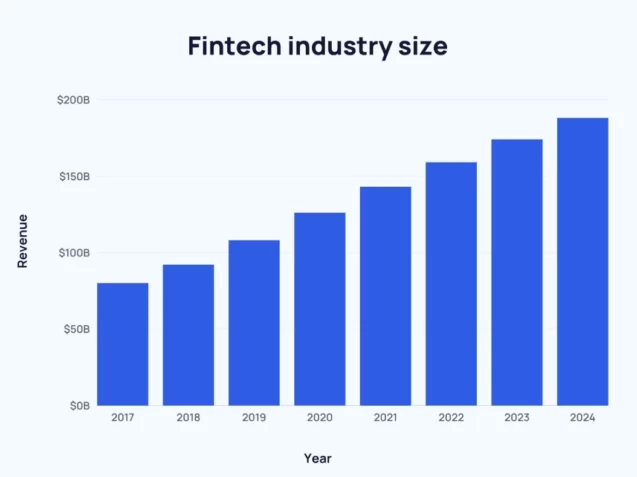

For some time now, fintech provides innovative and convenient ways for individuals and businesses to manage their finances. It’s a rapidly growing industry that attracts thousands of new fintech apps every year, combining software and finance in a way that is beneficial to users worldwide. According to Deloitte, since 2017, global fintech industry revenue has nearly doubled.

But don’t let these numbers fool you. Developing a successful fintech app is difficult, risky, and mistakes can be costly. Often, fintech apps fail before getting a chance to make our lives easier. The reasons are multiple, including underfunding, app development mistakes, marketing mistakes, security measures, complicated regulations, and fierce, and I mean fierce competition.

In this article, we’ll focus on mistakes that are often made during fintech app development. Of course, this won’t be the full list of such mistakes, as there is no such thing as a full list of mistakes. These are the most common ones and the ones that deserve your attention the most.

-

Not knowing your target audience

Not understanding your target audience is a crucial mistake for any app. However, for fintech, this one can be a deal breaker. Most likely, you’ll be focusing on one feature instead of making an all-in-one fintech software that manages all financial problems or challenges. Knowing which feature to make is what makes or breaks your app and requires serious market research.

For example, a popular fintech app that solves one big problem is Acorns. Acorns rounds up users’ purchases to the nearest dollar and invests the difference in a diversified portfolio of exchange-traded funds (ETFs) with the so-called “Round-Ups” feature. This allows users to invest spare change automatically and seamlessly, without having to think about it or make manual transfers.

This feature is what they discovered their target audience needs, what created their unique value, and what made the app so widely used and appreciated.

-

Bad user onboarding

User onboarding is the process of introducing new users to your app and its features. A common mistake in fintech app development is overwhelming users with too much information or complex features during onboarding. User onboarding is indeed a complex dilemma. On one hand, you can’t make it short, as the user might not understand the process straight away and abandon the app in frustration. On the other hand, long and detailed onboarding tends to confuse and bore new users, leading to the same result. As a rule of thumb, the more complicated the features, the longer the onboarding.

To create a smooth onboarding process, developers can use progressive profiling, guided tours, or video tutorials to gradually introduce users to the app’s features. It’s also important to make onboarding at least slightly entertaining, investing in design and copywriting that keeps the user’s attention.

-

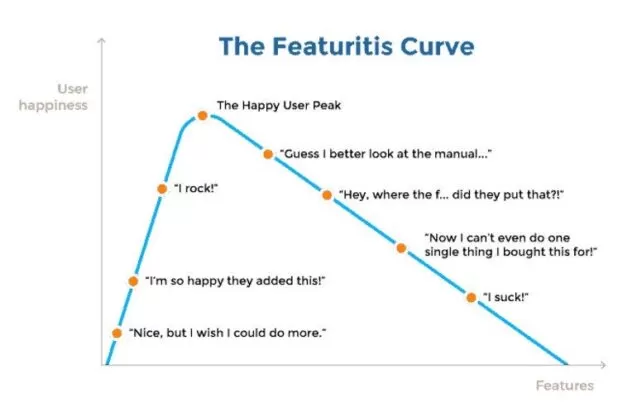

Too many features

We’ve brushed on that before, but cramming as many features as possible into a fintech app is a very common mistake. Developers often feel like this will make them take over the market; instead, it leaves users confused and distracted due to a more complicated UI.

Besides, as it is impossible to make all features equally well, the team often distributes their effort ineffectively, and you end up having multiple mediocre or even badly working features instead of one stellar feature. Prioritizing features based on user needs, business goals, and technical feasibility is essential to balancing simplicity and functionality.

-

Poor UX

Talking about UI/UX, user experience (UX) is absolutely critical in fintech app development. Cluttered interfaces, confusing navigation, or slow loading times can drive users away from an app and can also drive them crazy, as fintech deals with an important matter ― money.

Education and transparency are also vital components of an excellent UX that are often overlooked. If you’re working with something as important and sensitive as finances, you have to use simple language and explain important concepts. At the same time, your UX should include some friction during key transactions so that the user must think twice before transferring their funds.

For inspiration, fintech app developers can turn to the personal finance management app Mint. Mint offers users a clear and intuitive interface that allows them to view all of their financial accounts in one place. The app also provides educational resources on various financial topics, such as credit scores, investing, and budgeting, making sure their users get financial education that most of us failed to get throughout our lifetime.

-

Poor security practices

Security is a top priority for fintech apps that handle sensitive user data and financial transactions. One hack would destroy a fintech app, no matter its reputation beforehand. It’s vital that fintech app developers incorporate strict protocols, use high-end encrypted codes that protect sensitive pieces of information, and multiple layers of user authentication and authorization.

However, it’s not enough to focus on just the app. The whole ecosystem you use should be taken care of. That includes your network infrastructure, databases, and web servers, as well as third-party platforms and APIs that your app uses. Insecure communication between any of these points can lead to hacks.

There is also no such thing as “done” cybersecurity. This part requires constant monitoring, testing, updating, and implementation of the latest security practices.

-

Inadequate data cleansing

Data is the backbone of fintech applications, and it is imperative to ensure that the data used is accurate and consistent. Inaccurate or inconsistent data can result in a loss of credibility for the fintech app and result in loss of users. Data cleansing is the process of identifying and correcting inaccurate or inconsistent data.

Developers often make the mistake of using outdated or incomplete data, ignoring duplicates or inconsistencies, or failing to validate inputs. The whole process is time-consuming, although has been recently made easier with the help of AI. But there is no way around it: to ensure that the data used in the fintech app is accurate and consistent, developers must perform data cleansing regularly.

-

Insufficient app testing

As with most apps, testing is crucial for fintech apps to ensure that they function properly and meet user needs at every step. Developers often make the mistake of inadequate testing coverage, failing to test for edge cases or stress tests, or neglecting to test on different devices and platforms.

To perform comprehensive app testing, developers can use automated testing tools, conduct manual testing, and perform user acceptance testing. Automated testing tools can be used to perform unit testing, functional testing, and regression testing. Manual testing is essential for testing the user interface and ensuring that the app is easy to use. User acceptance testing can help in identifying issues that users may face while using the app.

App testing should be performed regularly, especially when new features are added or changes are made to the app. Regular app testing can help in identifying issues early on, reducing the cost of fixing them.

-

Not having active monitoring

Active monitoring is crucial for fintech apps to detect and respond to issues quickly and efficiently. Developers often make the mistake of relying on passive monitoring, neglecting to monitor key metrics or events, or failing to act on alerts or notifications.

Active monitoring involves setting up real-time dashboards, alerts, and notifications to detect issues early on. Key metrics, such as app performance, user engagement, and transaction volume, should be monitored regularly to identify any anomalies.

Developers should also conduct regular reviews and audits to identify issues that may not be apparent in real-time monitoring. Regular reviews can help in identifying areas for improvement and reducing the risk of issues.

Conclusion

Fintech app development is a complex process that requires attention to detail and a thorough understanding of user needs, technical feasibility, and regulatory compliance. Perhaps, even more so compared to many other types of apps. By avoiding the common mistakes discussed above, fintech developers can create apps that are user-friendly, secure, and reliable, enhancing their credibility and reliability.

At Elinext, we take pride in our ability to make mistake-free fintech apps. You can check out some of our fintech case studies and contact us directly to learn more.