Every financial services firm in some form or another is looking to adopt emerging technologies. Still, be that cloud and edge computing, AI, or next-gen data analytics, the technologies of today and tomorrow are intricately linked to security risks and vulnerabilities.

The Digital Operational Resilience Act (DORA) – EU’s response to the rising wave of cyberattacks that continue to follow right alongside tech advancements – aims to establish a consistent level of digital operational resilience across financial institutions in or doing business with the EU.

What Is DORA?

Enacted in 2022, the Digital Operational Resilience Act establishes a mandatory and comprehensive framework for ICT risk management for the EU financial sector.

DORA requirements for network and information system security extend beyond financial entities to include key third-party vendors supporting the finance industry with ICT services like cloud computing, data analytics, etc.

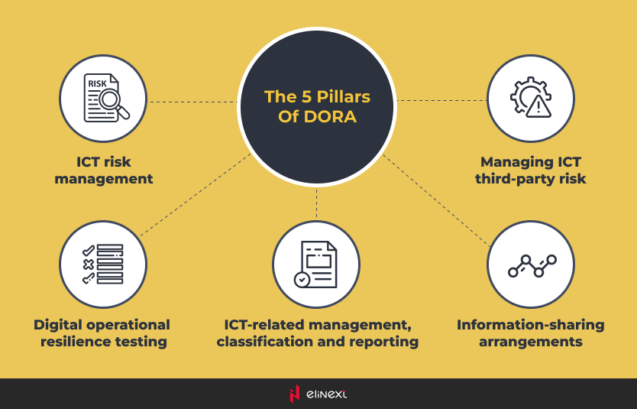

ICT Risk Management

From implementing a documented ICT risk management framework to performing annual risk assessments, reporting major ICT incidents to regulators within set deadlines, and more, DORA requirements obligate financial service entities to establish robust ICT risk controls.

Incident Reporting

FIs are required to establish systems for early incident detection, report documented incidents (including their root causes, effects, and remedial actions) to regulators within specified timeframes, and examine the aftermath of incidents to enhance their response strategies.

Digital Operational Resilience Testing

To ensure DORA compliance, EU financial service firms must test critical systems annually (with the involvement of critical third-party ICT providers) using realistic disruption scenarios. The results help assess a company’s response and recovery capabilities accurately.

ICT Third-party Risk Management

DORA mandates strict third-party risk management for financial entities outsourcing critical services. Key steps include identifying high-risk vendors, conducting thorough risk assessments, and enforcing resilience clauses in contracts.

Information Sharing

Under DORA compliance, FIs are required to develop systems and processes that facilitate the secure exchange of ICT risk-related information between these financial institutions, ICT vendors, supervisory authorities, and other stakeholders.

Who Does DORA Apply To?

Complementing the Network and Information Security 2 (NIS2) Directive and the EU’s General Data Protection Regulation (GDPR), DORA applies to a broad swath of FIs and mandates compliance not just for EU financial service firms, but also for their third-party vendors and subcontractors, even if they are headquartered outside of Europe.

Digital Operational Resilience Act’s reach extends to basically any technology service provider and financial service entity, including (but not limited to):

- Banks and Credit Institutions

- Insurance and Reinsurance Companies

- Investment Firms

- Payment Institutions and eMoney Institutions

- Crypto-Asset Service Providers

- Central Securities Depositories (CSDs)

- Central Counterparties (CCPs)

- Trading Venues and Trade Repositories

- Credit Rating Agencies

- Management Companies and Alternative Investment Fund Managers (AIFMs)

- Crowdfunding Service Providers

- Data Reporting Service Providers

Elinext: Expert-level in Financial Software Development

An expert financial software development services provider with 27+ years in cybersecurity and compliance consulting, Elinext offers its rich expertise to FIs looking to achieve full compliance with all five DORA pillars.

With 160+ completed fintech projects, Elinext knows better than anyone how important it is to comply with DORA regulations today and how overwhelming the task can be.

From comprehensive DORA compliance assessment, strategic roadmap development, establishing all necessary policies, procedures, and technical controls, to continuous monitoring and updates, our certified compliance and security experts provide end-to-end support to ensure a client meets and sustains adherence to DORA requirements (as well as other financial software standards like PCI SSF, GDPR, PSD2, etc.). – Anastasia Timoshenko

Looking to safeguard your compliance with the DORA regulations? An internationally recognized leader in banking software development services, Elinext, is eager to be your go-to partner.

Conclusion

With more and more industries becoming heavily technology-dependent, strong operational resilience is now more essential than ever. Yet, the threat is particularly significant in the finance industry, which is essential to keep economies and society at large running.

Designed to alleviate technological risks for banks and credit institutions, investment firms, insurance and reinsurance companies, among other FIs in the financial network, the DORA regulation mandates stringent ICT risk management, incident reporting, and third-party oversight for financial entities and their third-party providers and subcontractors, thus harmonizing digital resilience in the European Union.

FAQ

1. What is DORA?

The Digital Operational Resilience Act is a regulation aimed at strengthening the cyber resilience of financial service entities within the EU. Its main goal is to ensure that companies within the financial industry are resilient against and can recover from cyber incidents and operational disruptions.

2. Does DORA apply to companies outside the EU?

You don’t necessarily need to be based in Europe to comply with DORA regulations. If you’re an ICT provider to an EU financial institution, compliance may be required, regardless of where your company is based.

3. What steps should companies take now to prepare?

You can hire Elinext’s cybersecurity, operational resilience, and regulatory compliance experts to evaluate your current DORA posture. If there are any adjustments that need to be made to ensure compliance with DORA, we stand ready to help.

4. How does DORA relate to other regulations?

Focusing on digital operational resilience in finance, DORA complements existing regulations like Network and Information Security Directive 2 (NIS2), General Data Protection Regulation (GDPR), Service Organization Control 2 (SOC2), and the Revised Payment Services Directive (PSD2).

5. What are the main requirements of DORA?

Compliance with DORA will require full adherence to five critical areas of focus outlined in the regulation, including ICT risk management, reporting of major ICT-related incidents, Digital operational resilience testing, Information and intelligence sharing, and Management of ICT third-party risk.

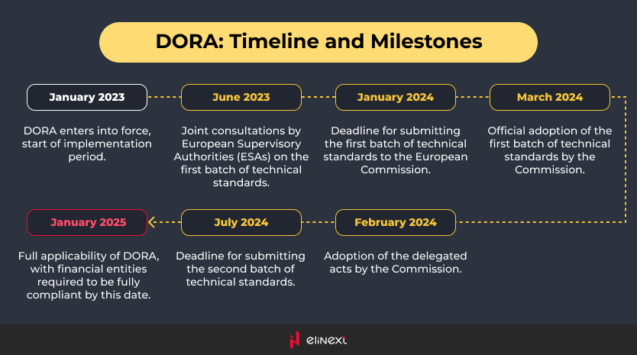

6. When does DORA come into effect?

The Digital Operational Resilience Act was introduced in 2020 and later enacted in 2022. It establishes mandatory ICT standards for FIs and their critical third-party technology service providers, with compliance required by 17 January 2025.