Healthcare payments are finally catching up with how people actually live. By 2026, paying for care won’t feel like navigating a maze of bills, portals, and phone calls. Instead, finance teams are rethinking cash flow, risk, and trust, while tech quietly removes friction. From real-time payments to smarter patient billing, the shift is practical and not flashy at all.

So, here are the biggest healthcare payments trends that are sure to stick around long after 2026.

Key Takeaways

- 70% of health plans say recent trends exceeded expectations.

- $50 billion was added to pharmacy spending in 2024, more than double 2023’s growth.

- 45% increase in behavioral health claims from early 2023 to late 2024.

- 75% of health plans rank the total cost of care as a top cost pressure.

Key Healthcare Payments Trends for 2026

Healthcare payments won’t sit quietly in the back office anymore. Rising costs, patient expectations, and tighter oversight are pushing payments into the spotlight. The healthcare payments trends below show how money, technology, and care delivery are starting to move in sync.

Digital Transformation and Automation

Healthcare payments are finally leaving the manual era behind. Claims processing, eligibility checks, and reconciliation are moving onto automated, data-driven platforms – with fewer errors, faster turnaround, and predictable cash flow. As volumes grow and margins shrink, automation gives finance teams breathing room. Also, this shift reduces dependency on fragmented vendors and one-off tools. In 2026, the most efficient organizations won’t work harder; they’ll work smarter.

Shift from Legacy Processes toward Consumer-friendly Payment Experiences

Patients don’t separate healthcare from the rest of their financial life, and they don’t want to. Confusing bills, delayed statements, and limited payment options are replaced by clear pricing, digital-first experiences, and flexible payment, like biometric payment solutions. When the process feels fair and familiar, collections improve without aggressive follow-ups. These changes reduce bad debt and cut call center noise, and, what’s more importantly, signal respect for the patient in a crowded market.

Accelerated Adoption of “Value-based Care” (VBC) and Payment Transparency

Value-based care is among the “hot” trends in healthcare payments. As reimbursement ties more closely to outcomes, accuracy and transparency matter more than ever. Providers need clean data, clear contract logic, and timely settlement to manage risk. Patients, in turn, want to know what they’ll pay before care begins. When payments reflect value, explaining it clearly, they support better decisions, lower friction, and stronger trust across the system.

Increased Regulatory Focus on Payment Accuracy, Fraud, and Waste Reduction

Oversight around healthcare payments is tightening. Regulators are zeroing in on billing accuracy, duplicate payments, and fraud patterns that violently drain the system. This is driving a considerable amount of investment in analytics, controls, and continuous monitoring. Getting ahead of these requirements protects revenue and avoids painful audits. In 2026, strong payment governance won’t slow organizations down. On the contrary, it will keep them out of trouble and in control over the long run.

Quote

“Healthcare payments used to be treated like plumbing: important, but invisible. Today, keeping up with trends in healthcare payments means bigger margins and better care decisions. If your payment systems are confusing or slow, people notice. All smart organizations are trying to fix issues before they show up in their bottom line. And mark my word, Elinext helps these smart organizations once they approach us.” – Victoria Yaskevich, Expert in Healthcare Software Development

How will Medicare and CMS payments change in 2026?

Medicare and CMS payments are likely to become more structured, more data-driven, and, what’s important, less forgiving. Value-based programs will continue to expand, tying a larger share of reimbursement to outcomes, cost controls, and patient experience. CMS is also signaling tighter payment validation, with fewer post-payment adjustments and faster reporting requirements. The outcomes? Some more pressure on providers to get claims right the first

time. We don’t know if current systems and teams are ready for that shift, or if payment risk will become an even bigger problem.

Elinext Payments Solutions: Secure, Compliant, and Efficient Healthcare Billing

Elinext knows how messy healthcare payments can get. With a strong background in custom healthcare software solutions, Elunext’s specialists build billing and payment solutions that are secure, compliant, and built to scale. The focus isn’t on blindly following trends in healthcare payments, but on systems that handle sensitive data, reduce risk, and make everyday payment workflows run smoother.

The real cost of payments isn’t always on the balance sheet. It’s in the process.

The Future Trends in Healthcare Payments

Many healthcare organizations today deal with delayed payments, confusing patient bills, and constant rework that quietly drains time, trust, and margins. But the current trend seems to be optimistic, as healthcare payments will definitely look easier. Behind the scenes, they will operate with far more discipline.

Payments move closer to real-time

Faster data exchange and automation shrink delays, rework, and retroactive fixes. The emphasis shifts from correcting errors after the fact to stopping them before money moves.

Value-based models take a larger share of reimbursement

A growing portion of payments will flow through outcome-driven contracts, forcing providers to manage cost, quality, and performance as a single equation.

Transparency becomes non-negotiable

Clear pricing, traceable payment logic, and audit-ready processes will be expected by regulators, payers, and patients alike.

Conclusion

Healthcare payments are entering a defining moment. Rising costs, consumer expectations, and tighter oversight are forcing long-overdue change. Automation, patient-friendly billing, value-based models, and tighter controls are no longer optional – they’re table stakes. By 2026, payment strategy will quietly separate leaders from laggards. The good news? Organizations that act right now can turn trends in healthcare payments into a real edge that solidifies trust.

FAQ

Why is value-based care becoming more important in 2026?

Because costs keep rising while budgets tighten. Value-based care ties payment to outcomes, pushing providers and payers to manage quality and total cost together instead of chasing volume.

How is technology reshaping healthcare payments in 2026?

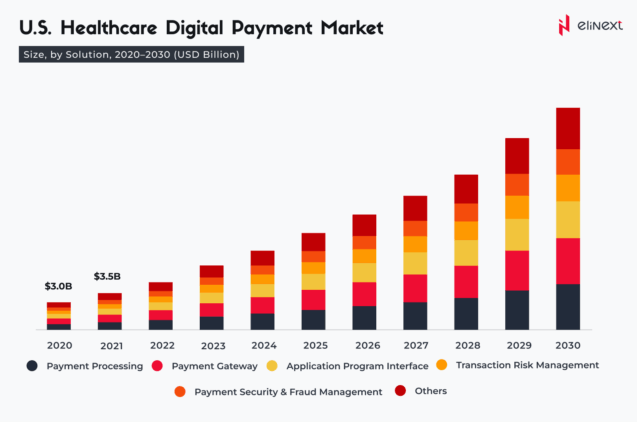

Payments are becoming faster and cleaner. Automation, APIs, analytics, and other payment processing software development services reduce manual work, catch errors early, and give finance teams better visibility into cash flow.

How will patient financial responsibilities change in 2026?

Patients will definitely carry more financial responsibility, but with clearer expectations. Upfront estimates, flexible payment options, and simpler bills make costs easier to understand and plan for.

Will consumers expect more transparency in healthcare payments?

Yes. Patients increasingly expect to know what they owe and why. Transparency is shifting from a “nice to have” to a baseline expectation.

What role will automation and AI play in revenue cycle management?

Automation and AI help prevent denials, reduce rework, and speed up collections. Elinext, as an AI software development company, already adopts AI and automation in digital payment solutions.

How will private insurers respond to 2026 payment trends?

Private insurers will mirror CMS moves, expanding value-based models and tightening payment controls. Expect more data sharing, stricter validation, and fewer manual adjustments, besides trends in healthcare payments.

What should providers do to prepare for these 2026 trends?

Providers should modernize payment systems, clean up data, and align clinical and finance teams. Preparing early reduces risk and protects margins as rules and models evolve.