As banks were forced to close their doors, the COVID-19 pandemic gave birth to major financial challenges among end-users and businesses alike. As the entrepreneurial ecosystem saw itself forced to open up to digitalization and the new online business model was gaining a strong foothold, more and more FinTechs have made it their priority to power businesses with innovative digital solutions designed to help them navigate the stormy COVID-19 landscape. The pandemic restrictions forced restaurants to reinvent themselves and turn FinTech solutions into one of their most valuable allies, especially as home-delivery, pick-up, or drive-through services and the emerging type of digital customers disrupted the traditional business model.

The COVID-19 era: the era of connected customers

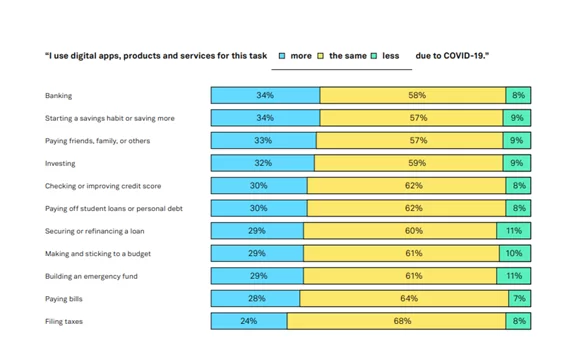

According to a survey conducted by Plaid in 2020, the respondents use FinTech solutions for a wide variety of tasks:

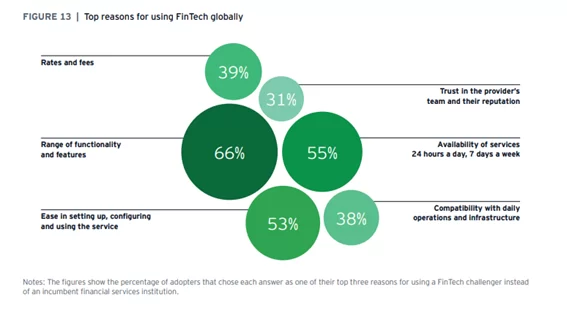

The compiled data clearly demonstrates that FinTech solutions are smoking hot among customers, forcing businesses to consider them a competitive must-have tool rather than a merely ‘desirable appendix’. According to EY, in 2019, the global adoption rate among SMEs was already 25%, with China displaying the highest FinTech adoption rate (61%) and followed by the U.S. (23%). Here are the main reasons:

Under this new entrepreneurial reality, SMEs need to become digitally active and competitive to address this new type of consumer and optimize processes such as banking, payments, financing, or financial management across their businesses.

Are restaurant businesses ready for the new type of connected customer?

Apart from meeting the needs and expectations of a connected type of customer who expects frictionless, customized, and intuitive services, businesses also need to adapt themselves to a proactive, digitalized business model.

After the lockdown phase, restaurants opened the doors again. However, the pandemic has forever changed the business model restaurants were based upon. In order to thrive – during the pandemic and post-pandemic era, – restaurants need to look for new strategies. Food represents only a small part of this complex equation. A restaurant’s expenses also comprise staff training, payroll, taxes, paying rent or mortgage, marketing, utilities, general maintenance, etc.

Basically, restaurants use two main types of financial management software:

- Front-of-the-house: reservations, orders, payments, customer behaviour analytics, etc.

- Back-of-the-house: inventory, supplier orders, payroll, other relevant analytics, etc.

These two dimensions are interdependent and it is where business is actually generated. Let’s take a look at some of the most innovative fintech solutions that help businesses adapt to a changing restaurant industry.

POS systems

During the crisis caused by the COVID-19 pandemic, restaurants saw themselves forced to subscribe to home-delivery apps (ex. JustEat, Glovo, etc.) or sell their products via a website. Understandably, keeping operating and food costs under control and providing a smooth customer experience became a new challenge to their bottom line. Luckily, robust, agile, and complex POS systems – such as TouchBistro or Clover – were up for this unprecedented challenge, streamlining digital ordering, mobile payments, analytics, and social integration.

Thought out to provide restaurants with innovative and efficient front of the house, back of the house, and customer engagement solutions, the TouchBistro platform offers inventory management, integrated payment processing, cloud-based reporting and analytics, menu and table management, as well as an exhaustive customer service that includes videos, self-diagnostic tools, or 24/7 phone support. TouchBistro also integrates with other popular programs such as QuickBooks or Sage. In collaboration with its hardware partners, TouchBistro offers additional services such as self-serve kiosks, customer-facing displays, or kitchen display systems.

Restaurant accounting software

Even though invoicing, cost management, budgeting, or banking are not the first aspects one may think of when it comes to a restaurant, they are key components that can make the difference between success and failure. Restaurants are – above all – businesses.

Restaurant365 is one of the best accounting software solutions for restaurants, providing seamless services such as bank reconciliation, budgeting, financial reporting, fixed asset management, receivables and payables management, workflow management, or user location security. Additionally, Reastaurant365 integrates with numerous POS systems. The General Ledger allows restaurants to keep their financial health under control by streamlining accounts and automating POS data entry and payroll data collection. The AI-powered inventory module tracks ingredients in real-time, thus allowing restaurants to keep costs down.

Payroll software

Payroll is one of the most time-consuming processes business owners have to deal with. Well, unless it is automated. For instance, QuickBooks Payroll provides restaurants with automated, error-free, and easy payroll and payroll taxes services. It also integrates with QuickBooks Online.

Tip reporting software

In most countries, the tips that the restaurant’s employees earn are subject to taxes. That means that employees have to regularly report the tips to their employers. Handling a restaurant’s tips pool can be tedious and time-consuming. Unless, of course, you opt for software such as Tip Reports.

Tip Reports can be integrated with POS systems such as Toast, Aloha, or Micros and comes with a series of notable advantages:

- Payroll software-friendly and compatible with most payroll companies such as Paychex

- Eliminates errors and payroll discrepancies

- Allows restaurant owners to track their employees’ performance

- Built on a secure and robust cloud network that uses Amazon Web Service.

- Tips breakdown on a daily basis

- Available for iPhone and Android

PATT (Pay At The Table) payments

Table-top software – such as TableSafe or Ziosk – grants restaurants a competitive edge by providing customers with an exceptional experience while still guaranteeing security and fostering business growth. What this type of software does is allow customers to rapidly and comfortably complete payments without server assistance. Customers can order and pay whenever and however they want to (credit card, cash, gift card, smartphone, etc.), thus allowing staff to focus on other crucial aspects such as serving or promoting your products to new clients.

TableSafe has been designed to enhance operational efficiency leaving the payment process in the customer’s hands. To ensure security, TableSafe includes EMV (Chip & Pin) and point-to-point encryption. What’s more, TableSafe directly integrates with the existing POS. This technology provides restaurants with real-time insights into their customers’ experiences.

Cashless payment apps

We wouldn’t be too venturous to assume that traditional leather wallets are becoming obsolete. The reason is simple: mobile wallets are becoming the new norm. Mobile wallets – such as Google Wallet, Apple Pay, or Samsung Pay – are secure smartphone apps that allow users to store payment information (ex. debit cards, credit cards, coupons, loyalty cards, etc.) In-app payments allow restaurants not only to enhance customers’ food experience but it is also a great way to reach out to their customers with important announcements, special offers, discounts, etc.

Zahlin, a Swiss start-up, provides customers with a hassle-free and secure payment experience. The credit card information is not stored on Zahlin’s servers or the customer’s phone but directly by the payment processor. If you are having dinner with friends and you decide to split the bill, Zahlin makes it easy for you to do so. In case there are disputes regarding bills, Zahlin offers protection to their customers.

The COVID-19 pandemic urged restaurants to provide their customers with contactless dining experiences. Apps such as Presto use QR codes to allow customers to check the menu, place orders, and pay using their smartphones. The app offers pre-order and pay options for both takeout, dine-in, and over-the-phone orders.

The Eat Now Pay Later apps such as Payo are also gaining momentum, allowing customers to pay in 4 interest-free instalments.

Food delivery apps

In an era undermined by social distancing, consumers rarely hesitate to pay a little more for extra safety and – above all- convenience. This is why food delivery apps such as UberEats, GrubHub, or Zomato have reached new heights over the past couple of years. Customers can pay for their orders using a wide range of payment methods: cash, credit and debit cards, PayPal, Apple Pay, Google Pay, gift cards, Venmo, etc. For instance, GrubHub accepts cash, Apple Pay, PayPal, Android Pay, eGift, as well as credit cards.

Wrap up

The growing relationship between fintech and restaurants marks the dawn of a new era for customers and business owners alike. The COVID-19 pandemic did nothing but catalyse the development of digital finance solutions, allowing restaurants to adapt to the new challenges, improve the overall customer experience, and boost profits. And the positive part is that customers not only quickly adopt the emerging technologies but are also ready to be surprised even further.