Financial digital transformation services are revolutionizing the global financial industry, driven by soaring demand for AI, cloud, blockchain, and analytics-powered solutions. The BFSI (Banking, Financial Services & Insurance) finance and digital transformation market reached about USD 307.8 billion in 2024, and is expected to grow at a CAGR of 29.5 % to reach nearly USD 1.39 trillion by 2030. Embracing digital transformation in financial services is no longer optional, but essential for financial organizations to stay competitive and future-ready.

What is Digital Transformation of the Financial Industry?

Digital transformation in finance industry is the integration of advanced technologies, such as AI, cloud, blockchain, and data analytics, into banking and financial services. It improves efficiency, security, compliance, and customer experience for every party involved.

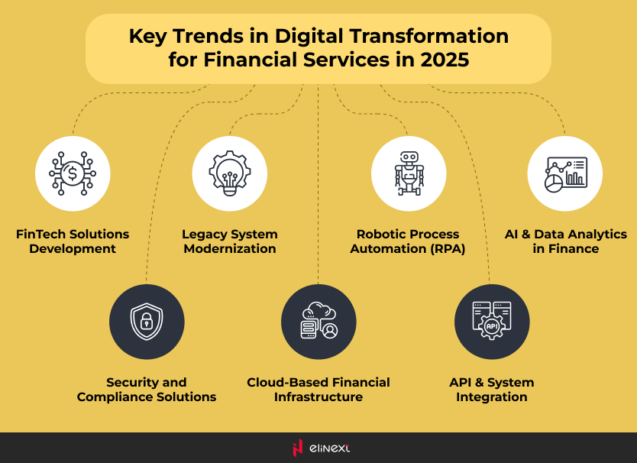

Financial Digital Transformation Services Elinext Provides

FinTech Solutions Development

Elinext builds custom FinTech solutions that enable digital transformation in financial services: digital payments, mobile banking, trading platforms, and innovative financial products. Such solutions help institutions deliver secure and customer-centric services.

Legacy System Modernization

We modernize outdated financial systems with scalable, future-proof architectures. This guarantees improved performance, regulatory compliance, and smooth migration while minimizing risks and operational disruptions.

Robotic Process Automation (RPA)

Elinext implements RPA to streamline repetitive tasks such as transaction processing, compliance checks, and reporting, enabling financial firms to reduce costs, minimize errors, and improve operational efficiency.

AI & Data Analytics in Finance

Our AI and data analytics solutions empower financial organizations with predictive insights, fraud detection, customer behavior analysis, and personalized services.

Security and Compliance Solutions

Elinext delivers robust cybersecurity frameworks and compliance solutions tailored for the financial industry, which protect sensitive data, mitigate risks, and ensure adherence to evolving global regulations.

Cloud-Based Financial Infrastructure

We design and implement cloud-based infrastructures that enhance scalability, resilience, and accessibility. Cloud-based financial infrastructures support digital banking platforms, data management, and secure collaboration across financial ecosystems.

API & System Integration

Elinext ensures smooth API development and system integration, enabling financial institutions to connect platforms, improve interoperability, and create cohesive digital ecosystems for enhanced service delivery.

Financial Digital Transformation Solutions by Elinext

Mobile & Internet Banking Platforms

Elinext develops secure mobile and web banking platforms that deliver account management, payments, and financial services with intuitive user experiences.

Neobank Infrastructure

We create scalable, cloud-native infrastructures for digital-only banks, enabling fast onboarding, personalized services, and compliance while supporting rapid market growth and innovation.

Digital Wallets & Mobile Payments

Elinext designs digital wallets and mobile payment apps that ensure secure transactions, support multiple currencies, and provide users with fast, convenient, and contactless financial services.

Payment Gateway Development & Integration

Our team builds and integrates payment gateways that support global transactions, multiple payment methods, and fraud protection, ensuring smooth, reliable, and secure payment processing.

Credit Scoring & Risk Assessment Tools

Elinext develops AI-powered tools that analyze customer data for accurate credit scoring, fraud prevention, and risk assessment, helping financial institutions make smarter, faster decisions.

Robo-Advisors

We deliver automated wealth management solutions that use algorithms and analytics to provide personalized investment advice, portfolio management, and cost-efficient financial planning services.

Underwriting & Claims Automation

Elinext streamlines insurance underwriting and claims processes through automation, enabling faster decision-making, reduced paperwork, and enhanced accuracy for insurers and policyholders.

KYC/AML Automation

Our KYC/AML automation solutions simplify compliance by verifying identities, detecting suspicious activity, and ensuring adherence to regulatory standards while reducing manual effort and risk.

Smart Contracts & Crypto Wallets

We build secure blockchain-based smart contracts and crypto wallets that enable transparent, automated transactions and digital asset management for banks, fintechs, and enterprises.

SaaS for Financial Services

Elinext develops SaaS platforms for banking, insurance, and fintech that offer scalability, cost-efficiency, and easy access to advanced financial services via secure cloud environments.

Discover more about financial digital transformation services by Elinext.

Benefits of Digital Transformation in Financial Industry

Improved Customer Experience

Financial digital transformation services enable personalized, convenient, and seamless financial services, improving customer satisfaction and loyalty.

Increased Efficiency and Productivity

Digital transformation of financial services means automation above everything. Modern tools streamline operations, reduce manual work, and boost productivity across financial institutions.

Enhanced Risk Management and Security

Advanced technologies strengthen fraud detection, regulatory compliance, and cybersecurity, minimizing risks and protecting assets.

Better Decision-making and Insights

AI and analytics provide real-time insights, enabling smarter decisions, accurate forecasting, and improved financial strategies.

“Digital transformation is reshaping the financial industry, turning innovation into a necessity. Leveraging AI, cloud technologies, automation, data analytics and other financial digital transformation services enables institutions to boost efficiency, strengthen security, and deliver smarter, customer-focused financial services.” ― James Carter, FinTech Industry Expert

Future Trends in Digital Transformation in Finance

The future of digital transformation in finance industry will be shaped by AI-driven personalization, blockchain adoption, and advanced data analytics. Cloud-native infrastructures, embedded finance, and real-time payments will redefine operations, while enhanced cybersecurity and regulatory tech will ensure compliance. Institutions embracing digital transformation of financial services will gain agility, efficiency, and a competitive edge in an increasingly digital financial landscape.

Conclusion

Digital transformation is revolutionizing the financial industry, driving efficiency, security, and customer-centric innovation. By adopting AI, automation, cloud solutions, and advanced analytics, institutions can modernize operations, ensure compliance, and unlock data-driven insights. Embracing these technologies is essential for staying competitive, resilient, and future-ready in a rapidly evolving financial landscape.

FAQ

1. What is financial digital transformation?

It’s the adoption of AI, cloud, automation, and analytics to modernize financial services, improve efficiency, and enhance customer experiences.

2. Why is digital transformation important in finance?

Finance and digital transformation together mean faster operations, better insights, improved security, and personalized services, helping institutions stay competitive and compliant.

3. How can digital transformation benefit financial providers?

Finance and digital transformation boost efficiency, reduce costs, enhance risk management, improve customer experience, and support data-driven decision-making.

4. Is digital transformation secure for client data?

Yes, with robust cybersecurity, encryption, and compliance measures, digital transformation can protect sensitive client information.

5. How long does a financial digital transformation project typically take?

Depending on scope and complexity, projects can take from a few months to over a year for full implementation.

6. How can Elinext help with digital transformation in finance?

Elinext offers financial software development services and banking software development services, delivers custom FinTech solutions, cloud infrastructure, and secure integration to modernize financial operations.