Fraud Detection Solutions

for Financial Organizations

Elinext: Leading Experts in Insurance Software Development

Since 2008, the Elinext team has been supporting the insurance industry with advanced technological solutions that streamline operations like policy administration, underwriting, claims processing, and customer interaction, drive profitability, and enable insurance service providers to operate in a more flexible and innovative way.

Since 2008, the Elinext team has been supporting the insurance industry with advanced technological solutions that streamline operations like policy administration, underwriting, claims processing, and customer interaction, drive profitability, and enable insurance service providers to operate in a more flexible and innovative way.

Custom Financial Fraud Detection Solutions by Elinext

We engineer software systems that use machine learning and advanced analytics to detect early signs of fraudulent activities (unauthorized access to or use of customer account information, unauthorized electronic fund transfers, phishing, etc.) and combat them promptly.

From card skimming to card cloning, identity theft, card not present fraud, chargeback fraud, and more, AI-led tools we design monitor transactions round the clock, assisting financial institutions in detecting and preventing many different types of payment fraud.

We can create customized software solutions that insurers deploy to sniff out indicators of insurance fraud, including recent policy purchase, frequent insurance claims, inconsistent or contradictory claim details, suspicious financial patterns related to the policy, etc.

Investment firms can equip themselves with Elinext’s financial fraud detection solutions that will spot Ponzi/pyramid schemes, pump-and-dump scams, stockbroker fraudulent activities (misrepresentations, unauthorized trading, etc.), enhancing their resilience against costly threats.

Identify suspicious activity and discrepancies in borrower data, i.g. stolen identities, fake business credentials, fabricated employment details, falsified income information, or misrepresenting property value or condition to avoid significant financial losses.

Rely on advanced, AI-powered technology solutions by Elinext to protect yourself against those mortgage fraud schemes that are on the rise, including synthetic identity fraud, builder bailout, straw buyer, air loan, double-sale, and more.

-

Banking Fraud Detection Solutions

We engineer software systems that use machine learning and advanced analytics to detect early signs of fraudulent activities (unauthorized access to or use of customer account information, unauthorized electronic fund transfers, phishing, etc.) and combat them promptly.

-

Payment Fraud Detection Solutions

From card skimming to card cloning, identity theft, card not present fraud, chargeback fraud, and more, AI-led tools we design monitor transactions round the clock, assisting financial institutions in detecting and preventing many different types of payment fraud.

-

Insurance Fraud Detection Solutions

We can create customized software solutions that insurers deploy to sniff out indicators of insurance fraud, including recent policy purchase, frequent insurance claims, inconsistent or contradictory claim details, suspicious financial patterns related to the policy, etc.

-

Investment Fraud Detection Solutions

Investment firms can equip themselves with Elinext’s financial fraud detection solutions that will spot Ponzi/pyramid schemes, pump-and-dump scams, stockbroker fraudulent activities (misrepresentations, unauthorized trading, etc.), enhancing their resilience against costly threats.

-

Lending Fraud Detection Solutions

Identify suspicious activity and discrepancies in borrower data, i.g. stolen identities, fake business credentials, fabricated employment details, falsified income information, or misrepresenting property value or condition to avoid significant financial losses.

-

Mortgage Fraud Detection Solutions

Rely on advanced, AI-powered technology solutions by Elinext to protect yourself against those mortgage fraud schemes that are on the rise, including synthetic identity fraud, builder bailout, straw buyer, air loan, double-sale, and more.

Our Awards and Recognitions

Advanced Techs We Implement in FinTech Software

With 70+ successfully accomplished AI initiatives behind us and 10+ years in fintech software development, Elinext is a reliable tech partner to create ML-powered financial software that addresses the distinct strategic challenges of BFSI companies.

Since 1997, the Elinext team has been working alongside our clients to develop and deploy custom data analytics solutions that enable financial services organizations to segment, analyze, and predict with unprecedented accuracy.

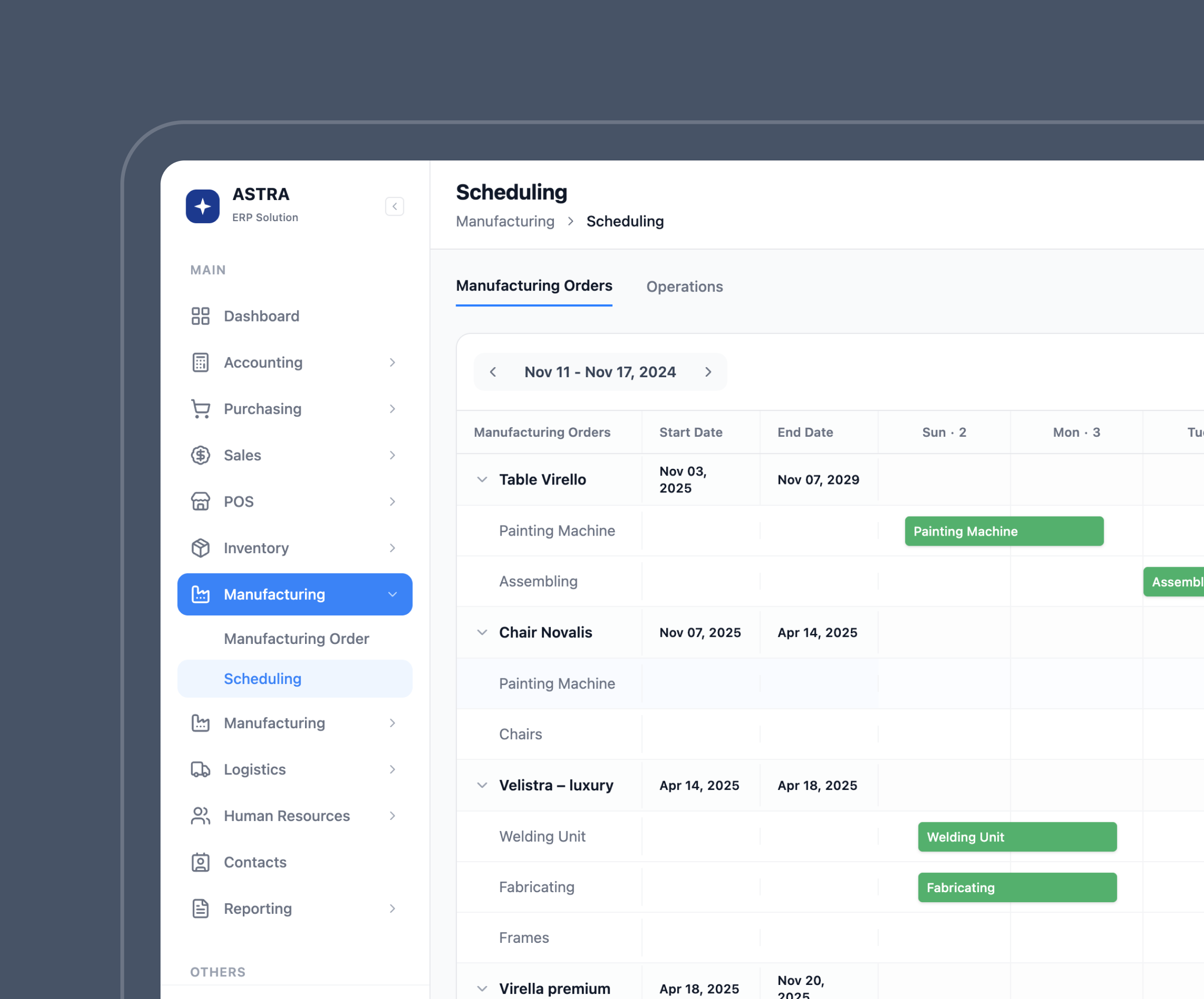

Having over 27 years of experience in enterprise software development, we can engineer multimodal, finely-tuned ERP applications that offer critical support for all business processes and provide the foundational intelligence for data-driven decision-making.

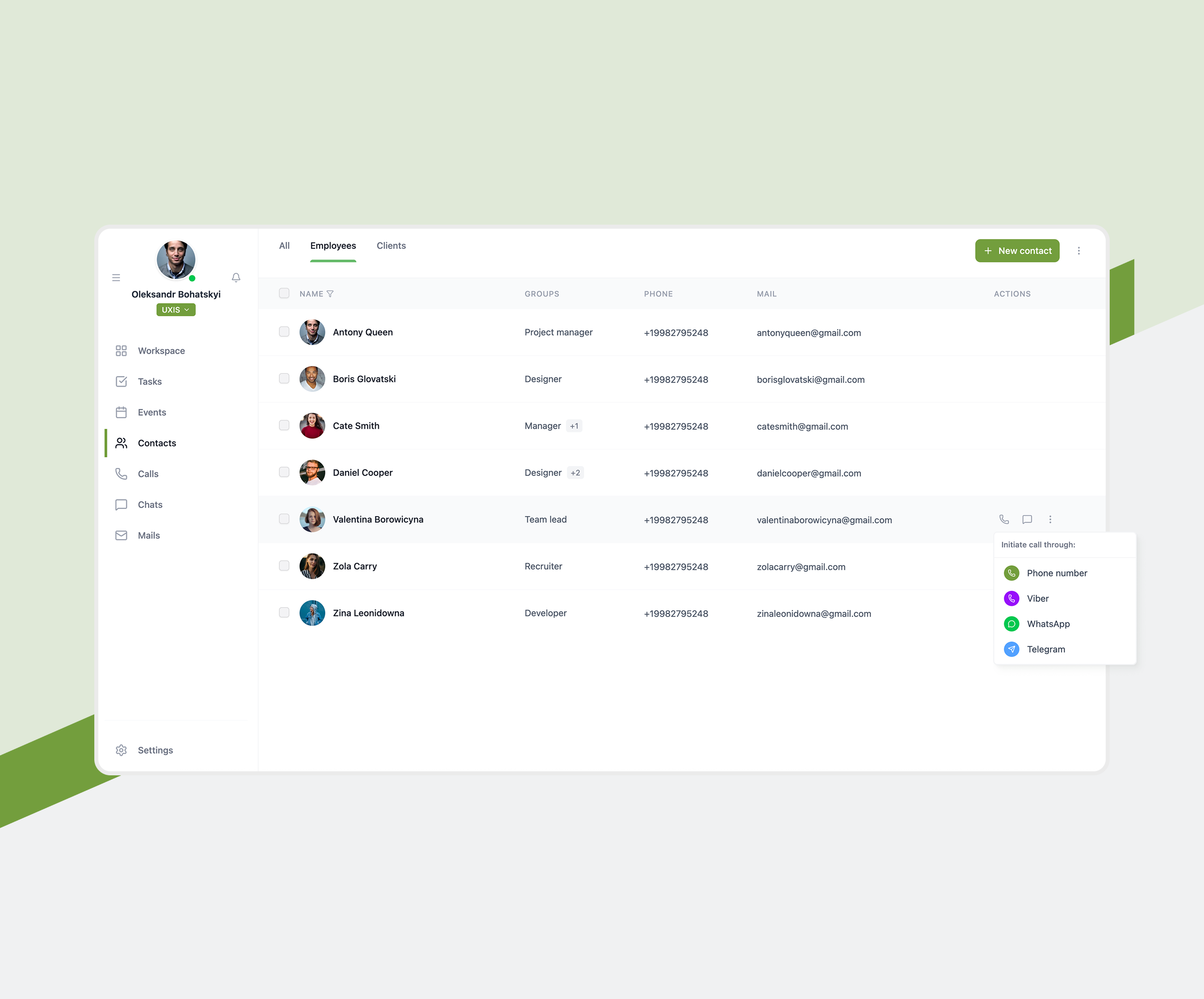

Armed with the insights we’ve gathered from our 80+ completed CRM projects, Elinext professionals offer full-fledged support on CRM projects, be that off-the-shelf CRM systems customization or engineering tailored AI-powered CRMs from scratch.

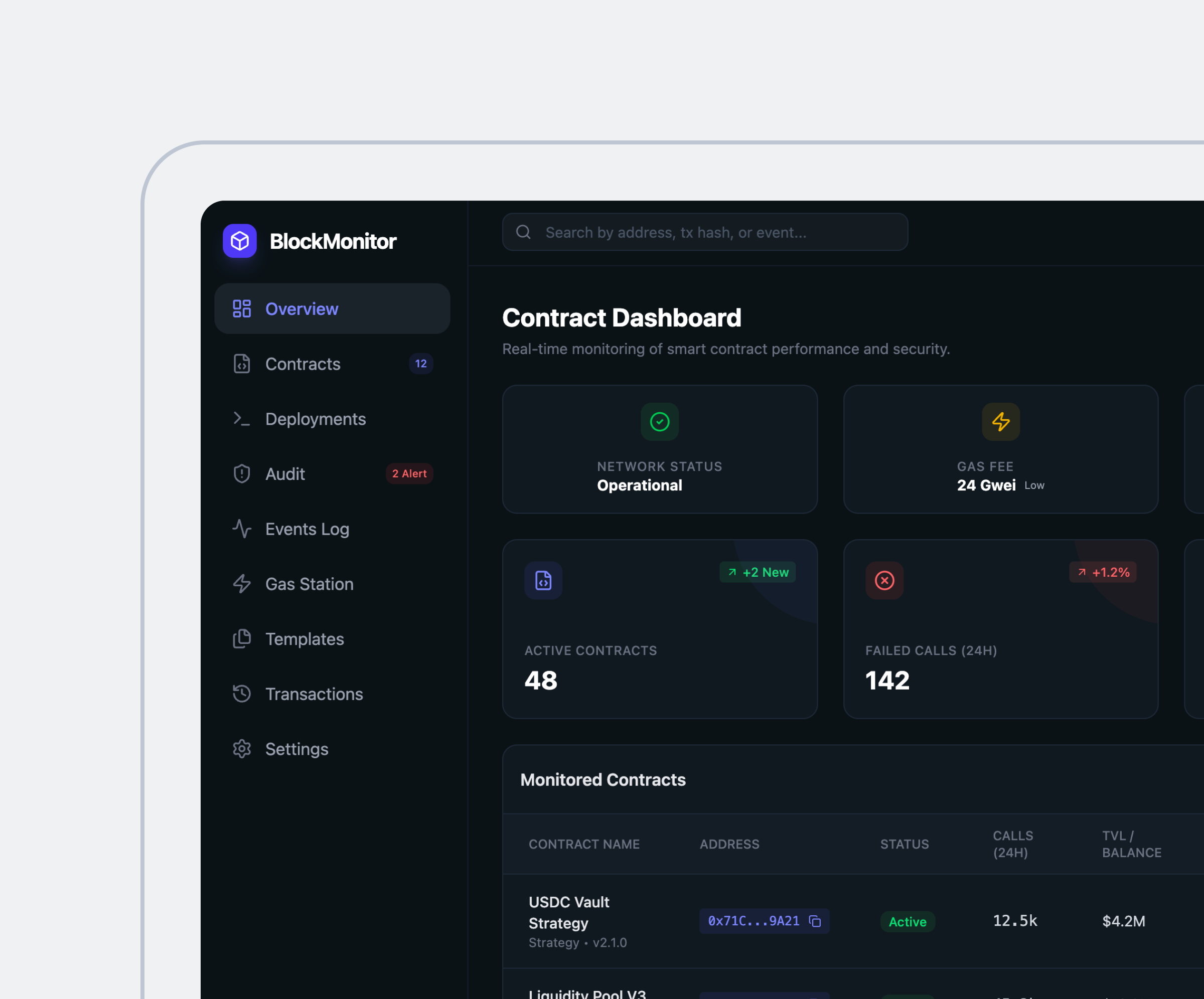

From crypto wallets to currency exchange platforms, smart contracts, ICOs, and more, we rely on our 10+ years of experience in blockchain software development to create robust decentralized software tailored to cater to the diverse demands of 16+ industries.

With a sound team of ML developers having 2-8 years of professional experience, we provide FIs with full-scope ML consulting services ranging from advisory on ML adoption to development/deployment of tailored ML models, and the ongoing optimization of your existing ML solutions.

At Elinext, we unite 20 years in the big data domain with our industry know-how to support financial brands’ journeys toward creating optimal architectures, pipelines, and solutions that underpin the intelligent use of massive-scale data.

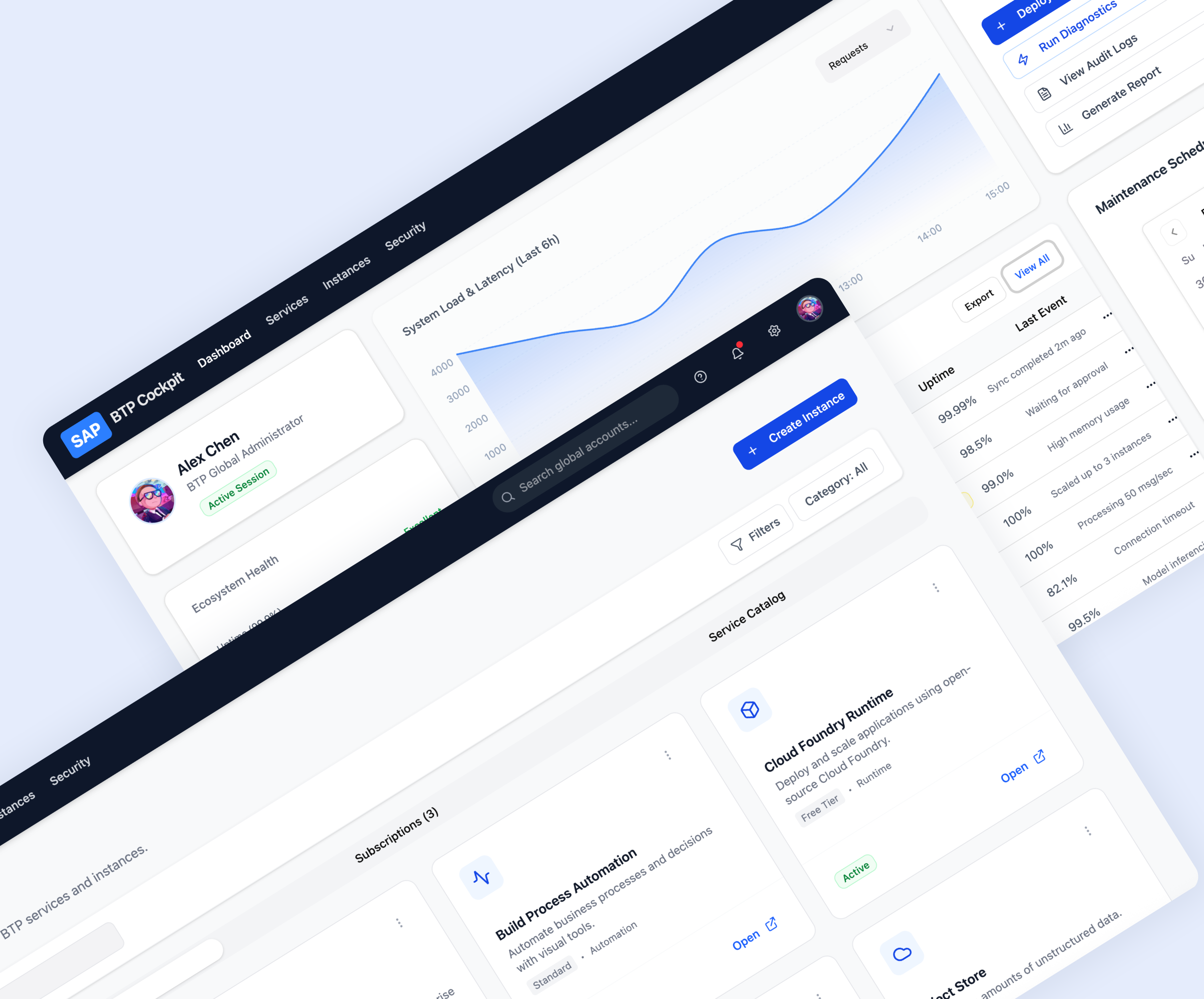

If you are a BFSI organization, you can use our decade-long cloud expertise to build a new, cost-effective, and fully compliant cloud-based solution or migrate the existing one to the cloud with zero downtime and maximum security.

Leverage the benefits of IoT for your finance business – including one-touch payments, better fraud detection capabilities, and hyper-personalized customer experience – by hiring the services of Elinext, a reputable IoT company with a demonstrated track record of over 25 relevant projects.

Being proficient in all major blockchain frameworks like Hyperledger, Ethereum, NEM, and Stellar, we offer expert cryptocurrency development services, covering Custom Coin Development, Token Migration Services, Crypto Coin Launch Services, Exchange Listing & Integration, etc.

In DevOps since 2015, Elinext has developed its own set of time-proven practices and effective tools (Docker, Kubernetes, OpenShift, Grafana, Prometheus, etc.) to ensure every change during the financial fraud detection software development cycle is instantly tested, deployed, and monitored.

With 70+ successfully accomplished AI initiatives behind us and 10+ years in fintech software development, Elinext is a reliable tech partner to create ML-powered financial software that addresses the distinct strategic challenges of BFSI companies.

Since 1997, the Elinext team has been working alongside our clients to develop and deploy custom data analytics solutions that enable financial services organizations to segment, analyze, and predict with unprecedented accuracy.

Having over 27 years of experience in enterprise software development, we can engineer multimodal, finely-tuned ERP applications that offer critical support for all business processes and provide the foundational intelligence for data-driven decision-making.

Armed with the insights we’ve gathered from our 80+ completed CRM projects, Elinext professionals offer full-fledged support on CRM projects, be that off-the-shelf CRM systems customization or engineering tailored AI-powered CRMs from scratch.

From crypto wallets to currency exchange platforms, smart contracts, ICOs, and more, we rely on our 10+ years of experience in blockchain software development to create robust decentralized software tailored to cater to the diverse demands of 16+ industries.

With a sound team of ML developers having 2-8 years of professional experience, we provide FIs with full-scope ML consulting services ranging from advisory on ML adoption to development/deployment of tailored ML models, and the ongoing optimization of your existing ML solutions.

At Elinext, we unite 20 years in the big data domain with our industry know-how to support financial brands’ journeys toward creating optimal architectures, pipelines, and solutions that underpin the intelligent use of massive-scale data.

If you are a BFSI organization, you can use our decade-long cloud expertise to build a new, cost-effective, and fully compliant cloud-based solution or migrate the existing one to the cloud with zero downtime and maximum security.

Leverage the benefits of IoT for your finance business – including one-touch payments, better fraud detection capabilities, and hyper-personalized customer experience – by hiring the services of Elinext, a reputable IoT company with a demonstrated track record of over 25 relevant projects.

Being proficient in all major blockchain frameworks like Hyperledger, Ethereum, NEM, and Stellar, we offer expert cryptocurrency development services, covering Custom Coin Development, Token Migration Services, Crypto Coin Launch Services, Exchange Listing & Integration, etc.

In DevOps since 2015, Elinext has developed its own set of time-proven practices and effective tools (Docker, Kubernetes, OpenShift, Grafana, Prometheus, etc.) to ensure every change during the financial fraud detection software development cycle is instantly tested, deployed, and monitored.

Custom AI Fraud Detection Solutions We Offer

Real-time transaction monitoring identifies cyber threats by continuously analyzing financial transactions to detect and respond to anomalies and suspicious activities.

Modern fraud detection solutions for financial organizations by Elinext rely on data analytics, machine learning, and automation to spot abnormal and potentially dangerous user and device behavior.

The advanced financial fraud detection solutions we build embed risk-based authentication tech that helps prevent fraud by adjusting the authentication requirements based on the perceived risk of each transaction.

We can build AI tools with features like Payment Flow Analysis, User History and Behavior Analysis, Watchlist Evaluation, Real-Time Risk Scoring and Response, etc., to stop instant payment fraud early.

Hire our services to design custom financial fraud detection solutions that use deep learning models, computer vision, blockchain, and other advanced tech to detect falsified or misrepresented claims.

AI-led fraud detection solutions for financial organizations that we engineer can analyze corporate IT systems to identify potential fraud threats, as well as evaluate the likelihood and impact of such illicit activities on business operations.

-

Real-Time Transaction Monitoring

Real-time transaction monitoring identifies cyber threats by continuously analyzing financial transactions to detect and respond to anomalies and suspicious activities.

-

Behavioral Analytics

Modern fraud detection solutions for financial organizations by Elinext rely on data analytics, machine learning, and automation to spot abnormal and potentially dangerous user and device behavior.

-

Risk-Based Authentication

The advanced financial fraud detection solutions we build embed risk-based authentication tech that helps prevent fraud by adjusting the authentication requirements based on the perceived risk of each transaction.

-

Instant Payment Fraud Prevention

We can build AI tools with features like Payment Flow Analysis, User History and Behavior Analysis, Watchlist Evaluation, Real-Time Risk Scoring and Response, etc., to stop instant payment fraud early.

-

Fraudulent Claims Detection

Hire our services to design custom financial fraud detection solutions that use deep learning models, computer vision, blockchain, and other advanced tech to detect falsified or misrepresented claims.

-

AI Risk Assessment

AI-led fraud detection solutions for financial organizations that we engineer can analyze corporate IT systems to identify potential fraud threats, as well as evaluate the likelihood and impact of such illicit activities on business operations.

Clients We Serve

With a reach that is both local and global, Elinext delivers top-flight financial fraud detection solutions to meet the demands and the pace set by modern banking and finance companies.

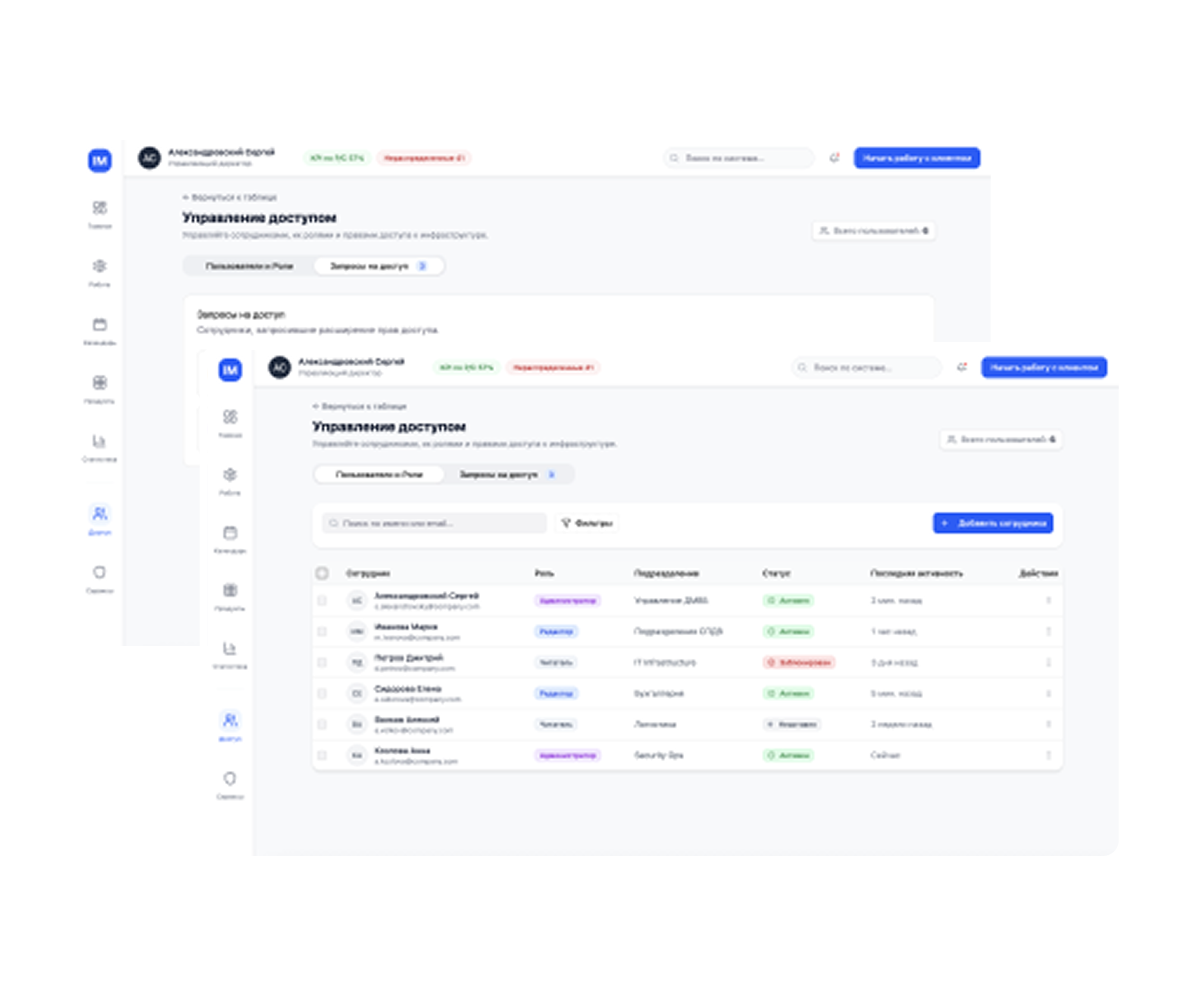

An ISO 9001- and ISO 27001-certified IT service provider, Elinext, engineers fully compliant software solutions that monitor online and offline banking transactions in real-time to detect anomalies that typically indicate fraudulent activities; identify and prioritize potential vulnerabilities in banking systems and networks; help maintain regulatory compliance, and more.

- Data privacy and security solutions

- Business intelligence solutions

- Banking CRM software

- Financial risk management software

We deliver software that promotes regulatory compliance using pre-configured rules; helps ensure the correspondence to international requirements & standards; automates accounting duties (invoice processing, bank reconciliation, expense management, payroll processing, tax compliance, and financial reporting); empowers users to enhance visibility, efficiency, and control in risk management and hedge accounting processes, etc.

- Invoice management and processing software

- Hedge accounting software

- Payroll management software

- Billing management systems

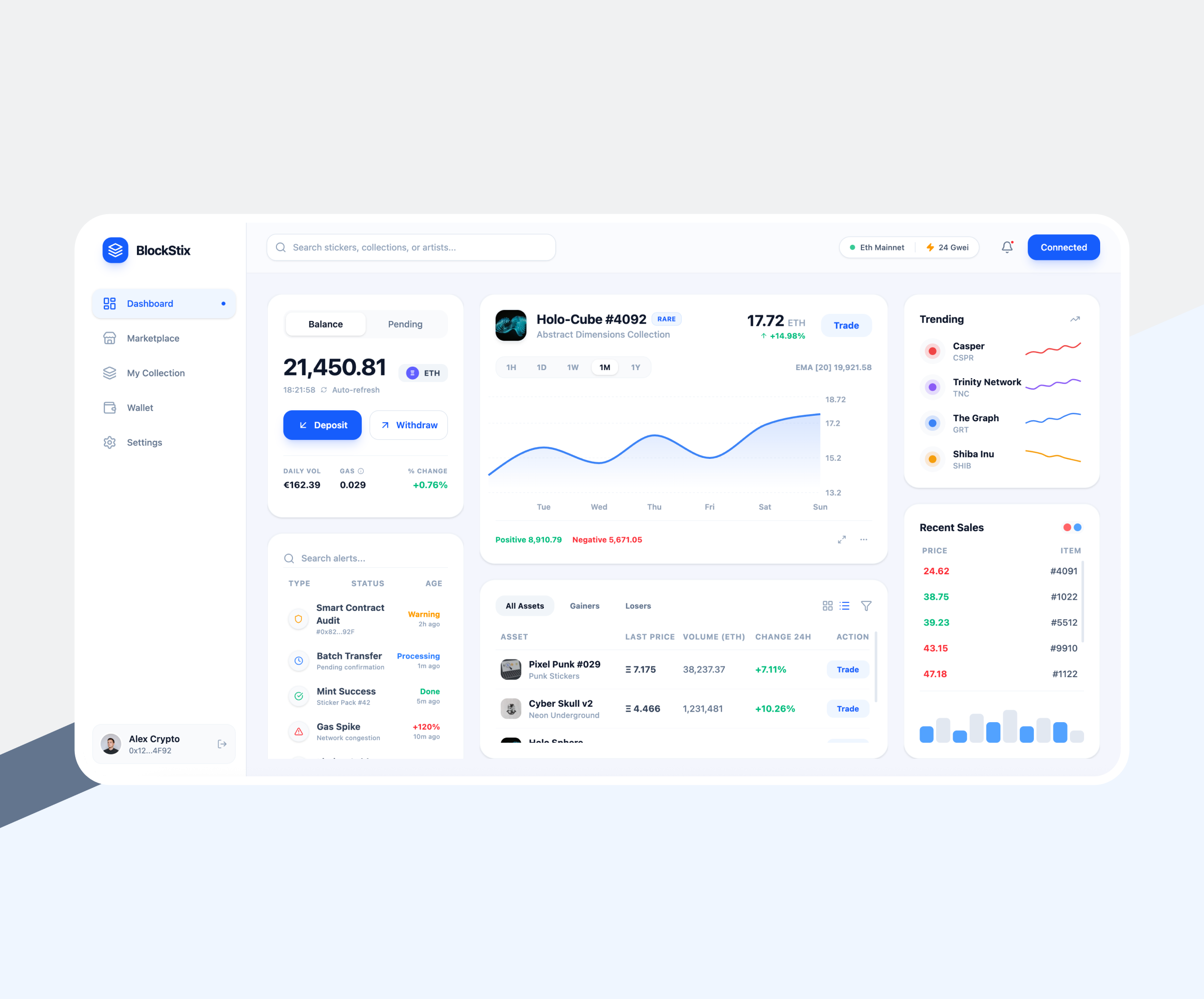

Experienced in PCI DSS, IFRS, and GDPR-compliant software development, we serve the payments industry with innovative systems that enable seamless domestic and cross-border funds transfers; provide real-time analytics of payment transactions and payer behavior to proactively identify and mitigate fraud; and offer greater mobility, convenience, and flexibility to process payments from any location.

- Money transfer applications

- Payment gateways

- Payment fraud detection systems

- (m)POS Systems

Backed up with 17+ years of experience in insurance software development, we design and implement specialized software that automates fraudulent claims detection with advanced, multi-layered analytics; streamlines policy lifecycle management; ensures seamless insurance application processing, risk assessment, policy issuance, and renewal, etc.

- Anti-fraud claims solutions

- Policy administration software

- Underwriting software

- Advanced insurance CRM systems

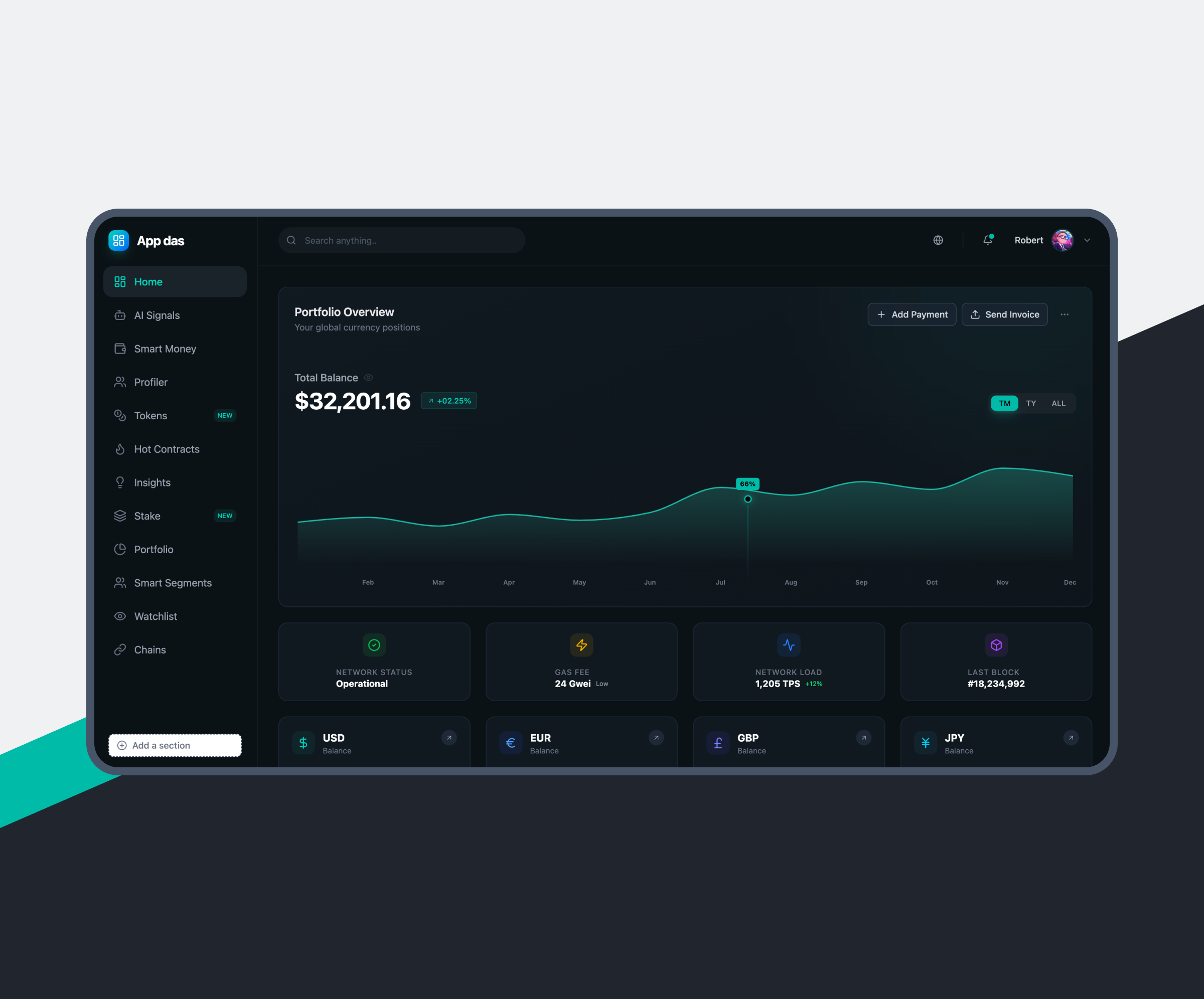

We can create trading solutions that allow you to easily analyze any financial statements and financial information; use AI to provide automated investment management services (portfolio rebalancing, tax-loss harvesting, financial planning, etc.), minimizing human supervision; offer traders actionable insights based on technical indicators, economic events, and market trends, and more.

- Robo advisory platforms

- Stock trading apps

- Alerting tools

- Trading signals and pattern recognition tools

If you are a lending institution, you can count on the Elinext team to get custom-made lending solutions that enable you to seamlessly manage the end-to-end lending process; leverage advanced credit assessment models integrating both traditional and alternative data to enhance credit scoring accuracy; and help optimize debt collection through the automation of debt collection execution, control, enforcement, and dispute management processes.

- Loan origination software

- Loan management systems

- Credit scoring tools

- Debt collection systems

Investment companies use our custom software development services to build robust solutions that let users easily manage their investments (due to advanced features like Real-time synchronization with Ethereum and Bitcoin-based blockchains, Order management dashboard, Transactions tracking, etc.); semi-automate agreement creation and allow multiple parties to seamlessly collaborate on documents related to bonds, and more.

- ICO investments and management apps

- Contract management software for bond trading

- Investment management software

- Masternodes investment web platforms

In blockchain development since 2015, Elinext is an experienced technology partner for financial service brands looking to develop reliable DeFi solutions to facilitate secure peer-to-peer cryptocurrency exchange, enhance crypto asset management, and ensure the secure custody and transfer of digital assets.

- Cryptocurrency exchange platforms

- Crypto wallets

- Smart contracts

- ICOs

With a reach that is both local and global, Elinext delivers top-flight financial fraud detection solutions to meet the demands and the pace set by modern banking and finance companies.

What Our Experts SayWhat Our Experts Say

The Benefits of Financial Fraud Detection Solutions by Elinext

Choose Your

Service Option

Hire Fraud Detection Engineers

from Elinext

Poland

Vietnam

Kazakhstan

Vietnam

Poland

Georgia

Poland

Kazakhstan

Why Elinext?

Listen to Our Clients

FAQ

-

Modern fraud detection solutions for financial organizations are software systems that rely on traditional and advanced technologies to monitor organizations’ IT assets in real time and help BFSI firms prevent, identify, assess, and respond to financial fraud risks.

-

Financial fraud detection solutions empower FIs to proactively mitigate risk, enhance regulatory compliance, and avoid financial and reputation damage by leveraging advanced analytics and AI to identify known and emerging fraud threats.

-

While AI can detect many common types of fraud including identity theft, phishing scams, payment fraud, and credit card fraud, it cannot identify all types. Its performance depends on data quality and ML model type, making it a powerful component within a broader, layered defense strategy against financial crime.

-

Finance fraud detection solutions can be integrated with existing IT infrastructure via APIs and secure data connectors. This enables real-time analysis within core platforms, minimizing disruption while enhancing governance and compliance.

-

Elinext develops custom AI fraud detection solutions strictly adhering to legal and regulatory requirements related to data protection, privacy, and security (ISO 27001, GDPR, PCI-DSS, GLBA, IFRS, Sarbanes-Oxley Act, etc.).

-

Serving all kinds of FIs (banks, credit unions, loan and mortgage companies, trust companies, etc.) Elinext creates tailored fraud detection solutions that balance pre-built frameworks with deep customization. This ensures precise alignment to FIs’ unique risk landscape, operational workflows, and evolving regulatory requirements.

Looking for Related Services?

Financial Solutions News

Contact Us