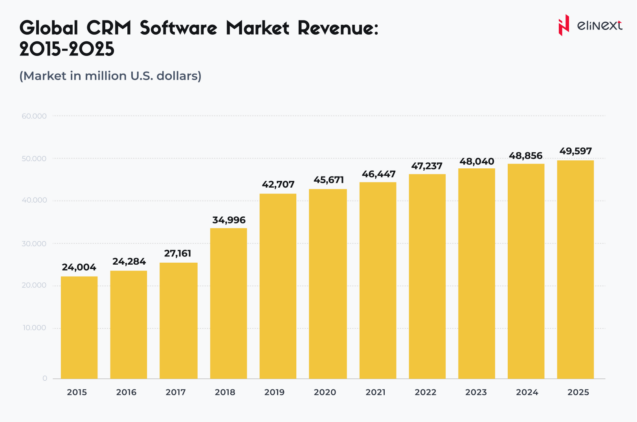

By 2025, creating a specialized CRM system for insurance agents using CRM software development services will become a strategic move. The insurance agency CRM market is projected to reach $6.2 billion, with 77% of insurers investing in digital transformation. To build a custom CRM for insurance agencies, it is necessary to define workflows (policies, claims, policy renewals), integrate it with an AMS, and automate tasks. A mid-sized agency using a specialized CRM system achieved a 39% increase in productivity and a 60% increase in sales, achieving a return on investment in less than 12 months.

Key Takeaways

- How to build custom CRM for insurance agents: 77% of insurers are investing in digital transformation, but age discrimination in the IT industry can slow down implementation if experienced employees are overlooked. Empower multigenerational teams to develop, train, and promote the new CRM system.

- Only 15% of tech companies actively hire employees over 50, risking losing valuable insurance experience.

- Combating ageism provides CRM projects with both innovation and institutional expertise.

What is Insurance CRM Software?

Custom CRM for insurance agents, created using insurance CRM software development services, centralizes data on clients, policies, and claims. It automates renewals, tracks leads, and monitors compliance. Agents use dashboards to view policy status, automate reminders, and generate reports, optimizing sales and service.

Build a custom CRM for insurance agencies to automate manual work, increase sales, and provide superior customer service.

Invest now to ensure your agency is future-ready and ahead of the competition.

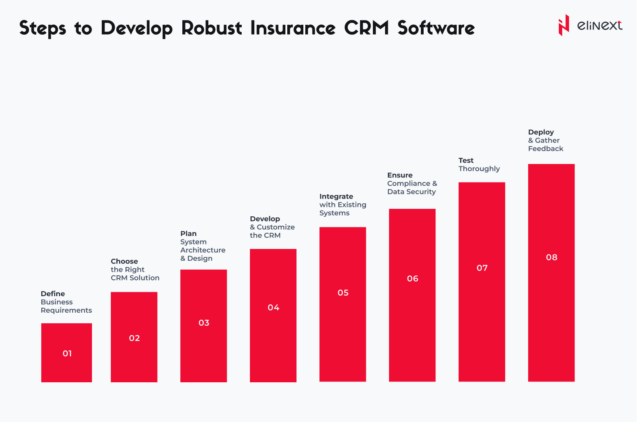

A Structured Guide of Custom CRM Development for Insurance

-

Define Business Requirements

Start by gathering information from agents, underwriters, and claims adjusters to identify necessary features, such as policy tracking and claims management. An insurance agency may require automated renewal reminders and customizable reporting to streamline workflows and improve customer service.

-

Choose the Right CRM Solution

Evaluate CRM platforms based on your requirements checklist, paying particular attention to insurance-specific features, such as compliance tracking and claims automation. Choose a CRM system that integrates with your policy management system and supports insurance company regulatory requirements.

-

Plan System Architecture & Design

Develop a scalable architecture that supports integration with existing tools and future growth. Use modular components for policy management, claims management, and customer engagement so your CRM system can adapt as your agency expands or regulatory requirements change.

-

Develop & Customize the CRM

Work with developers to create and customize your CRM system to your workflows. Set up dashboards for agents to view client portfolios, automate document creation, and customize claims workflows to align the system with your unique insurance processes.

-

Integrate with Existing Systems

Link your CRM to policy administration, billing, and document management systems. Integration with your claims platform allows agents to access all client data in one place, reducing manual entry and improving agency efficiency.

-

Ensure Compliance and Data Security

Implement robust security measures and compliance tools, such as encrypted document storage and audit trails. Ensure your CRM complies with insurance regulations like GDPR or HIPAA, protecting sensitive customer data and supporting regulatory audits.

-

Test Thoroughly

Conduct comprehensive testing, including user experience and security testing. Simulate real-world insurance scenarios, such as filing a claim or creating a policy, to ensure your CRM is robust and meets all business requirements before launch.

-

Deploy and Gather Feedback

Deploy your CRM system in phases and collect user feedback. After deployment, agents may suggest improvements to the claims process or request additional reporting features, allowing you to optimize the system for maximum efficiency and customer satisfaction.

Invest in a CRM system for insurance companies to streamline operations, improve compliance, and enhance customer relationships—key factors for competitiveness in today’s insurance market.

Basic Features to Develop CRM Software for Insurance Businesses

-

Policy Management

How to build custom CRM for insurance agents? Enable policy lifecycle tracking—agents can view, renew, and update policies in one place, reducing errors and improving compliance.

-

Workflow Automation

Custom CRM for insurance agents automates renewals, claims processing, and follow-up. Automatic reminders reduce missed renewals by 50%, freeing agents to focus on more important tasks.

-

Case Management

Build a custom CRM for insurance agencies with integrated case management—track claims, support tickets, and escalations, ensuring timely resolution and improving customer satisfaction.

-

Document Management

How to build custom CRM for insurance agents? Ensure secure upload, electronic signature, and search of policy documents, reducing paperwork and speeding up the approval process.

-

Contact Management

Build a custom CRM for insurance agencies to centralize client information, conversation logs, and policy history, ensuring personalized service and faster response times.

-

Reporting and Analytics

Custom CRM for insurance agents provides dashboards for tracking key performance indicators for sales, client retention, and claims settlements. Real-time analytics helps agencies identify trends and optimize performance.

“Custom CRM for insurance agents transforms agencies by automating workflows, centralizing data, and enabling data-driven decision making. The right CRM system improves productivity, compliance, and customer satisfaction, delivering measurable ROI in today’s digital insurance landscape.”

Elinext software development expert

Key Advantages of Custom CRM Solutions for Insurance Companies

Custom software development services help build a custom CRM for insurance agencies that automates manual tasks, integrates with AMS, and ensures compliance. Agencies using a custom CRM system report a 50% reduction in manual data entry, a 39% increase in sales productivity, and improved customer retention. Full integration with pricing, e-signature, and marketing tools streamlines operations and facilitates scalable growth.

- Superior visibility

- Enhanced efficiency

- Increased profits

- Improved customer experience

Conclusion

Insurance software development company and ERP software development services enable custom CRM for insurance agents that deliver rapid ROI. By 2025, agencies using customized CRM systems will see a 39% increase in productivity, a 60% increase in sales, and a 15% increase in customer retention. Using AI, automation, and analytics, agencies achieve a positive ROI within 12 months and a net present value (NPV) of up to $37 million over five years. Customized CRM systems are essential today for compliance, efficiency, and sustainable growth.

FAQ

How is an insurance CRM different from general-use CRMs?

How to build custom CRM for insurance agents? Insurance CRM systems offer built-in tools for managing insurance policies, claims, and compliance, while general CRM systems require significant customization. Insurance CRM systems natively integrate with AMS and pricing systems, streamlining an insurance company’s workflows.

How do we choose the right CRM for an insurance company?

Custom CRM for insurance agents should align with the agency’s workflows, support integration with AMS, and offer automation. Consider CRM software development services for insurance agents that provide policy management, compliance, and analytics tailored to the needs of the insurance company.

How can a CRM improve insurance business?

How to build custom CRM for insurance agents? Automate policy renewals, centralize data, and personalize service. Agencies using CRM report a 39% increase in productivity and a 15% improvement in customer retention, which drives growth and increases customer satisfaction.

What tools can insurance CRMs be integrated with?

Build a custom CRM for insurance agencies that integrates with AMS, quote generation, e-signature, accounting, and marketing tools. Connect your CRM to AMS360, DocuSign, and Mailchimp to ensure seamless workflows and unified data.

Why do insurance companies need a CRM solution?

Custom CRM for insurance agents centralizes client data, automates tasks, and ensures compliance. Agencies using CRM reduce manual work by 50% and increase client retention, remaining competitive in the digital market.

What’s the difference between CRM & AMS?

Build a custom CRM for insurance agencies that will enable them to focus on sales, marketing, and client interactions. An AMS manages policies, billing, and insurance company data. A CRM focuses on relationships, while an AMS is responsible for back-office insurance operations.