Insurance mobile app development and insurance app integration are transforming the industry in 2025. More than 70% of policyholders prefer digital channels, allowing insurers to increase customer retention by 30% and speed up claims processing by 40%. Apps now allow users to submit claims, renew policies, and communicate with agents instantly. Analytics show that integrated apps reduce operating costs and increase customer satisfaction, making them indispensable for modern insurers.

How insurance app development helps manage insurance services

Insurance app integration streamlines policy management, claims, and renewals. For example, users can upload documents, track claims, and receive instant notifications, making insurance services more accessible and efficient for both customers and insurance companies.

So let’s consider the main advantages that mobile users may obtain due to mobile app development services:

- quick search and easy-to-access information about insurance proposals;

- the possibility to acquire an insurance policy while in motion;

- ubiquitous and immediate support from insurance service providers;

- self-servicing capabilities allowing to make policy changes and get quotes;

- the opportunity to submit claims instantly;

- the resource for managing policies from anywhere on the earth.

What is app development for insurance providers

App development for insurance companies involves creating digital platforms for managing insurance policies, processing insurance claims, and providing customer support. For example, apps allow users to purchase insurance policies, submit claims, and communicate with agents, improving efficiency and customer service.

Mobile technology adoption strategies can serve as:

- one more effective way to reach and retain digital users;

- a marketing strategy for deeper customer engagement;

- an effective communication tool for getting in touch with next-generation agents, brokers, advisers, and other intermediates;

- another channel to communicate with customers that differentiates an insurance company from competitors;

- improved operational efficiency and high-level service personalization.

Types of Insurance Web and Mobile Apps

Insurance mobile app development covers personal, corporate, medical, and auto insurance apps. Health insurance apps track health status, while auto insurance apps allow accident reporting. These apps make it easier for both users and insurers to file claims, renew policies, and manage policies.

Personal Insurance Applications

Insurance app integration allows personal insurance apps to manage health, auto, or home insurance policies. For example, a health insurance app allows users to submit claims, access telemedicine, and track rewards for wellness programs. Integration with wearables and payment systems makes renewals and claims easier, and push notifications keep users up to date, increasing customer engagement and satisfaction.

- Life Insurance Apps

- Health Insurance Apps

- Auto Insurance Apps

- Homeowners Insurance Apps

- Flood Insurance Apps

Business Insurance Applications

Insurance app development for business simplifies policy management, claims, and compliance. For example, a company can use an app to manage multiple policies, file property damage claims, and access risk analytics. These apps offer dashboards, document uploads, and real-time support to help companies stay compliant and respond quickly to incidents.

- General Liability Insurance Apps

- Professional Liability (E&O) Insurance Apps

- Commercial Property Insurance Apps

- Commercial Auto Insurance Apps

- Workers’ Compensation Insurance Apps

- Environmental Insurance Apps

- Aviation Insurance Apps

- Marine Insurance Apps

- Energy Insurance Apps

- Engineering Insurance Apps

New Insurance Models

App development for insurance is opening up new models such as pay-as-you-go and on-demand insurance. For example, pay-per-mile auto insurance apps track driving behavior and adjust premiums. Peer-to-peer insurance platforms allow users to pool resources. These mobile app-based innovations provide flexibility and transparency, attracting tech-savvy customers and expanding market reach.

- Parametric Insurance Apps

- Microinsurance Apps

- P2P Insurance Apps

- Pay-as-you-live Insurance Apps

Ready to modernize your insurance customer experience?

We create secure and compliant apps with pricing, onboarding, FNOL, claims tracking, eKYC, payments, policy self-service, chat, and telematics.

Get a roadmap, UI mockups, timeline, and fixed pricing.

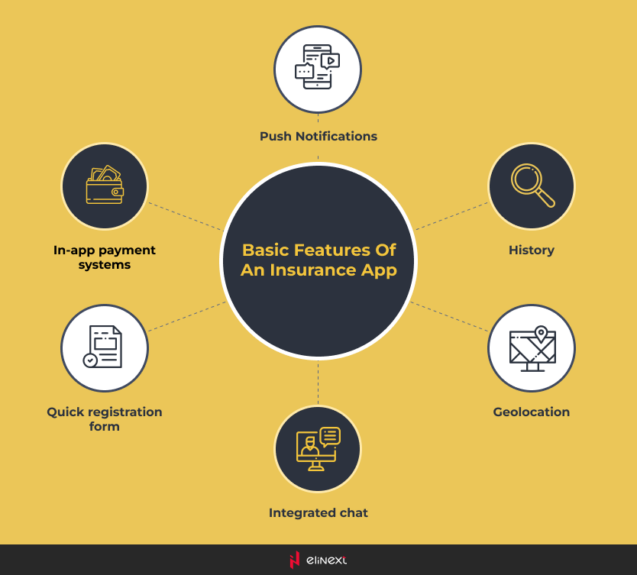

Best Features of an Insurance Mobile Applications

-

MVP Features

Insurance mobile app development MVPs include policy management, digital claims processing, document uploads, and live chat support. Users can view policy information, submit claims with photos, and get instant help. Push notifications remind them about renewals. These core features provide ease of use and quick time to market, allowing insurers to gather feedback and iterate.

-

Income Generating Features

Users can expand their insurance coverage or purchase additional services directly from within the app. Insurance app integration adds revenue-generating features such as in-app policy renewals, cross-selling, and referral programs. Payment gateway integrations enable instant transactions, and referral bonuses encourage users to invite friends, increasing revenue and customer acquisition.

-

Security Features

Apps use fingerprints or facial recognition for access, encrypt sensitive data, and comply with regulations such as GDPR. Real-time fraud detection and secure document uploads protect users, building trust and ensuring compliance with industry standards. App development for insurance prioritizes security with biometric login, data encryption, and secure cloud storage.

“Insurance mobile and web apps transform slow, paper-heavy processes into real-time ones: FNOL in minutes, automated claims routing, and self-service policy changes. With secure cloud, analytics, IoT, and telematics, insurers reduce costs, reduce fraud, and personalize pricing, improving CX and compliance.”

Elinext Web Developer

How Insurance Software Development Services by Elinext Help the Industry

Insurtech software development services enable the creation of specialized insurance applications with advanced features such as AI-powered claims processing, chatbots, and seamless integration. Elinext solutions automate claims processing, reduce paperwork, and enable policy renewals in real-time. The company’s applications support multi-platform access, secure data processing, and analytics dashboards, helping insurers improve efficiency, customer satisfaction, and compliance in a competitive marketplace.

Conclusion

Insurance app development is revolutionizing the industry by making services faster, more accessible, and more customer-centric. In 2025, over 70% of policyholders used digital channels, resulting in a 30% increase in customer retention and a 40% acceleration in claims processing. Insurance mobile app development enables instant policy management, digital claims processing, and real-time support.

Integrated apps allow users to renew policies, upload documents, and communicate with agents from anywhere. Analytics show that insurers implementing these solutions reduce operating costs and improve customer satisfaction. Advanced features such as AI-powered claims processing, telemedicine, and secure payments further enhance the value of services. As digital technologies evolve, insurance app integration is becoming essential to remain competitive, meet customer expectations, and drive business growth.

FAQ

How does app development benefit insurance companies?

Insurance mobile app development improves efficiency and customer retention. Apps allow instant claims, policy renewals, and real-time support, reducing paperwork and operational costs, and increasing customer satisfaction and loyalty.

How do insurance apps improve customer experience?

Users can instantly submit claims, upload documents, and communicate with agents, making insurance services more convenient, transparent, and accessible for customers. Insurance app integration streamlines claims, renewals, and support.

How do mobile and web platforms impact customer retention?

Policyholders who use mobile apps are 30% more likely to renew their contracts due to convenience and proactive engagement features. App development for insurance increases customer retention by offering 24/7 access, instant claims processing, and personalized notifications.

What are the business benefits for insurers?

Digital applications and policy renewals reduce paperwork, while in-app cross-selling and push notifications increase revenue and customer engagement for insurers. Insurance mobile app development reduces costs, increases sales, and improves customer loyalty.

Can insurance apps integrate with existing insurance systems?

Yes, insurance app integration connects new apps with legacy systems. Insurers can sync policy, claims, and payment data across platforms, ensuring a seamless experience and consistent customer experience without disrupting existing workflows.

Related Cases: A Showcase of Diverse Web Solutions

Outstaffing for Web App Development for a Top-Notch Insurance Company

Web Design for a Healthcare Company

Web Application for Seamless Subtitle Management

Web Application Development for a Swiss Interior Design Studio

Web Application for ICO Investments and Management

Masternodes Investment Web Platform

Web App for IoT Devices Monitoring

Web App Development for Remote Orders Making

Text-to-Speech Web Application

Web Solution for Mental Health Clinics