Our blog contains dozens of articles about healthcare innovations. The topics vary vastly:

we try to cover a little bit of everything: from Medical VR applications and future to top IT healthcare conferences announcements (some of which turned out as not-to-be ones) to… well, virtual care observations on the markets we cover.

Some might ask, why would you turn back to the topic of Virtual Healthcare if you’ve written about it intensively at the beginning of the year. The main reason is that this market, like many others, has experienced a massive shift due to COVID-19.

No matter how ‘emerging’ the virtual health trend seemed for the past decade or two, adoption of it hasn’t been massive. Now, the shift towards health system investment in virtual health apps is undeniable.

In this blog post, we’ll explore the new horizon of telehealth and virtual health, and describe the difference between the two trends (to avoid confusion).

We’d also explore the forecasts of the leading consultants’ firms (such as McKinsey’and PwC) reports and takeaways them on virtual health, and try to figure the full potential on the trend in the modern healthcare tech world.

How Is Virtual Healthcare Different from Telehealth?

Virtual healthcare (aka remote patient management) is closely interlinked with telehealth, or telemedicine, but not interchangeable.

Virtual care is a broader term that defines the wholesome of remote tech-driven healthcare

Marcus Grindstaff, COO of Care Innovations, describes the entirety of terms for different distance healthcare operations in the following manner:

“Telehealth is a very broad category of solutions that service patients at a distance — so it could be doctor visits at a distance, it could be chronic condition management, it could be managing high-risk pregnancy. But doing that at a distance, doing it remotely.”

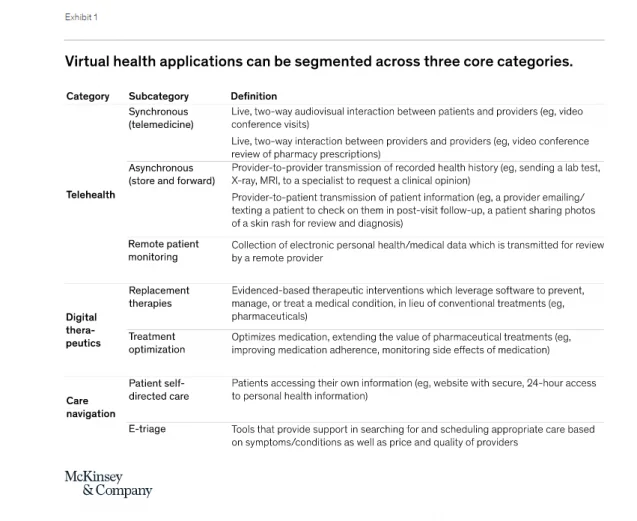

According to McKinsey’s report, the definitions in the area are the following:

Source: mckinskey.com

That the terms are so often confused indicates how integral virtual healthcare is to telehealth delivery. Either way, demand is growing for a means to avoid the expense, burden and time spent traveling to and from clinics or doctor’s offices. And in rural areas struggling to attract physicians and practitioners at all, eliminating the need for transportation isn’t just a matter of convenience but also of basic access — especially for those unable to drive.

It’s also worth noting that patient demand for virtual healthcare tends to transfer to satisfaction after implementation. Writing in the Harvard Business Review, Dr. Adam Licurse describes how a virtual visit pilot program at Brigham and Women’s Hospital yielded a 97% satisfaction rate among patients, with 74% stating “that the interaction actually improved their relationship with their provider.”

“We were encouraged to find that 87% of patients said they would have needed to come into the office to see a provider face to face if it weren’t for their virtual visit,” adds Dr. Licurse, who serves as the hospital’s Medical Director for Telehealth.

Source: pwc.com

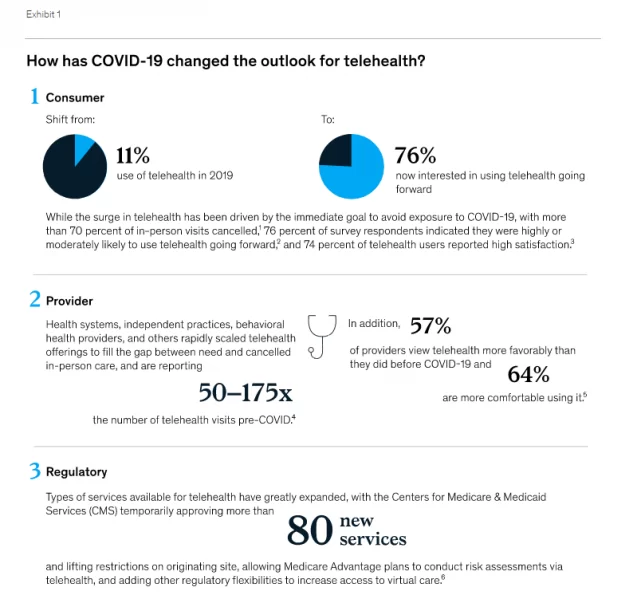

Many of these dynamics are likely to be in place for at least the next 12 to 18 months, as concerns about COVID-19 remain until a vaccine is widely available. During this period, consumers’ preferences for care access will continue to evolve, and virtual health could become more deeply embedded in the care delivery system.

However, challenges remain. Our research indicates providers’ concerns about telehealth include security, workflow integration, effectiveness compared with in-person visits, and the future for reimbursement. Similarly, there is a gap between consumers’ interest in telehealth (76 percent) and actual usage (46 percent). Factors such as lack of awareness of telehealth offerings, education on types of care needs that could be met virtually, and understanding of insurance coverage are some of the drivers of this gap.

What is the full potential for telehealth and virtual care?

We identified five models for virtual or virtually enabled non-acute care and analyzed the full potential of healthcare volume and spend that could be delivered this way. These models of virtual care have increasing requirements to engage broader and broader portions of the healthcare delivery system, going from offering one-off urgent visits, to building omnichannel care models that deliver a large portion of office visits virtually or near virtually, to embedding virtual services in-home care models. They include:

On-demand virtual urgent care as an alternative to lower acuity emergency department (ED) visits, urgent care visits, and after-hours consultations. These care needs are the most common telehealth use cases today among payers. This allows a consumer to remotely consult on-demand with an unknown provider to address immediate concerns (such as acute sinusitis) and avoid a trip to the ED or an urgent care center. Such usage could be further scaled to address a larger portion of low acuity visits previously seen in EDs.

Virtual office visits with an established provider for consults that do not require physical exams or concurrent procedures. Such visits can be primary care (such as chronic condition checks, colds, minor skin conditions), behavioral health (such as virtual psychotherapy sessions), and some specialty care (select follow-up visits such as virtual cardiac rehabilitation). An omnichannel care model that fully leverages virtual visits includes a mix of telehealth and in-person care with a consistent set of providers, improving patient convenience, access, and continuity of care. This model also enables clinicians to better manage patients with chronic conditions, with the support of remote patient monitoring, digital therapeutics, and digital coaching, in addition to virtual visits.

Near-virtual office visits extend the opportunity for patients to conveniently access care outside a provider’s office, by combining virtual access to physician consults with “near home” sites for testing and immunizations, such as worksite clinics or retail clinics. For example, a virtual visit of a patient with flu or COVID-like symptoms could be followed up by a trip to a nearby retail clinic for the flu or COVID-19 test, with a subsequent follow-up virtual check-in with the primary care physician to consult on follow-on care.

Virtual home health services leverage virtual visits, remote monitoring, and digital patient engagement tools to enable some of these services to be delivered remotely, such as a portion of an evaluation, patient and caregiver education, physical therapy, occupational therapy, and speech therapy. Direct services, such as wound care and assistance with daily living routines, would still occur in person, but virtual home health services could enhance the patient’s and caregiver’s experience, extend the reach of home health providers, and improve connectivity with the broader care team. For example, a physical therapist could conduct virtual sessions with elderly patients at their home to improve their strength, balance, and endurance, and to advise them on how to avoid physical hazards to reduce the risk of falls.

Tech-enabled home medication administration allows patients to shift receiving some infusible and injectable drugs from the clinic to the home. This shift can happen by leveraging remote monitoring to help manage patients and monitor symptoms, providing self-service tools for patient education (for example, training for self-administration), and providing telehealth oversight of staff (for example, an oncologist overseeing a nurse delivering chemotherapy to a patient at home and monitoring for side effects). This would be coupled with home delivery of the therapeutics

Action Plan for Entrepreneurs in the Virtual Care Industry

What actions should healthcare stakeholders take in the near term to shape this opportunity?

Actions payers could consider:

Define a value-backed virtual health roadmap, taking a data-driven view to prioritize interventions that will improve outcomes for priority populations, and develop strategies to digitally enable end-to-care care journeys.

Optimize provider networks and accelerate value-based contracting to incentivize telehealth.

Define approaches (beyond the immediate COVID-19 response measures) to reimbursement and covered services, embed in contracting, and optimize networks and value-based models to include virtual health. Align incentives for using telehealth, particularly for chronic patients, with the shift to risk-based payment models.

Build virtual health into new product designs to meet changing consumer preferences and demand for lower-cost plans. This new design may include virtual-first networks, digital front-door features (for example, e-triage), seamless “plug and play” capabilities to offer innovative digital solutions, and benefit coverage for at-home diagnostic kits.

Integrate virtual health into the care delivery approach. Given the significant disruptions to providers, payers are reassessing their role in care delivery—from ownership of care delivery assets, value-based contracting, or anything in between. Consider options in virtual health (for example, platforms, digital-first providers) as a critical element of this approach.

Reinforce the technology and analytics foundation that will be required to achieve the full potential of virtual health.

Actions health systems could consider:

Accelerate development of an overall consumer-integrated “front door.” Consider what the integrated product will initially cover beyond what currently exists and integrate with what may have been put in place in response to COVID-19 (for example, e-triage, scheduling, clinic visits, record access).

Segment the patient populations (for example, with specific chronic disease) and specialties whose remote interactions could be scaled with home-based diagnostics and equipment.

Build the capabilities and incentives of the provider workforce to support virtual care (for example, workflow design, centralized scheduling, and continuing education); align benefit structure to drive adoption in line with the health system and/or physician practice economics.

Measure the value of virtual care by quantifying clinical outcomes, access improvement, and patient/provider satisfaction to drive advocacy and contracting for continued expanded coverage. Include the potential value from telehealth when contracting with payers for risk models to manage chronic patients.

Consider strategies and rationale to go beyond “telehealth”/clinic visit replacement to drive growth in new markets and populations and scale other applications (for example, teleICU, post-acute care integration).

Actions Investors, Health Services and Technology Firms Should Consider

Here is the list of actions healthcare-related companies and their investor should mind while dealing with business.

Develop scenarios on how virtual health will evolve and when, including how usage evolved post-COVID-19, based on expected consumer preferences, reimbursement, CMS, and other regulations.

Assess impact across virtual health solution/service types, developing a view of the opportunity for each solution/service type, including expected consumer/provider adoption, impact (for example, to outcomes, experience, affordability), and reimbursement.

Develop potential options and define investment strategies based on the expected virtual health future (for example, combinations of existing players/platforms, linkages between in-person and virtual care offerings), and create sustainable value.

Identify the assets and capabilities to implement these options, including specific assets or capabilities to best enable the play, and business models that will deliver attractive returns.

Execute, execute, execute. The next normal will rapidly take hold, and those that can best anticipate its impact will create disproportionate value. Don’t underestimate the potential of network effects.