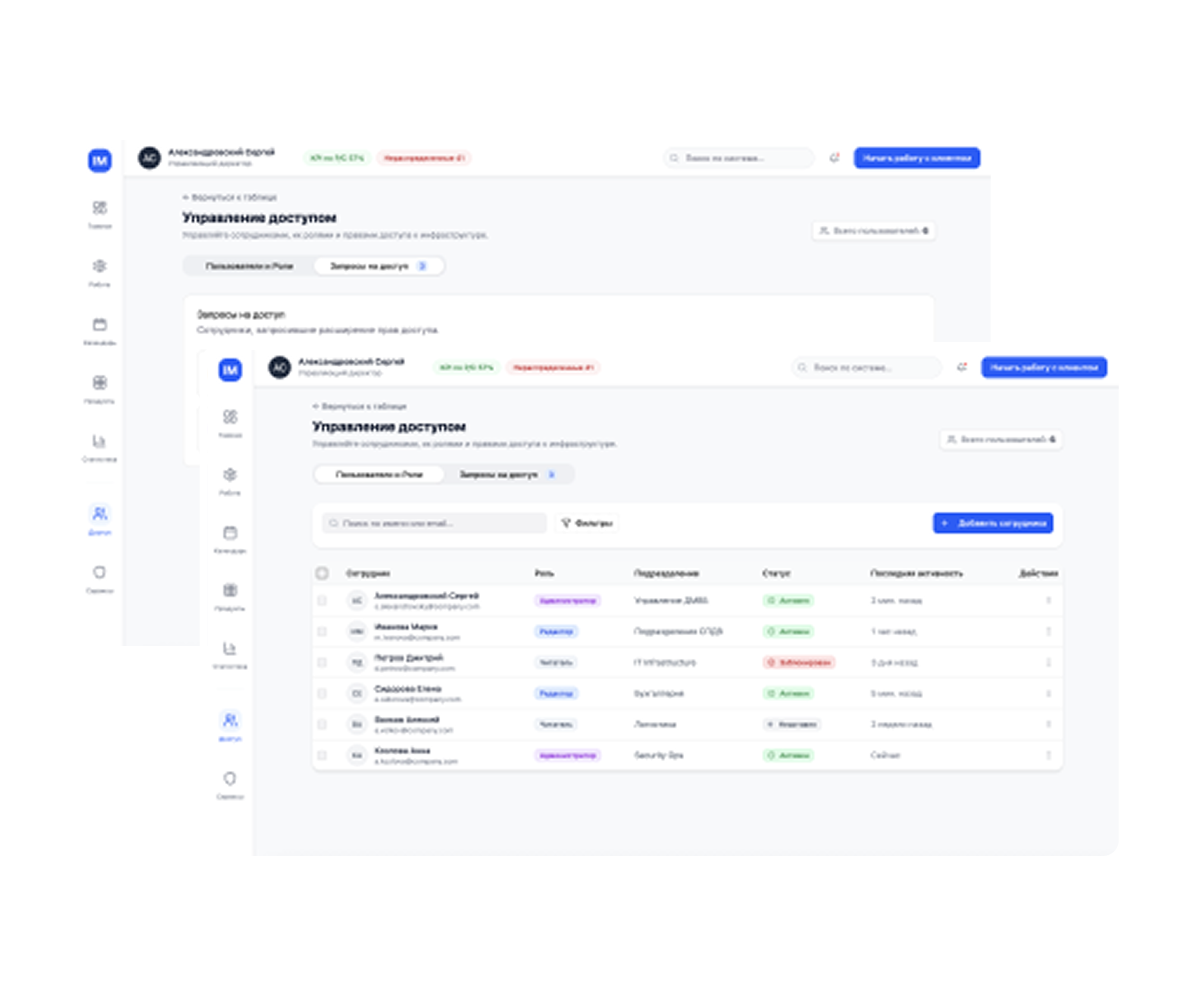

Users get a simple dashboard where they can update their profile, view loans, manage cards, and check spending history all in one secure, organized place.

-

User Registration and Pre-qualification

We design simple onboarding flows that verify identity and estimate creditworthiness in seconds. Users get fast approval, and providers reduce manual checks and onboarding errors.

-

Loan Terms Management Solutions

Elinext enables providers to set and update installment rules, fees, and repayment schedules with ease. Clear terms help users understand their commitments and improve repayment rates.

-

Loan Request Processing Solutions

Our systems process loan requests instantly using automated scoring and fraud checks. This helps users make quick decisions and reduces operational load for the provider.

-

Loan Repayment Solutions

We build repayment tools that support autopay, reminders, and flexible payment methods. This keeps repayment smooth for users and predictable for businesses.

-

BNPL Transactions Tracking

Users can track every purchase, installment, and payment date in real time. Clear visibility helps reduce confusion and improves overall trust in the service.

-

BNPL Analytics and Reporting

Elinext creates dashboards that highlight repayment trends, risks, and customer behavior. Providers get the insights they need to refine offers and meet compliance requirements.

-

In-app Shopping Solutions

We develop built-in shopping tools that let users browse, select items, and activate BNPL directly in the app. This creates a smooth, uninterrupted buying experience.

-

In-store Shopping Solutions

Elinext supports QR codes and POS integrations so customers can use buy now pay later app services at physical stores as easily as online. Approvals happen instantly at checkout.

-

Account Management for App Users

Users get a simple dashboard where they can update their profile, view loans, manage cards, and check spending history all in one secure, organized place.

Our Awards and Recognitions

Advanced Techs We Implement in FinTech Software

Elinext builds analytics tools that turn raw financial data into clear insights. Using our solutions, you can track your business’ performance, monitor risks, and make confident decisions.

Our team develops ERP systems tailored for financial operations, helping organizations manage accounting, budgeting, and reporting in one centralized, automated environment.

We create CRMs that help financial institutions track leads, manage clients, and streamline onboarding. This improves customer experience overall.

Elinext builds blockchain solutions for secure transactions, smart contracts, and transparent record-keeping. Our solutions reduce fraud, speed up settlements, and boost trust.

We implement ML models for credit scoring, customer segmentation, and risk forecasting. These models help financial companies predict behavior and improve decision accuracy.

Our big data solutions process massive financial data sets to uncover patterns, detect anomalies, and improve investment or lending strategies across the organization.

We migrate and build fintech systems on cloud to improve scalability, security, and uptime. This makes financial services faster, more resilient, and cost-efficient.

Elinext develops IoT-driven fintech tools, from asset tracking to insurance monitoring. These solutions help automate claims, assess risks, and offer more personalized services.

We build secure crypto wallets, exchange platforms, and payment gateways. Elinext supports digital assets safely and ensures compliance with regulatory standards.

Our DevOps practices ensure faster releases, stable performance, and continuous monitoring. This helps fintech products stay reliable and secure.

Elinext builds analytics tools that turn raw financial data into clear insights. Using our solutions, you can track your business’ performance, monitor risks, and make confident decisions.

Our team develops ERP systems tailored for financial operations, helping organizations manage accounting, budgeting, and reporting in one centralized, automated environment.

We create CRMs that help financial institutions track leads, manage clients, and streamline onboarding. This improves customer experience overall.

Elinext builds blockchain solutions for secure transactions, smart contracts, and transparent record-keeping. Our solutions reduce fraud, speed up settlements, and boost trust.

We implement ML models for credit scoring, customer segmentation, and risk forecasting. These models help financial companies predict behavior and improve decision accuracy.

Our big data solutions process massive financial data sets to uncover patterns, detect anomalies, and improve investment or lending strategies across the organization.

We migrate and build fintech systems on cloud to improve scalability, security, and uptime. This makes financial services faster, more resilient, and cost-efficient.

Elinext develops IoT-driven fintech tools, from asset tracking to insurance monitoring. These solutions help automate claims, assess risks, and offer more personalized services.

We build secure crypto wallets, exchange platforms, and payment gateways. Elinext supports digital assets safely and ensures compliance with regulatory standards.

Our DevOps practices ensure faster releases, stable performance, and continuous monitoring. This helps fintech products stay reliable and secure.

Buy Now Pay Later App Development Services by Elinext

We build BNPL apps tailored to your business model, including custom workflows, repayment logic, scoring rules, and user journeys. Our team ensures the solution is secure, scalable, and ready for both online and in-store use.

Elinext helps define the right strategy, features, and technology stack for your BNPL product. We analyze your goals, compliance needs, and customer behavior to shape a solution that fits the market and drives adoption.

We design clean, intuitive interfaces that make registration, approvals, and repayments easy for users. Our team ensures every screen feels fast, familiar, and trustworthy to maximize conversion and long-term engagement.

Elinext integrates payment gateways, KYC/AML providers, credit bureaus, analytics tools, and merchant platforms. This ensures smooth data flow, secure transactions, and seamless cooperation between all services.

We add AI capabilities such as risk scoring, fraud detection, and payment behavior prediction. These features help automate decisions, reduce losses, and personalize offers for each user.

Our ML models analyze large data sets to improve credit decisions, forecast repayment behavior, and adjust risk rules over time. This helps providers reduce defaults and optimize approval rates.

Elinext performs functional, performance, and security testing to ensure every BNPL app runs flawlessly. We check payment flows, integrations, and compliance features to deliver a stable, high-quality product.

We build BNPL apps tailored to your business model, including custom workflows, repayment logic, scoring rules, and user journeys. Our team ensures the solution is secure, scalable, and ready for both online and in-store use.

Elinext helps define the right strategy, features, and technology stack for your BNPL product. We analyze your goals, compliance needs, and customer behavior to shape a solution that fits the market and drives adoption.

We design clean, intuitive interfaces that make registration, approvals, and repayments easy for users. Our team ensures every screen feels fast, familiar, and trustworthy to maximize conversion and long-term engagement.

Elinext integrates payment gateways, KYC/AML providers, credit bureaus, analytics tools, and merchant platforms. This ensures smooth data flow, secure transactions, and seamless cooperation between all services.

We add AI capabilities such as risk scoring, fraud detection, and payment behavior prediction. These features help automate decisions, reduce losses, and personalize offers for each user.

Our ML models analyze large data sets to improve credit decisions, forecast repayment behavior, and adjust risk rules over time. This helps providers reduce defaults and optimize approval rates.

Elinext performs functional, performance, and security testing to ensure every BNPL app runs flawlessly. We check payment flows, integrations, and compliance features to deliver a stable, high-quality product.

Custom Solutions that Integrate with a Buy Now Pay Later App

Elinext connects your BNPL app with trusted payment gateways to ensure secure, fast, and compliant transaction processing. Users can pay for installments easily, while providers benefit from automated workflows and accurate payment tracking.

We integrate third-party credit scoring services to support instant, reliable user assessments. This helps providers evaluate risk quickly, offer appropriate loan terms, and reduce the likelihood of defaults.

Elinext buy now pay later app development company connects your BNPL system with internal accounting tools to automate invoices, settlement reports, and financial reconciliation. This reduces manual work, prevents errors, and keeps financial data consistent and up to date.

Elinext connects your BNPL app with trusted payment gateways to ensure secure, fast, and compliant transaction processing. Users can pay for installments easily, while providers benefit from automated workflows and accurate payment tracking.

We integrate third-party credit scoring services to support instant, reliable user assessments. This helps providers evaluate risk quickly, offer appropriate loan terms, and reduce the likelihood of defaults.

Elinext buy now pay later app development company connects your BNPL system with internal accounting tools to automate invoices, settlement reports, and financial reconciliation. This reduces manual work, prevents errors, and keeps financial data consistent and up to date.

Clients We Serve

Elinext delivers buy now pay later app development services tailored to the realities of each industry, helping companies streamline payments, increase conversions, and reduce operational overhead. Our expertise ensures smooth integration, secure transactions, and customer-friendly installment options across various business sectors.

BNPL helps retailers boost impulse purchases, increase average order value, and improve customer loyalty. Elinext integrates installment payments into in-store systems and mobile checkouts.

- POS-based BNPL activation

- Real-time purchase approvals

- Loyalty program integration

- Fraud detection tools

Online stores benefit from higher conversion rates and reduced cart abandonment when offering BNPL. We seamlessly embed installment options into existing platforms.

- One-click BNPL checkout

- Integration with Shopify, Magento, WooCommerce

- Customer scoring automation

- Multi-currency support

Startups use BNPL to enter the lending space quickly with scalable, secure technology. Elinext builds modular solutions that grow as the business expands.

- Custom scoring engines

- Payment orchestration

- KYC/AML automation

- Cloud-native architecture

Banks use BNPL to modernize lending, attract younger customers, and compete with digital-first providers. We integrate BNPL directly into banking apps and core systems.

- Core banking integration

- Risk assessment modules

- Unified user onboarding

- Compliance-ready workflows

Lenders and financial service providers adopt BNPL to diversify offerings and streamline loan management. Elinext builds secure and regulation-compliant platforms.

- Installment scheduling

- Automated repayment tracking

- Advanced analytics

- Secure identity verification

Telecom companies use BNPL to enable device financing, prepaid plans, and bundled services. Our BNPL solutions help reduce churn and increase ARPU.

- Device installment plans

- Billing system integration

- Customer eligibility checks

- Payment-reminders

Travel companies leverage BNPL to allow customers to book trips now and pay later, boosting bookings and reducing friction.

- Travel package financing

- Dynamic pricing tools

- Real-time approval engines

- Multi-currency installment options

Healthcare providers use BNPL to help patients access treatments without financial stress. We implement secure, compliant installment solutions for medical services.

- HIPAA-compliant payment flows

- Patient financing portals

- Automatic reminders

- Transparent installment plans

Elinext delivers buy now pay later app development services tailored to the realities of each industry, helping companies streamline payments, increase conversions, and reduce operational overhead. Our expertise ensures smooth integration, secure transactions, and customer-friendly installment options across various business sectors.

What Our Experts SayWhat Our Experts Say

The Benefits of BNPL App Development Solutions by Elinext

Choose Your

Service Option

Hire BNPL App Developers

from Elinext

Poland

Poland

Vietnam

Vietnam

Kazakhstan

Georgia

Kazakhstan

Uzbekistan

Why Elinext?

Listen to Our Clients

FAQ

-

A BNPL app lets customers buy what they need right away and pay for it in smaller scheduled installments. It handles approvals, sets up repayment plans, and keeps everything easy for the user. For businesses, BNPL increases sales and gives shoppers more flexibility at checkout.

-

BNPL apps help companies raise conversion rates, reduce abandoned carts, and attract customers who prefer alternative payment options. They also automate scoring, decision-making, and repayment tracking, taking pressure off internal teams. For many businesses, offering BNPL is now a competitive advantage rather than a nice-to-have.

-

A BNPL app can include user onboarding, identity checks, loan request processing, installment planning, reminders, in-app shopping, transaction history, analytics dashboards, and fraud protection. Elinext can also connect it to payment gateways, credit bureaus, accounting tools, or any other system you rely on.

-

Retailers, eCommerce brands, fintech startups, banks, telecom providers, and even healthcare services can benefit. Essentially, any business that sells products or services and wants to offer customers more flexible ways to pay can gain value from a BNPL solution.

-

Security is built into every layer. Offering buy now pay later app development services we offer encryption, biometric authentication, fraud detection tools. We ensure compliance with standards like PCI DSS, GDPR, and AML. Your users’ financial data and transactions remain protected, whether they’re paying online or in-store.

-

Absolutely. We tailor the app around your repayment rules, scoring model, branding, integrations, and customer journey. Whether you need a simple checkout plugin, a full BNPL platform, or an app that works both online and in-store, we build it the way you envision.

-

Most BNPL apps take around 4–8 months to develop, depending on complexity and how many integrations are required. We follow an agile approach, so you start seeing progress early and can refine features as we go. This helps speed up delivery without sacrificing quality.

Looking for Related Services?

FinTech Solutions News

Contact Us