Loan Lending Mobile App Development Services

Elinext: Leading Experts in Financial App Development

Custom Loan Lending Mobile App Development Solutions We Offer

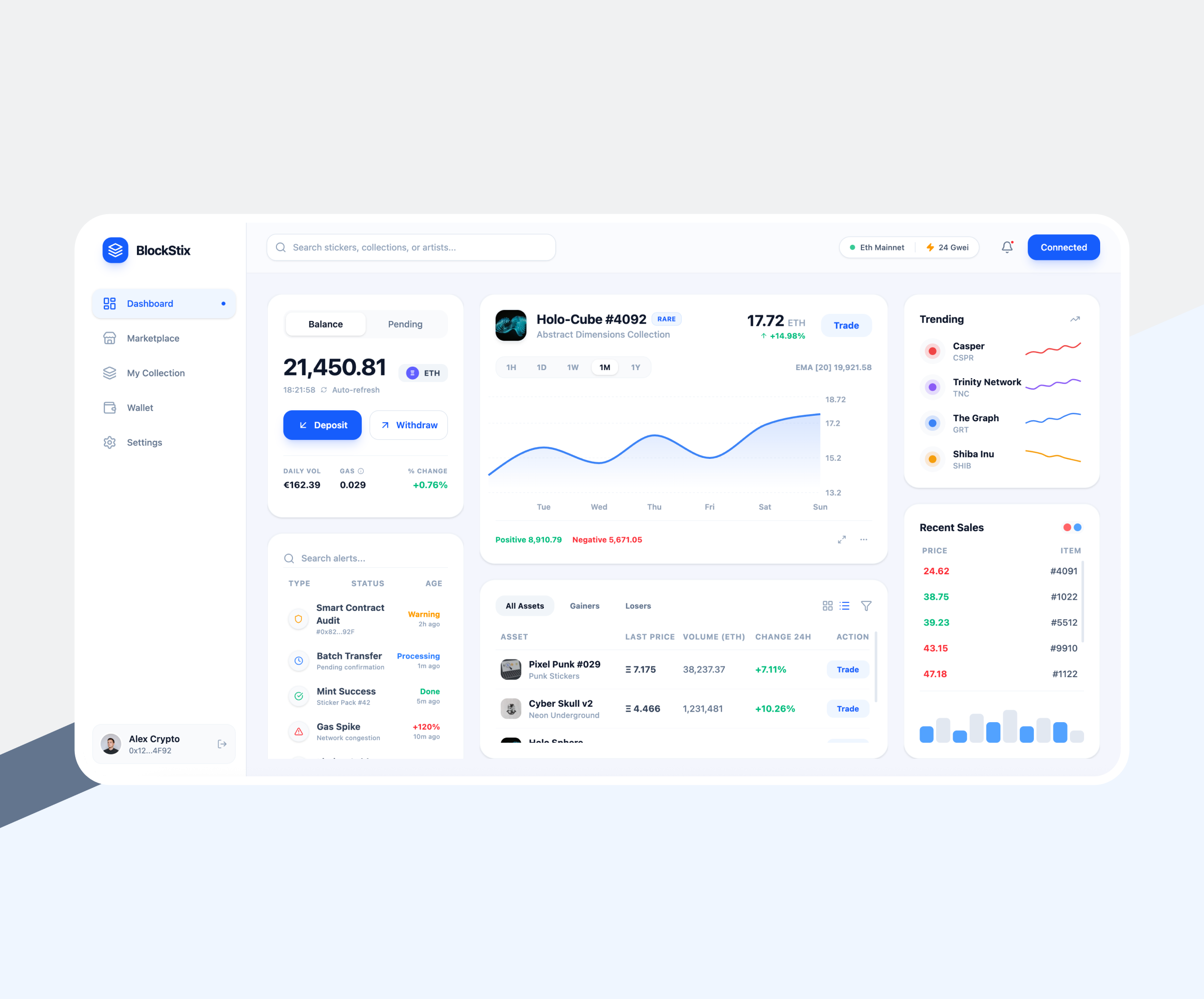

-

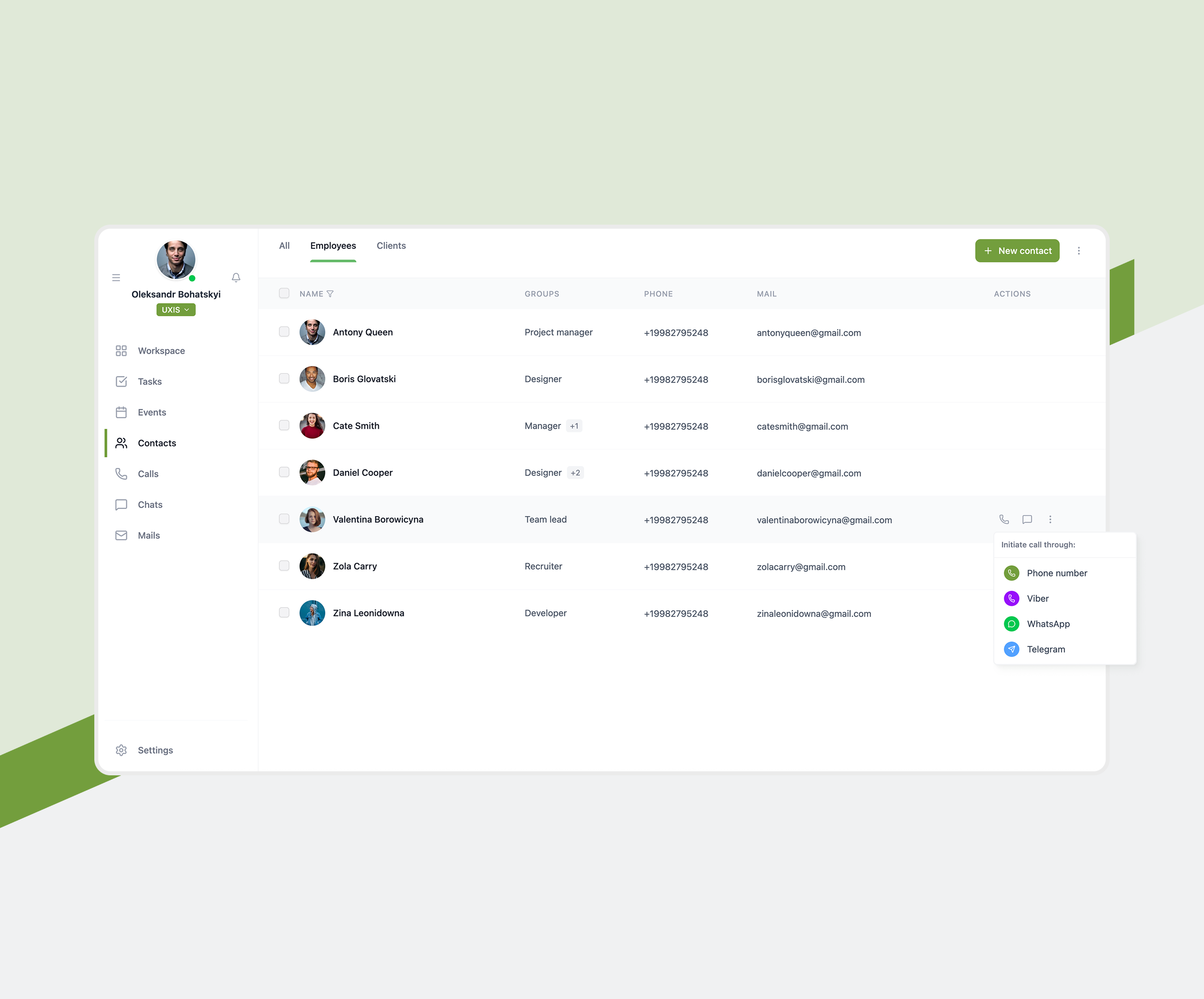

We design account management modules that give borrowers full visibility into their personal details, active loans, payment schedules, and notifications. Users can update their profiles, manage settings, and review their financial activity in a clean, intuitive interface that reduces support inquiries.

-

KYC/AML Verification Solutions

Elinext integrates automated identity checks, document scanning, biometric validation, and AML screening. These tools help lenders verify borrowers quickly while staying compliant with local regulations. The result is a faster onboarding process with fewer manual reviews and fewer risky applicants slipping through.

-

Loan Calculator Development

We create transparent loan calculators that help borrowers estimate payments, compare terms, and understand borrowing costs before applying. This reduces uncertainty, improves decision-making, and increases the likelihood of successful applications by setting clear expectations early in the process.

-

Money Loan Application Development

Elinext builds application flows that collect user data smoothly, validate information instantly, and run automated scoring models. Borrowers receive quick decisions, while lenders benefit from fewer errors, faster processing times, and better control over approval rules.

-

Loan Repayment App Development

We design repayment modules that support autopay, manual payments, alerts, and multiple payment methods. Borrowers stay on track thanks to reminders and clear schedules, and lenders see fewer missed payments and improved overall repayment performance.

-

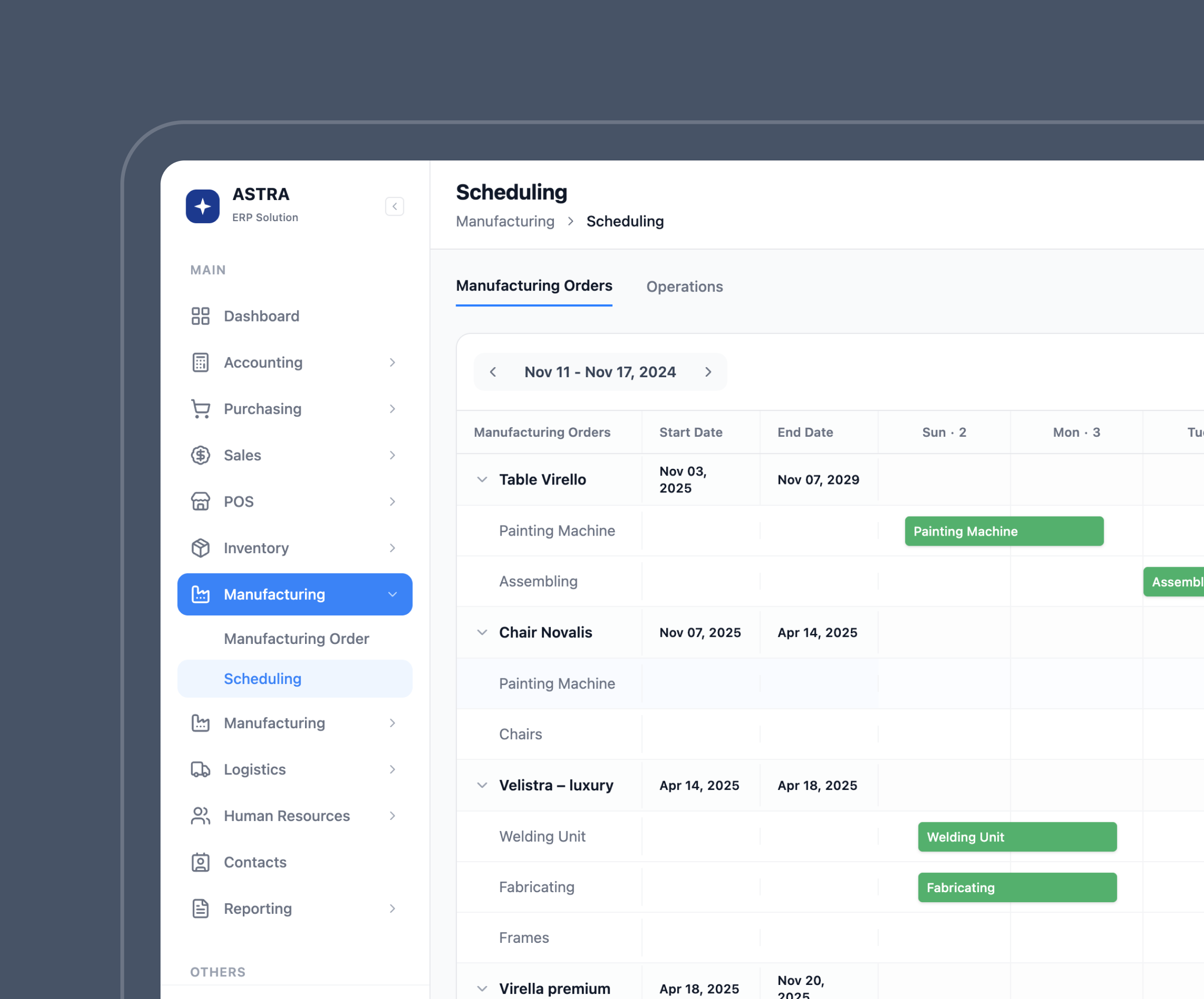

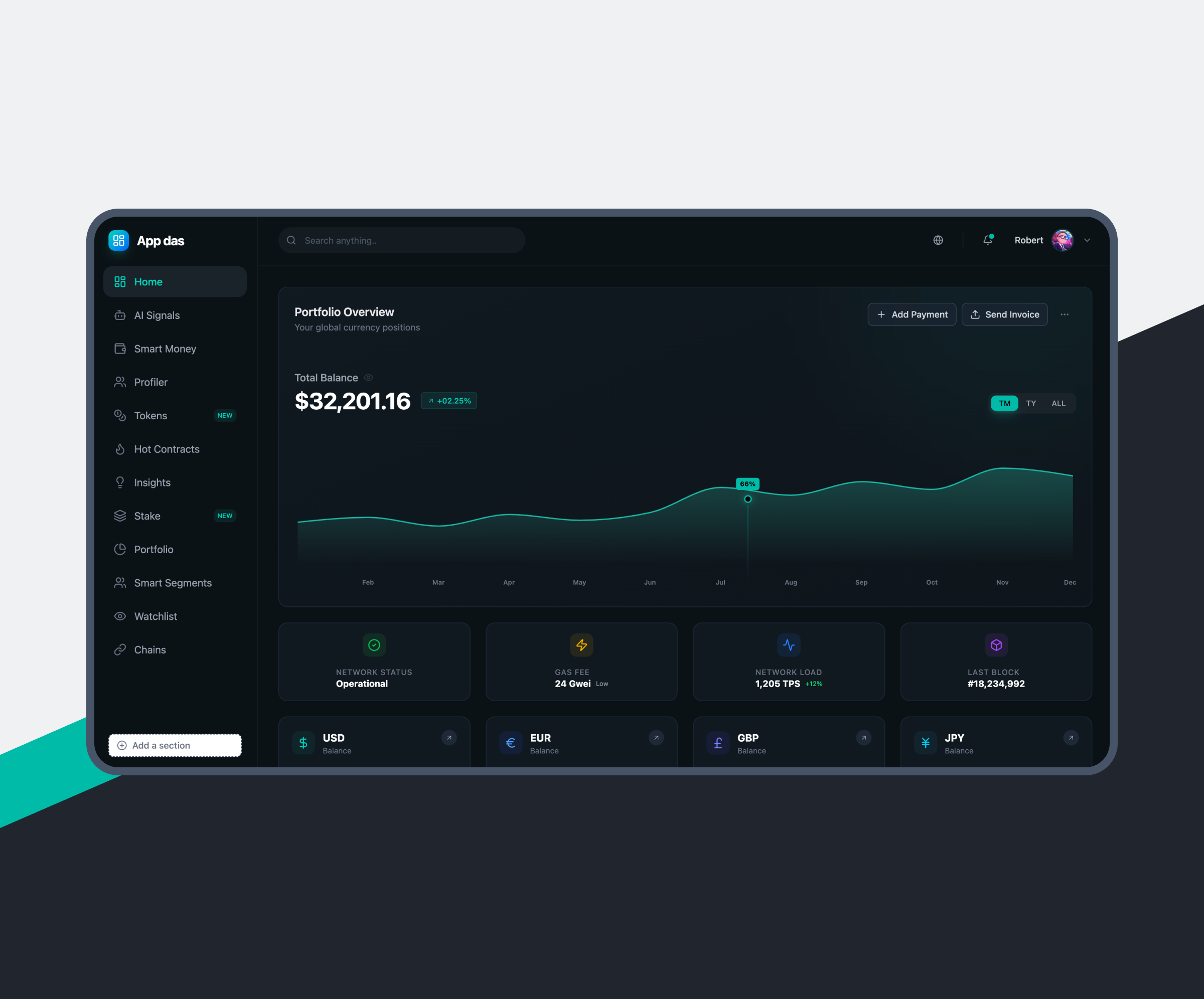

Loan Progress Control App Development

Borrowers can monitor their repayment status, outstanding balance, and upcoming installments through clear progress dashboards. Real-time updates help reduce confusion and increase borrower engagement while lowering the number of support tickets about loan status.

-

Intelligent Virtual Assistants Integration

Elinext adds AI-based assistants that guide borrowers through applications, answer common questions, explain loan terms, and assist with payments. This reduces customer service load, shortens response times, and improves the overall user experience without requiring extra staff.

-

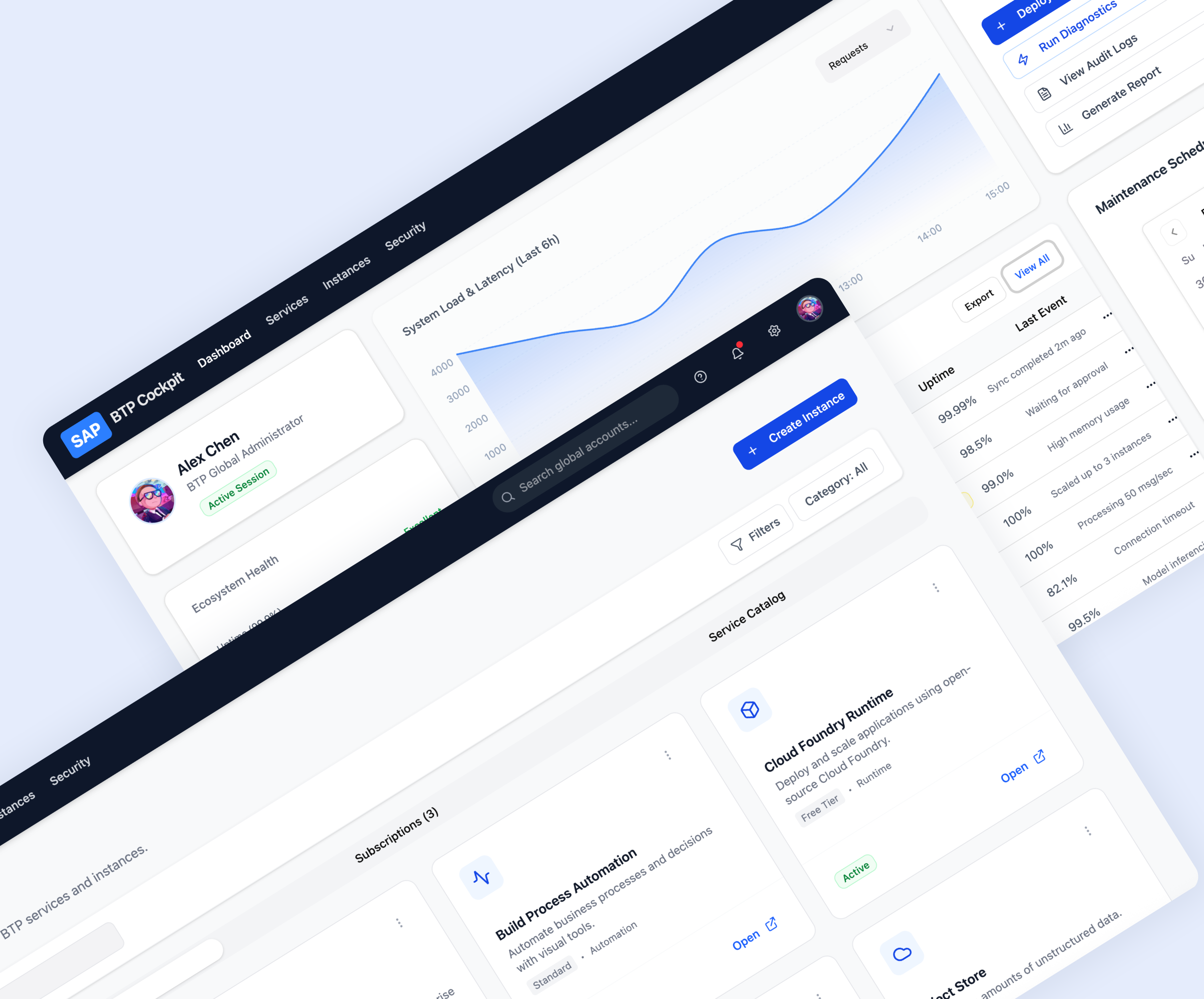

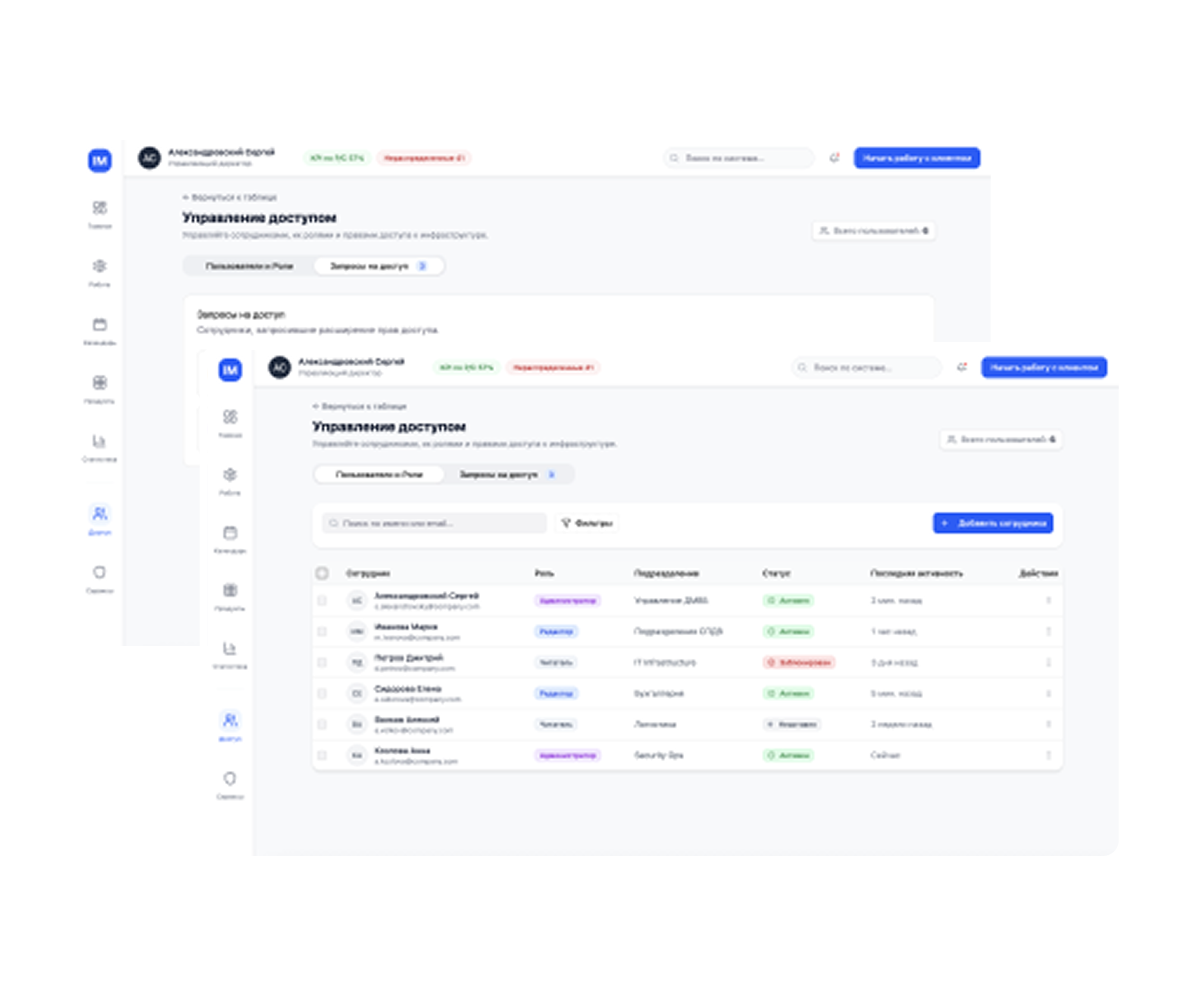

Security and Compliance Solutions

We incorporate industry-standard security measures like encryption, secure authentication, audit logs, and fraud monitoring. Combined with compliance support for PCI DSS, GDPR, and lending regulations, our solutions protect sensitive borrower data and help lenders avoid costly risks.

-

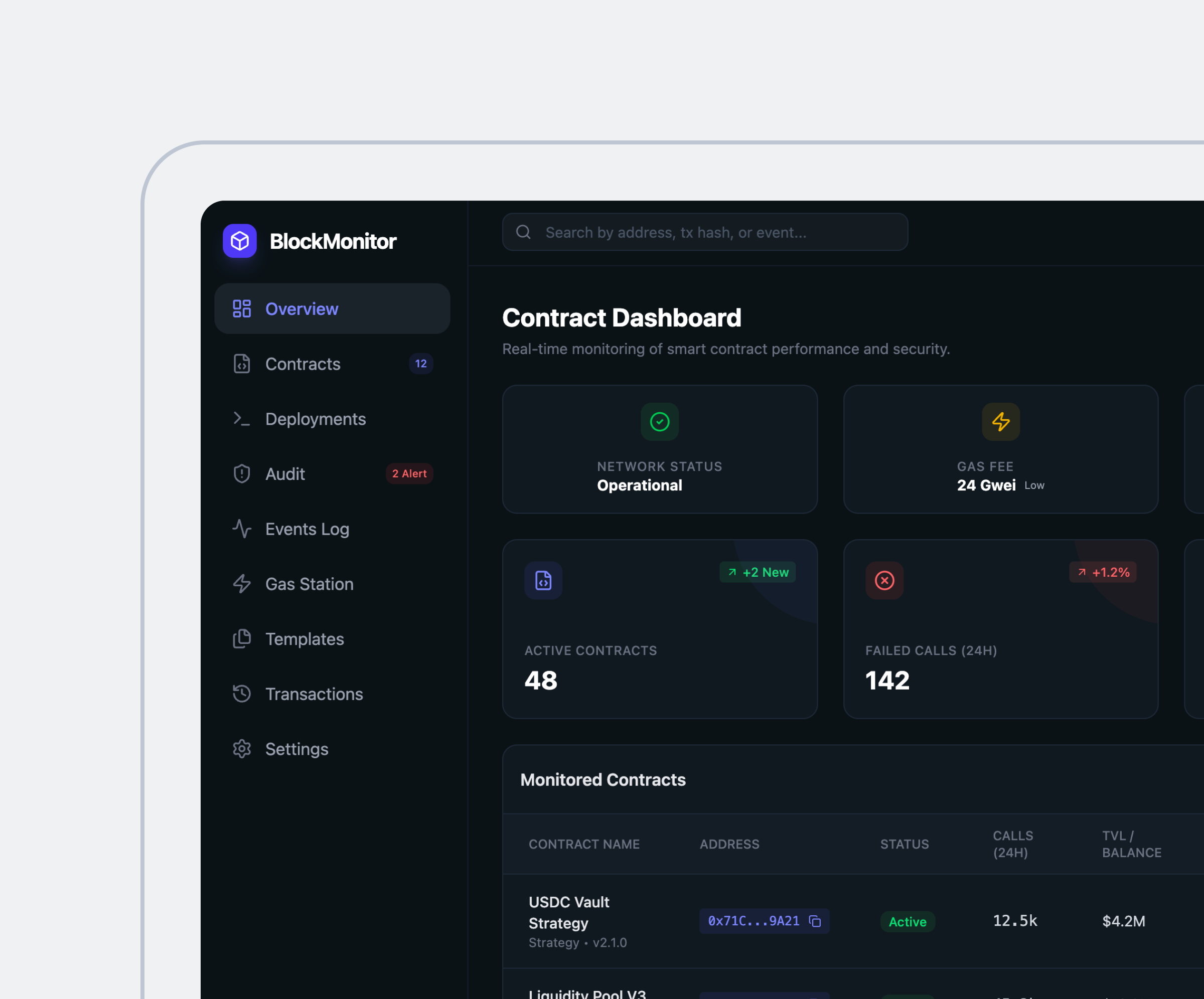

Interface Customization Solutions

Elinext tailors UI/UX to match your brand, lending workflows, and audience. Whether you need a simple design or a feature-rich interface, we ensure every screen is intuitive, accessible, and optimized for both first-time borrowers and frequent users.

Our Awards and Recognitions

Advanced Techs We Implement in FinTech Software

Estimate the Price of Money Lending App Development Services

Loan Lending Mobile App Development Services by Elinext

Сustom Solutions that Integrate with a Money Lending App

Clients We Serve

We offer loan lending mobile app development services tailored to the unique workflows, compliance needs, and customer expectations of different financial sectors. Our goal is always the same: streamline lending operations, automate routine tasks, and give both lenders and borrowers a smoother digital experience.

We offer loan lending mobile app development services tailored to the unique workflows, compliance needs, and customer expectations of different financial sectors. Our goal is always the same: streamline lending operations, automate routine tasks, and give both lenders and borrowers a smoother digital experience.

What Our Experts SayWhat Our Experts Say

Core Technologies We Work with

-

Back-end 12+0Practice20 yearsProjects150+Workforce50+Framework enabling enterprises to build scalable desktop, mobile, and web apps with enterprise-ready security and integrations globally.Practice27 yearsProjects250+Workforce60+Enterprise programming language enabling enterprises to build scalable, reliable, and secure applications globally.Practice20 yearsProjects130+Workforce50+Popular programming language enabling enterprises to build AI, analytics, web, and backend apps with simplicity and scalability globally.Practice13 yearsProjects100+Workforce50+JavaScript runtime enabling enterprises to build scalable, fast, and real-time applications globally.Practice20 yearsProjects110+Workforce30+Popular web programming language enabling enterprises to build dynamic websites, CMS, and apps globally.

-

-

Front-end 12+0Practice28 yearsProjects400+Workforce80+Most popular web programming language enabling interactive apps, dynamic websites, and enterprise-scale platforms globally.Practice7 yearsProjects20+Workforce15+Progressive front-end framework enabling developers to build scalable, lightweight, and maintainable apps globally.

-

-

Mobile 12+0Practice15 yearsProjects60+Workforce25+Apple’s mobile operating system enabling enterprises and developers to build apps for iPhone, iPad, and wearable devices globally.Practice14 yearsProjects70+Workforce30+Google’s mobile OS enabling enterprises and developers to build apps for billions of smartphones and devices globally.Practice7 yearsProjects30+Workforce15+Cross-platform framework enabling enterprises to build mobile apps using JavaScript and React with scalability globally.Practice6 yearsProjects20+Workforce15+Cross-platform framework enabling enterprises to build apps for iOS, Android, and web with a single codebase globally.

-

-

Low-code Development 12+0

-

-

Databases / Data Storages 12+0Practice10 yearsProjects70+Workforce15+Enterprise software and database leader delivering secure cloud, analytics, and infrastructure for banks, governments, and global corporations.

-

-

Cloud 12+0

-

-

Real-time Data Processing 12+0

-

-

DevOps 12+0

-

The Benefits of Loan Lending Mobile App Development Solutions by Elinext

Choose Your

Service Option

Hire Loan Lending App Developers

from Elinext

Why Elinext?

Listen to Our Clients

FAQ

-

A money lending mobile app lets users apply for loans, upload documents, and manage repayments from their phone. With our loan lending mobile app development services, lenders get faster processing and borrowers get smoother, clearer experience.

-

Banks, fintech startups, credit unions, and microfinance providers all benefit. Our loan lending app development services help these organizations automate approvals, reduce manual work, and offer borrowers a modern, easy-to-use lending experience.

-

Yes. Apps built through our loan lending mobile app development services use encryption, secure logins, fraud protection, and strict KYC/AML compliance. This keeps sensitive borrower data protected throughout the entire lending process.

-

Absolutely. With loan lending app development services, we integrate credit bureaus, payment gateways, KYC tools, banking APIs, and CRMs. This creates a seamless lending workflow without constant manual switching between systems.

-

Timelines vary by complexity. A basic version takes about 3–4 months, while a full-featured solution may take 6–9 months. During loan lending mobile app development services, we provide a detailed estimate once we review your requirements.

-

Yes. We offer updates, fixes, and performance improvements. Post-launch support is an essential part of our money lending app development services, ensuring your system stays compliant, secure, and ready for scaling as demand grows.

-

We combine fintech expertise with deep knowledge of scoring, compliance, and borrower workflows. Our loan lending app development services focus on practical automation and a user-friendly design that works in real lending operations.