April 28, 2021

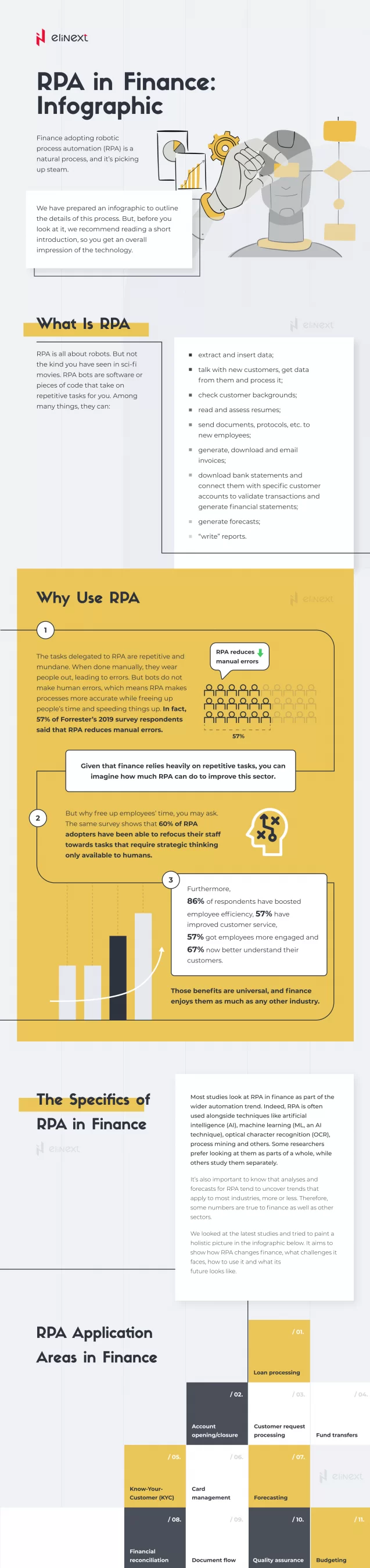

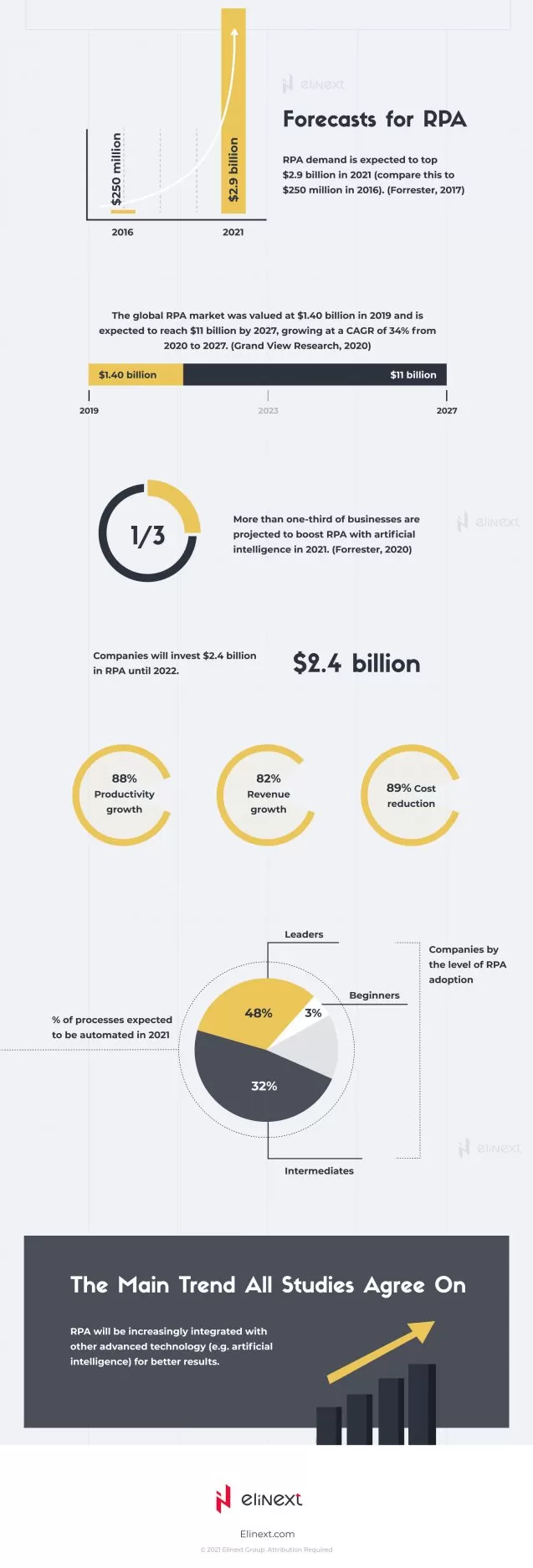

Just like any other niche connected to the B2B and B2C services, fintech is experiencing constant change and digitization. Smooth transformation is challenged by a higher security demand, high bureaucracy level, and nonhomogeneous environment. Here, robotic process automation is one of the key upgrade tools. Find out how RPA is used in fintech, what are the processes it can automate, and what are the main challenges in our new ultimate infographic on the RPA in finance:

Share