Let’s start with myth-busting, shall we?

AI-powered chatbots aren’t solely used for communication purposes. It would be fair to begin with this statement as, contrary to popular belief, bots are bigger than they may seem to the general public. In fact, more and more financial institutions are starting to consider them as customer-facing tools in their own right.

The Amex bot – the American Express bot – is a perfect illustration. This application connects an eligible U.S. Card to a Facebook Messenger account (so-called “Connected Card”) to get messages in Messenger for each purchase a cardholder makes. Moreover, it is also possible to get helpful information about your Connected Card’s benefits, Amex Offers and more. These messages will show up in a Messenger conversation on all devices logged into a Messenger account. Evidently, the Amex advisor can also respond to certain types of questions. If the chatbot isn’t able to answer a question, it will ask this particular customer for more information or propose to log into an American Express online account to chat with a customer care officer.

It is also fair to say that, in the circumstances, the term “chatbot’” I have used in the title of this article may sound a bit generalizing. Depending on their functions, their names can vary.

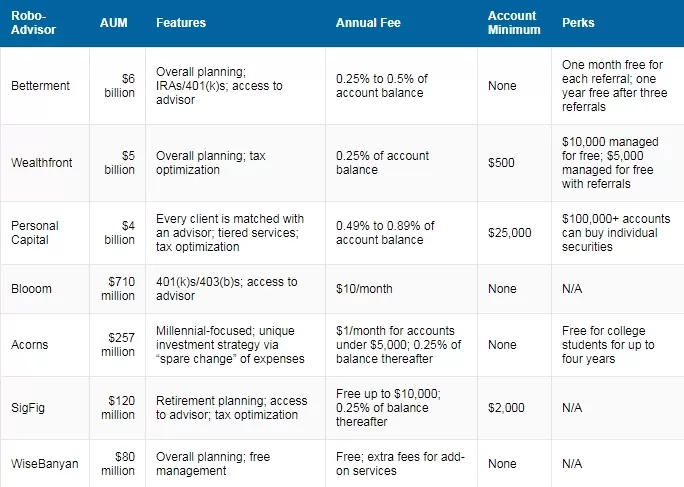

In my opinion, robo-advisors are the most promising among them. These artificial helpers manage client’s money and invest certain percentages in stocks and bonds just like human brokers do. According to Investopedia, client assets managed by robo-advisors reached nearly $1 trillion in 2020, and are projected to hit whopping $2.9 trillion worldwide by 2025.

By the way, did you know that robo-advisors hold the same legal status as human advisors? They are registered with the U.S. Securities and Exchange Commission to conduct business, and, therefore, they are subject to the same securities laws and regulations as traditional brokers. Their official designation is “Registered Investment Adviser,” or RIA. Most robo-advisors are members of the independent regulator Financial Industry Regulatory Authority (FINRA) as well. Consumers choose bots over human assistants for a simple yet irresistible reason: they provide absolute convenience. They are available 24/7, and they are ready to serve clients no matter what their current account balance is. According to Servion’s prediction, by 2025, artificial intelligence (AI) will be behind 95% of customer interactions, including real-time phone and online chats that will be indistinguishable from human interaction. Despite these statistics, about 60% of US financial services respondents said that they’re limited by regulations or budget issues to invest in such innovative development. The question is, what about the ones who aren’t?

For instance, the Bank of America uses Erica (a beautiful example of naming, considering the bank’s…name). This digital assistant provides customers with key and real-time updates on their finances using their favorite channel of communication. The predictive analytics and cognitive messaging help customers make payments, pay down debts, and check their balances. Besides, she directs people to look up their FICO score and check out educational videos and other content. The other example is Swedbank which uses a tool called Nina. The bank says that Nina resolves 40,000 conversations a month which is 81% of the issues. At the moment, Nina operates only in Sweden, but there’s a plan to introduce it to Baltic markets as well. “AI can help our customers become more digitized, for example by guiding a client in paying bills on the Internet,” Swedbank spokeswoman Josefine Uppling says. France doesn’t stay aside either. For instance, French bank Societe Generale developed an advisor that represents a full-fledged financial tool with various possibilities. “What started as a simple bot that could only answer a couple of questions about investment in equity funds, turned into a more complex application that can assist customers in selecting and subscribing to investment funds, transferring money between funds, bill payment or withdrawing money from their accounts,” Horia Velicu, head of the bank’s innovation lab, told Business Review.

“We know that our clients are increasingly looking for seamless, convenient and secure mobile banking experiences and by potentially adding a smart bot through Facebook Messenger, we’re helping to meet the evolving expectations of our clients,” resumes Linda Mantia, the executive vice president at Royal Bank of Canada.

In a nutshell, fintech chatbots can be used for the following purposes:

- taking and processing orders from social media channels

- providing bank account details

- managing consumer credit score

- notifying clients about upcoming payments

- helping consumers to create realistic budgets

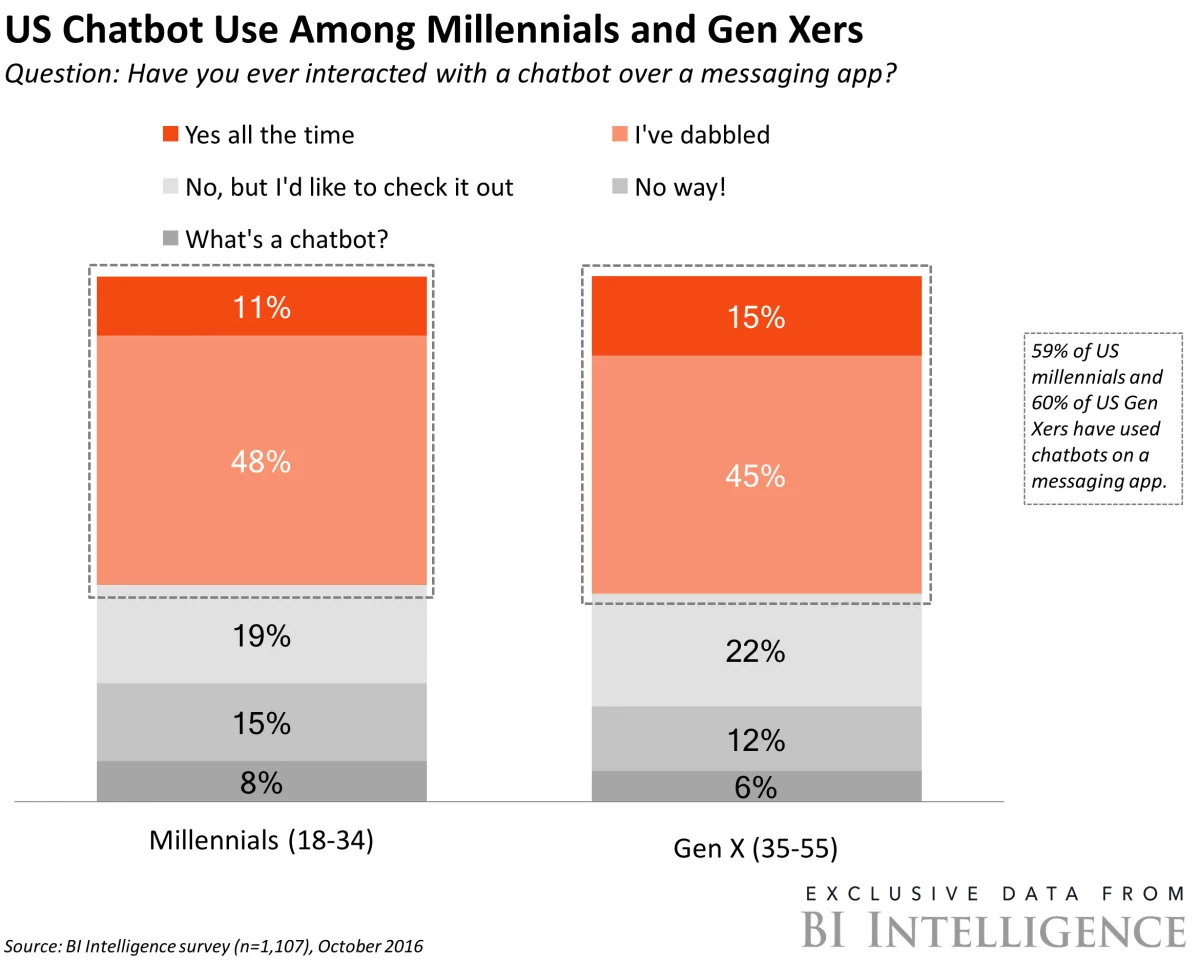

Given the continuous use of the word “consumer”, it’s the right time to describe them. Who are they in the first place? The majority of them are Millennials and GenXers. Millennials (also known as Generation Y) represent the generational demographic group which follows Generation X. As stated in Wikipedia, “demographers and researchers typically use the early 1980s as starting birth years and the mid-1990s to early 2000s as ending birth years”.

Compared to the older generations, Millennials and GenXers consider digital services as the primary method of dealing with a business. “An entire generation is coming of age financially now. They grew up in the world of texting,” said Keith Armstrong, founder and COO of a personal finance advisor, Abe.ai. This way, due to their familiarity with digital technologies, banks are offering financial services that resonate with the zeitgeist in full measure. The 21st century leaves little space for old-fashioned bureaucracy as the modern world is fast-paced and technology-driven. Just imagine the process of, say, getting a loan twenty years ago. Firstly, a customer would have to call an advisor during regular business hours (not to mention the possibility of going to meet him in person). Then he would get a pile of paperwork to cope with. Finally, he waits as long as it takes to decide whether he’s eligible or not. What’s the right word to describe all these steps? It’s “inefficiency” or, most simply, red tape. Let’s admit: no one likes this. And that’s where chatbots come real handy. Nowadays, the process is subject to automation: a customer can go through a whole cycle at home by clicking on a few buttons.

In 2017 the numbers above went even higher. In 2022 70% of Millennials who have given a try to chatbots describe their experience as positive against 21% who don’t. However, respondents felt that higher accuracy and more natural sounding conversation should be the next things put on the list of improvements.

Undoubtedly, banks institutions aren’t the sole players on the market. Startups across the globe can’t stay away from the fintech scene as well. This said, fintech startups are developing chatbots as Plum, Chip and Cleo to help individuals manage their finances. Thanks to the hype around the technology, money rolls in, and companies are patiently waiting for new investors to participate. For instance, Betterment, an online financial advising platform, has the estimated value range is between $1 billion and $10 billion. (PrivCo reports that as of September 29, 2021) In early 2016 the company valued $700 million and held just $4 billion in assets under management, according to Bloomberg. Today the firm’s asset under management has reached nearly $10 billion.

Key Takeaways:

- To remain competitive, banking institutions must innovate digitally, and robo-advisors provide a tangible opportunity to progress. Banks can either develop a chatbot in-house or resort to the services of a third-party development company.

- Like anything innovative, chatbots still have flaws, but it’s a temporary problem. After all, their pros outweigh their current imperfection, and in the long term, a proper-made chatbot can deliver tangible benefits.

- Banks should develop chatbots that efficiently automate basic and time-consuming tasks. This practice will free up human employees for more complex enquiries, thus improving customer relations and loyalty.

Summing up all these insights, chatbots are the future of conversational banking. That is why banks are rushing to develop and launch their own banking chatbots. However, fintech partnerships enable banking institutions to innovate faster, cheaper, and better than they could in-house. If you’re interested in developing your own chatbot, let us know at [email protected]