Decentralized Exchange (DEX) Development Services

What is a Decentralized Exchange (DEX)?

A decentralized exchange, or DEX, is a trading platform where users exchange digital assets directly through smart contracts, without a central authority holding funds. Trades are executed on the blockchain, giving users full control over their assets. DEX platforms improve transparency, reduce custody risks, and enable permissionless trading with on-chain verification.

Decentralized Exchange Development Services We Offer

Elinext builds fully tailored DEX platforms based on your trading model, liquidity logic, and governance rules. Our DEX development services cover architecture, smart contracts, UI, and backend to match your business goals.

We design exchanges that support multiple tokens, stablecoins, and trading pairs. As an experienced DEX development company, Elinext ensures correct token standards, pricing logic, and smooth asset swaps.

Our DEX platforms use audited smart contracts, secure wallet interactions, and on-chain validation. As a decentralized exchange development company, we focus on minimizing risks and protecting user funds.

Elinext integrates DEX platforms with wallets, analytics tools, liquidity providers, and third-party services. These decentralized exchange development services ensure seamless data flow and ecosystem connectivity.

We develop and test smart contracts for trading, liquidity pools, fees, and governance. Our decentralized exchange (DEX) development services prioritize accuracy, transparency, and upgrade-ready logic.

Our team connects fiat and crypto payment gateways where required, enabling smooth onboarding and off-chain interactions. These integrations expand accessibility without compromising decentralization principles.

Elinext implements optional 2FA layers for user actions such as withdrawals or account changes. This adds an extra security layer on top of blockchain-based authorization.

We help define tokenomics, liquidity strategies, and technical architecture before development starts. Our consulting approach reduces risks and shapes effective DEX development solutions.

Elinext builds automated market maker models with custom formulas, fee structures, and liquidity incentives. These systems support stable trading and efficient price discovery.

We develop cross-chain bridges that allow assets to move between blockchains securely. This expands liquidity access and supports multi-chain DEX strategies.

Elinext builds fully tailored DEX platforms based on your trading model, liquidity logic, and governance rules. Our DEX development services cover architecture, smart contracts, UI, and backend to match your business goals.

We design exchanges that support multiple tokens, stablecoins, and trading pairs. As an experienced DEX development company, Elinext ensures correct token standards, pricing logic, and smooth asset swaps.

Our DEX platforms use audited smart contracts, secure wallet interactions, and on-chain validation. As a decentralized exchange development company, we focus on minimizing risks and protecting user funds.

Elinext integrates DEX platforms with wallets, analytics tools, liquidity providers, and third-party services. These decentralized exchange development services ensure seamless data flow and ecosystem connectivity.

We develop and test smart contracts for trading, liquidity pools, fees, and governance. Our decentralized exchange (DEX) development services prioritize accuracy, transparency, and upgrade-ready logic.

Our team connects fiat and crypto payment gateways where required, enabling smooth onboarding and off-chain interactions. These integrations expand accessibility without compromising decentralization principles.

Elinext implements optional 2FA layers for user actions such as withdrawals or account changes. This adds an extra security layer on top of blockchain-based authorization.

We help define tokenomics, liquidity strategies, and technical architecture before development starts. Our consulting approach reduces risks and shapes effective DEX development solutions.

Elinext builds automated market maker models with custom formulas, fee structures, and liquidity incentives. These systems support stable trading and efficient price discovery.

We develop cross-chain bridges that allow assets to move between blockchains securely. This expands liquidity access and supports multi-chain DEX strategies.

Our Awards and Recognitions

Custom DEX Features & Functions by Elinext

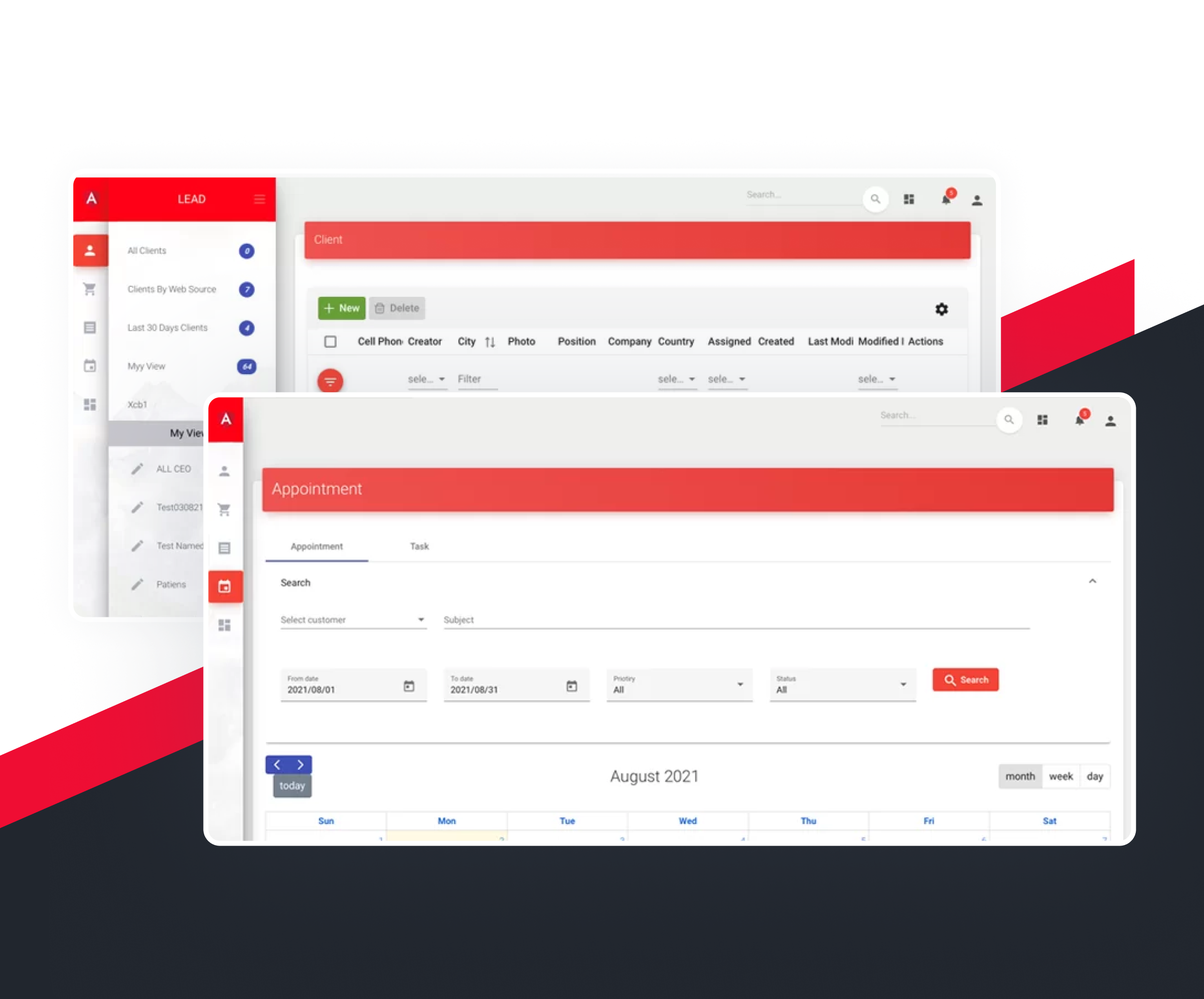

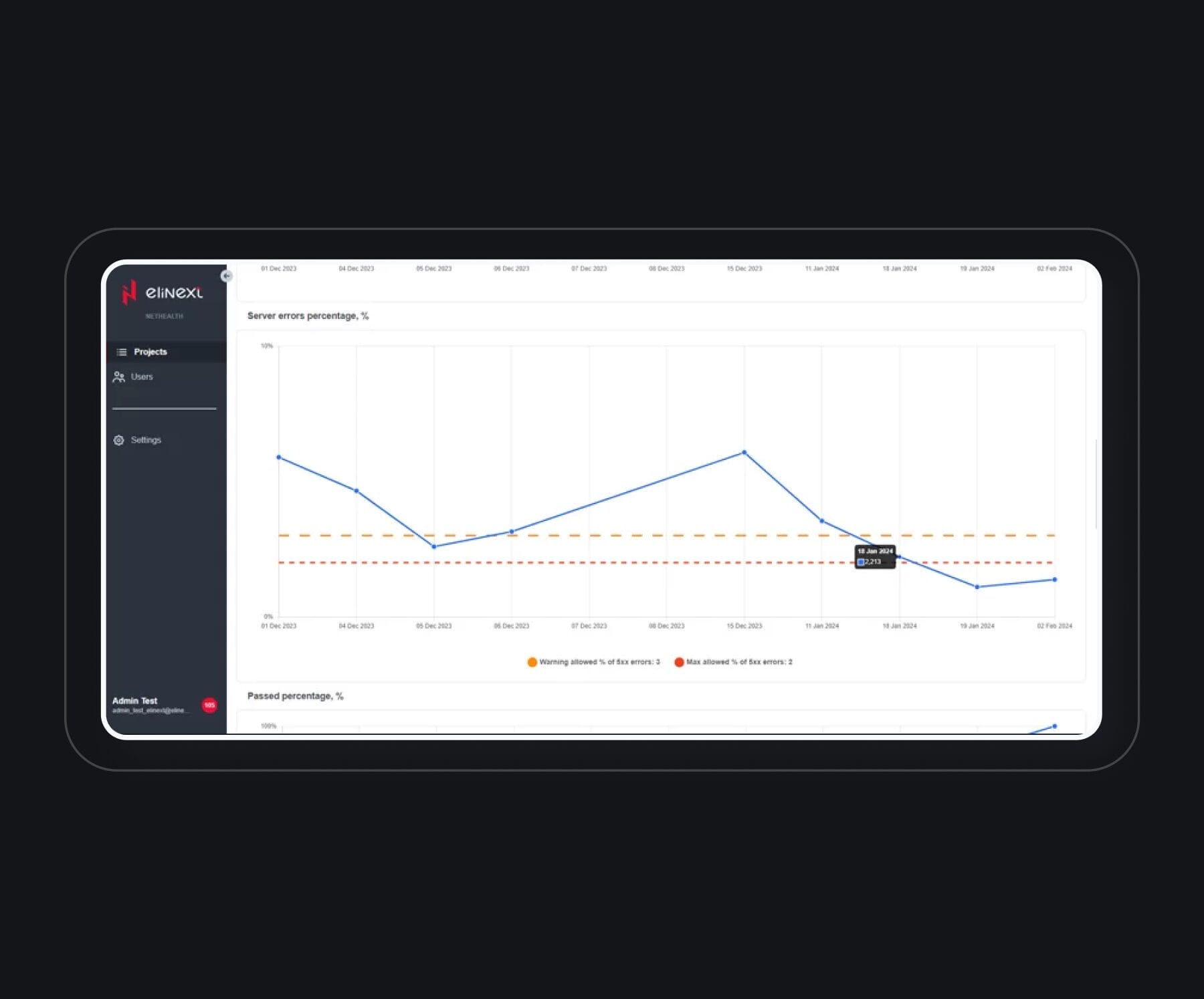

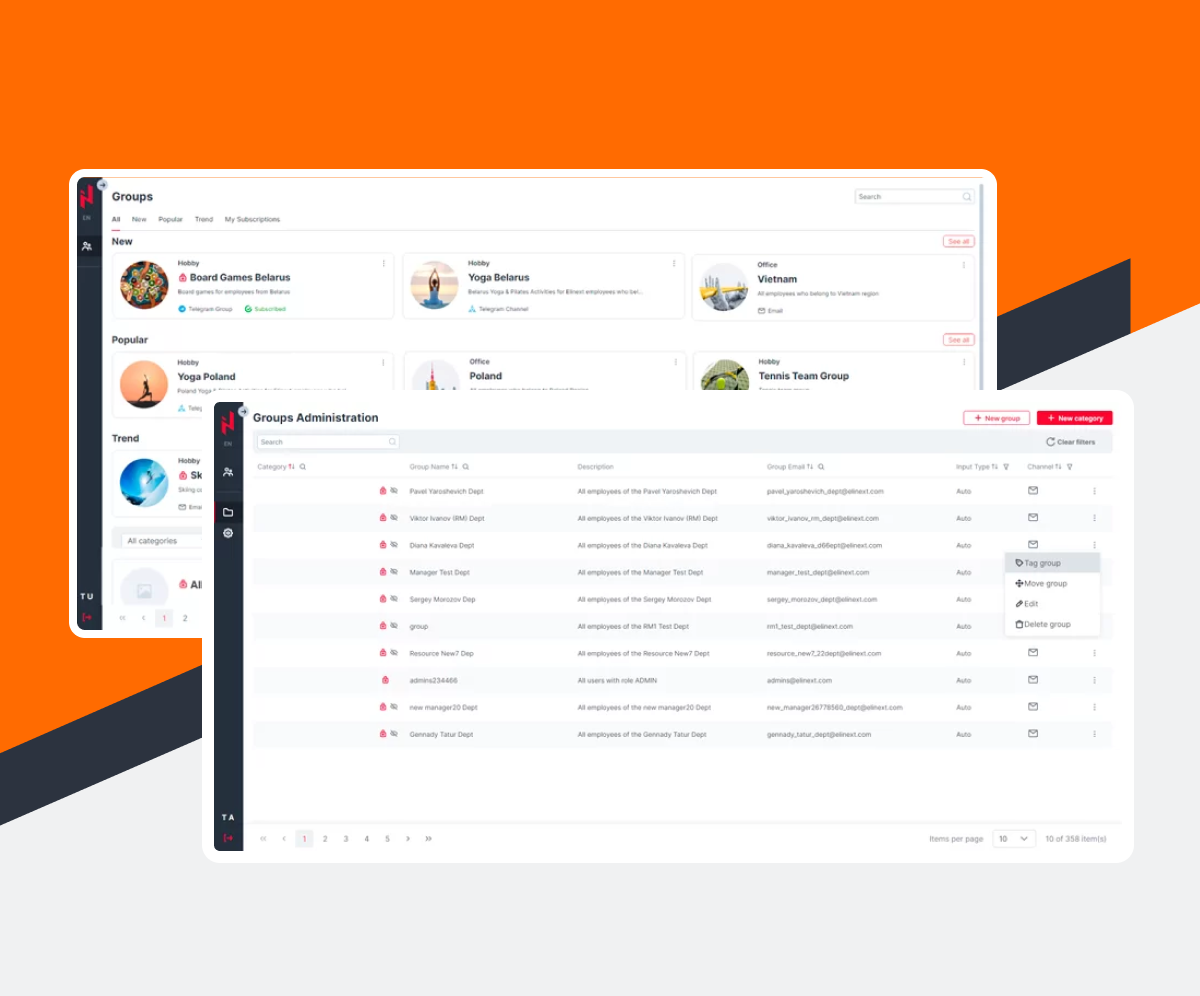

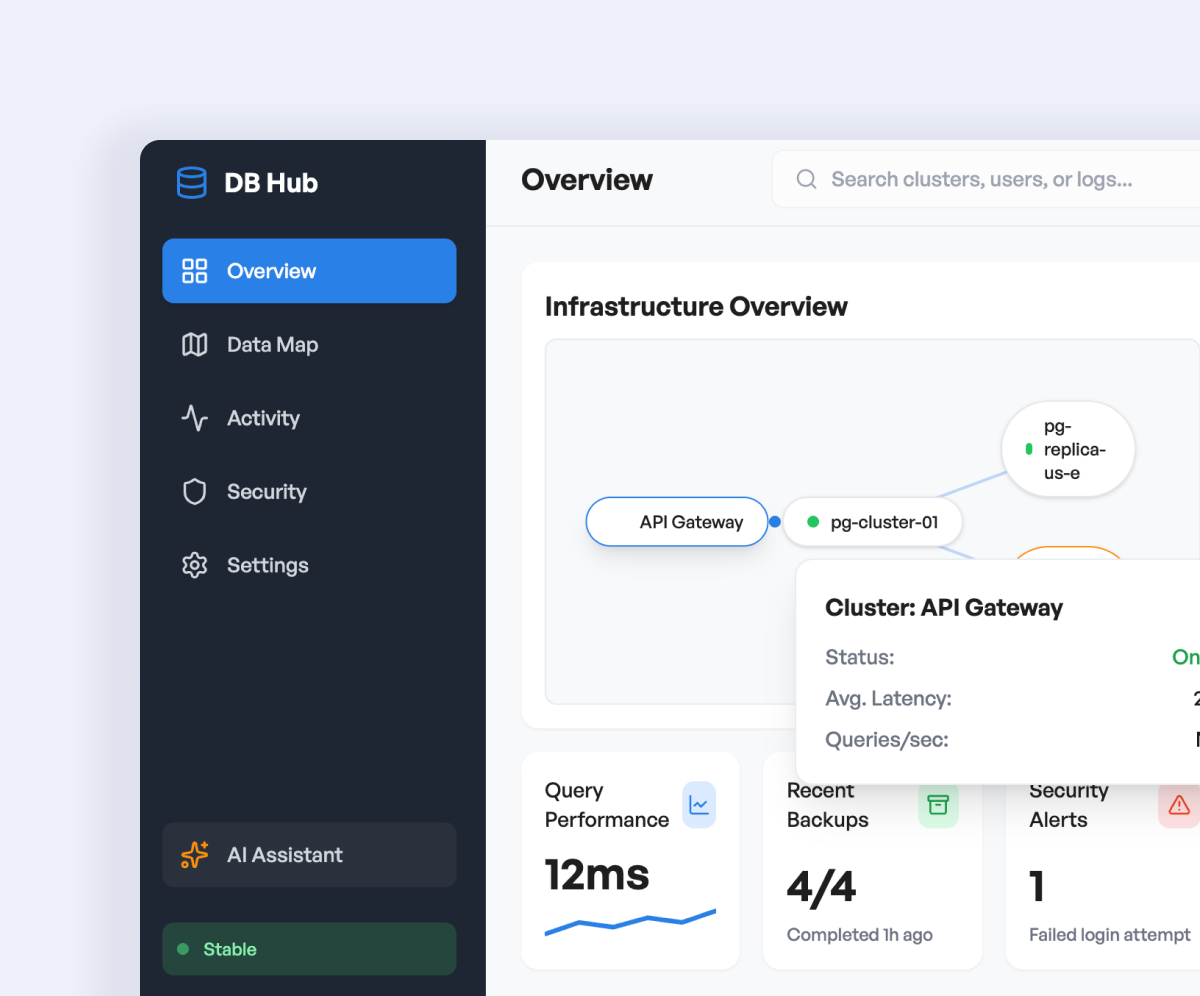

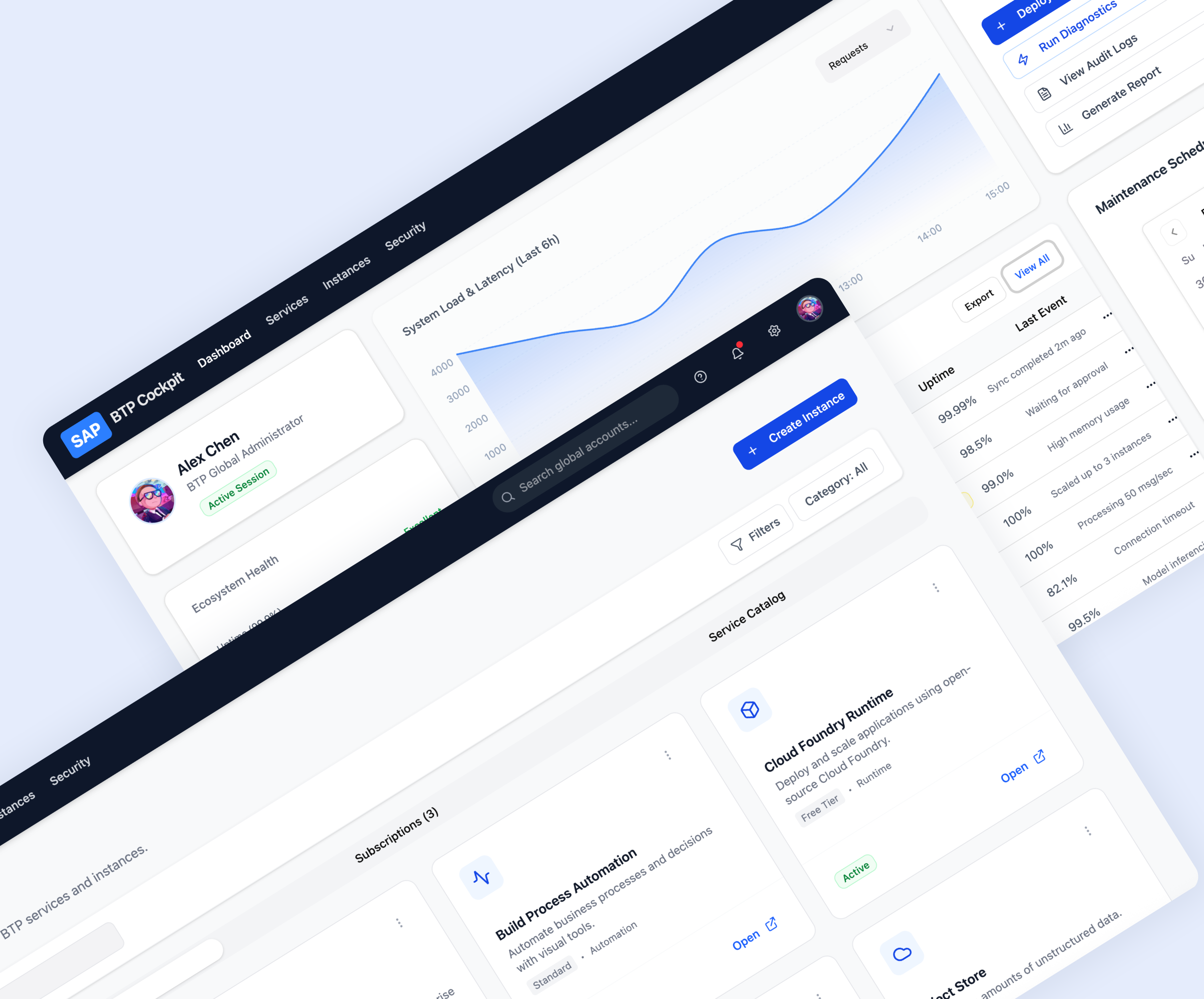

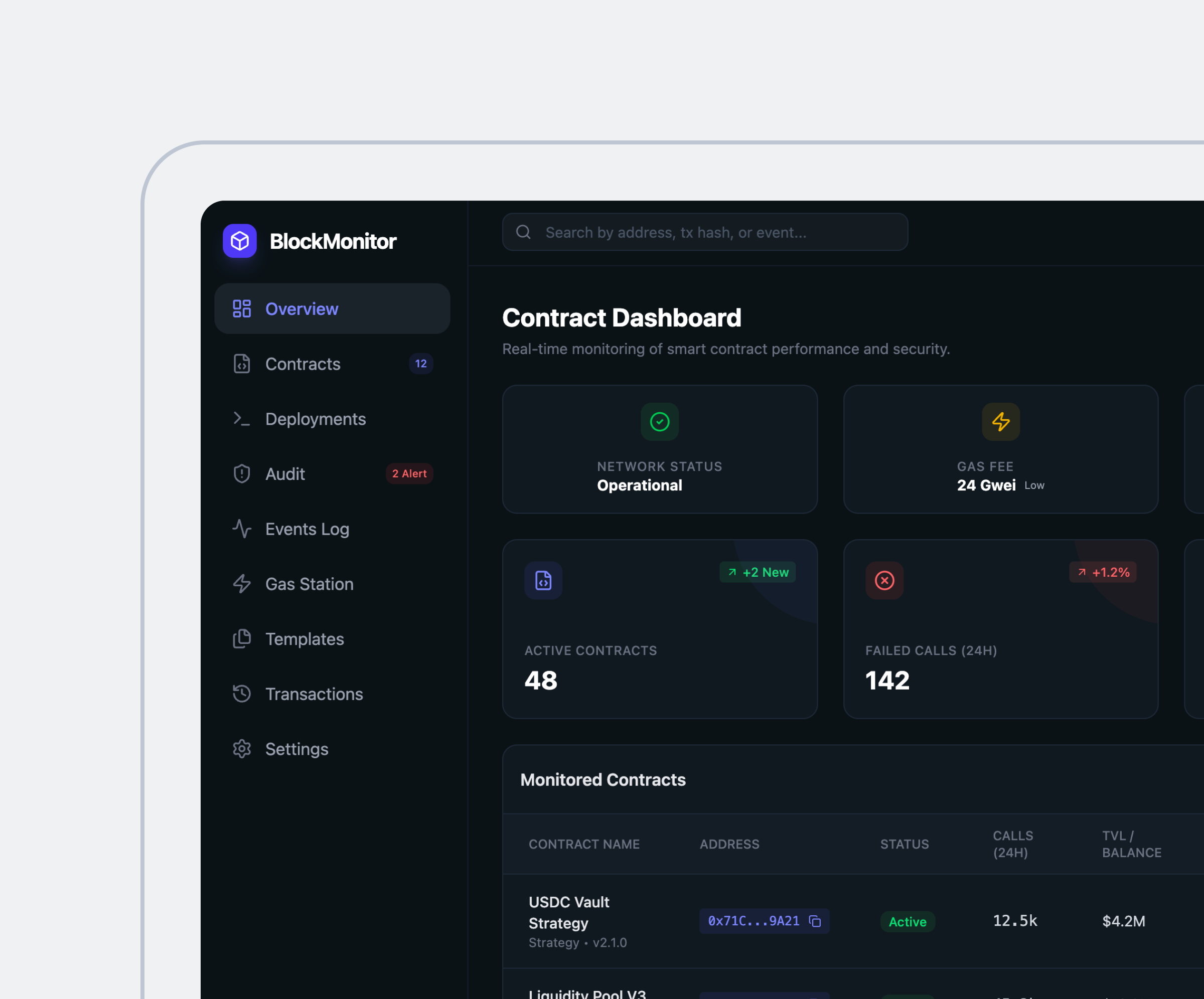

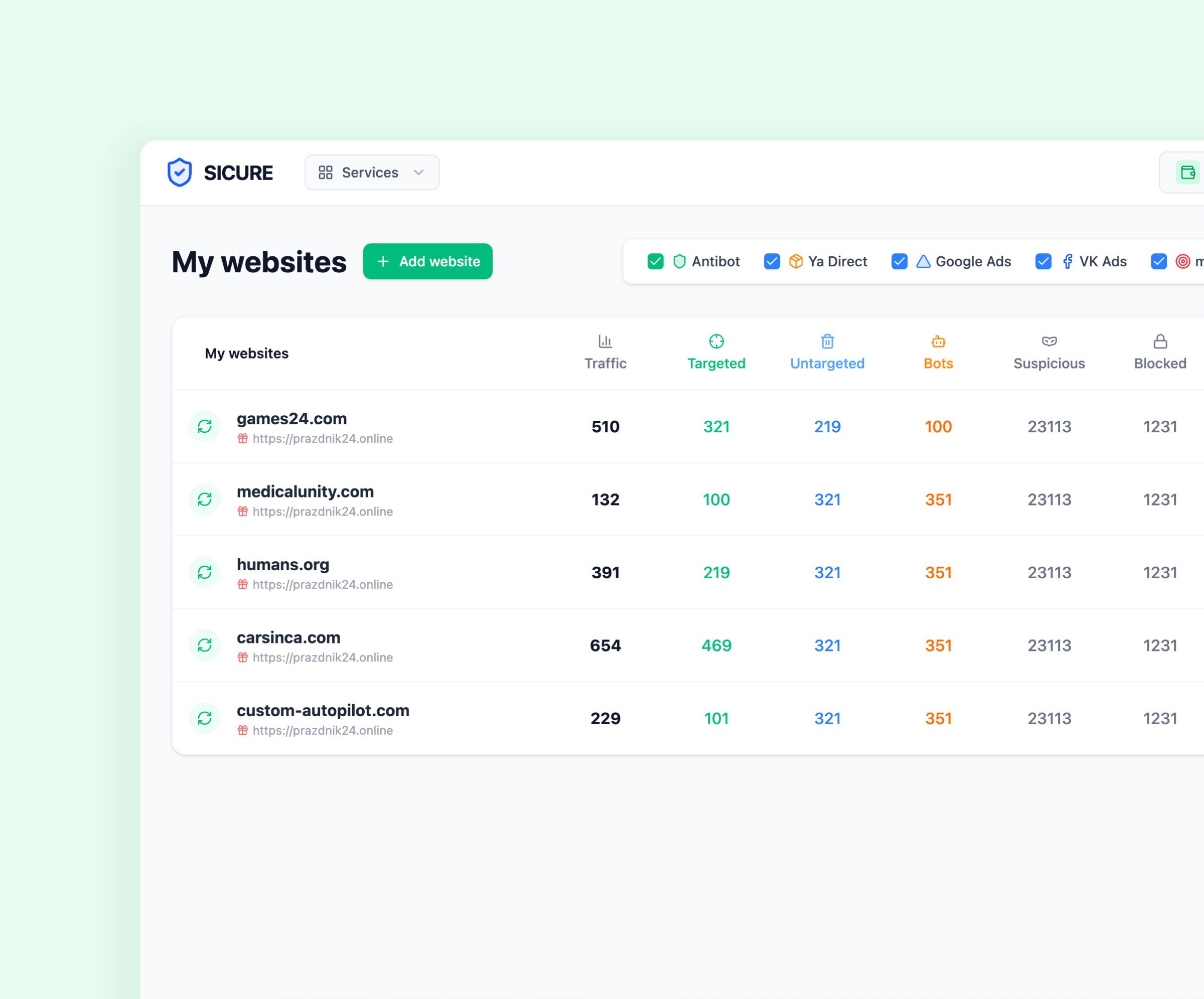

We build admin panels that give operators visibility into liquidity pools, fees, user activity, and system health. This feature is a core part of our DEX development services, enabling efficient platform oversight without central custody.

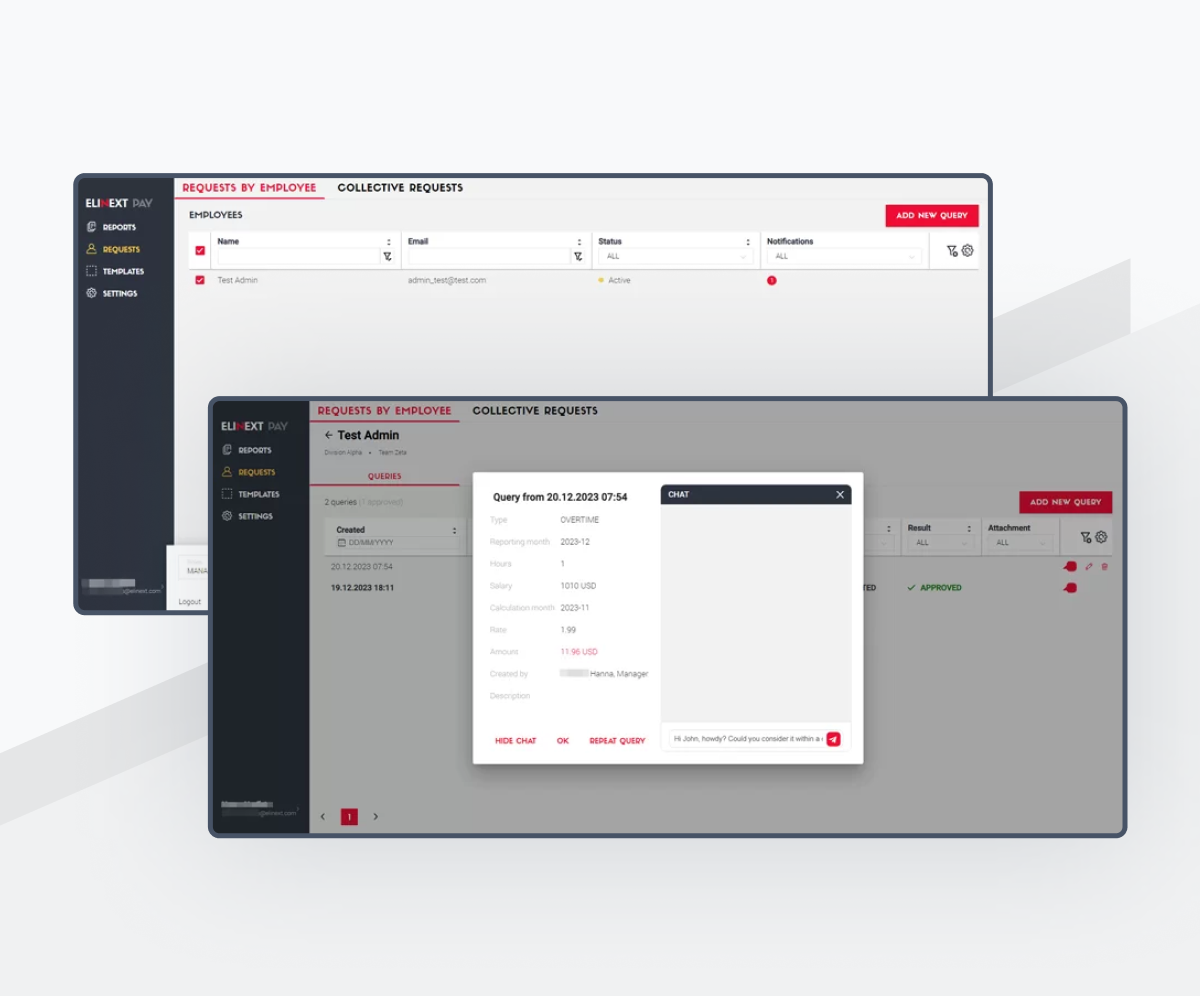

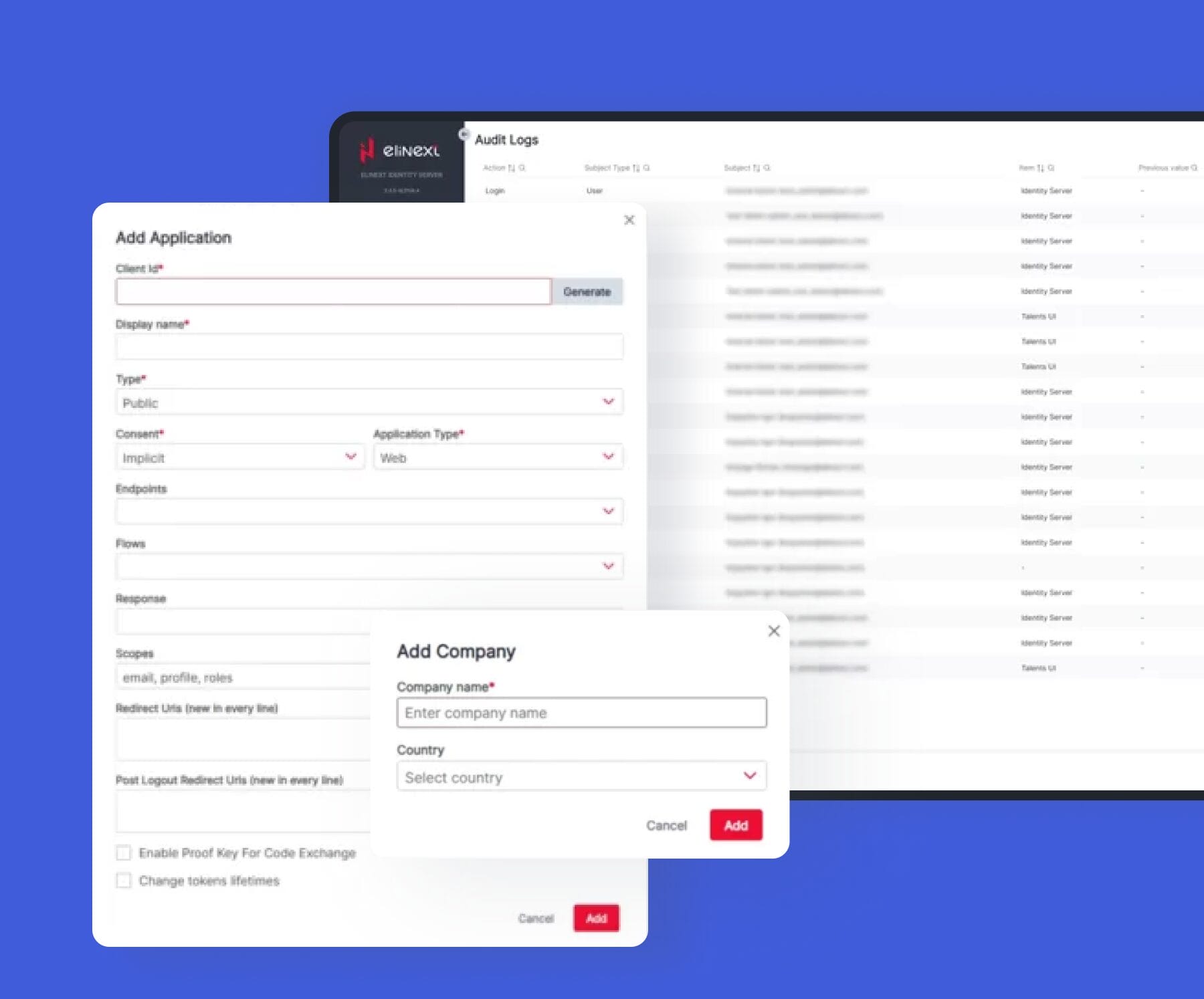

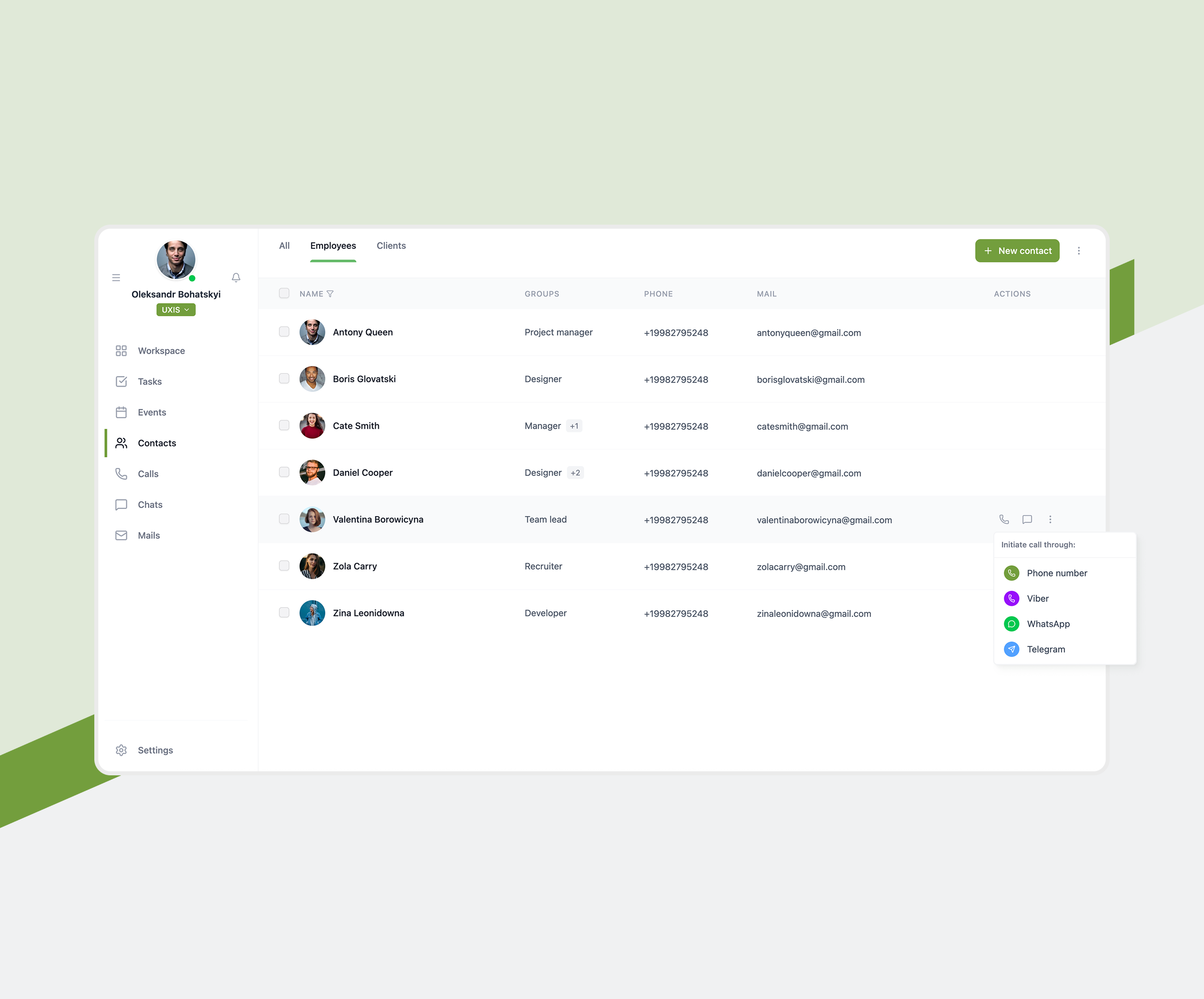

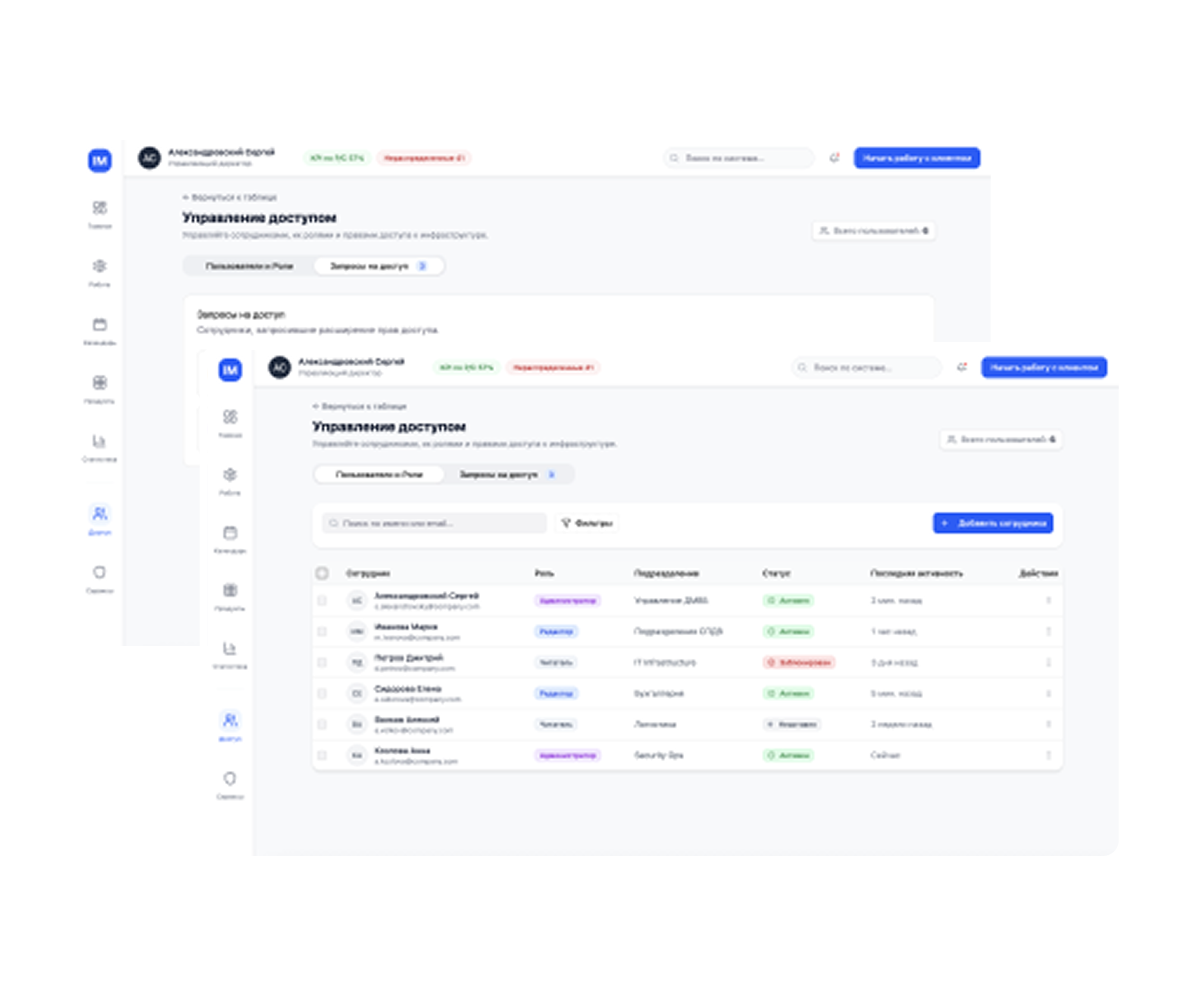

Elinext implements secure authentication flows using wallet-based login, optional 2FA, and role controls. These mechanisms are designed to support user safety within decentralized exchange development services without compromising self-custody.

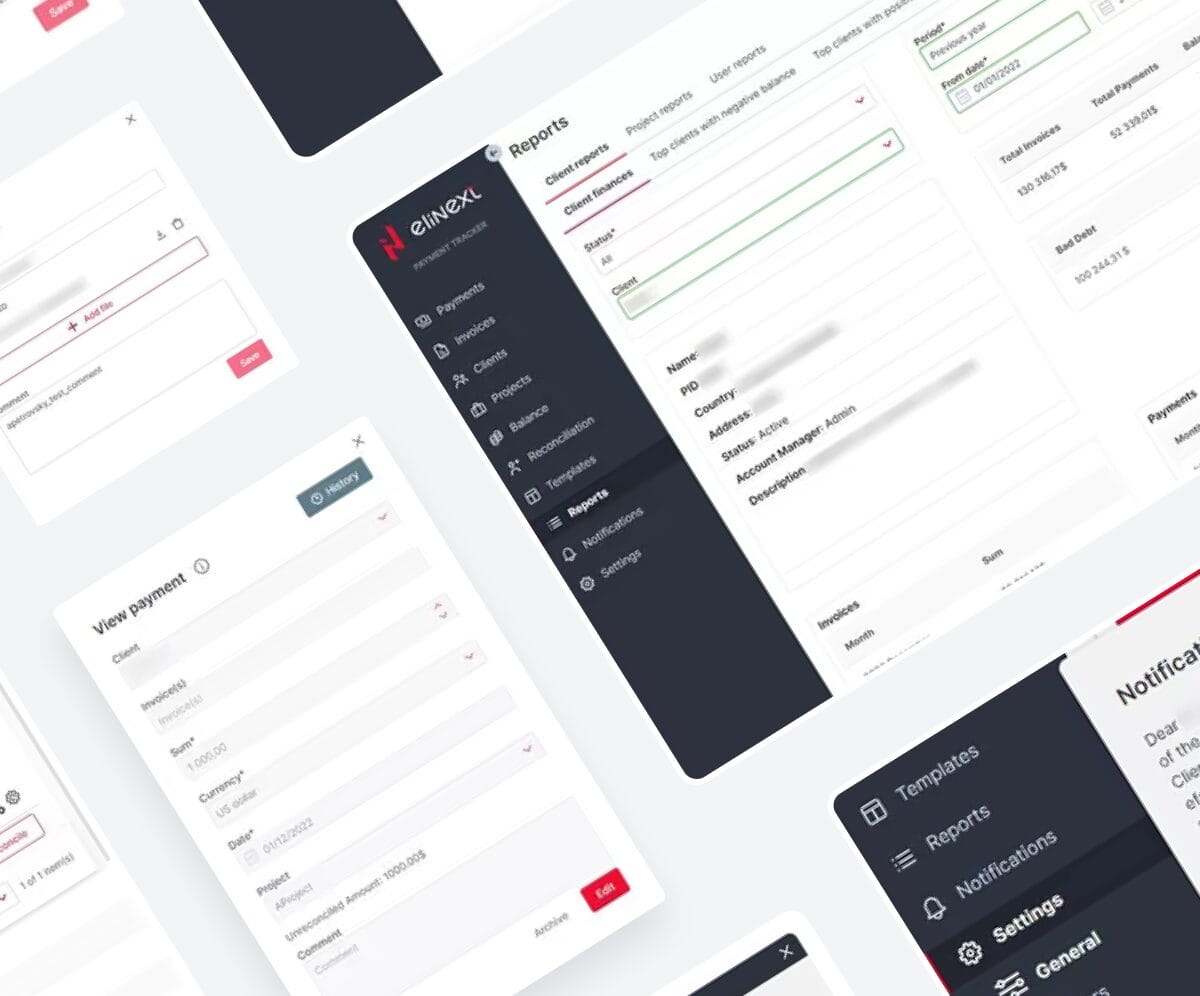

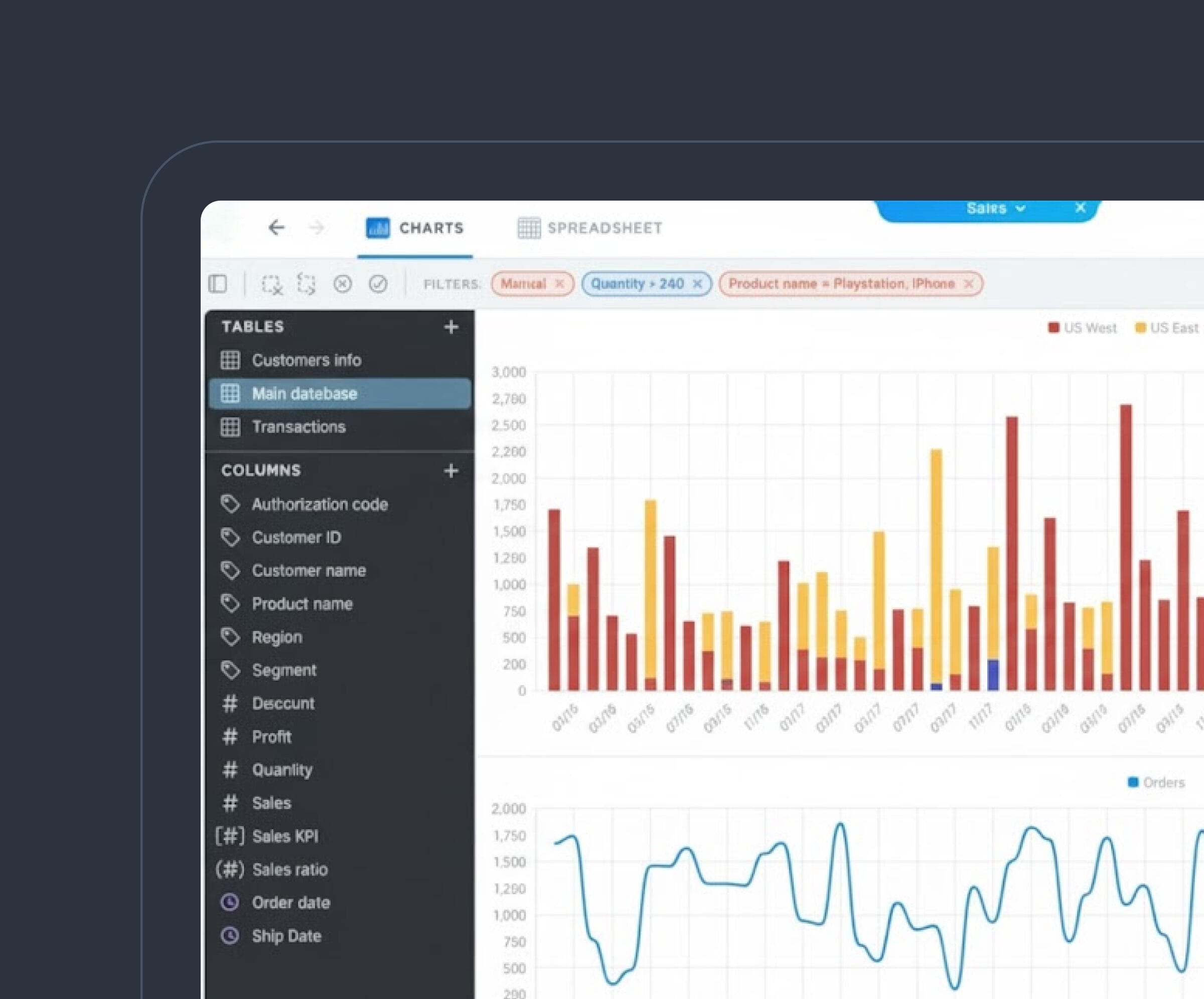

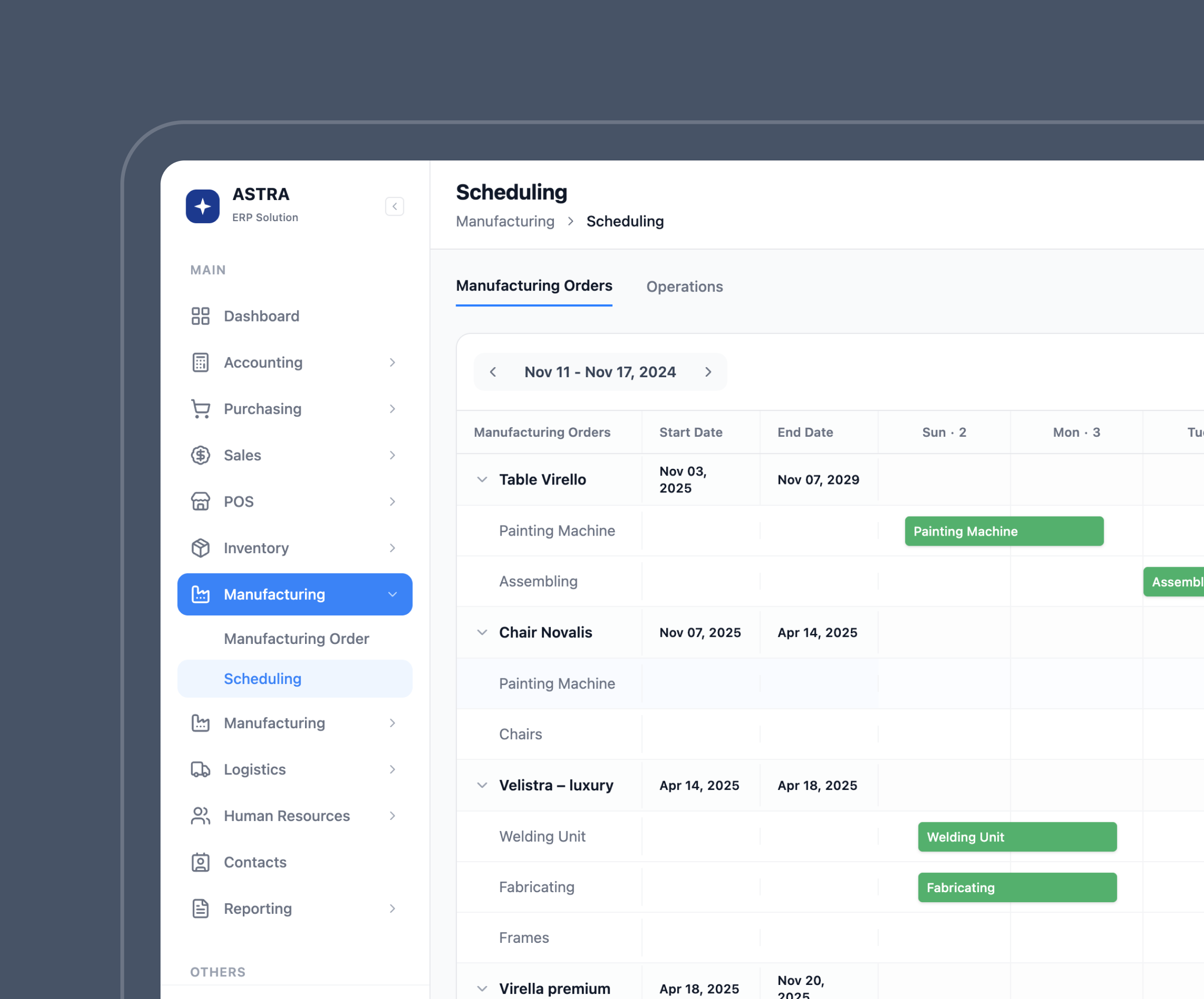

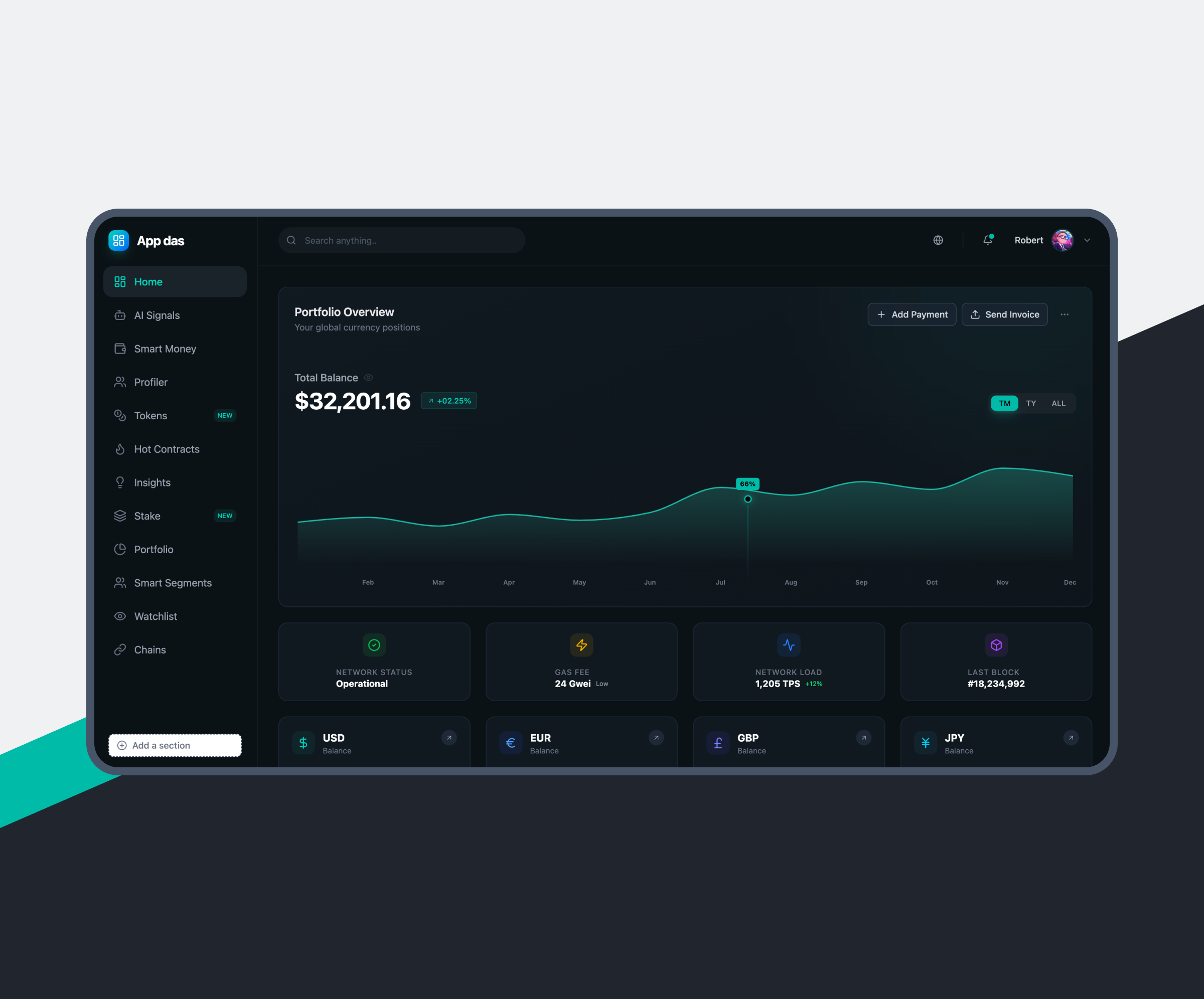

Our DEX platforms store and display full on-chain transaction histories with filtering and export options. Users and operators can easily audit trades, liquidity actions, and fees for transparency and compliance.

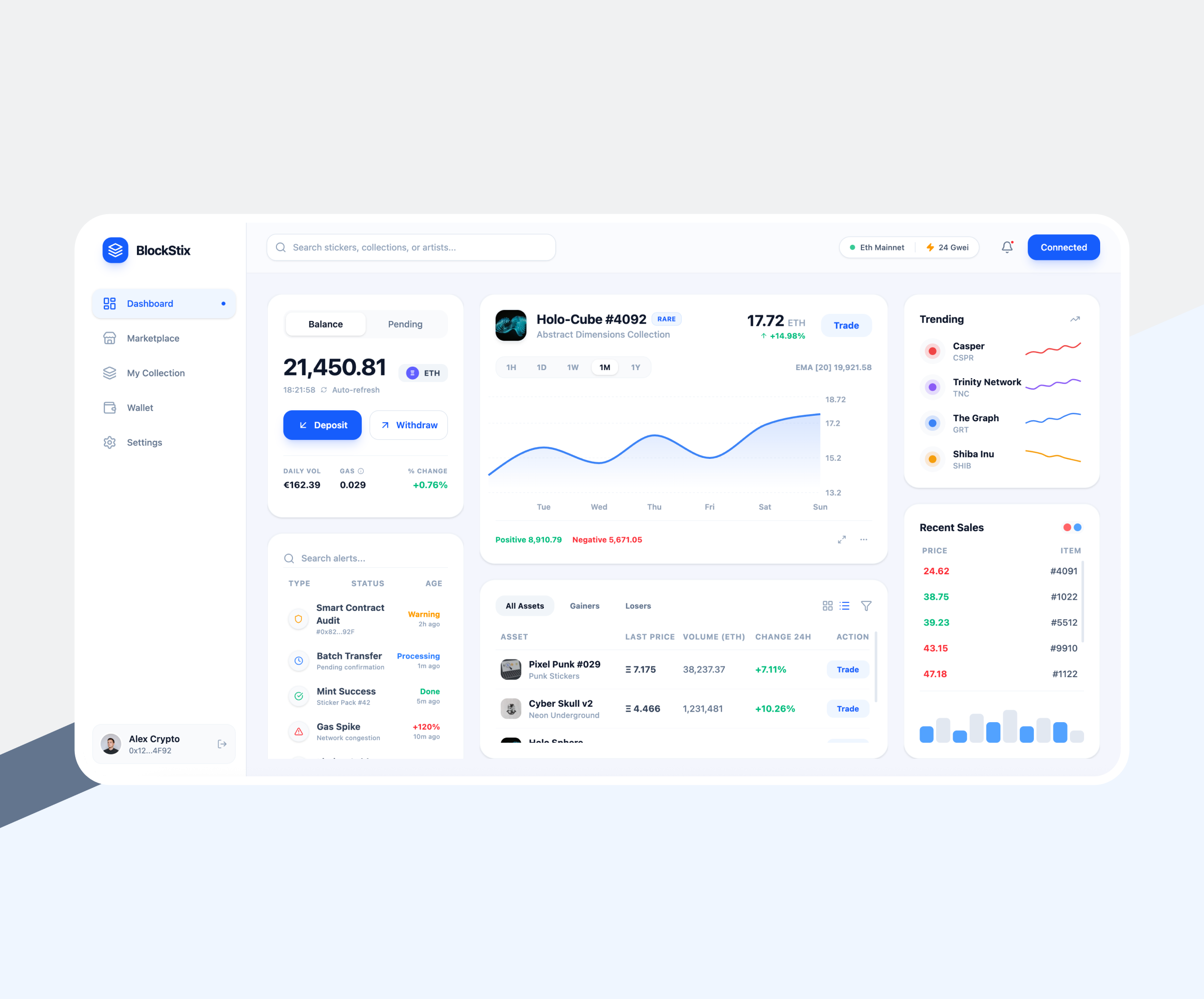

We design secure transaction flows with smart contract validation, reentrancy protection, and gas optimization. These safeguards are essential to reliable decentralized exchange (DEX) development services.

Elinext integrates popular wallets using standard protocols, enabling seamless connection, signing, and asset management. This ensures users retain full control of private keys and funds.

Where required, we integrate fiat on-ramps and off-ramps to simplify user onboarding. These integrations are designed carefully to coexist with decentralized trading logic and regulatory needs.

-

Effective Admin Panel

We build admin panels that give operators visibility into liquidity pools, fees, user activity, and system health. This feature is a core part of our DEX development services, enabling efficient platform oversight without central custody.

-

Authentication

Elinext implements secure authentication flows using wallet-based login, optional 2FA, and role controls. These mechanisms are designed to support user safety within decentralized exchange development services without compromising self-custody.

-

Complete Transaction History

Our DEX platforms store and display full on-chain transaction histories with filtering and export options. Users and operators can easily audit trades, liquidity actions, and fees for transparency and compliance.

-

We design secure transaction flows with smart contract validation, reentrancy protection, and gas optimization. These safeguards are essential to reliable decentralized exchange (DEX) development services.

-

Elinext integrates popular wallets using standard protocols, enabling seamless connection, signing, and asset management. This ensures users retain full control of private keys and funds.

-

Where required, we integrate fiat on-ramps and off-ramps to simplify user onboarding. These integrations are designed carefully to coexist with decentralized trading logic and regulatory needs.

Choose Blockchain for Your DEX Platform

Solana is well suited for high-frequency trading thanks to low fees and fast finality. Elinext uses its parallel processing model to build scalable DEX platforms focused on performance and smooth user experience within professional DEX development services.

BSC offers compatibility with Ethereum tools and lower transaction costs. Elinext builds DEX solutions on BSC that support fast swaps, liquidity pools, and wide wallet adoption as part of reliable decentralized exchange development services.

Ethereum remains the most mature ecosystem for DeFi and liquidity. Elinext develops DEX platforms with secure smart contracts, AMMs, and Layer-2 integrations, delivering robust decentralized exchange (DEX) development services for long-term growth.

Polkadot enables cross-chain communication and flexible architecture. Elinext builds DEX platforms that leverage parachains to support interoperability, shared security, and future multi-network expansion.

Polygon helps reduce gas costs while staying compatible with Ethereum. Elinext develops DEX platforms that benefit from faster transactions, scalable liquidity, and seamless integration with existing DeFi tools.

Solana is well suited for high-frequency trading thanks to low fees and fast finality. Elinext uses its parallel processing model to build scalable DEX platforms focused on performance and smooth user experience within professional DEX development services.

BSC offers compatibility with Ethereum tools and lower transaction costs. Elinext builds DEX solutions on BSC that support fast swaps, liquidity pools, and wide wallet adoption as part of reliable decentralized exchange development services.

Ethereum remains the most mature ecosystem for DeFi and liquidity. Elinext develops DEX platforms with secure smart contracts, AMMs, and Layer-2 integrations, delivering robust decentralized exchange (DEX) development services for long-term growth.

Polkadot enables cross-chain communication and flexible architecture. Elinext builds DEX platforms that leverage parachains to support interoperability, shared security, and future multi-network expansion.

Polygon helps reduce gas costs while staying compatible with Ethereum. Elinext develops DEX platforms that benefit from faster transactions, scalable liquidity, and seamless integration with existing DeFi tools.

What Our Experts Say

The Benefits of DEX Development Solutions by Elinext

Choose Your

Service Option

Hire Marketing Software Developers from Elinext

Poland

Vietnam

Poland

Uzbekistan

Vietnam

Vietnam

Vietnam

Uzbekistan

What Our Customers Think

FAQ

-

A DEX is a blockchain-based trading platform where users swap assets directly from their wallets. Trades are executed by smart contracts, so there’s no central authority holding funds or controlling transactions.

-

Unlike a CEX, a DEX doesn’t custody user funds or require account-based trading. Users keep control of their assets, and all trades happen on-chain, improving transparency and reducing counterparty risk.

-

Elinext builds AMM-based DEXs, order-book DEXs, hybrid models, and cross-chain platforms. We tailor liquidity logic, fees, and governance to your specific trading strategy.

-

We develop DEX platforms on Ethereum, BSC, Solana, Polygon, Polkadot, and other networks. The choice depends on performance, fees, ecosystem maturity, and your growth plans.

-

Typical features include wallet integration, token swaps, liquidity pools, price oracles, admin dashboards, transaction history, and security layers. Each DEX is customized based on your requirements.

-

Yes. Elinext DEX development company develops, tests, and audits smart contracts to ensure correct logic, security, and performance. We focus on preventing vulnerabilities before deployment.

-

Timelines depend on complexity. Basic DEX development services can take a few months, while platforms with custom AMMs, cross-chain bridges, or advanced governance require more time.

-

Security is built into every layer. We use audited libraries, follow best practices, run extensive testing, and conduct manual reviews to reduce risks before launch.

Looking for Related Services?

Decentralized Exchange (DEX) Development News

Contact Us