Investment Software Development Services

Elinext: Leading Experts in Investment Software Development

Investment Software Development Services We Offer

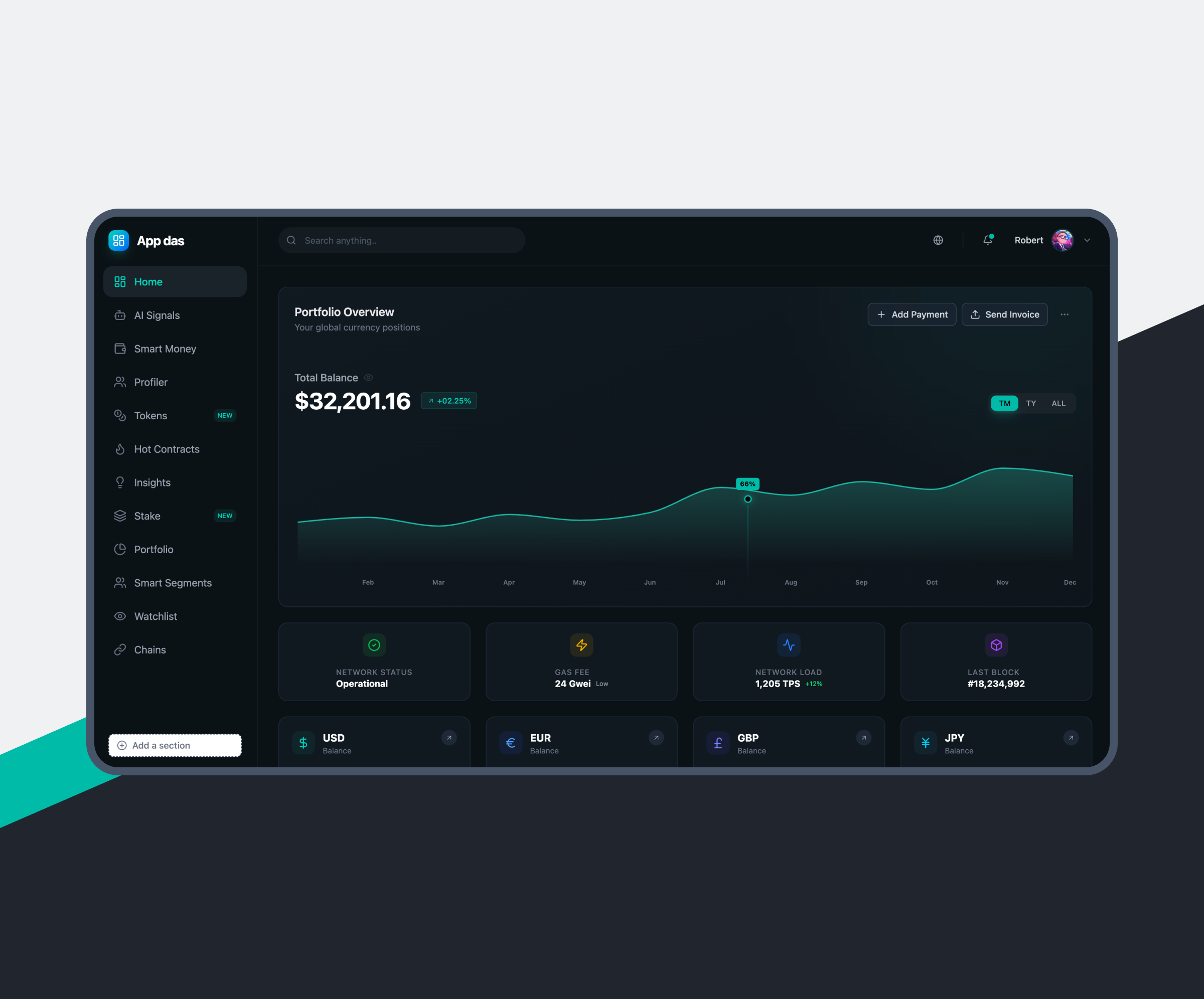

We develop asset management systems that track portfolios, valuations, and performance in real time. Solutions are built to handle complex asset structures, reporting requirements, and integrations with custodians and market data providers.

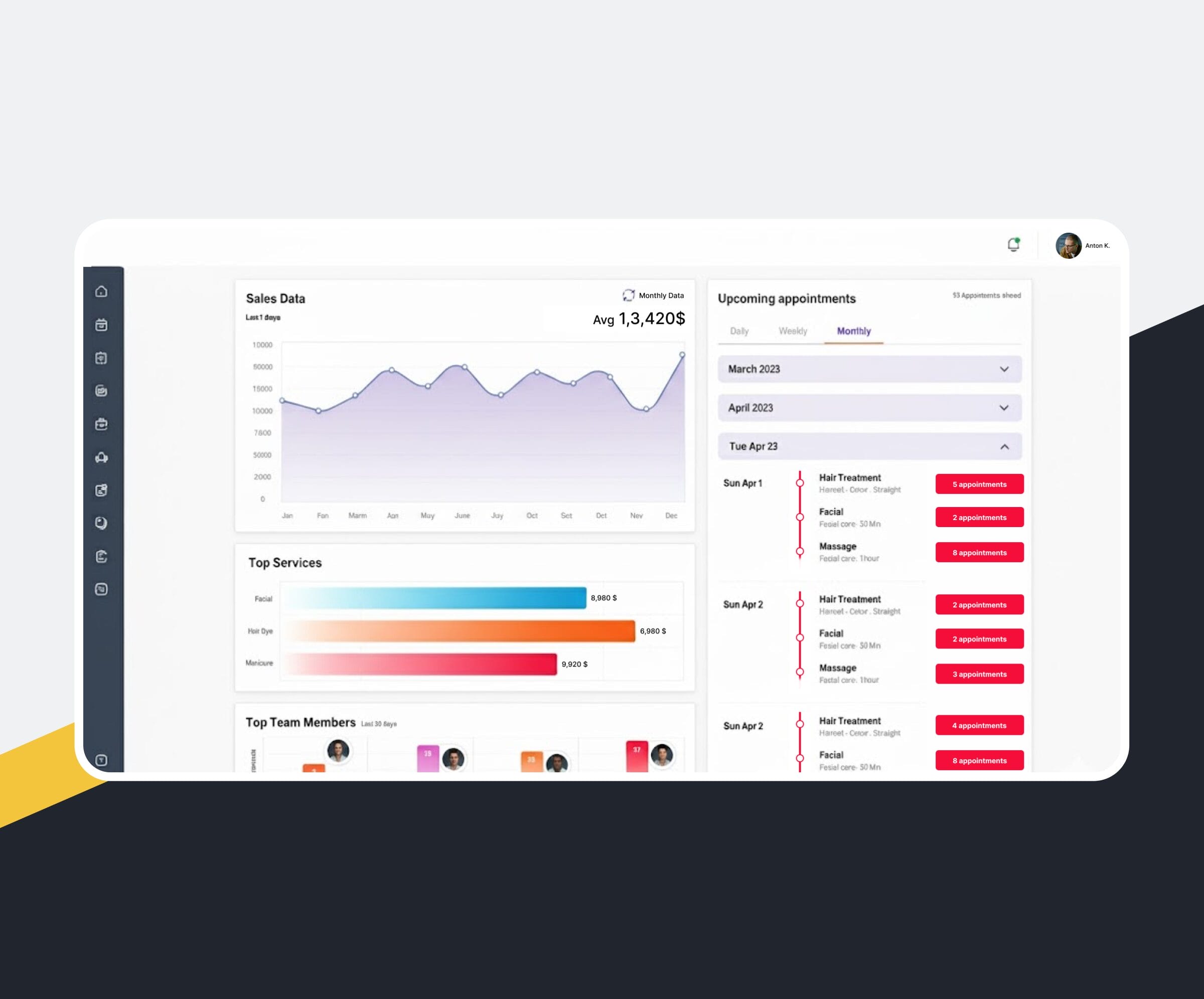

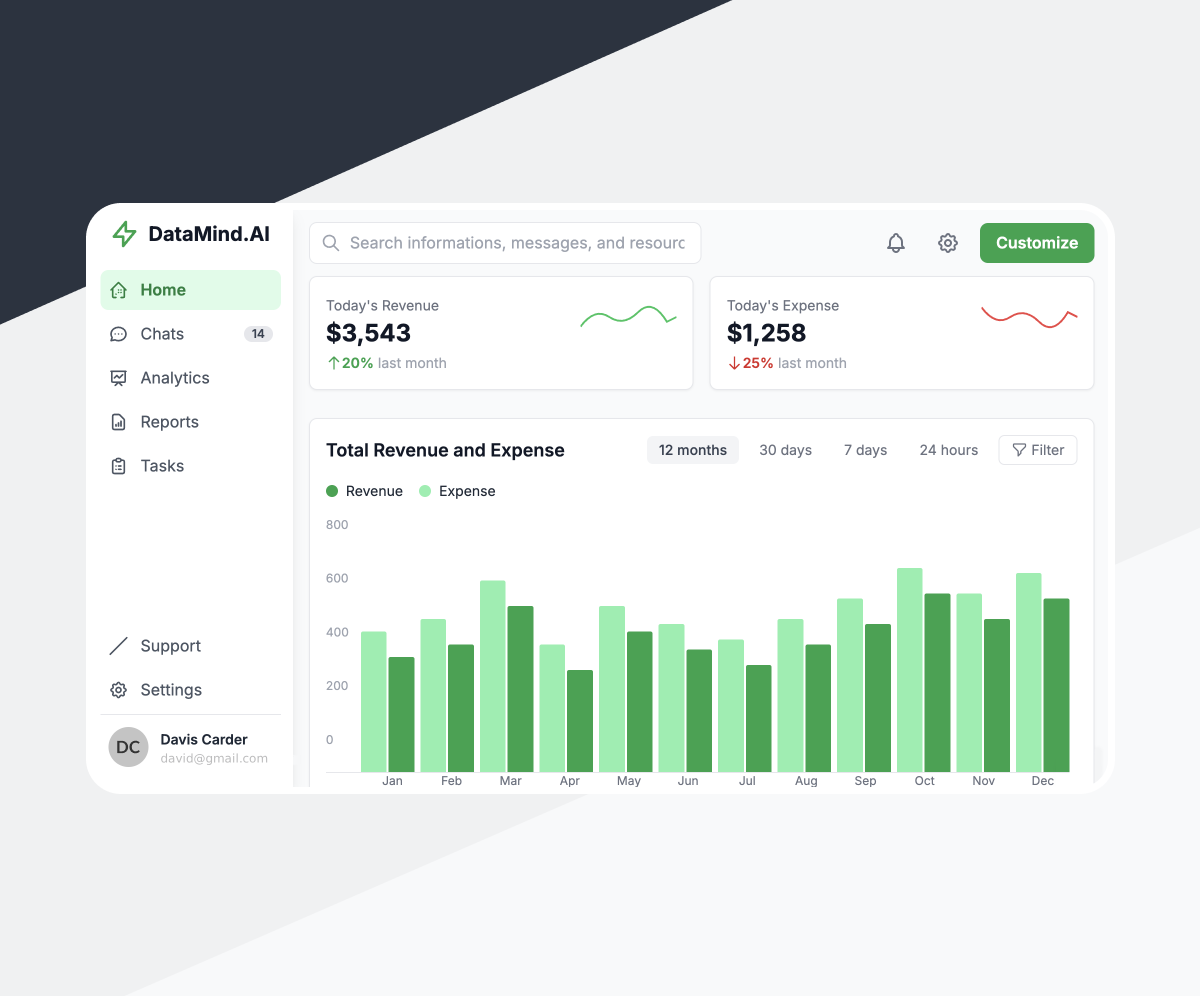

Our engineers build analytical platforms that process large financial datasets and support modeling, forecasting, and scenario analysis. Accuracy, transparency of calculations, and performance under a load are key design priorities.

We design compliance software that embeds regulatory rules directly into workflows. Automated checks, audit trails, and reporting help firms meet regulatory requirements without slowing down investment operations.

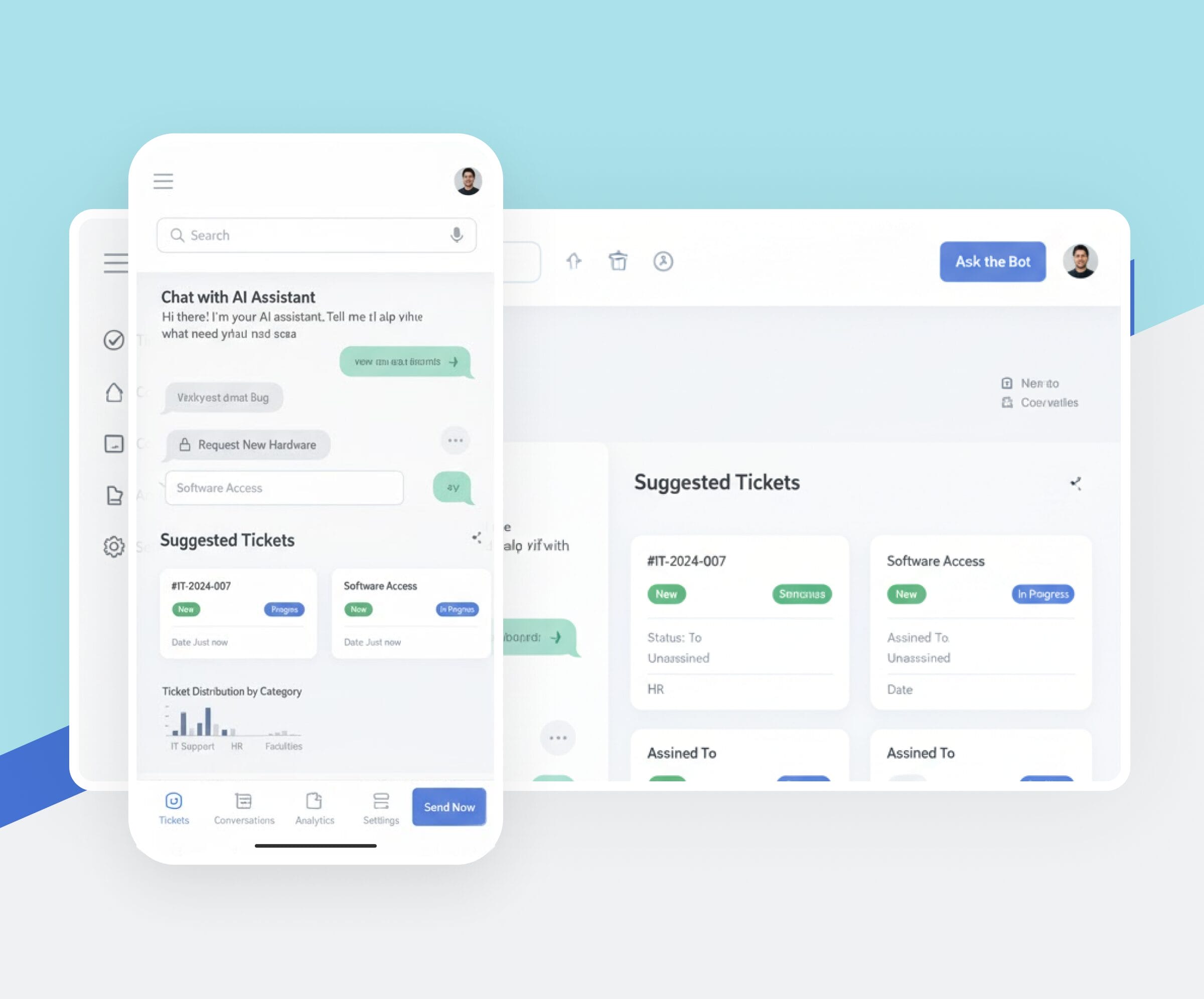

We build secure mobile investment applications that give users a controlled access to portfolios, transactions, and analytics. Security, performance, and usability are balanced to support active decision-making on the go.

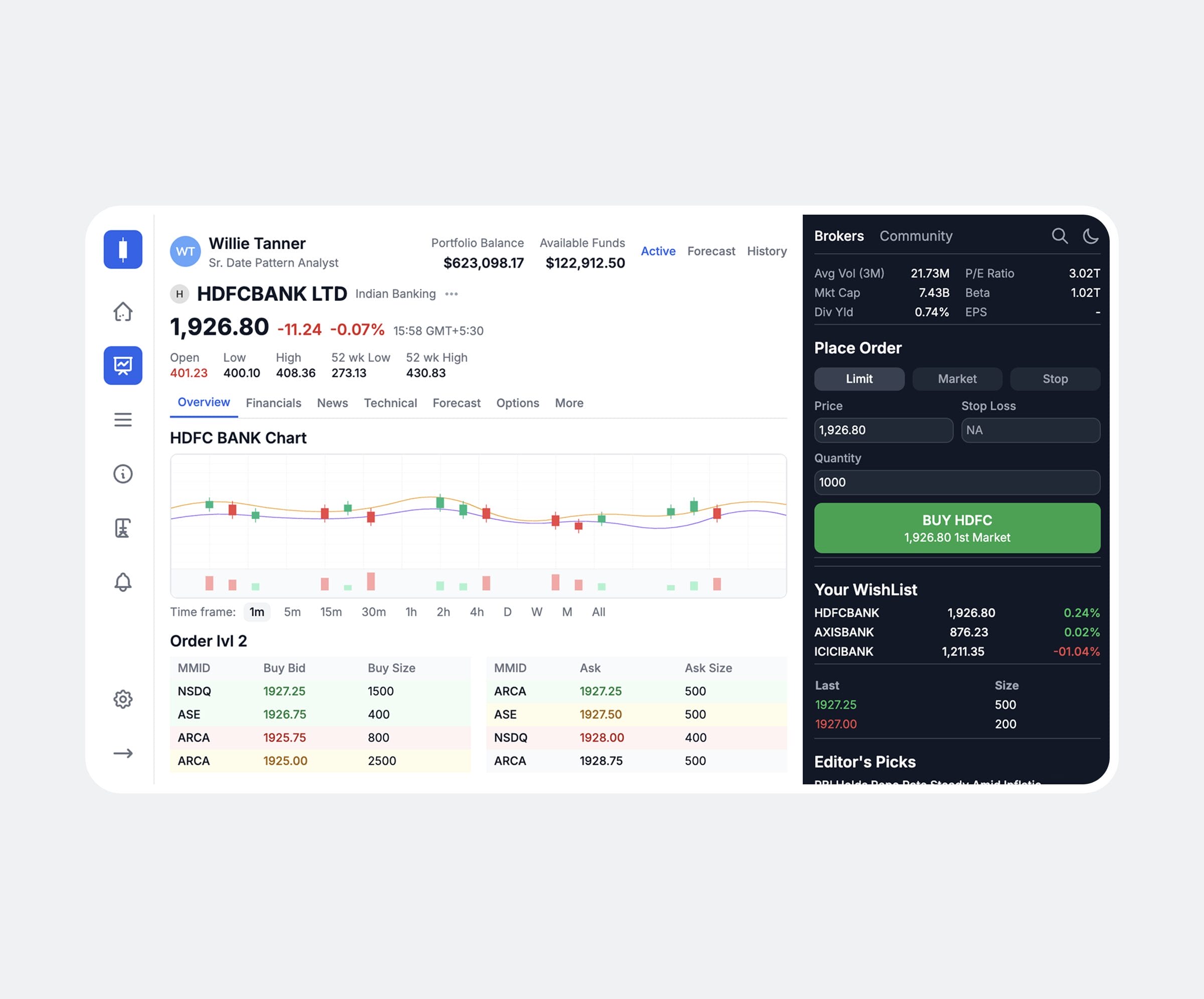

Our team develops trading APIs that connect investment platforms with exchanges, brokers, and liquidity providers. APIs are designed for low latency, reliability, and predictable behavior during peak market activity.

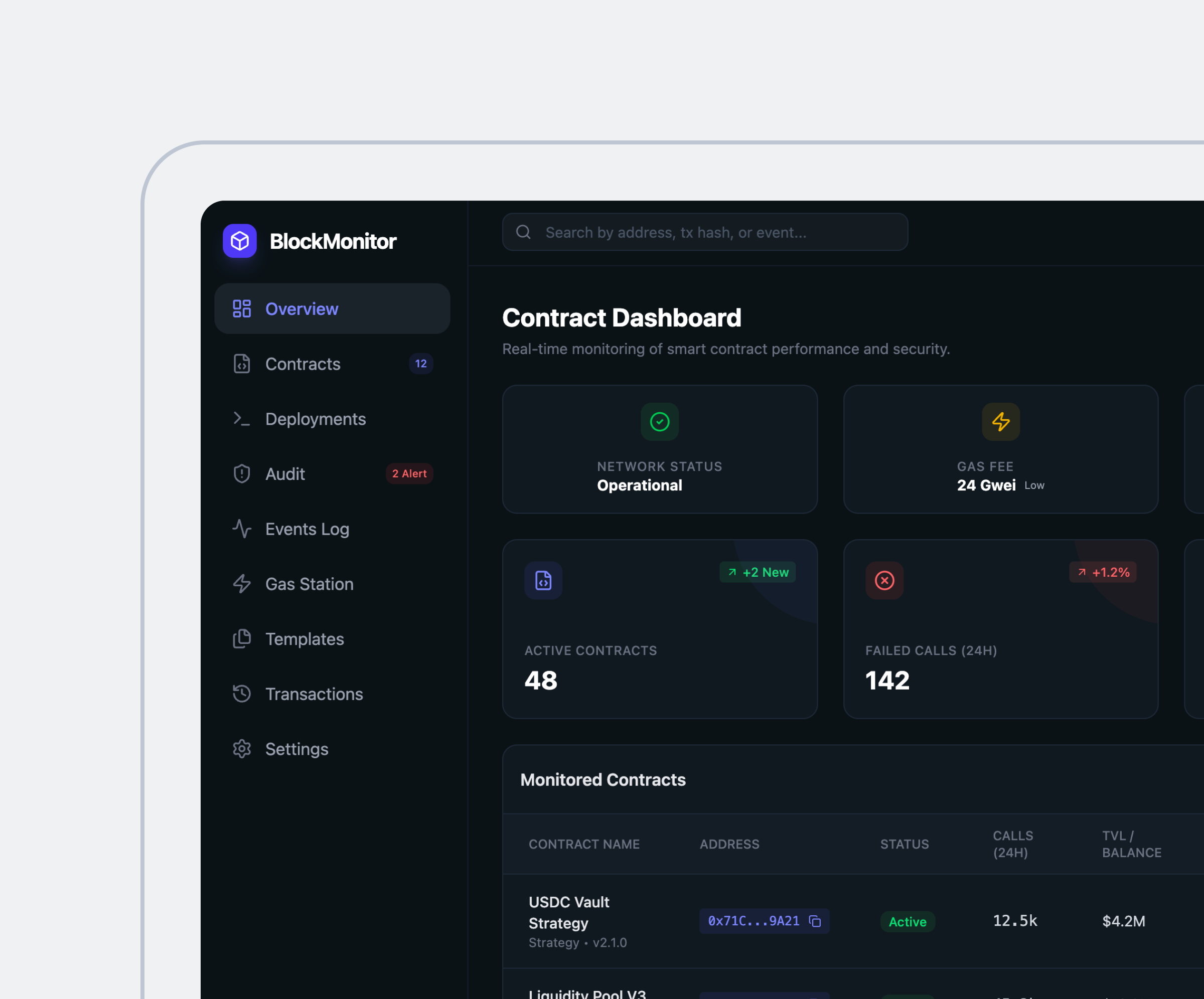

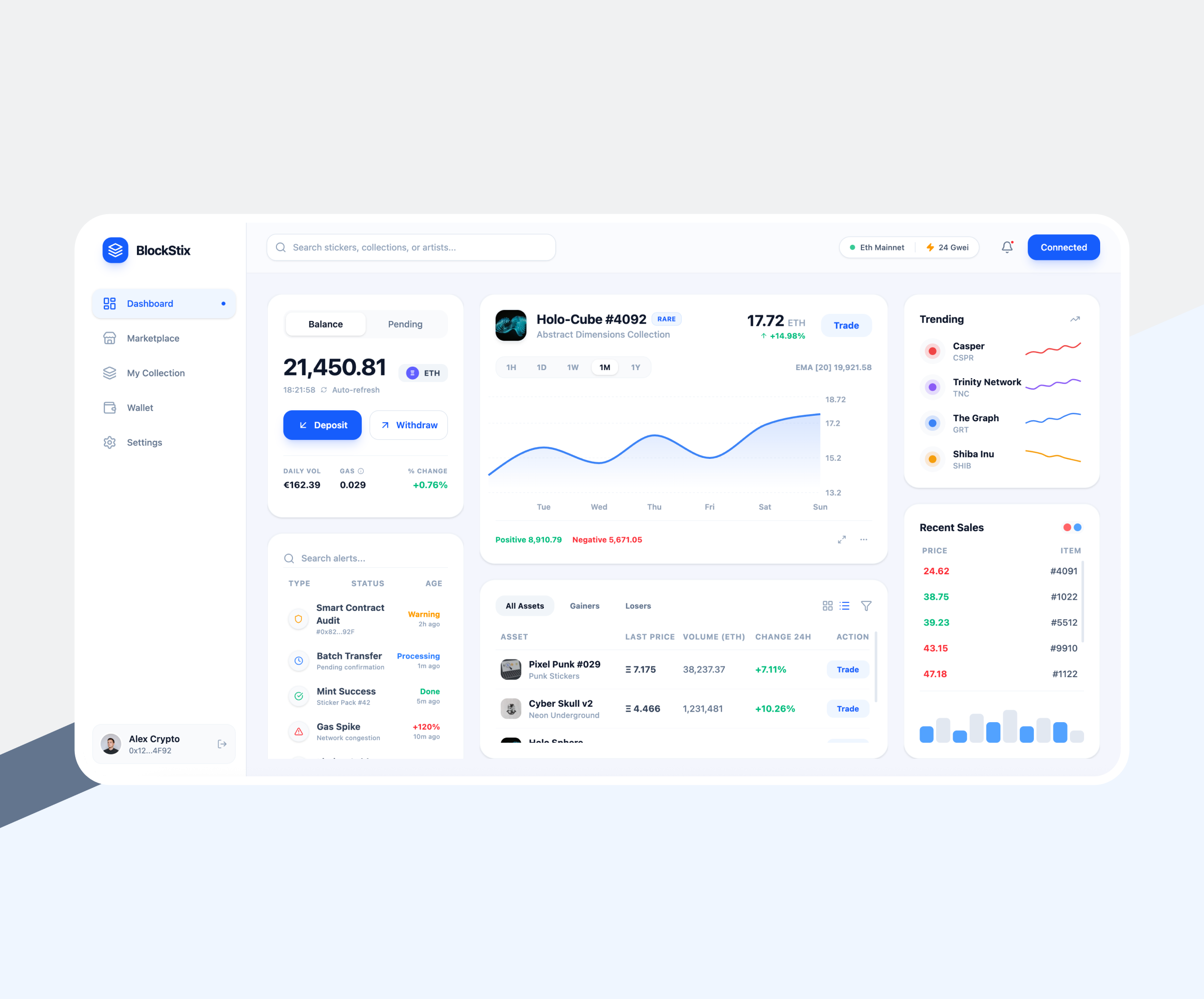

We build cryptocurrency platforms that support trading, custody, and portfolio tracking. Solutions focus on security, key management, and compliance with evolving digital asset regulations.

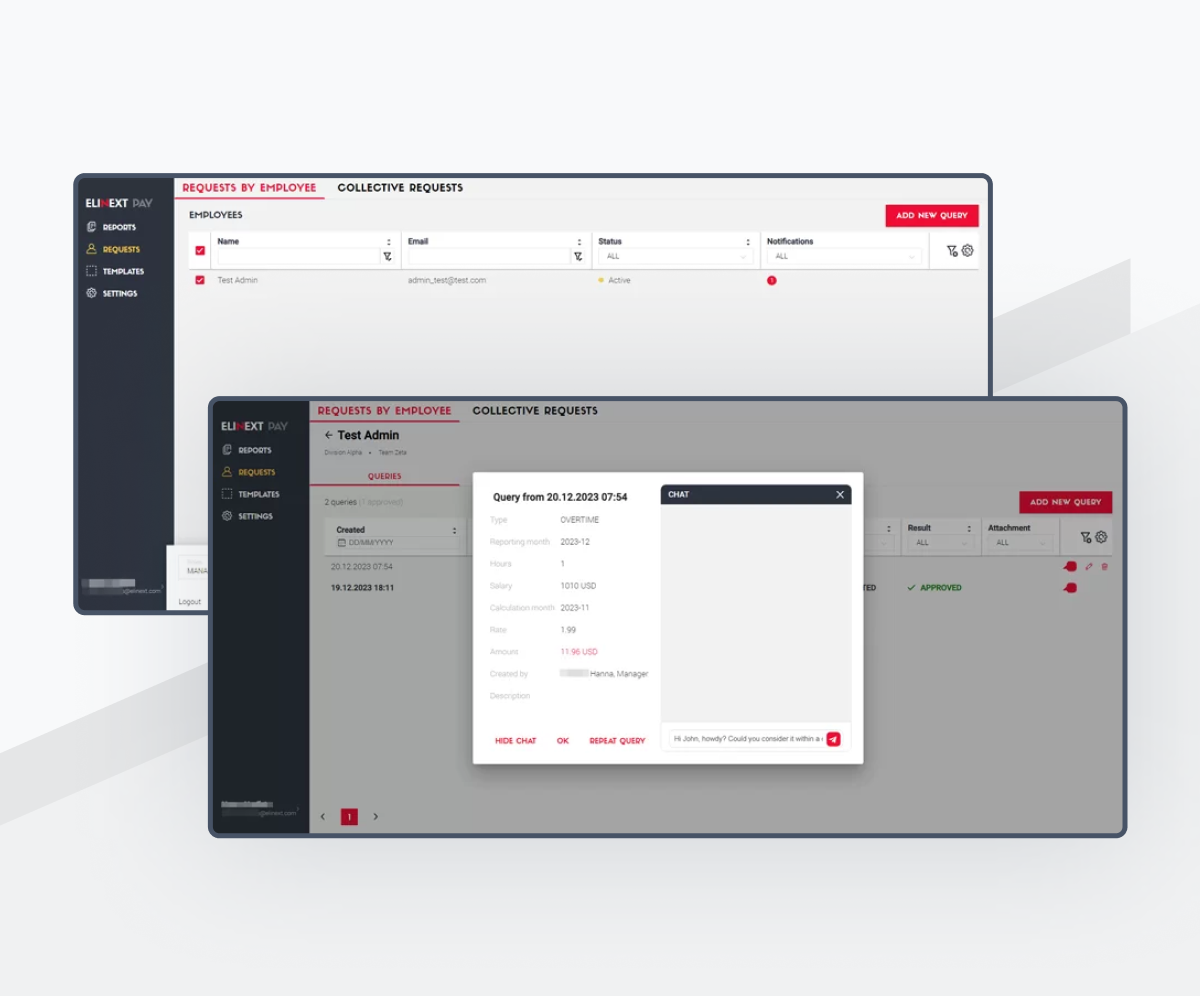

Robotic process automation is used to handle repetitive investment operations such as reporting, reconciliation, and data validation. This reduces manual errors and frees teams for higher-value analysis.

Payment solutions that support investment transactions, settlements, and fund transfers are our strong side. Systems are built with absolute security controls and integration with banking and payment networks.

Our engineers build DeFi platforms that support decentralized trading, lending, and asset management. Smart contracts and integrations are designed with a focus on transparency, risk control, and long-term maintainability.

-

Asset Management Software Development

We develop asset management systems that track portfolios, valuations, and performance in real time. Solutions are built to handle complex asset structures, reporting requirements, and integrations with custodians and market data providers.

-

Financial Analysis Software Development

Our engineers build analytical platforms that process large financial datasets and support modeling, forecasting, and scenario analysis. Accuracy, transparency of calculations, and performance under a load are key design priorities.

-

Investment Compliance Development

We design compliance software that embeds regulatory rules directly into workflows. Automated checks, audit trails, and reporting help firms meet regulatory requirements without slowing down investment operations.

-

We build secure mobile investment applications that give users a controlled access to portfolios, transactions, and analytics. Security, performance, and usability are balanced to support active decision-making on the go.

-

Our team develops trading APIs that connect investment platforms with exchanges, brokers, and liquidity providers. APIs are designed for low latency, reliability, and predictable behavior during peak market activity.

-

We build cryptocurrency platforms that support trading, custody, and portfolio tracking. Solutions focus on security, key management, and compliance with evolving digital asset regulations.

-

Robotic process automation is used to handle repetitive investment operations such as reporting, reconciliation, and data validation. This reduces manual errors and frees teams for higher-value analysis.

-

Payment solutions that support investment transactions, settlements, and fund transfers are our strong side. Systems are built with absolute security controls and integration with banking and payment networks.

-

Our engineers build DeFi platforms that support decentralized trading, lending, and asset management. Smart contracts and integrations are designed with a focus on transparency, risk control, and long-term maintainability.

Our Awards and Recognitions

Custom Investment Solutions Elinext Integrates for Industries

For lending platforms, we build systems that support credit scoring, portfolio tracking, and repayment analytics. Our investment software development services help automate decision logic while keeping risk models transparent and auditable.

We develop trading solutions that handle high-frequency data, order execution, and market integration. As an investment software development company, Elinext focuses on low latency, data consistency, and system stability during peak activity.

In crypto trading, we integrate platforms that manage volatile markets, liquidity sources, and digital asset custody. Security, transaction traceability, and real-time analytics are built into every component.

Banks rely on investment systems that align with strict compliance and reporting standards. We integrate solutions that support portfolio management, disclosures, and internal controls without disrupting core banking systems.

FinTech platforms benefit from modular, API-driven investment systems. Our investment software development solutions support rapid product launches while maintaining regulatory alignment and scalable architecture.

For insurance companies, we integrate investment software that supports asset allocation, risk exposure analysis, and long-term portfolio planning. Systems are designed to align investment activity with policy and liability structures.

-

For lending platforms, we build systems that support credit scoring, portfolio tracking, and repayment analytics. Our investment software development services help automate decision logic while keeping risk models transparent and auditable.

-

We develop trading solutions that handle high-frequency data, order execution, and market integration. As an investment software development company, Elinext focuses on low latency, data consistency, and system stability during peak activity.

-

Cryptocurrency Trading

In crypto trading, we integrate platforms that manage volatile markets, liquidity sources, and digital asset custody. Security, transaction traceability, and real-time analytics are built into every component.

-

Banks rely on investment systems that align with strict compliance and reporting standards. We integrate solutions that support portfolio management, disclosures, and internal controls without disrupting core banking systems.

-

FinTech platforms benefit from modular, API-driven investment systems. Our investment software development solutions support rapid product launches while maintaining regulatory alignment and scalable architecture.

-

For insurance companies, we integrate investment software that supports asset allocation, risk exposure analysis, and long-term portfolio planning. Systems are designed to align investment activity with policy and liability structures.

Investment Software Elinext Specializes in

We build systems that support portfolio oversight, asset allocation, and performance tracking across asset classes. Solutions reflect real approval flows, reporting cycles, and operational controls used by investment teams.

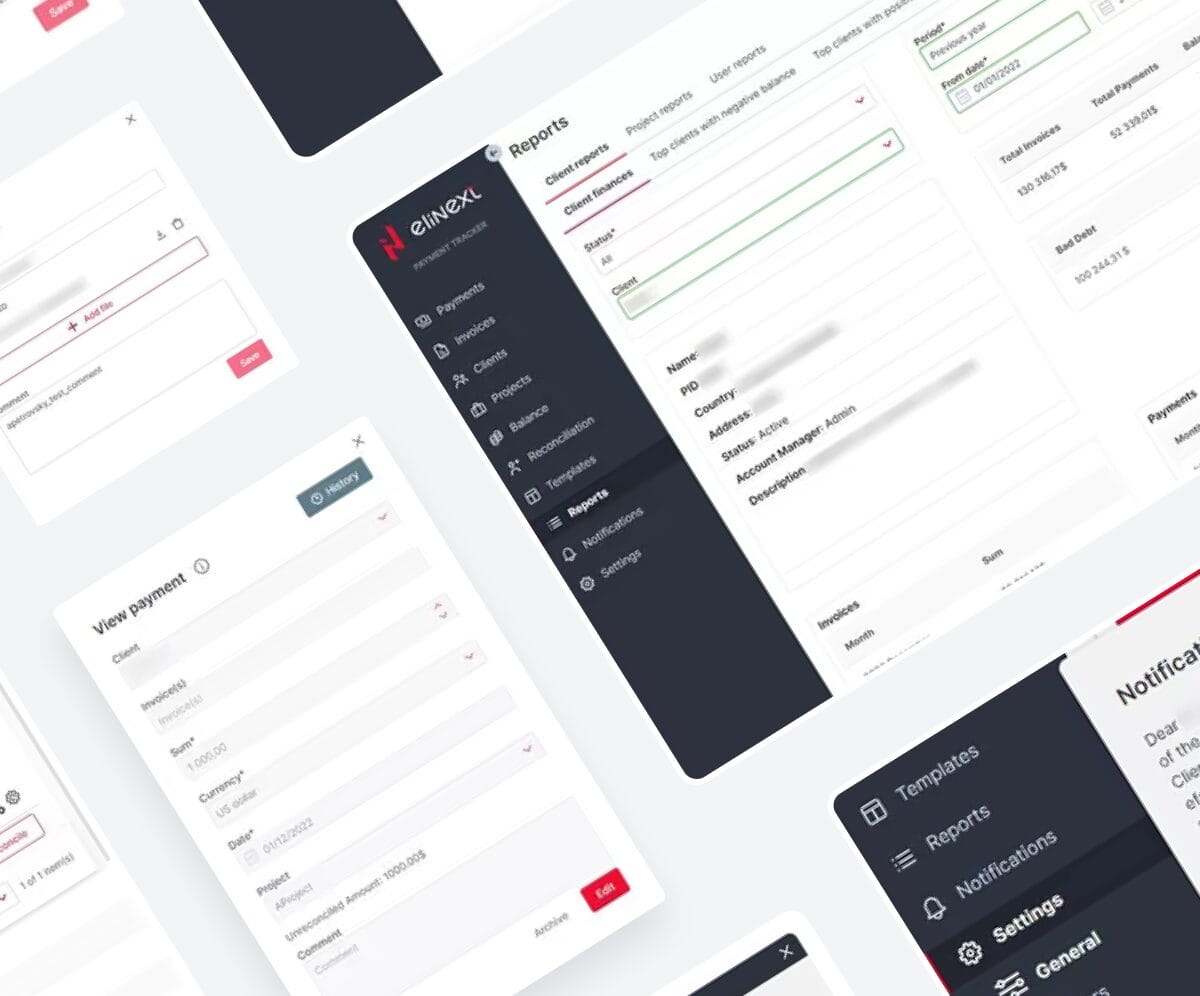

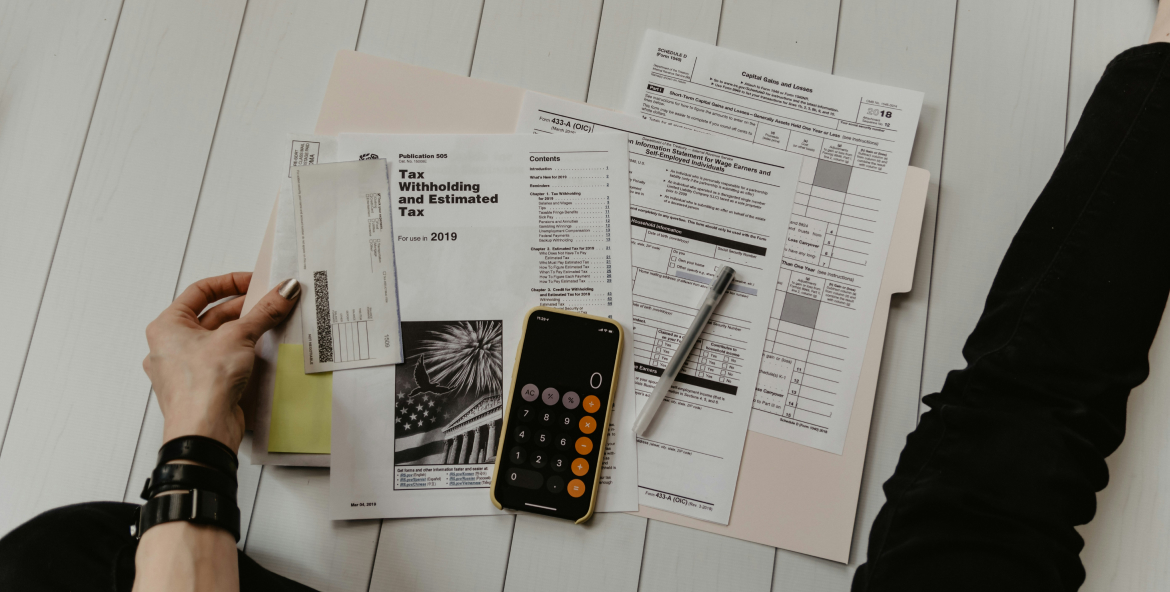

Our accounting platforms handle valuations, accruals, and reconciliations with full audit trails. Accuracy, transparency of calculations, and compliance with financial standards are built into the core logic.

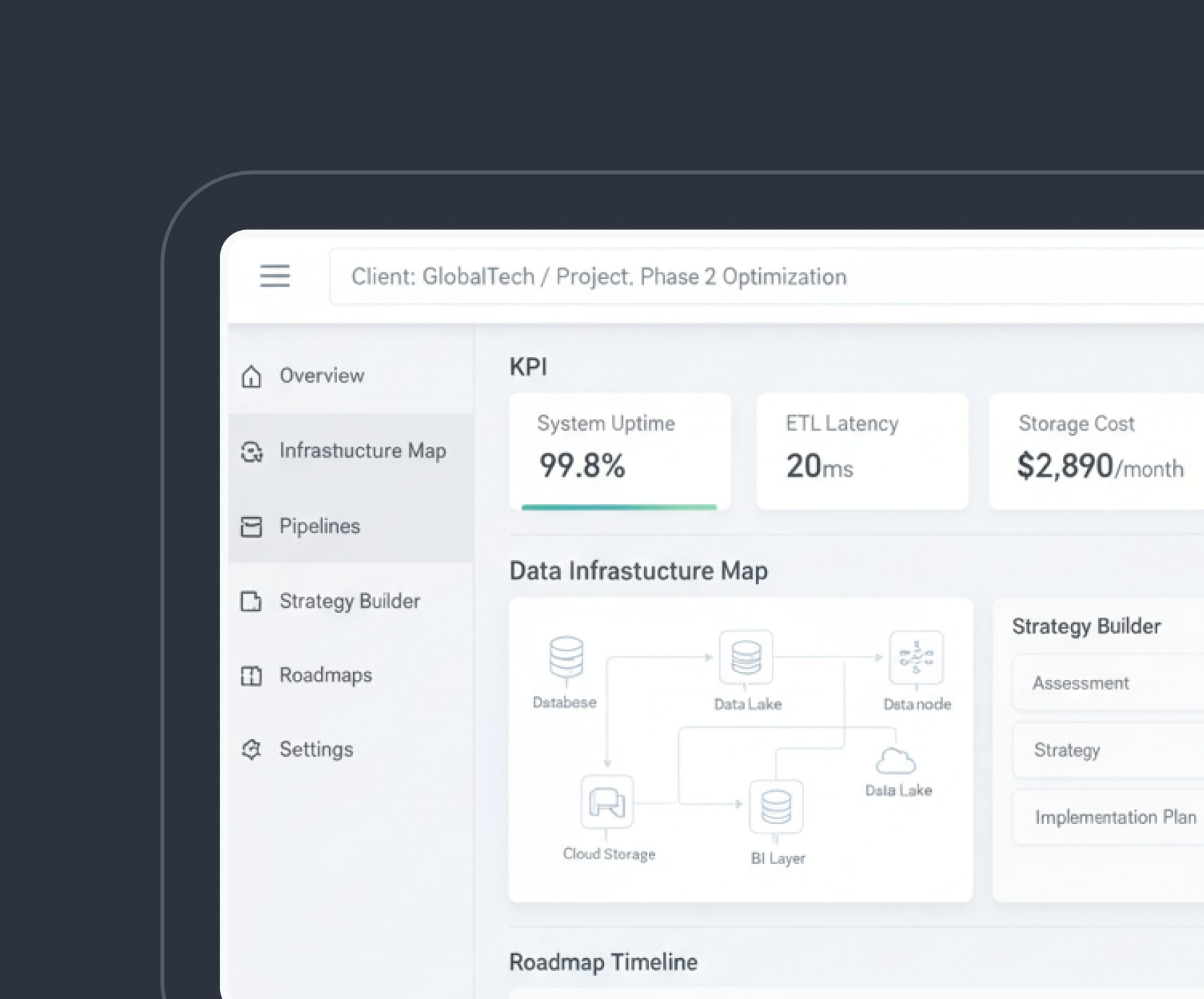

We develop centralized data layers that aggregate market feeds, transactions, and internal records. This reduces inconsistencies and provides a single, trusted source for analytics and reporting.

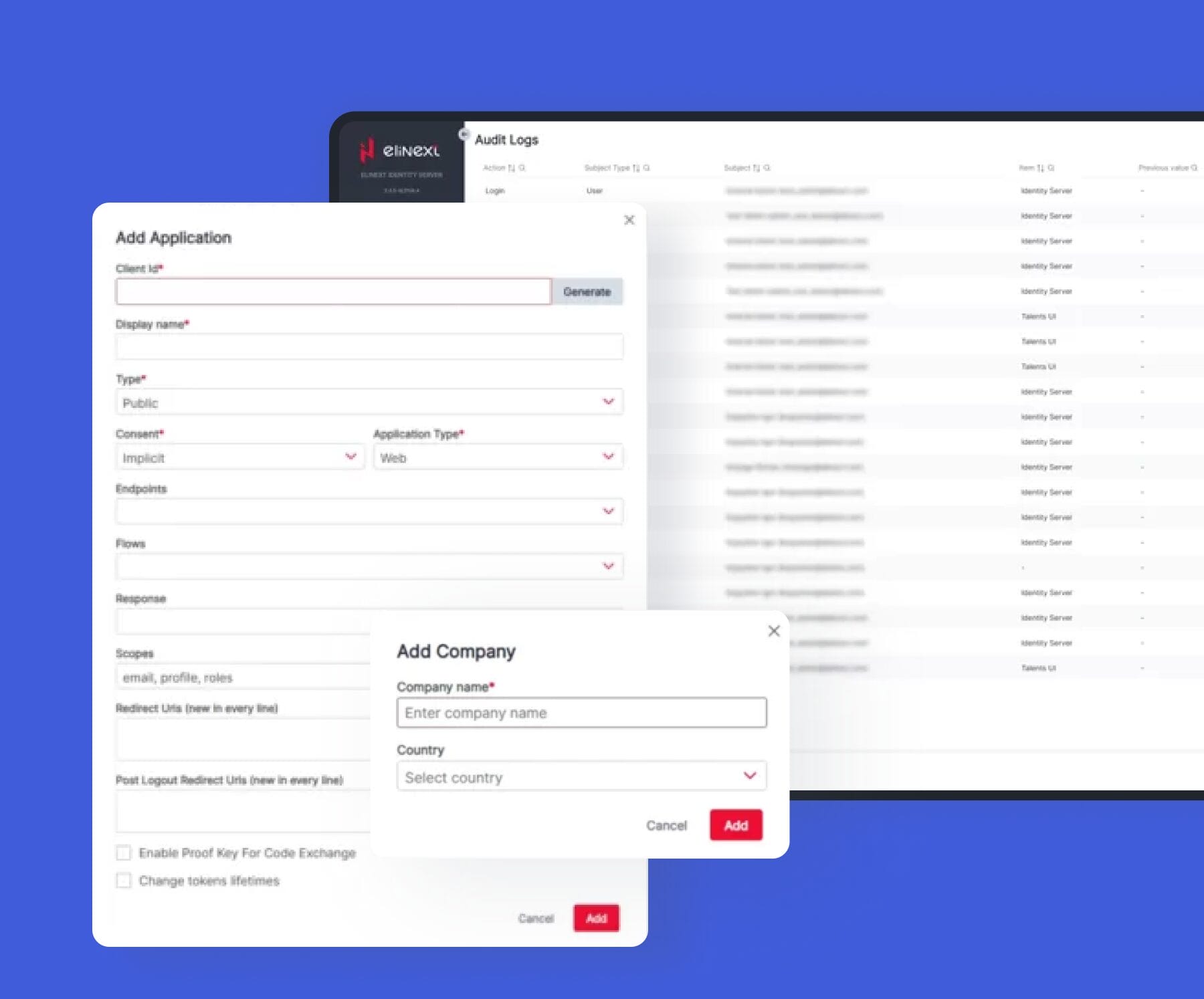

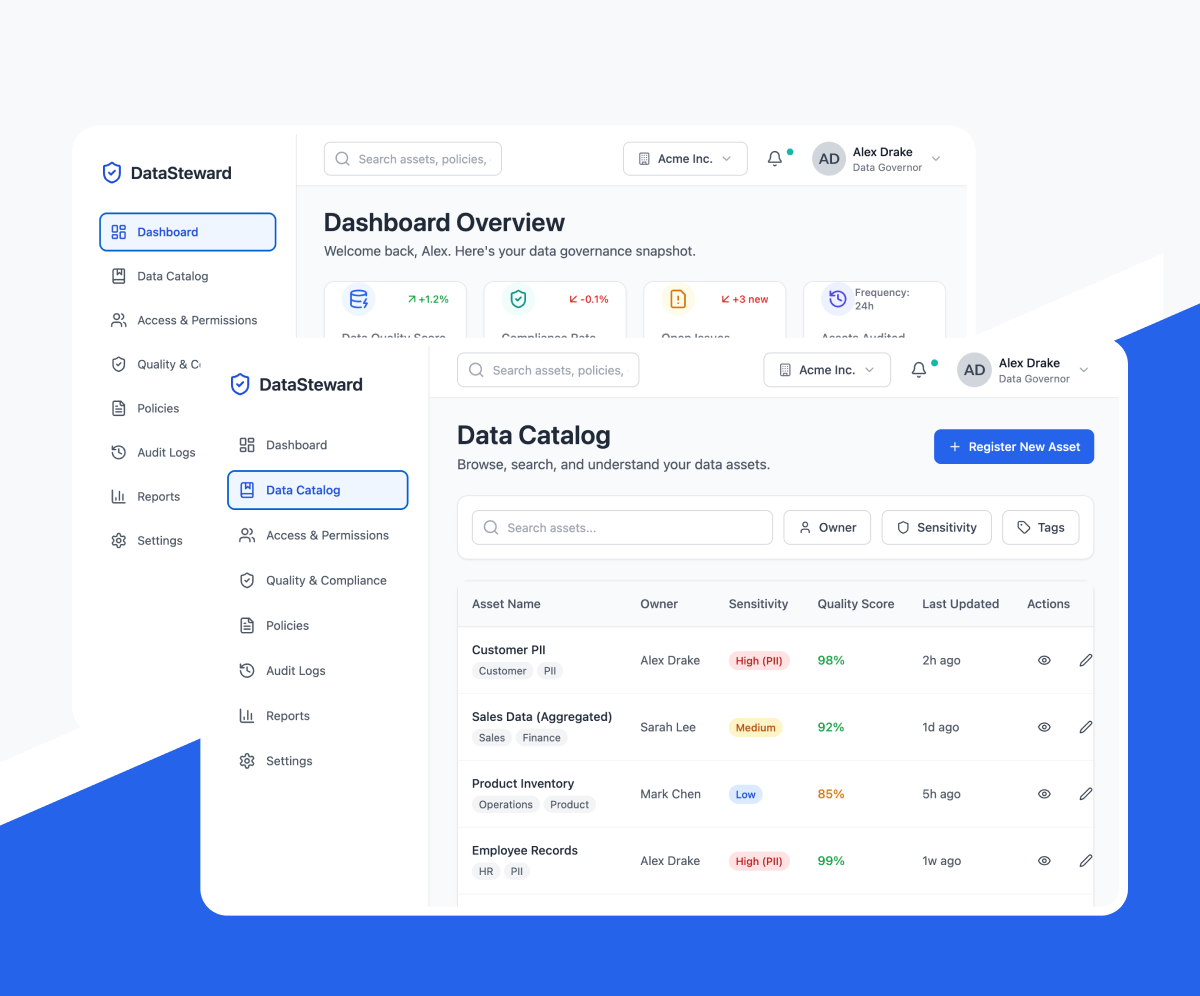

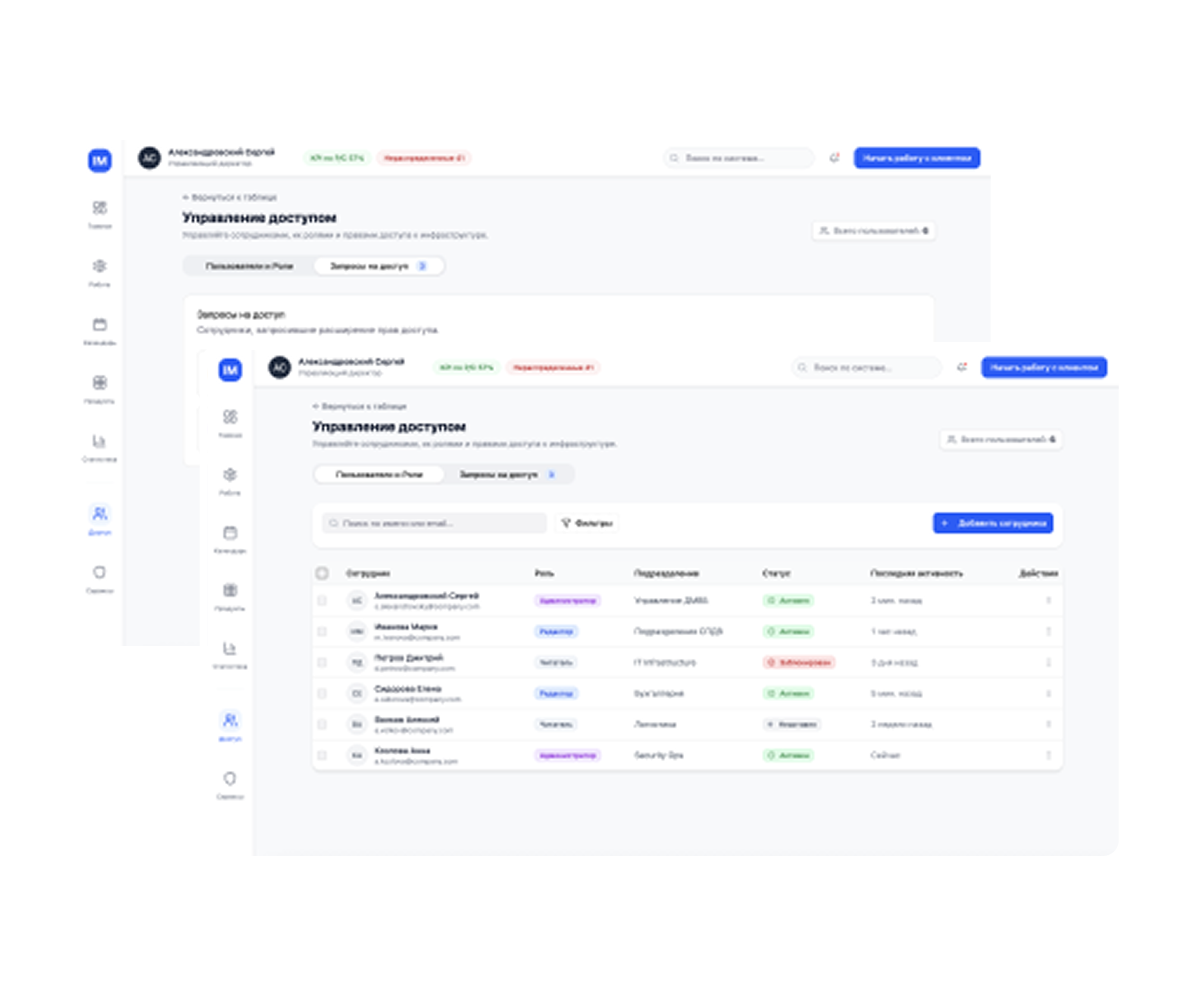

Compliance tools embed regulatory rules into everyday workflows. Automated checks, alerts, and logs help firms detect issues early and maintain audit-ready documentation.

We create reporting systems that generate clear, timely investor statements. Reports are based on real portfolio data and calculations, without manual consolidation or spreadsheet risk.

Secure investor portals provide controlled access to portfolios, documents, and performance updates. Permissions, authentication, and data visibility are designed to protect sensitive financial information.

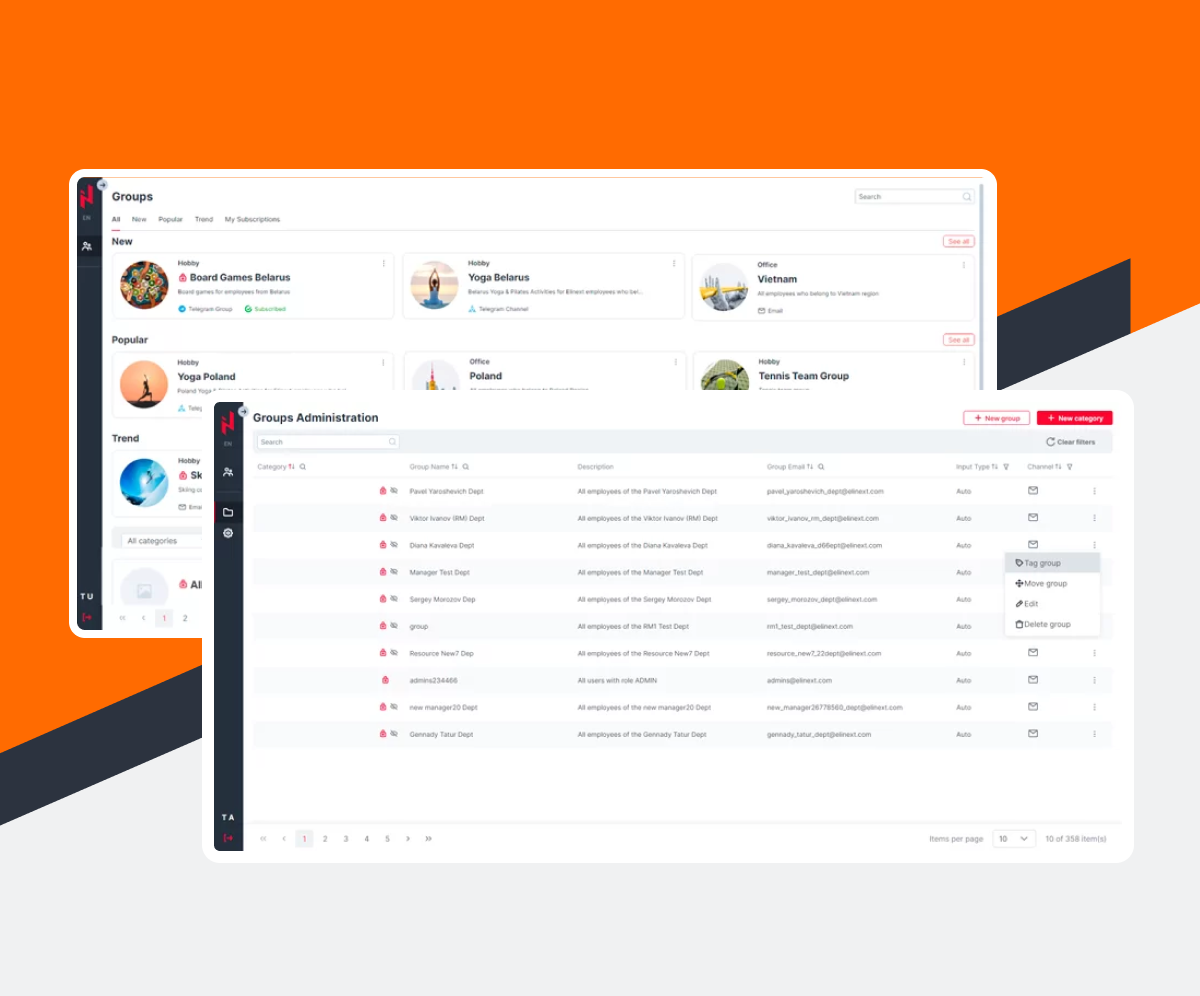

We deliver full-scale investment platforms that combine data processing, transactions, and user management. These investment software development services are built to scale as products, users, and assets grow.

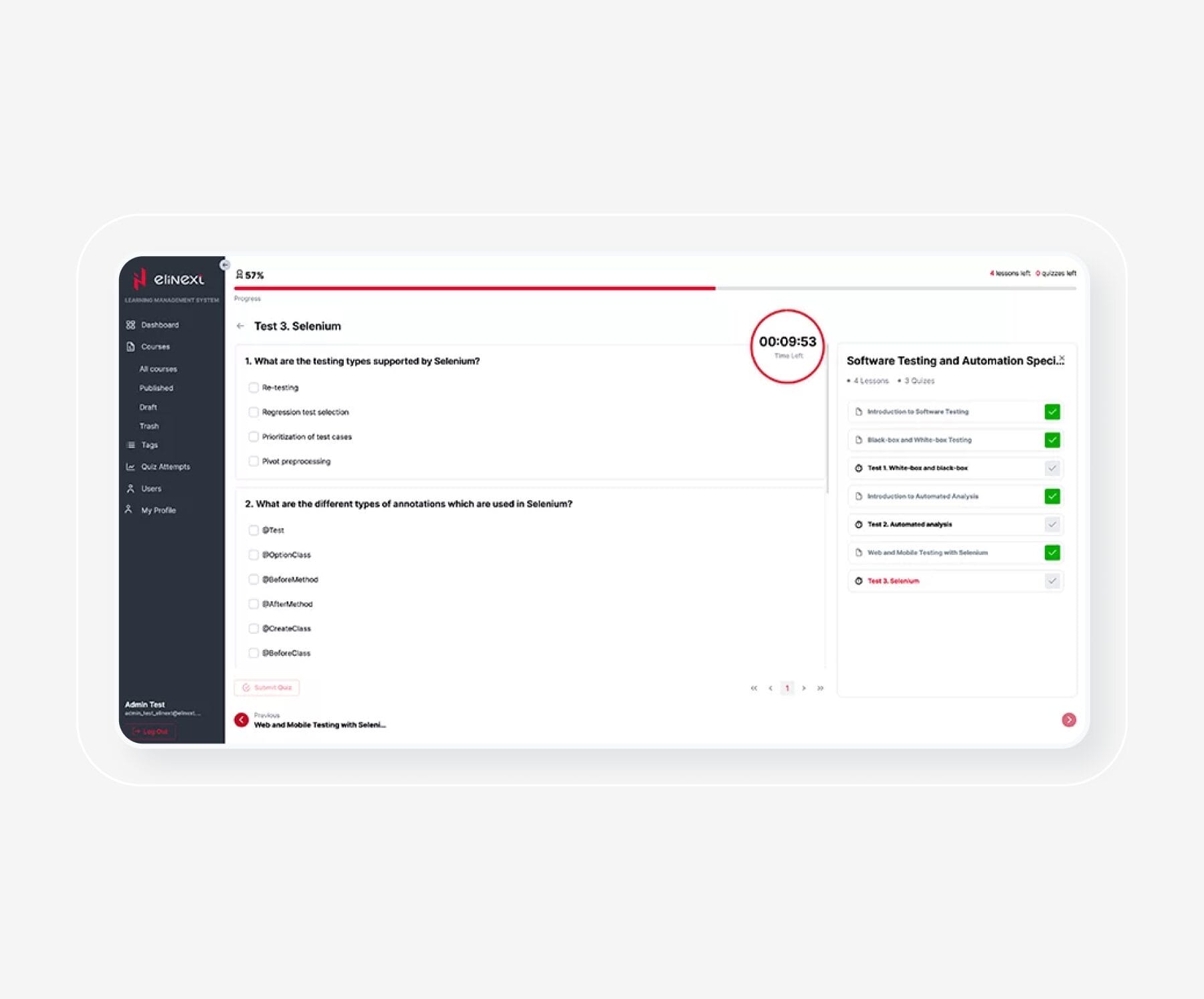

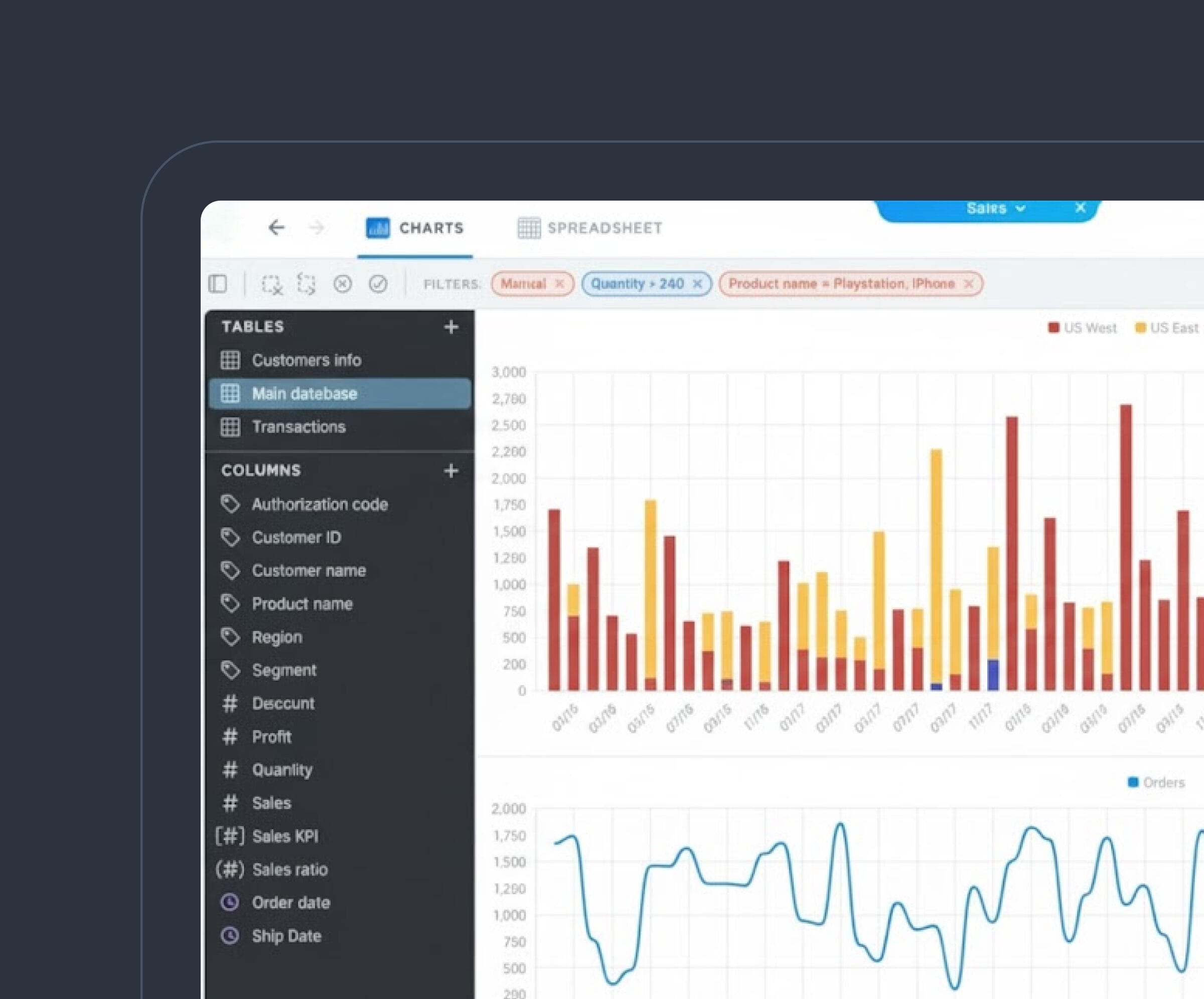

Our research tools support modeling, forecasting, and scenario analysis on large datasets. Systems are optimized for performance and clarity, helping analysts trust the numbers behind decisions.

Portfolio management solutions track holdings, exposure, and performance in near real time. Architecture supports complex structures, frequent updates, and integration with external data sources.

We build OMS platforms that manage the full order lifecycle from creation to settlement. Reliability during market volatility and clear state tracking are key engineering priorities.

EMS solutions focus on fast, controlled execution across venues and brokers. As an investment software development company, Elinext prioritizes low latency and predictable behavior.

We develop systems to manage shareholder records, transactions, and communications. Data accuracy and regulatory alignment are essential for long-term operational stability.

Our trading applications provide secure access to markets with real-time pricing and execution. UX is designed for speed, clarity, and informed risk-taking.

We build robo-advisory platforms that automate portfolio recommendations using defined rules and risk profiles. Logic remains transparent and compliant with regulatory expectations.

We integrate language models to support research, reporting, and internal queries. Assistants are designed to augment analysts, not replace human judgment.

We develop platforms for tokenized assets and transparent transaction records. These investment software development solutions are built with security, auditability, and regulatory context in mind.

We build systems that support portfolio oversight, asset allocation, and performance tracking across asset classes. Solutions reflect real approval flows, reporting cycles, and operational controls used by investment teams.

Our accounting platforms handle valuations, accruals, and reconciliations with full audit trails. Accuracy, transparency of calculations, and compliance with financial standards are built into the core logic.

We develop centralized data layers that aggregate market feeds, transactions, and internal records. This reduces inconsistencies and provides a single, trusted source for analytics and reporting.

Compliance tools embed regulatory rules into everyday workflows. Automated checks, alerts, and logs help firms detect issues early and maintain audit-ready documentation.

We create reporting systems that generate clear, timely investor statements. Reports are based on real portfolio data and calculations, without manual consolidation or spreadsheet risk.

Secure investor portals provide controlled access to portfolios, documents, and performance updates. Permissions, authentication, and data visibility are designed to protect sensitive financial information.

We deliver full-scale investment platforms that combine data processing, transactions, and user management. These investment software development services are built to scale as products, users, and assets grow.

Our research tools support modeling, forecasting, and scenario analysis on large datasets. Systems are optimized for performance and clarity, helping analysts trust the numbers behind decisions.

Portfolio management solutions track holdings, exposure, and performance in near real time. Architecture supports complex structures, frequent updates, and integration with external data sources.

We build OMS platforms that manage the full order lifecycle from creation to settlement. Reliability during market volatility and clear state tracking are key engineering priorities.

EMS solutions focus on fast, controlled execution across venues and brokers. As an investment software development company, Elinext prioritizes low latency and predictable behavior.

We develop systems to manage shareholder records, transactions, and communications. Data accuracy and regulatory alignment are essential for long-term operational stability.

Our trading applications provide secure access to markets with real-time pricing and execution. UX is designed for speed, clarity, and informed risk-taking.

We build robo-advisory platforms that automate portfolio recommendations using defined rules and risk profiles. Logic remains transparent and compliant with regulatory expectations.

We integrate language models to support research, reporting, and internal queries. Assistants are designed to augment analysts, not replace human judgment.

We develop platforms for tokenized assets and transparent transaction records. These investment software development solutions are built with security, auditability, and regulatory context in mind.

Build investment software you can rely on when markets move fast and somewhat unpredictable.

Advanced Techs We Implement in Investment Software

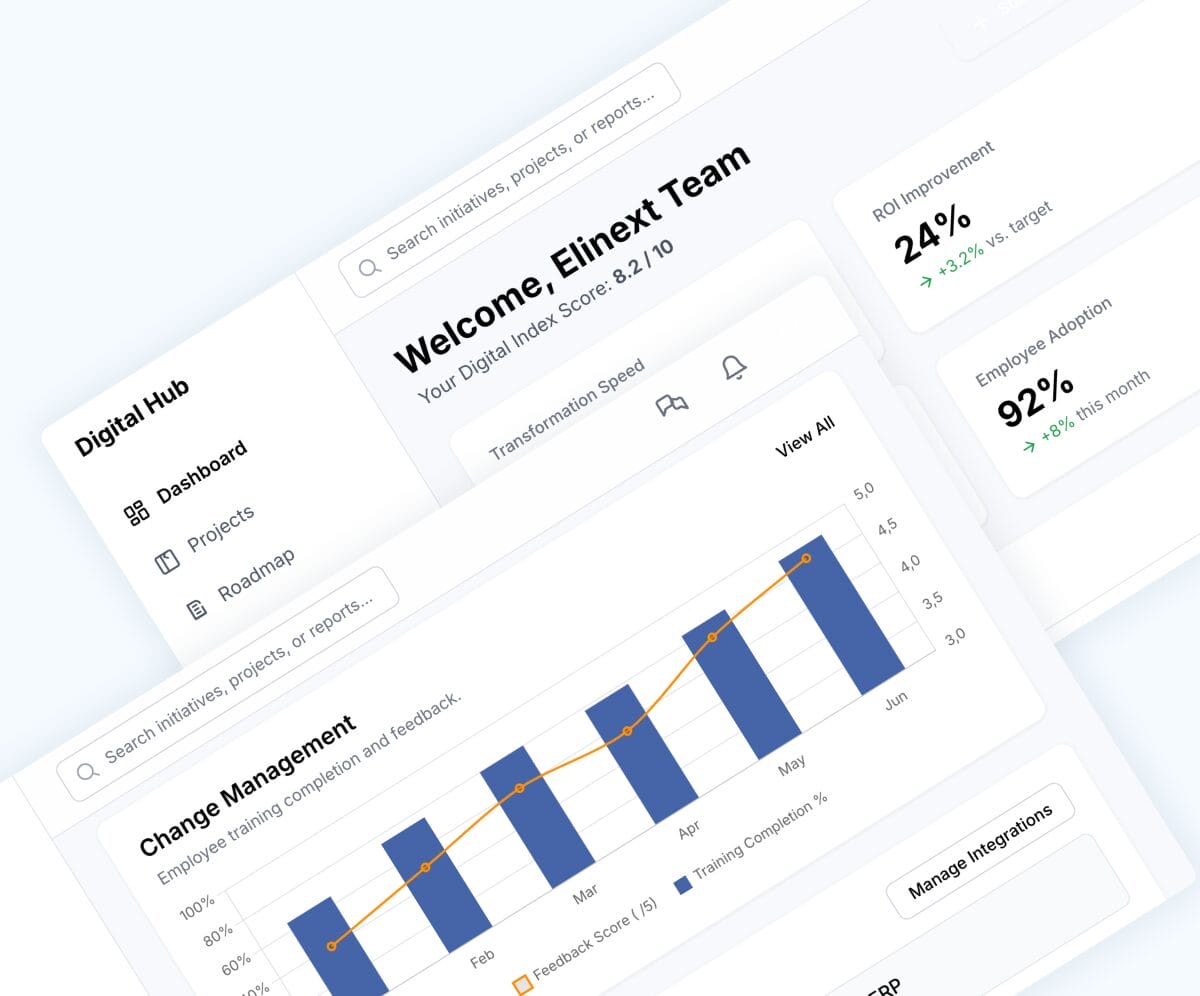

We apply AI to portfolio analysis, risk signals, and decision support. These investment software development services help teams process complex data faster while keeping models transparent and explainable.

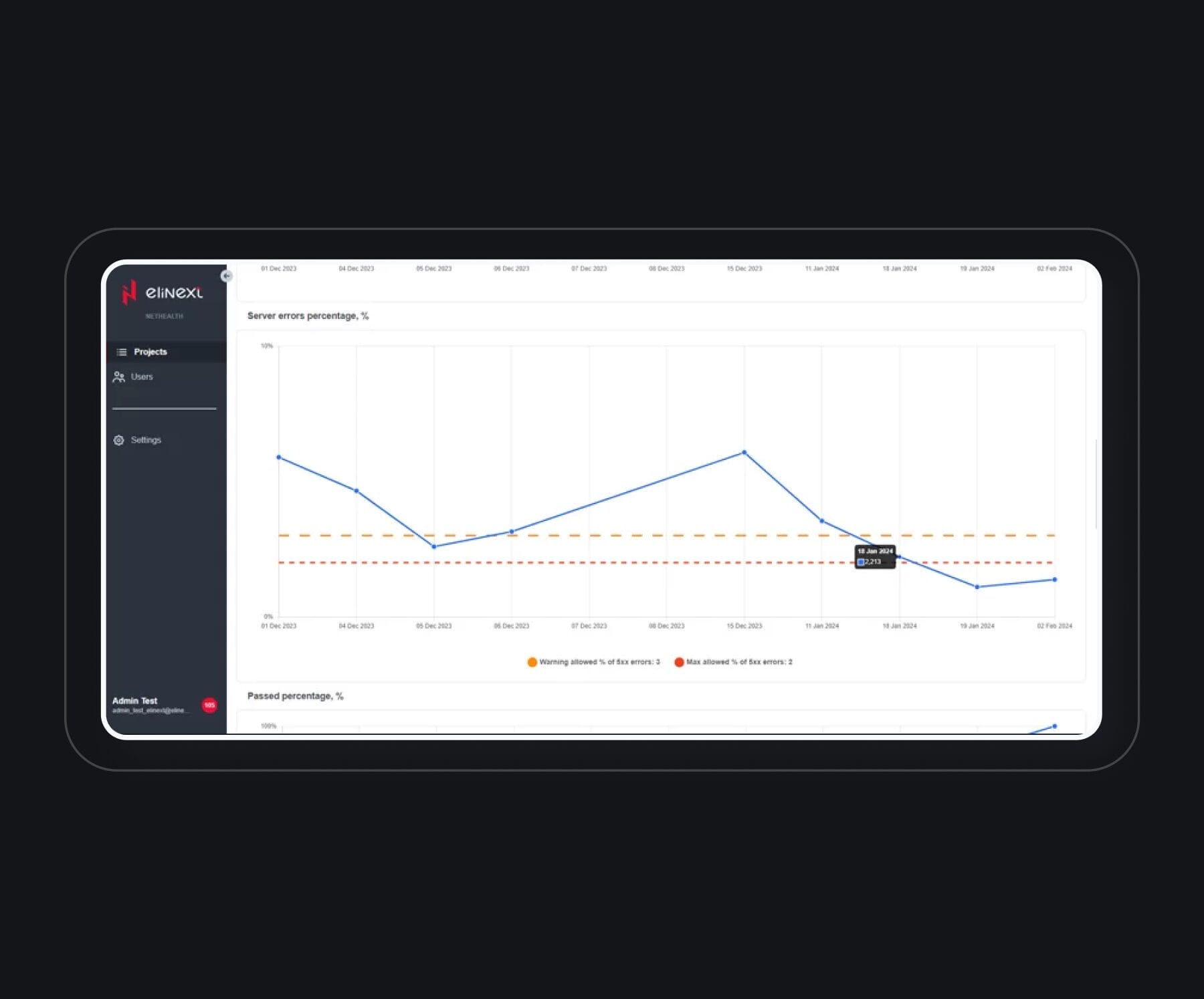

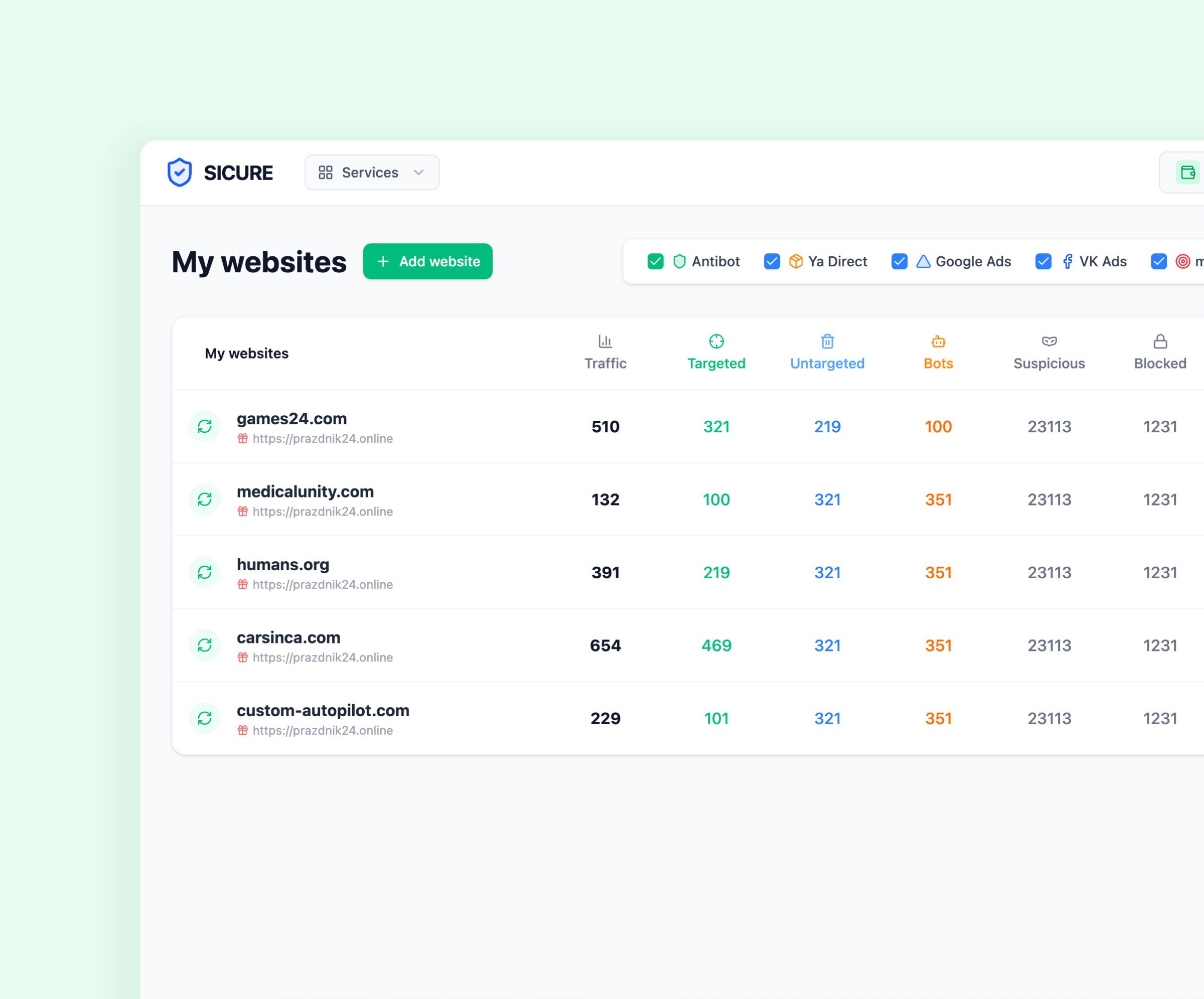

Our analytics platforms aggregate market, transactional, and internal data into reliable dashboards. Systems are designed for accurate calculations, traceable metrics, and regulatory-ready reporting.

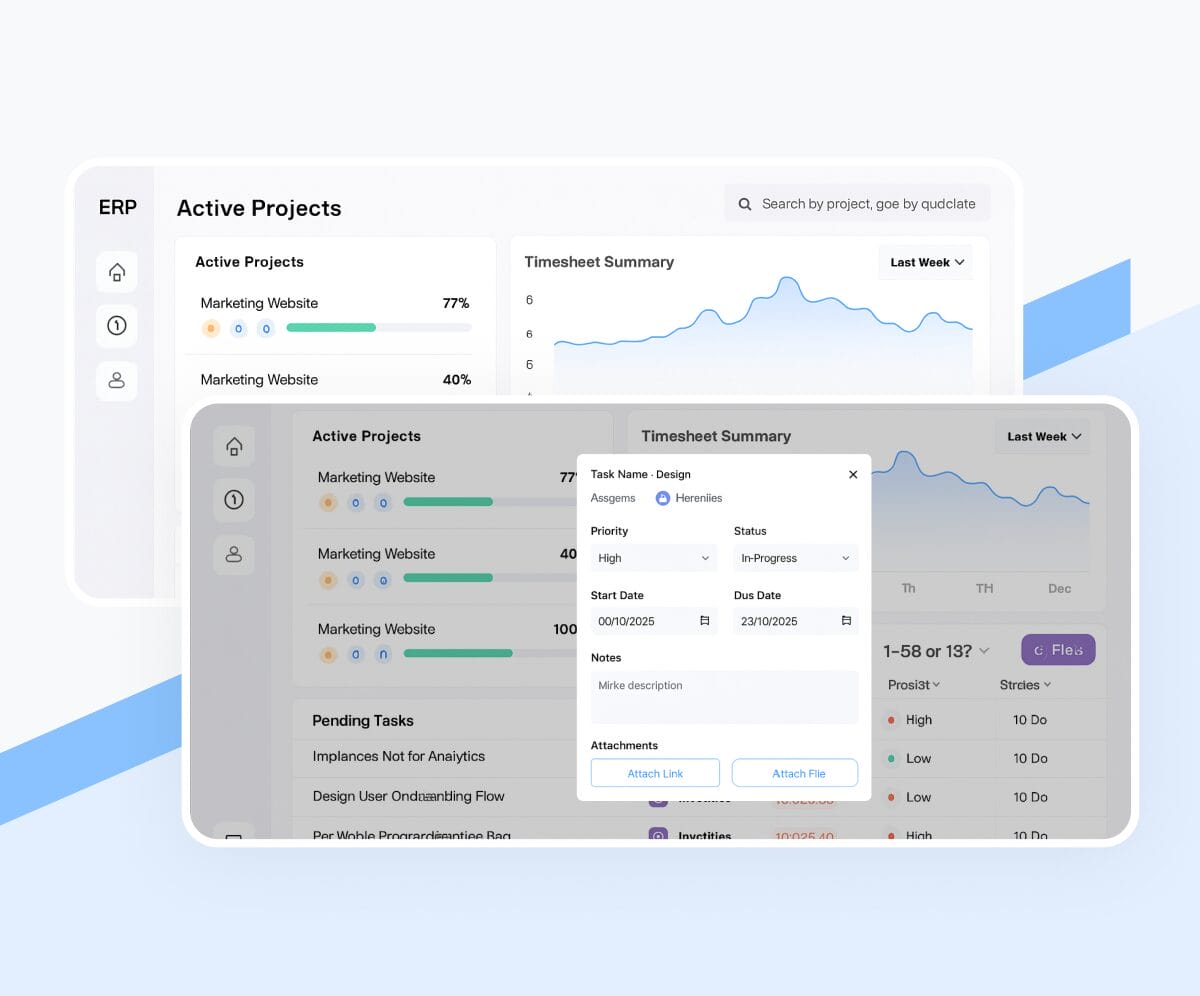

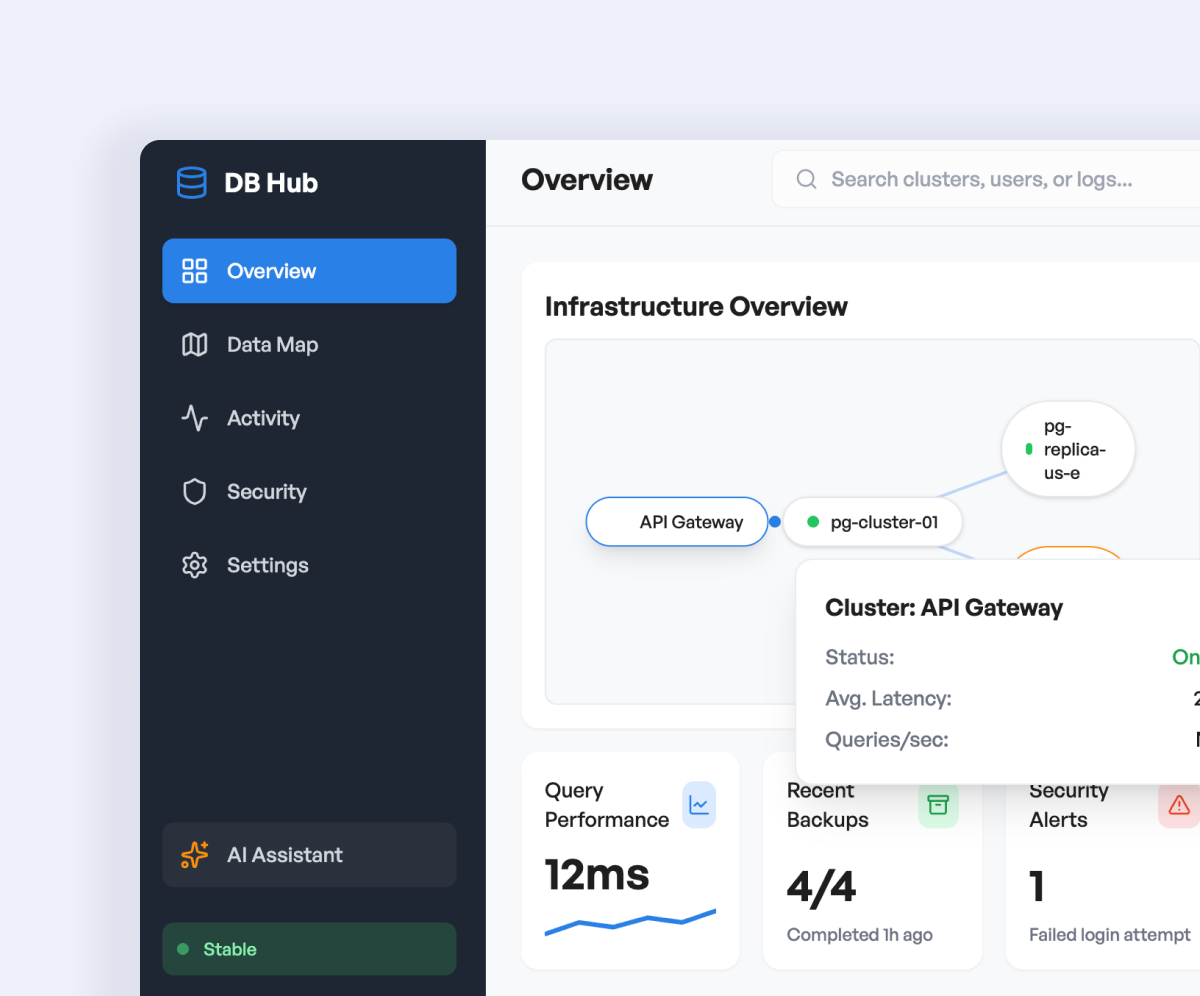

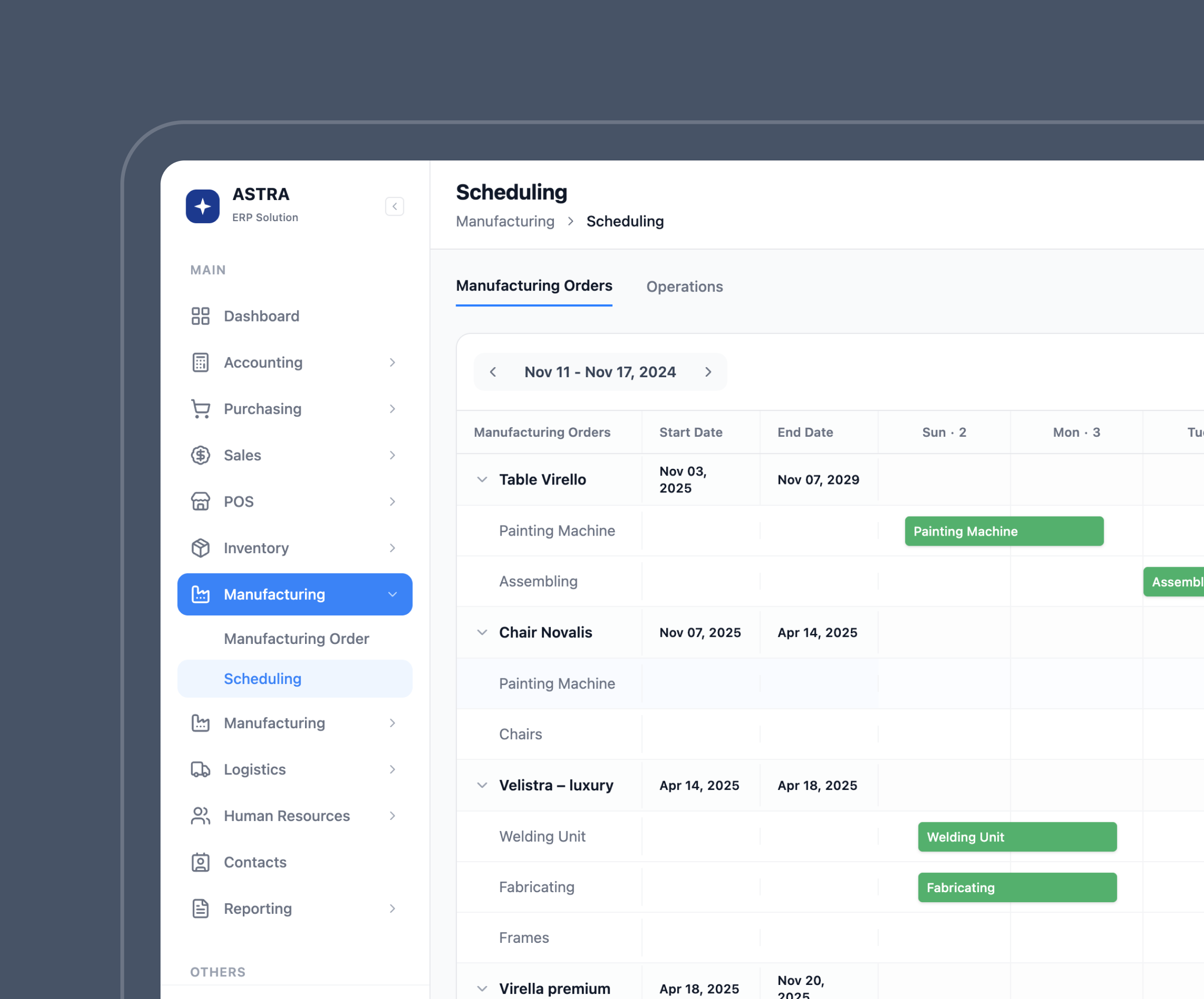

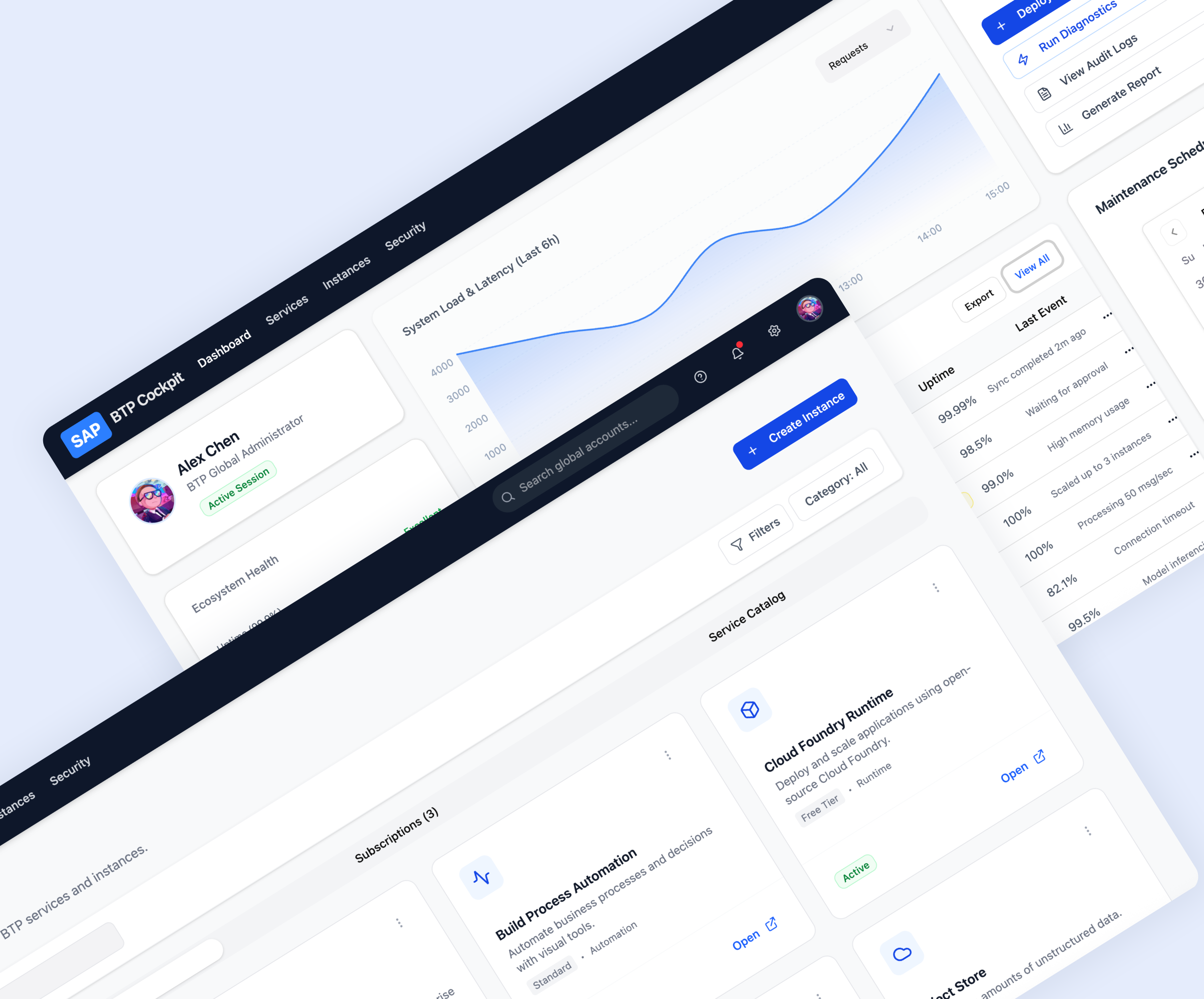

We build ERP solutions tailored to investment operations, covering accounting, compliance, and asset tracking. Integrations ensure consistent data flow between finance, operations, and reporting teams.

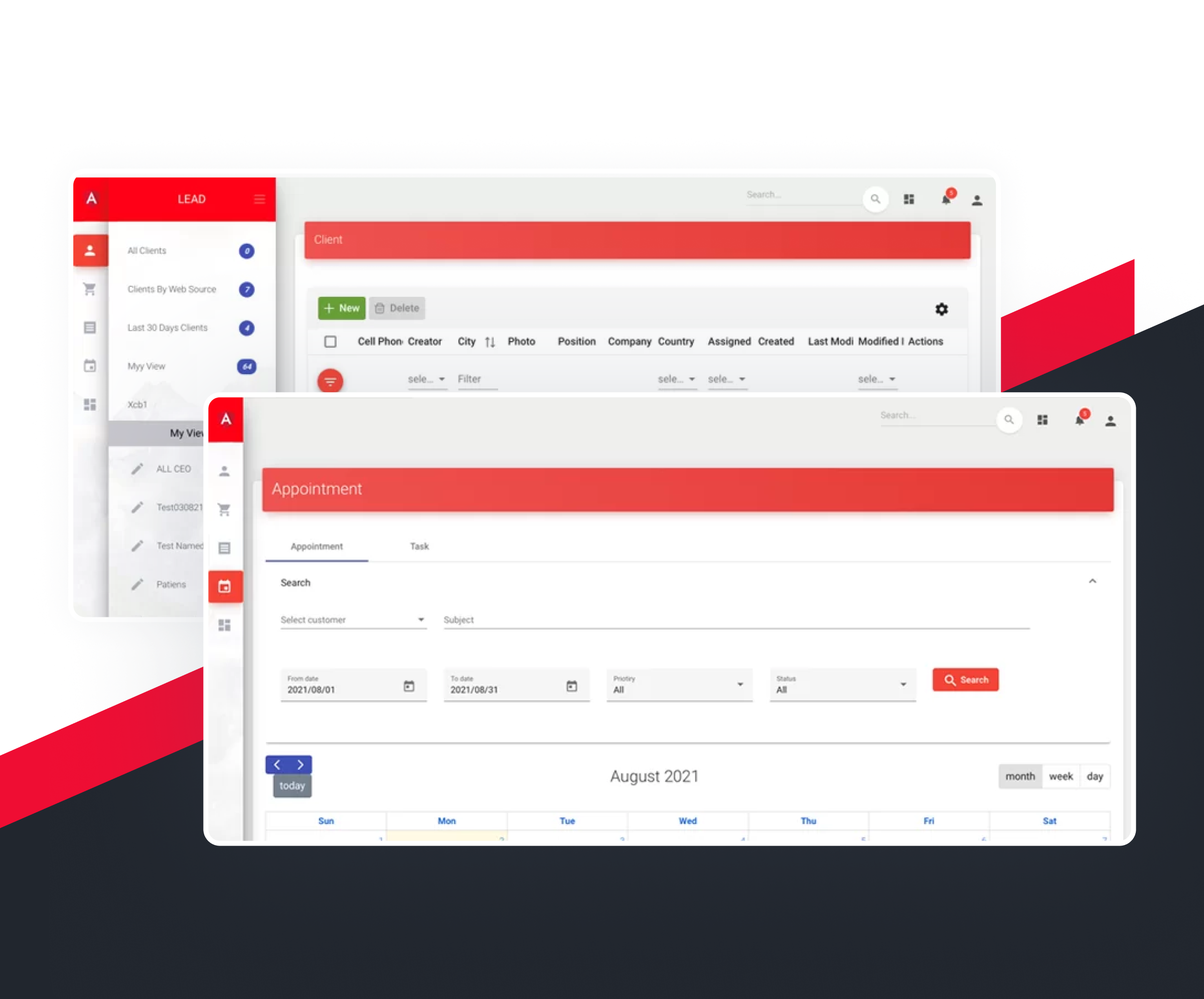

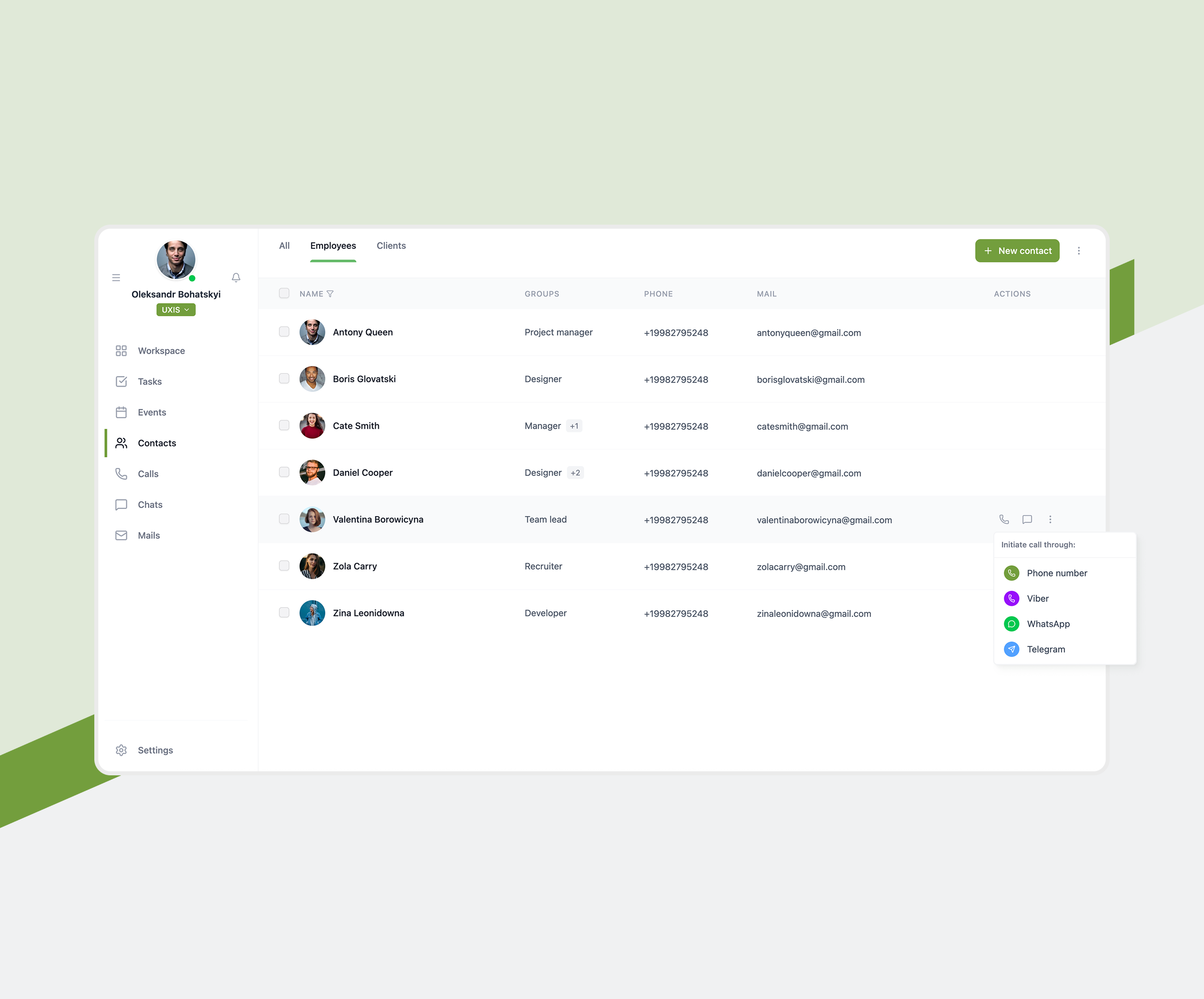

Custom CRMs support investor relations, deal tracking, and communication history. Workflows reflect real fund operations rather than generic sales pipelines.

We implement blockchain components for asset tokenization, immutable records, and transparent transactions. Architecture choices are driven by security, auditability, and regulatory context.

Machine learning models support forecasting, anomaly detection, and behavior analysis. Models are trained on relevant datasets and deployed with clear monitoring and control mechanisms.

We design big data pipelines that process large market feeds and historical datasets. Performance and data consistency are prioritized to support real-time and batch analytics.

Cloud infrastructure is used to scale investment platforms securely. We design environments that balance performance, cost control, and compliance requirements.

IoT data is integrated where physical assets impact investment decisions. Sensor data feeds analytics and reporting systems without compromising data integrity.

We build platforms for digital asset trading, custody, and portfolio tracking. Security controls and transaction traceability are embedded into core workflows.

Our DevOps practices support frequent updates without disrupting operations. These investment software development solutions rely on automated testing, monitoring, and controlled deployments.

We apply AI to portfolio analysis, risk signals, and decision support. These investment software development services help teams process complex data faster while keeping models transparent and explainable.

Our analytics platforms aggregate market, transactional, and internal data into reliable dashboards. Systems are designed for accurate calculations, traceable metrics, and regulatory-ready reporting.

We build ERP solutions tailored to investment operations, covering accounting, compliance, and asset tracking. Integrations ensure consistent data flow between finance, operations, and reporting teams.

Custom CRMs support investor relations, deal tracking, and communication history. Workflows reflect real fund operations rather than generic sales pipelines.

We implement blockchain components for asset tokenization, immutable records, and transparent transactions. Architecture choices are driven by security, auditability, and regulatory context.

Machine learning models support forecasting, anomaly detection, and behavior analysis. Models are trained on relevant datasets and deployed with clear monitoring and control mechanisms.

We design big data pipelines that process large market feeds and historical datasets. Performance and data consistency are prioritized to support real-time and batch analytics.

Cloud infrastructure is used to scale investment platforms securely. We design environments that balance performance, cost control, and compliance requirements.

IoT data is integrated where physical assets impact investment decisions. Sensor data feeds analytics and reporting systems without compromising data integrity.

We build platforms for digital asset trading, custody, and portfolio tracking. Security controls and transaction traceability are embedded into core workflows.

Our DevOps practices support frequent updates without disrupting operations. These investment software development solutions rely on automated testing, monitoring, and controlled deployments.

Clients We Serve

Asset managers rely on systems that track portfolios, risk, and performance across asset classes. Our platforms support complex structures and reporting cycles while reducing manual data handling.

- Portfolio and asset tracking systems

- Performance and risk analytics

- Compliance and audit reporting

- Integration with custodians and data providers

Wealth managers need clear, client-focused platforms that combine portfolio visibility with advisory tools. Software helps advisors manage relationships while maintaining regulatory alignment.

- Client portfolio dashboards

- Advisory workflow management

- Secure client communication portals

- Reporting and disclosures

For advisors, software must support analysis, recommendations, and documentation. Our systems embed compliance and record-keeping directly into advisory workflows.

- Research and analysis tools

- Recommendation tracking

- Compliance documentation

- Client reporting systems

Investment banks use software to manage transactions, risk exposure, and reporting across complex deals. Our platforms are built for scale, security, and integration with trading infrastructure.

- Deal and transaction management

- Risk and exposure monitoring

- Regulatory reporting tools

- Integration with trading systems

Closed-end funds require accurate valuation and investor reporting over long horizons. Software supports consistent calculations and transparent communication.

- Net asset value tracking

- Investor reporting platforms

- Compliance monitoring

- Fund accounting tools

ETF operations depend on precise data and frequent updates. Our systems support creation, redemption, and performance reporting with minimal latency.

- Real-time pricing data

- Portfolio composition tracking

- Regulatory disclosures

- Integration with market data feeds

UITs require predictable structures and long-term reporting accuracy. Software supports trust administration and investor communications.

- Trust asset tracking

- Fixed portfolio reporting

- Compliance documentation

- Investor statements

REITs manage physical assets alongside financial data. Our platforms integrate property performance with financial reporting.

- Asset and property tracking

- Income and distribution reporting

- Compliance and tax support

- Investor communication tools

Mutual fund platforms must handle high transaction volumes and daily valuations. Our systems support operational stability and regulatory compliance.

- Daily NAV calculations

- Transaction processing

- Investor reporting

- Compliance controls

PE firms manage complex deal structures and long investment cycles. Software supports deal tracking, portfolio monitoring, and reporting.

- Deal lifecycle management

- Portfolio performance analysis

- Investor reporting tools

- Compliance tracking

VC firms need visibility into early-stage investments and portfolio growth. Our platforms support flexible reporting and data aggregation.

- Portfolio company tracking

- Performance and valuation tools

- Investor reporting

- Document management

Hedge funds require fast, accurate systems under volatile market conditions. Our investment software development services focus on performance, risk analytics, and operational resilience.

- Real-time risk monitoring

- Trade and exposure analytics

- Compliance reporting

- Integration with trading platforms

What Our Experts Say

The Benefits of Investment Software Development Solutions by Elinext

Choose Your

Service Option

Hire Investment Software Developers from Elinext

Kazakhstan

Vietnam

Uzbekistan

Uzbekistan

Poland

Georgia

Poland

Kazakhstan

What Our Customers Think

FAQ

-

Investment software development services cover the design and implementation of platforms for portfolio management, trading, analytics, compliance, and reporting. They focus on accurate calculations, secure data handling, and integrations with financial systems.

-

Asset managers, banks, funds, advisors, and FinTech firms benefit from custom investment software. These solutions help manage complex portfolios, regulatory obligations, and growing data volumes without relying on manual processes.

-

Yes. Security and compliance are built into architecture through access controls, audit trails, encryption, and regulatory logic. Systems are designed to meet industry standards and support audits without disrupting operations.

-

Elinext integrates investment platforms with exchanges, brokers, custodians, and market data providers. APIs are designed for reliability, data consistency, and predictable behavior during peak market activity.

-

Elinext primarily delivers custom-built solutions tailored to specific workflows and regulations. In some cases, existing components are reused, but architecture and logic are always adapted to real operational needs.

-

Timelines depend on scope, integrations, and compliance complexity. Smaller modules may take weeks, while full investment platforms with analytics, reporting, and audits usually require several months of phased delivery.

-

Yes. Post-launch support includes updates, security patches, performance monitoring, and feature improvements. This ensures the software remains stable as market conditions, data volumes, and regulations change.

-

Cost depends on architecture complexity, integrations, data sources, and compliance requirements. We estimate budgets based on real scope, helping clients understand trade-offs and long-term maintenance impact upfront.

Looking for Related Services?

Investment Software Development News

Contact Us