In 2025, insurance agency software development is driven by key trends in the insurance industry: AI-powered automation streamlines claims processing and underwriting, while embedded insurance integrates policies into digital platforms to improve customer engagement. For example, AI-powered chatbots handle routine queries, while IoT devices enable real-time risk assessments. Insurance industry trends 2025: insurers that adopt these technologies will see faster service, improved personalization, and greater operational efficiency.

Why Should Your Company Develop an Insurance Mobile App?

Developing a mobile app for an insurance company through software development for insurance business and using data analytics services provides significant benefits. For example, a mobile app allows customers to instantly submit claims and access policy information at any time, while data analytics services help insurers understand user behavior and personalize offers. This improves customer satisfaction, streamlines operations, and drives business growth in a digitally oriented market.

Trends of Insurance App & Software Development

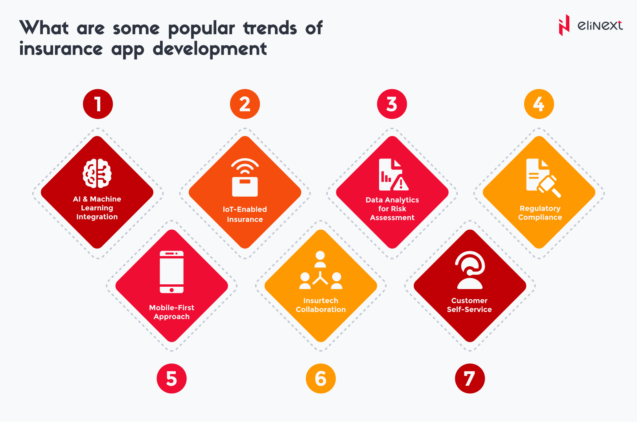

Insurance product development software streamlines the creation of new offerings by keeping up with insurance industry trends such as digital transformation and customer-centric solutions. Growing trends in insurance app and software development include AI integration, personalization, and improved user experience, which are fundamentally changing the way insurers meet changing customer needs and improve operational efficiency.

-

AI and ML Integration

AI software development services enable companies to integrate AI and ML technologies to create smarter solutions. For example, insurance companies use AI and ML integration to automate claims processing, improve fraud detection, and enhance customer service, resulting in more efficient and personalized interactions.

-

Mobile-First Approach

Insurance industry trends 2025 are dominated by a mobile-first approach. Insurers offer apps for managing policies, filing claims, and quoting. For example, users can instantly file claims via a mobile device, which increases customer satisfaction and engagement.

-

IoT-Enabled Insurance

Insurance agency software development takes advantage of the Internet of Things (IoT)-based insurance. Smart devices such as car telematics systems or home sensors send data to insurers in real time, enabling dynamic pricing and proactive risk management. Careful drivers receive lower insurance premiums.

-

Insurtech Collaboration

Insurers are partnering with tech startups to integrate AI, automation, and digital platforms. Software development for insurance business is now thriving thanks to collaborations with insurtech. For example, a traditional insurer is teaming up with a fintech company to launch a digital claims portal.

-

Data Analytics for Risk Assessment

By analyzing customer data, insurers predict their needs and risks. Insurance product development software uses data analytics to personalize offers. The software offers customized life insurance plans based on lifestyle and health data. Big data development services revolutionize risk assessment. For example, property insurers use satellite data and weather conditions to accurately price policies.

-

Customer Self-Service

Customers can purchase, renew or change policies online without agent intervention. A user instantly updates their address and insurance coverage through a web portal. Thus insurance product development software provides customer self-service.

-

Regulatory Compliance

Compliance in insurance software ensures adherence to laws and standards. For example, automated compliance checks when processing insurance claims help insurance companies avoid fines and maintain the trust of regulators and customers.

Get Ready for Technology Trends in the Insurance Industry

Insurance industry trends highlight the need to be prepared for technology trends. Insurers are adopting AI, IoT, and cloud solutions to streamline operations and improve customer service. Chatbots process insurance claims, and IoT devices monitor risks, making insurance more flexible and efficient.

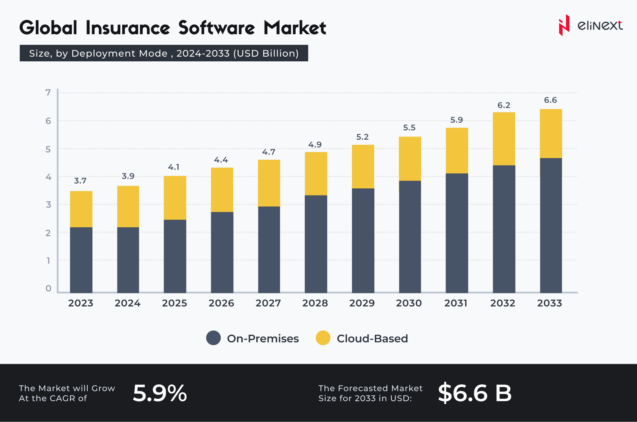

How Elinext’s Software and App Development Solutions Help Insurance

Offering cloud software development services and insurance product development software, Elinext provides scalable and secure solutions for insurers. For example, Elinext’s cloud platforms enable insurance companies to manage policies, automate claims processing, and analyze data in real time, improving efficiency and customer service.

Conclusion

In conclusion, the insurance industry trends 2025 and insurance agency software development point to a technology-driven future. By 2027, AI, IoT, and cloud platforms will dominate, enabling hyper-personalization, real-time risk assessment, and seamless digital experiences. For example, agencies using advanced software will offer instant quotes, automated applications, and personalized products, maintaining leadership in a competitive market.

FAQ

How is AI transforming insurance operations in 2025?

Insurance industry trends 2025 show AI will automates claims processing, detects fraud, and personalizes policies. For example, chatbots instantly process customer queries, improving efficiency and customer satisfaction.

What is hyper-personalization in insurance?

Software development for insurance business enables hyper-personalization by using data to tailor policies. For example, customers receive unique offers based on their lifestyle, driving habits, or health status.

What is embedded insurance and why is it growing?

Embedded insurance is coverage offered at the point of sale of another product, like travel insurance with flight booking. It is growing because it simplifies the process of buying insurance and increases convenience for customers.

What is usage-based and behavior-based insurance?

Usage-based and behavior-based insurance uses real-time data, such as driving habits, to set premiums. For example, careful drivers pay less for auto insurance, which encourages responsible behavior and fair pricing.

How is blockchain being used in insurance?

Blockchain in insurance protects data, automates claims processing, and prevents fraud. For example, smart contracts instantly process claims when conditions are met, reducing paperwork and increasing trust.

What’s the role of generative AI in insurance in 2025?

In 2025, generative AI will create personalized insurance documents, automate customer interactions, and model risk scenarios. For example, AI develops customized insurance proposals, saving time and increasing accuracy.