Cloud adoption in the banking industry is revolutionizing how financial institutions operate, offering cloud banking solutions that improve agility, scalability, and customer satisfaction. By leveraging cloud development services, banks can streamline operations, reduce costs, and enhance data analytics capabilities. Benefits include increased flexibility in deploying new services and improved recovery from outages.

However, challenges such as regulatory compliance, cybersecurity, and integration with legacy systems persist. As the industry evolves, trends like hybrid cloud strategies and AI integration will play a crucial role in shaping the future of banking, allowing institutions to meet dynamic customer needs while maintaining security and compliance.

Introduction to Cloud Computing in Banking and Financial Services

What is Cloud Computing and How is it Applicable to Banking?

If you are reading this, you probably have a general understanding of the matter. By cloud computing, we mean a new hybrid technology that combines servers, software, networking, databases, different documents, and other stuff across the Internet. This enables virtually limitless specialized uses for businesses such as data storage for insurance companies, content management for publishers, CRM for banks and other large institutions, and countless other applications. Cloud computing in the banking sector refers to using internet-based services for data storage, processing, and management, enhancing scalability, efficiency, and collaboration.

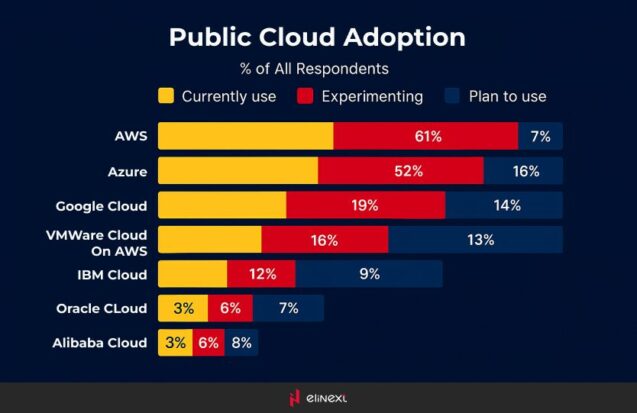

The companies that offer such services are cloud providers, and here you’ll see world’s tech giants: Amazon, Microsoft, Google – ahead of the race with their brands called AWS (Amazon Web Services), Azure and Cloud respectively.

Cloud services are delivered on demand with pay-as-you-go pricing.

We’ll tell you which major bank prefers whose service a little later, and now we’d like to give you a glimpse at what it is all about.

Cloud computing in banking creates a multi-channel relationship with the customer at many levels, helping banks with maintaining and improving customer service.

Cloud for banking is used for storing, backup and recovering data of the enterprise-sized companies. Banks are known for the slow adoption of technologies due to doubts in reliability and issues regulation of their services, however, the volumes of data storage are initiating the unavoidable transition to cloud in the nearest future.

Let’s explore how cloud adoption and banking software development services might help banking institutions manage their activities more efficiently?

Core Drivers Behind Cloud Adoption in Banking Industry

The cloud adoption in the banking industry is driven by several key factors. Firstly, cloud computing in banking and financial services helps reduce costs by minimizing IT infrastructure costs and enabling pay-as-you-go models. Additionally, cloud for banking services increases agility, allowing institutions to quickly roll out new services and adapt to market changes.

Improved data analytics capabilities enable banks to make informed decisions and personalize customer experiences. Moreover, regulatory compliance and security advances in cloud computing help reduce risks, making it a viable solution for modern financial operations. These factors together highlight the transformative potential of cloud adoption in banking.

Returning to the reasons, the British Bankers’ Association (BBA) sees the following three key motivators for the adoption of public cloud-based services by the banks:

- Agile Innovation

- Risk Mitigation

- Cost Benefits

Agile innovation

Banks aim for innovation with the help of improvement in agility, efficiency, and productivity. Cloud banking solutions deployment allows banks having their own direct access to the internal product and their delivery to the market in a more speedy fashion.

Risk mitigation

Adding to the risk factors is the one thing modern banks can’t afford. As the cloud computing in banking help to lower the risks concerning capacity, resiliency, and redundancy together with improving scalability in their security sectors equipment, there is an additional point to using it.

Cost benefits

While this is not the deciding factor for many banks as of yet, it matters a lot in the long run. The potential of savings is significant, the profit comes from saving on investments that are needed for traditional IT infrastructure, improved risk mitigation, improved ability to combat financial crime with increased transparency, etc.

Key Benefits of Cloud Computing in Banking Sector

Cloud computing in banking and financial services offers numerous benefits that improve operational efficiency. First, it reduces IT costs by eliminating the need for extensive on-premises infrastructure. It also provides scalability, allowing banks to quickly adjust resources based on demand. Advanced data analytics capabilities support personalized services and better decision-making.

Additionally, financial software development services benefit from faster deployment and innovation cycles, ensuring that banks remain competitive and responsive to customer needs. Overall, cloud computing promotes agility and improves customer service in the banking sector.

Scalability and Flexibility

Cloud banking solutions provide unmatched flexibility, allowing financial institutions to easily adapt to changing requirements. This flexibility not only reduces capital expenditures, but also drives innovation, allowing banks to quickly roll out new services and respond to market trends, ultimately improving customer experience and operational efficiency.

Cost Efficiency and Operational Agility

Cloud banking solutions improve cost efficiency by minimizing the need for extensive hardware and maintenance, allowing banks to use a pay-as-you-go model. This approach increases operational flexibility, allowing financial institutions to quickly roll out new services, adapt to market changes, and optimize processes, ultimately improving responsiveness to customer needs.

Enhanced Disaster Recovery and Security

Cloud computing in banking sector provides improved disaster recovery, ensuring that data is reliably backed up and easily retrieved in the event of a failure or disruption. With built-in redundancy and automated recovery processes, banks can maintain continuity. Additionally, advanced cloud security measures protect sensitive financial data from cyber threats, ensuring compliance with regulatory standards.

Improved Customer Experience via Real-time Services

This feature allows banks to offer immediate access to account data, transaction updates, and customized recommendations. Using real-time data, financial institutions can quickly respond to customer queries and resolve issues, minimizing wait times and increasing satisfaction.

Support for Innovation (AI, ML, data analytics, etc.)

Cloud banking platforms empower financial institutions by providing powerful support for innovation through technologies such as AI, ML, and data analytics. An ML software development company can help banks use these tools to analyze vast data sets, improve decision-making, and deliver personalized services. By integrating advanced analytics, banks can anticipate customer needs, improve product offerings, and increase operational efficiency, ultimately staying competitive in a rapidly changing marketplace.

Key Challenges of Cloud Computing in Banking and Financial Services

While cloud computing offers significant benefits, it also presents key challenges for banking and financial services. Data security and privacy concerns remain paramount, as sensitive financial information must be protected from breaches. Additionally, regulatory compliance can be challenging, as requirements vary by region. Integration with legacy systems presents another hurdle, as banks must ensure seamless connectivity between modern cloud solutions and existing infrastructure. Finally, managing vendor relationships and service reliability are critical to maintaining business continuity and customer trust.

Security and Data Sovereignty Concerns

Data security and sovereignty are vital issues in cloud banking. Financial institutions must ensure robust protection against cyber threats, complying with local laws regarding data storage and processing, protecting customer privacy and trust.

Compliance with Local and International Regulations

Compliance with local and international regulations is critical for cloud banking. Financial institutions must navigate complex laws such as GDPR and PCI-DSS to ensure data protection, consumer rights, and regulatory compliance while building trust.

Legacy System Integration

Integrating legacy systems with cloud solutions poses significant challenges for banks. Ensuring seamless communication and data flow while minimizing disruptions is essential to maintaining operational efficiency and service continuity.

Vendor Lock-in Risks

Vendor lock-in risks occur when financial institutions become overly dependent on a single cloud service provider. This can limit flexibility and increase costs, making it difficult to switch providers or adopt new technologies in the future.

Organizational Resistance and Skills Gaps

Organizational resistance to cloud adoption can hinder progress in banking. Additionally, skill gaps among employees can hinder effective implementation, requiring targeted training and change management strategies for success.

How Leading Banks Are Implementing Cloud for Banking Operations

J.P. Morgan Chase & Co., after more than a year of testing offerings from large cloud providers, has its first two applications to run in the public cloud back in 2017.

The bank started the move with a couple of applications in wholesale trading, and the third app in risk modeling sometime later, “aiming to use the bursting capability of cloud computing to handle high-volume, complex computations at sometimes irregular intervals”, according to the word of bank’s ex-CIO Dana Deasy.

“Public cloud is serious. It’s time to move.” – he added.

Amazon.com Inc.’s Amazon Web Services (AWS) was chosen by the bank at the time.

The current Chief Information Officer at JPMorgan Chase, Lori Beer continued the course chosen by her predecessor.

She claimed that the bank has learned a lot during its transition to using services from outside cloud computing providers such as Amazon Web Services. In succession of these endeavors, “JPMorgan will soon give the green light to storing “highly confidential” data with cloud providers”. That serves as a sign of the bank’s confidence in its revamped cloud strategy.

TD Bank Group (TD) and Microsoft back in April 2019 announced a strategic relationship in which TD will use Microsoft Azure as the cloud foundation to provide its technology and design teams with tools designed for secure, agile and flexible access to data and AI resources.

This further enables the Bank to adapt and quickly respond to changing customer needs.

“At TD we are shaping the future of banking in the digital age by creating personalized, connected and legendary experiences across all of our channels. Our strategic relationship with Microsoft will help accelerate and fuel new and innovative banking experiences for our customers, clients, and colleagues”, – said Bharat Masrani, Group President and Chief Executive Officer, TD.

Microsoft Azure is positioned to help accelerate new capabilities when it comes to the design and delivery of future customer banking experiences.

Royal Bank of Canada

Royal Bank of Canada (RBC) has adopted the IBM Cloud to increase business agility, shorten time-to-market, and facilitate the adoption of emerging technology.

“Perhaps three main imperatives for us to adopt something like IBM Cloud solution: The top one is increasing the business agility, and the next one is much shorter time to market; and the last one is the ability to take advantage of IBM Cloud in terms of adopting new technology, to speed us up tremendously in terms of adopting new technology as well. ”

Those are the words of Francis Li, senior director of solution engineering and wealth management at Royal Bank of Canada.

We can see that there is no special trend to follow and no one-fits-all solutions for all the banks as big banks choose across different providers.

An AI software development company like Elinext has the expertise and experience to create customized cloud solutions utilizing services from all leading providers across multiple domains, including the financial sector. If you’re in search of tailored solutions, feel free to reach out for a free quote!

Cloud Security and Compliance in the Banking Industry: ISO 27001-Certified Approach by Elinext

Our company proudly holds the ISO 27001 certification, demonstrating our commitment to maintaining the highest standards of information security management. This certification validates our robust processes and practices in protecting sensitive data. You can trust that we prioritize security and compliance in all our services.

Conclusion

Cloud adoption in the banking industry is a transformative opportunity, offering benefits such as increased flexibility, scalability, and cost efficiency. However, to fully realize its potential, challenges such as data security, regulatory compliance, and the integration of legacy systems must be addressed.

As financial institutions navigate these hurdles, they will need to embrace innovative solutions and develop a culture of adaptability. Looking ahead, the future of cloud computing in banking will likely include advanced technologies such as AI and machine learning, which will drive further innovation and improve the customer experience.

FAQ

What is cloud adoption in the banking industry?

Cloud adoption in banking refers to integrating cloud computing technologies to enhance operations, improve scalability, and deliver innovative services.

Why are banks moving to cloud computing?

Banks are moving to cloud computing for cost efficiency, enhanced scalability, improved security, and the ability to innovate rapidly with new technologies.

How does cloud computing improve banking services?

Cloud computing improves banking services by providing scalability during peak hours, increasing processing speeds and offering cost-effective solutions using a pay-as-you-go model, allowing banks to innovate quickly and respond effectively to customer needs.

What is the future of cloud computing in banking and financial services?

The future of cloud computing in banking includes tighter integration of artificial intelligence, improved data analytics, enhanced security measures and a focus on regulatory compliance, driving innovation and personalized customer service.